YieldBasis on Curve: What’s Happened So Far

Curve and YieldBasis have seen a wave of DAO activity in recent weeks. Here’s a recap of what has been happening on Curve’s side, focusing on governance and ecosystem impact rather than YieldBasis performance.

The Curve and YieldBasis partnership has started on a strong note, with the mutually beneficial relationship benefiting both protocols even amid recent market turbulence. It’s easy to lose track of all the moving parts, so here’s a quick recap of what’s happened so far, and what’s coming next.

What is YieldBasis and how is it related to Curve?

YieldBasis is a protocol built on top of Curve’s liquidity infrastructure that aims to solve one of the longest-standing challenges in AMMs: impermanent loss (IL). It enables users to provide liquidity using various BTC wrappers (currently cbBTC, tBTC, and WBTC) without being exposed to impermanent loss — while still earning trading fees.

The mechanism is elegant yet powerful: YieldBasis maintains a 2x compounding leverage on deposited BTC by matching it with an equal value of crvUSD. You can learn more about the mechanics here: YieldBasis Documentation.

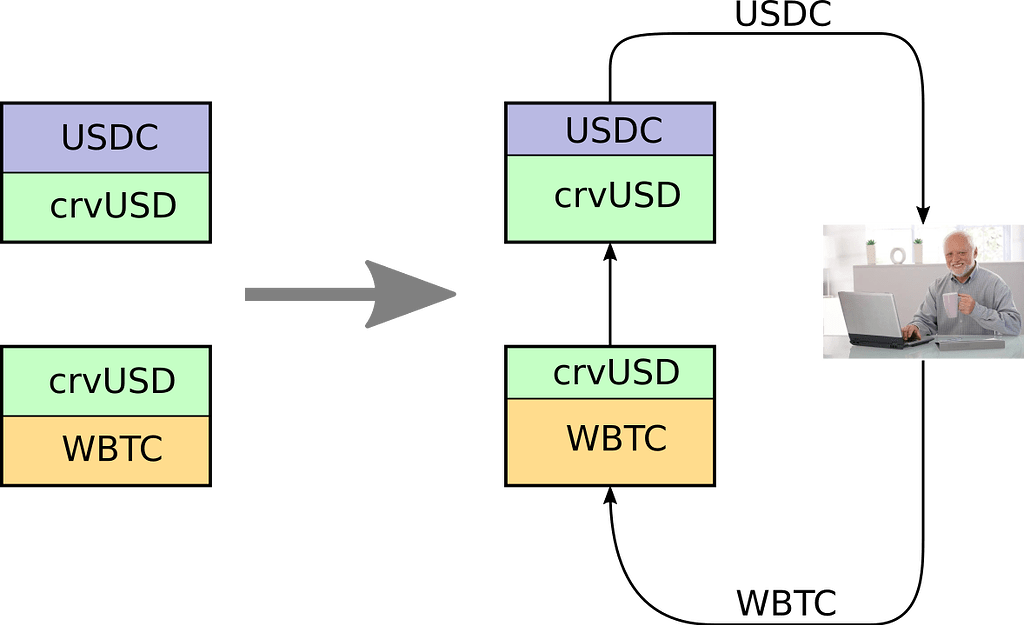

YieldBasis relies on two core components from Curve:

- Curve AMM (specifically: FXSwap)

- A crvUSD credit line approved by the DAO, which sustains the 2x compounding leverage on positions.

How YieldBasis Benefits Curve

Curve stands to gain a new revenue stream from the 75 million $YB tokens to be vested to the DAO over the coming years. The current plan is to use these tokens to expand the crvUSD supply by incentivizing crvUSD pools, an approach that should, in turn, boost DAO revenue.

However, the Curve DAO retains full discretion over how these tokens are used, and can redirect them as it chooses through a governance vote.

Recent DAO Votes

- September 24, 2025: Initial Credit Line Approval: The initial proposal to grant YieldBasis a crvUSD credit line of up to 60M passed and executed. Shortly after execution, the first three markets, cbBTC, WBTC, and tBTC, went live on YieldBasis with a cap of 1M worth of BTC per pool.Due to immense demand, the UI briefly struggled to handle traffic, and some users even deposited directly via Etherscan. Once the interface recovered, all pools filled within a minute.

