Spectra Finance: A Curve Ecosystem Success Story

Built on Curve’s Stableswap and oracle pools, Spectra splits deposits into PT/IBT/YT so markets can price future yield without selling principal. Curve’s deep liquidity, stable pricing, and fee share make it the settlement layer for on-chain interest.

What if you could access next year’s interest today? In traditional finance, that typically requires complex derivatives. In DeFi, it’s becoming a reality thanks to protocols like Spectra Finance.

Spectra allows users to separate interest-bearing assets from the future yield they generate. By tokenizing that yield, it enables fixed-rate returns, directional interest rate trades, and access to upfront capital, without selling the underlying asset.

None of this would be possible without the liquidity and pricing reliability provided by Curve’s Stableswap pools, which serve as the liquidity foundation for Spectra’s yield markets.

How Spectra Works: A Practical Example

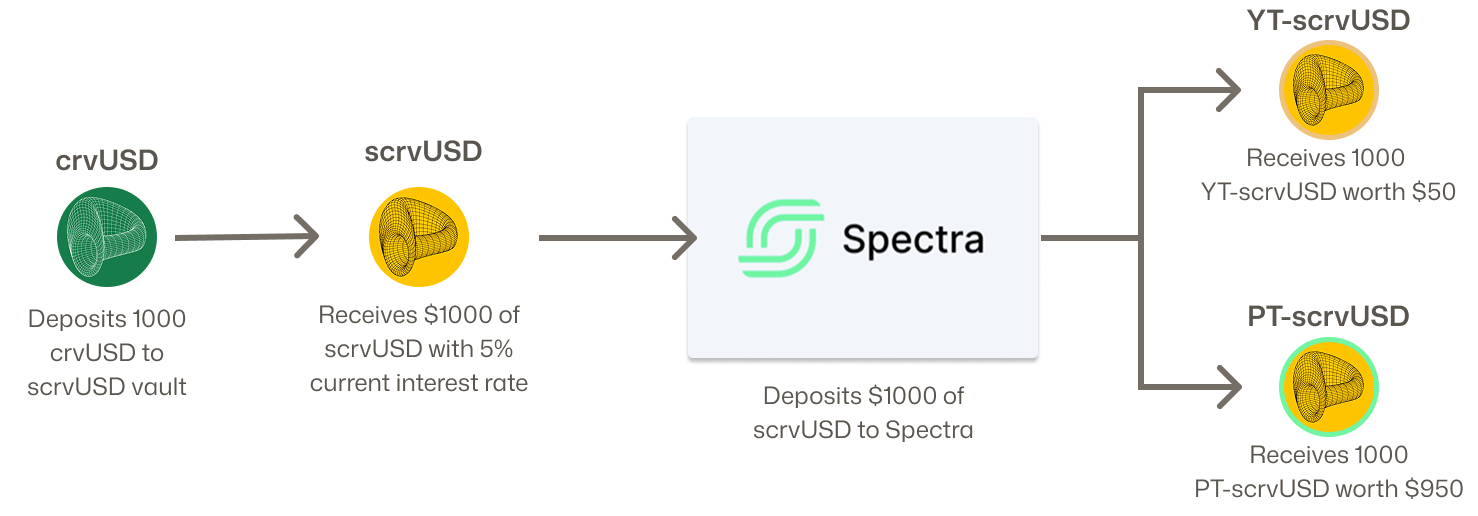

Let’s walk through a practical example to see how this works.

This is a hypothetical scenario, there is currently no active Spectra market for a 1-year scrvUSD term.

Imagine a user gets an unexpected expense and needs cash while holding crvUSD but doesn’t want to sell it. Instead of selling, he could do the following:

- They deposit their crvUSD into Curve’s scrvUSD savings vault, currently yielding around 6.9% annually.

For this example, we’ll assume a 5% annual yield for simplicity. - Next, they take their scrvUSD to Spectra and deposit it into a 1-year market. In return, Spectra issues them:

- Principal Token (PT-scrvUSD): Represents the original crvUSD without the yield. One PT token can be redeemed for one crvUSD after one year.

- Yield Token (YT-scrvUSD): Represents the right to all yield generated by the scrvUSD over the next year. At a 5% rate, this would trade for about $0.05 today.

- The user can now sell their YT token immediately for upfront cash, helping them cover their short-term needs, all while still holding the PT token and reclaiming their original crvUSD after maturity.

Because scrvUSD earns a share of Curve DAO revenue from crvUSD mint markets, trading YT-scrvUSD is effectively a bet on whether that revenue of the DAO, and the vault’s yield, will rise or fall over the term.

