Smoothing crvUSD Borrow Rates

Curve DAO has voted in an update to crvUSD’s monetary policy that smooths borrow rates for minting crvUSD. By shifting short-term peg defense to PegKeepers and applying rate smoothing over time, the update reduces abrupt rate movements while preserving peg incentives.

Curve DAO has voted in an update to crvUSD’s monetary policy to introduce smoother and more predictable borrow rates.

This update changes how peg-defense is reflected in interest rates, aiming to reduce sharp short-term rate volatility.

What is changing:

- Updated Peg Defense: PegKeepers remain the primary short-term defense for the crvUSD peg, while interest rates now react over longer timeframes.

- Slower Rate Changes: Because interest rates are no longer the first line of defense, they will adjust more gradually, giving borrowers more time to react.

- Rate Alignment: Interest rates for wstETH and sfrxETH have been adjusted (lowered by 2% flat) to better align with broader market conditions.

Overall, these changes act to minimize short-term borrow rate fluctuations while preserving the core mechanisms that peg crvUSD to $1.

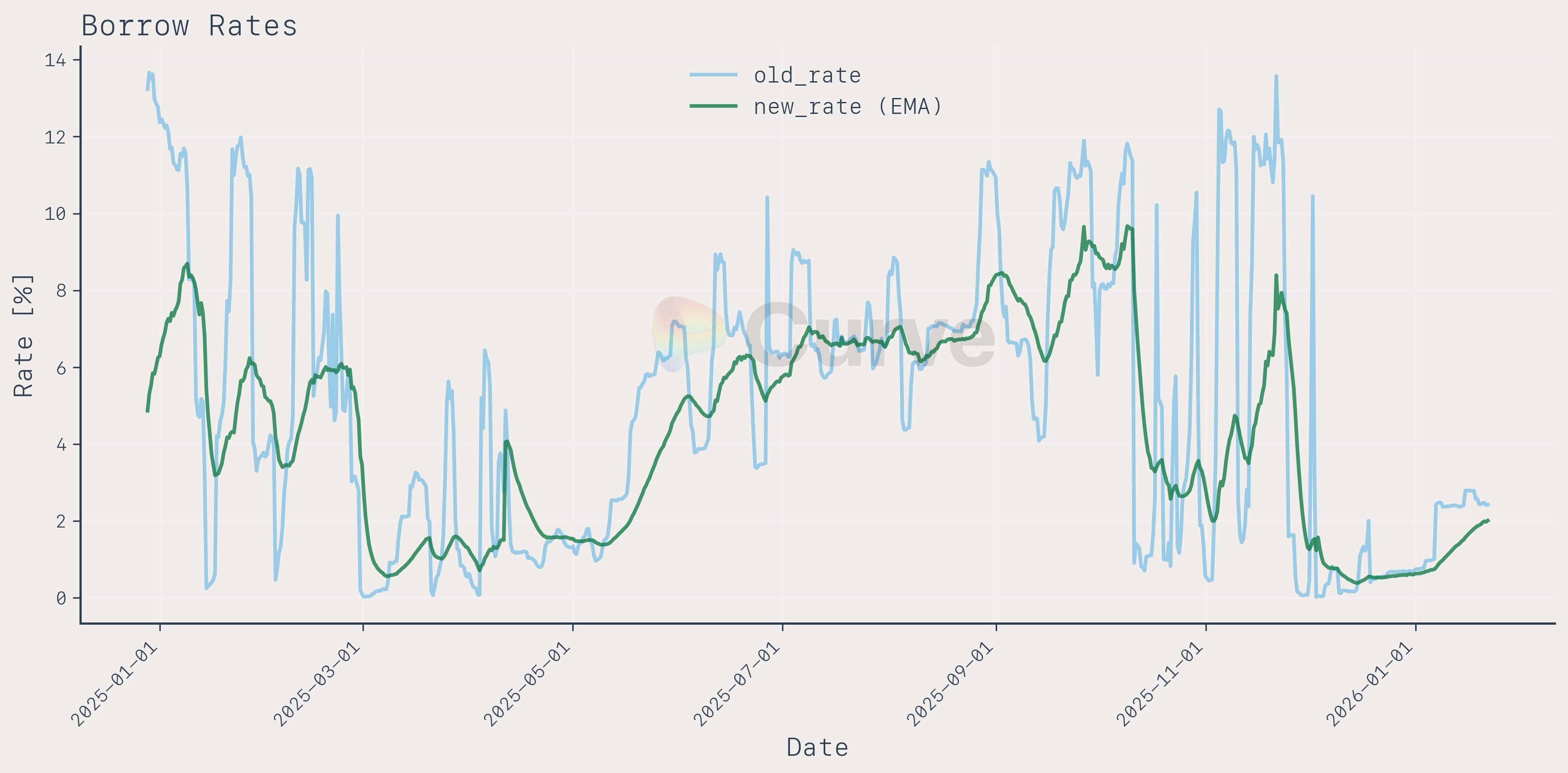

See the chart below for how interest rates would have looked for 2025 with this new policy vs. the old policy.