- October 2, 2025: Market Cap Increase to 10M: After the successful launch of initial markets, a second vote on the YieldBasis side approved an increase in pool caps to 10M per market. As before, pools reached full capacity within minutes.

- October 7–14, 2025: Credit Line Expansion to 300M: In response to continued demand, another Curve DAO proposal was created on October 7 to expand YieldBasis’s credit line to 300M crvUSD. The vote passed and was executed on October 14, allowing market caps to rise again — this time to 100M per pool. Unsurprisingly, the markets filled almost instantly once more.

- October 15, 2025: YB Token Emissions and Airdrop: At 10:00 UTC, YieldBasis initiated YB token emissions, marking the start of inflationary vesting to the Curve DAO. This also included the setup of a YB/crvUSD pool and an airdrop for veCRV holders who voted Yes on proposals #1206, #1213, and #1222.

YB Impact in Numbers

Since launch, YB has had a clear positive effect on Curve. It’s boosted TVL, trading volumes, and DAO revenue. Let’s take a look at the impact so far.

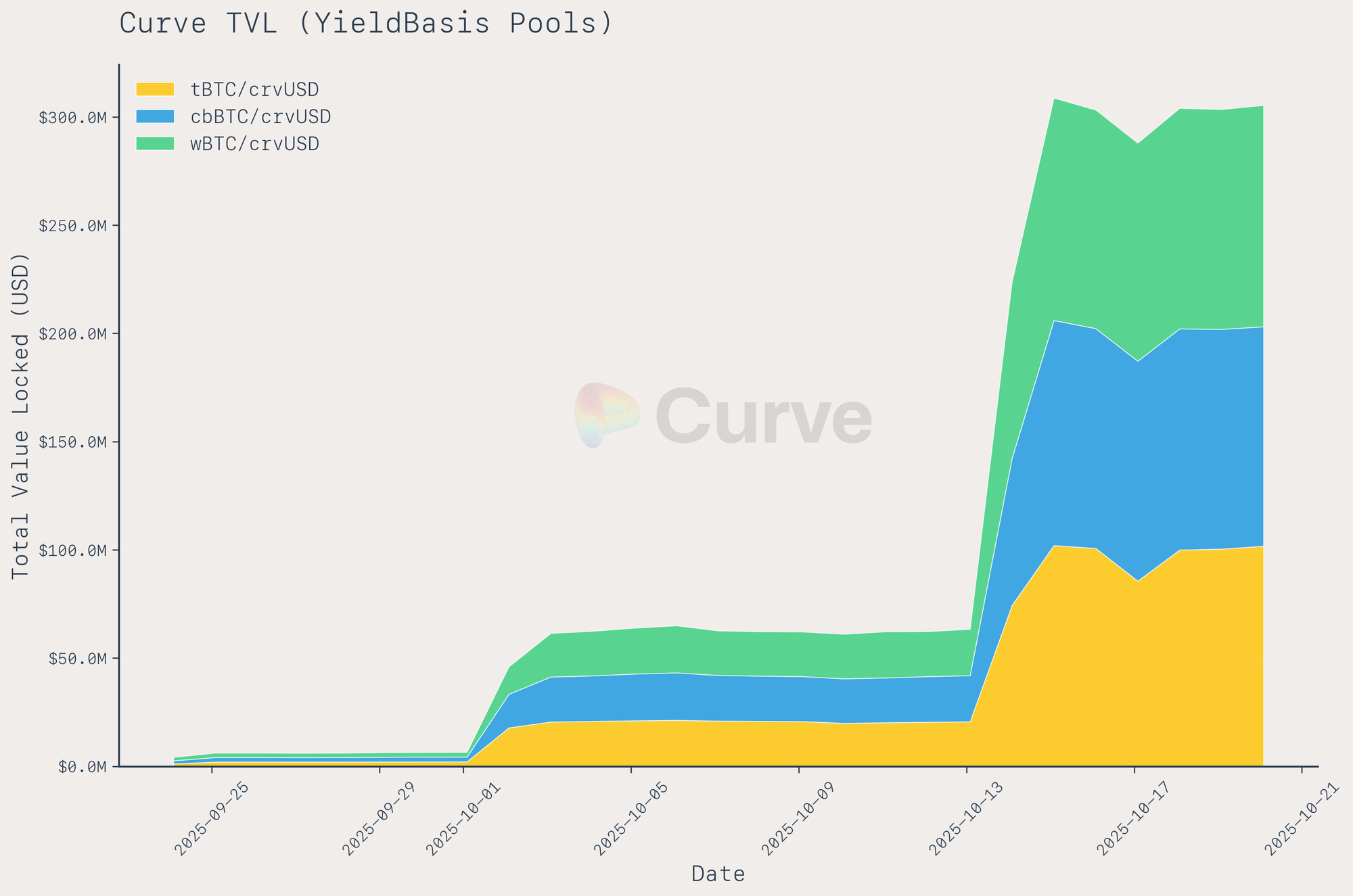

TVL

Every dollar worth of BTC deposited into YieldBasis results in two dollars of TVL for Curve, since YieldBasis leverages its liquidity 2x through crvUSD. Because each round of pool caps was filled almost instantly, Curve’s TVL saw three sharp jumps: 6M → 60M → 300M.