How Curve Powers Spectra’s Yield Markets

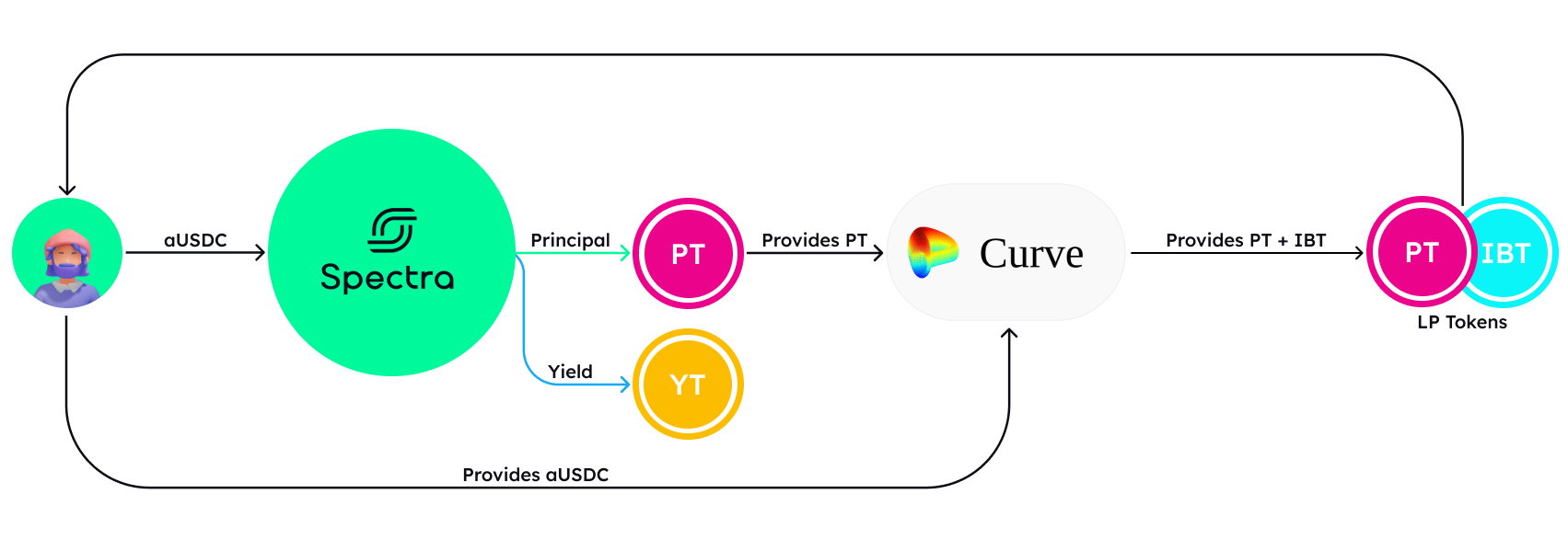

Spectra’s yield tokenization relies on liquid and precise markets between three types of tokens:

- Interest-Bearing Token (IBT)

- Principal Token (PT)

- Yield Token (YT)

To create this liquidity, Spectra uses Curve's oraclized Stableswap pools. This mechanism already enables highly liquid and efficient pools for other assets with predictable price changes, for example an scrvUSD/USDT pool, or an wstETH/ETH pool.

Spectra applies this same technology to its yield markets by creating a PT/IBT pool. Because any user can redeem 1 IBT by returning 1 PT plus 1 YT, a single PT/IBT pool creates liquidity for all three tokens. As PT and IBT change in value over time, a custom oracle is integrated into the pool that feeds their expected prices into the Curve AMM. This allows the AMM to focus on pricing the difference between the expected rate and the actual market rate, which is set by traders buying and selling based on their views of future yields.

The diagram below illustrates how a liquidity provider contributes to this foundational PT/IBT market:

Spectra’s Growth & Benefits for Curve

Spectra has seen significant growth over the past year, with total value locked (TVL) rising from around $20 million to $100 million, a 5x increase in 12 months. This growth reflects increasing demand for on-chain interest rate markets and broader adoption of tokenized yield strategies. However, it also speaks to Spectra’s strong execution, attention to detail, slick UI and positive sum interactions with the broader DeFi ecosystem.

Spectra builds its markets on Curve's specialized Stableswap pools, gaining access to highly efficient and proven infrastructure. In return, the Curve DAO receives 20% of all swap fees from these pools. This ensures that as Spectra's trading volume grows, it continuously generates direct revenue for the Curve ecosystem, creating a positive sum relationship.

Building With Curve

Spectra’s growth highlights how protocols can build new financial primitives on top of Curve’s infrastructure, in a sustainable and positive sum way for both Spectra and Curve. As adoption of DeFi accelerates, Curve is positioning itself as a core layer for the ecosystem.

If you're building in DeFi and need deep liquidity, oracle support, or stable pricing infrastructure, Curve is ready to support your integration.