Liquidation Protection: Making Volatile Markets Manageable

Llamalend’s liquidation protection turns sudden wipeouts into a controlled, manageable process. It helps loans survive volatility and gives borrowers more time to react and adjust. Find out how.

TL;DR

Llamalend turns liquidations from sudden wipeouts into a slow, and controllable process. Instead of a hard liquidation price, positions enter a liquidation range where collateral is gradually adjusted to keep the loan alive as long as health stays above 0.

- No single liquidation price — health determines liquidation, not LTV.

- Inside the protection range, LLAMMA gradually adjusts the collateral, not all at once.

- Borrowers get time to react, often surviving dips that would instantly liquidate on other platforms.

- Case study: a large ETH loan survived 7 days of extreme volatility without liquidation.

Volatile markets are one of the biggest risks when taking out onchain loans. Prices can collapse in seconds, and on many lending platforms, a single sharp move can liquidate a user before they even have time to respond.

Llamalend’s liquidation protection solves this problem.

Instead of liquidating a position the moment it reaches a specific price, Llamalend gives borrowers time, flexibility, and breathing room. Even during the extremest market swings, the system often manages to keep a loan alive automatically.

This turns the liquidation experience on its head. A sudden, irreversible liquidation becomes a gradual and predictable process. With Llamalend, borrowers can:

- navigate extreme conditions with much higher resilience

- increase their odds of surviving flash crashes and sudden volatility

- adjust or repay their loan before it is too late

- remain safe even when the market briefly dips below their “liquidation price”

- avoid surprise liquidation spikes

- Health is the only factor that determines liquidation.

- Liquidation protection range triggers gradual conversions, not instant liquidation.

- Losses only occur inside the range, and they accumulate with volatility.

Now let’s look at how it actually works.

Liquidation Protection

Liquidation protection in Llamalend works differently from systems that use a fixed liquidation price. There is no single price at which your loan suddenly disappears. A position is only liquidated when its health reaches 0%.