Revenue Impact

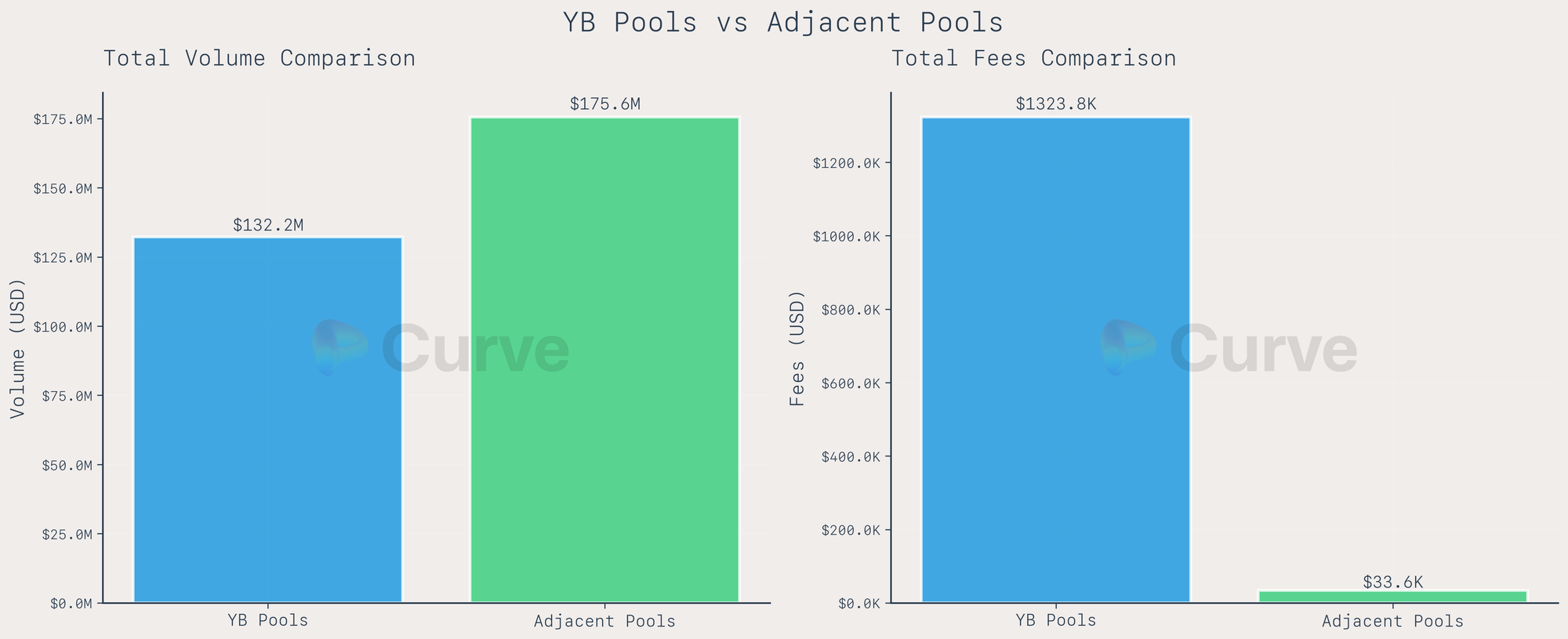

With YieldBasis operating for a few weeks now, we can now analyze its effect on Curve’s trading volume and fee generation. Data was obtained on the 21st of October.

First, looking at liquidity pools:

Interestingly, every $1 of volume on the YieldBasis pools generated $1.32 of adjacent volume on other Curve pools, mainly crvUSD/USDC and crvUSD/USDT. For example, when a user sells USDC for BTC, the routing path typically looks like: USDC → crvUSD → BTC. This adjacent trading activity generated about $33.6K in total revenue on Curve — split evenly between LPs and the DAO.