Borrow rates — short refresher

For a full explanation of how crvUSD mint borrow rates are calculated and which components influence them, see the earlier deep dive:

(1) the market price of crvUSD relative to $1 and

(2) the size of PegKeeper debt relative to total system debt.

Why rates moved sharply — and what changed

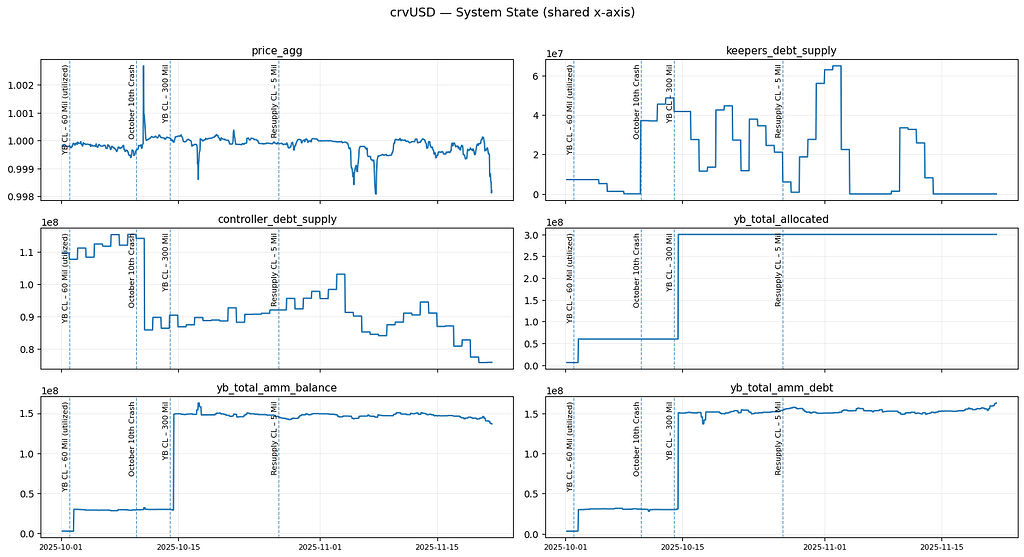

Recent rate movements were primarily driven by changes in PegKeeper activity.

As new integrations such as YieldBasis expanded crvUSD supply outside the traditional loop, PegKeeper balances began changing more frequently and in larger increments. Because PegKeeper debt fed directly into the borrow-rate formula, these short-term peg-defense actions were immediately reflected in mint borrow rates.

The newly approved monetary policy changes how this impact is reflected in borrow rates.

Instead of passing PegKeeper balance changes straight through to the borrow rate, the policy now smooths PegKeeper debt over time using an exponential moving average (EMA). PegKeeper actions themselves remain unchanged and continue to defend the peg in real time, but their influence on borrow rates is applied more gradually.

The EMA window is currently set to 9 days, a configuration chosen to significantly reduce short-term rate fluctuations while maintaining meaningful responsiveness to underlying system conditions.

This update is based on detailed analysis by LlamaRisk, which examined historical borrow-rate behaviour, PegKeeper dynamics, and borrower responses under different smoothing configurations. Their research showed that applying an EMA to PegKeeper debt significantly reduces short-term rate fluctuations while preserving the stabilization that support crvUSD’s peg.

Deep dive: LlamaRisk’s analysis of borrow-rate smoothing

Lets dive in a bit deeper: The new monetary policy does not smooth the entire crvUSD borrow rate.

Instead, EMA smoothing is applied specifically to the PegKeeper debt fraction component of the rate calculation. This is the part that reflects how large PegKeeper debt is relative to total crvUSD debt, and it was identified as the dominant driver of short-term rate variability.

Crucially, the price-based component of the policy remains unchanged. Borrow rates still respond immediately to crvUSD trading above or below $1. This preserves the incentive-driven mechanism that directly supports the peg.

This design ensures that:

- Short-term PegKeeper balance changes no longer cause abrupt rate shifts

- Borrow rates remain responsive to meaningful price deviations

- Mint-market incentives continue to play an active role in peg stabilization

LlamaRisk’s analysis also examined how smoothing affects the strength of borrower-facing rate signals. While EMA smoothing significantly reduces short-term volatility, it also dampens how sharply rates can rise during periods of stress.

To offset this effect, the monetary policy includes an adjustment to rate0, which is the baseline level of the mint borrow rate. Increasing rate0 shifts the entire smoothed rate curve upward. This ensures that borrow rates can still reach levels that historically encouraged repayment and deleveraging, even with PegKeeper debt smoothed over time.

In this design, EMA smoothing and the rate0 adjustment work together. Smoothing improves predictability, while a higher baseline preserves the effectiveness of borrower incentives and the mint market’s contribution to peg defense.

The decision to smooth only the PegKeeper debt fraction and to pair this change with a calibrated rate0 adjustment reflects the findings of the LlamaRisk analysis. Their work showed that selective smoothing delivers a more predictable borrowing experience without materially weakening peg defense.