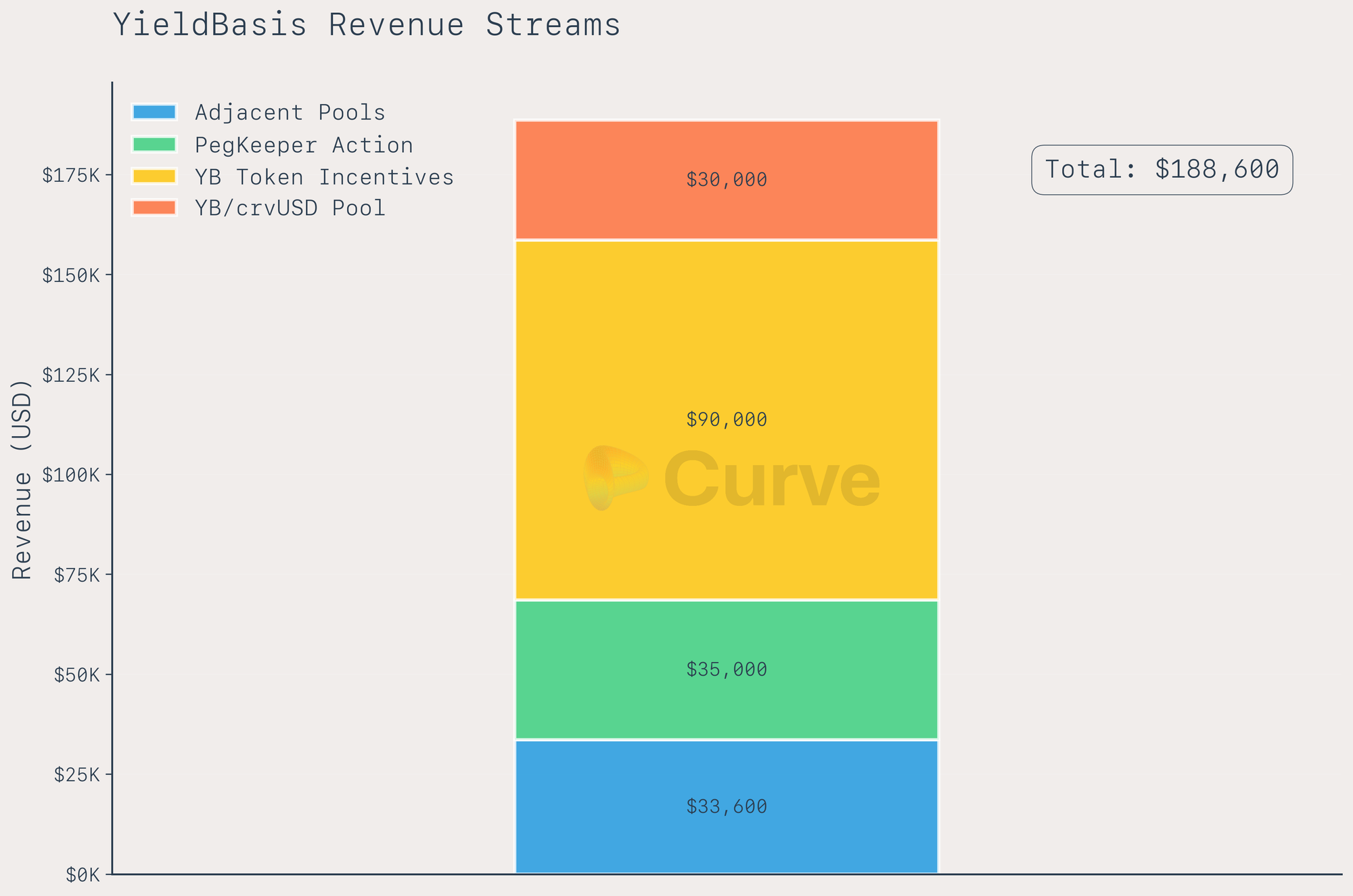

Another YieldBasis-related revenue source came from PegKeepers, which generated roughly $35K in profit.

PegKeepers help stabilize crvUSD’s peg by depositing crvUSD into their pools when the price is above $1 (effectively selling crvUSD) and withdrawing when it’s below $1 (effectively buying crvUSD). This process creates profit opportunities while supporting the peg.

Most trades in YieldBasis pools originate from arbitrage as BTC prices move:

- When BTC rises, arbitrageurs buy crvUSD to then buy BTC.

- When BTC falls, they sell BTC for crvUSD, adding sell pressure.

Because of recent volatility and the large size of the YieldBasis pools (around $300M), these arbitrage cycles caused greater crvUSD price movement, leading to more PegKeeper activity and, in turn, additional revenue for the Curve DAO.

To dampen short-term crvUSD volatility, YieldBasis decided to incentivize the pyUSD/crvUSD pool with 200,000 YB tokens (~$90K) for one week, ahead of the main emissions (more on that below).

Finally, the YB/crvUSD liquidity pool, which serves as the main trading venue for the $YB token, currently holds $1.4M in TVL and has generated over $30K in revenue since launch.

In total, YieldBasis has generated approximately $188K in revenue (for LPs and the DAO combined). This is a conservative estimate, as it doesn’t include secondary effects, such as new crvUSD minted in response to higher demand.

Whats Ahead?

Before Curve can extend additional credit lines to YieldBasis and raise pool caps further, crvUSD liquidity must deepen significantly. Current liquidity levels are only just sufficient to support the existing 300M in YieldBasis pools — expanding beyond that without stronger crvUSD markets would risk higher volatility and potential price instability.

The next major step is Proposal #1238, which redirects the $YB vesting emissions to a dedicated DepositPlatformDivider contract. This contract will use the vested $YB tokens as vote incentives on platforms like Votium and VoteMarket to attract gauge weights for crvUSD pools. In practice, this means those pools will attract more CRV emissions, making liquidity provision in crvUSD pairs far more appealing for LPs.

The start of YB emissions has already set things in motion — activating the vesting of 75M YB tokens to the Curve DAO. This creates a continuous stream of incentives that can be strategically redirected toward strengthening crvUSD liquidity.

Following this, Michael Egorov (founder of Curve and YieldBasis) introduced a broader proposal package to scale YieldBasis responsibly:

These proposals focus on:

- Increasing crvUSD liquidity through deeper incentives and emissions alignment.

- Raising PegKeeper limits to allow larger crvUSD supply flexibility.

- Preparing the system for safe scaling of YB pool caps once liquidity conditions improve.

Relevant votes are already up for voting:

- Proposal #1238: Setting the $YB emission recipient to

DepositPlatformDivider - Proposal #1241: Increasing PegKeeper capacities by a factor of 3

In short: YieldBasis has proven its potential, but sustainable growth now depends on expanding crvUSD liquidity. The upcoming DAO votes aim to create exactly that foundation, ensuring both protocols can scale together without compromising stability.