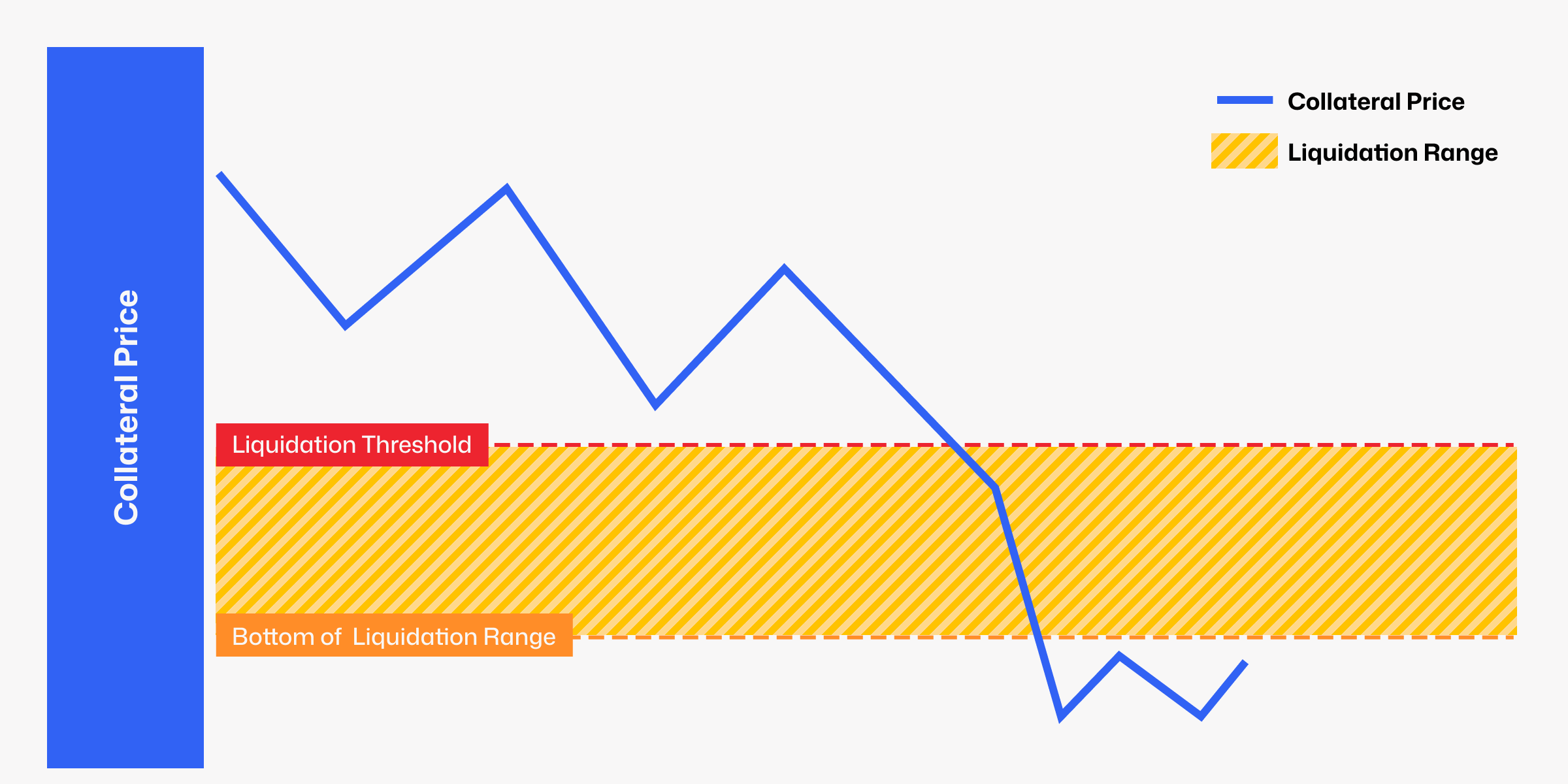

To prevent health from collapsing instantly during volatility, every loan is given a liquidation range, defined by two price points. When the market price enters this range, the system begins gradually adjusting your collateral to keep the loan stable.

The Liquidation Range is defined by:

- the Liquidation Threshold, which is the price below which liquidation begins — essentially the start of the liquidation range.

- the Bottom of the Liquidation Range, where collateral has been fully converted. Important: this is not the price at which a position becomes fully liquidated.

Here is what happens when the collateral price inside the range:

- When prices fall, the system automatically and gradually sells off parts of your collateral asset (for example ETH) for crvUSD. This reduces exposure to the falling asset and helps preserve the value supporting loans.

- When prices rise again, the system uses the previously obtained crvUSD to buy back the initial collateral, restoring part of the original asset balance.

These adjustments happen continuously and automatically while the price moves up and down inside the range.

Instead of a sudden liquidation at a single price, the loan is stabilized through small, ongoing conversions that give users more time to act.

However, these conversions come with a cost. Because the system needs to incentivize arbitrage traders to perform them, each conversion incurrs a slight loss. When the market moves up and down inside the range, these losses accumulate and gradually reduce your health. This can happen both on the way down and on the way back up. The more volatility and the less liquidity in the liquidation zone, the faster health gets eroded.

But as long as health stays above 0%, the loan survives. Only when health reaches zero — regardless of the current price — is the position fully liquidated.

The good news is that users have full control over the health of the loan:

- If the loan is not yet in liquidation protection, they can prevent entering the zone by adding collateral or repaying debt, which shifts the liquidation range downward.

- If the loan is already inside liquidation protection, repaying so me debt immediately increases health and slows further conversion.

Need more convenience in monitoring your loan and watching your health? Check out the LLamalend Telegram Monitoring Bot!

In short, liquidation protection turns sudden liquidation into a controlled, step-by-step process that helps borrowers manage volatility rather than be wiped out by it.

Quick Reference

| Concept | What It Means |

|---|---|

| Liquidation Protection Range | A price zone where the system starts protecting your position by adjusting collateral. It is not a hard liquidation price. | Liquidation Protection | When price enters the liquidation protection range, your collateral is gradually converted to keep the loan stable. Conversions reverse when price recovers. |

| Health | A measure of how close you are to full liquidation. At 0, the position is closed. Above 0, the loan survives. |

| Full Liquidation | Happens only when health reaches 0, regardless of the collateral price. |

| Losses in Protection | Each conversion incurs small losses that accumulate with volatility. Losses do not revert even if prices return to the top of the range. |

Case Study: User 0x…9abd

This case study shows how liquidation protection kept a large loan alive during one of the most volatile weeks of late 2025. The position survived extended periods below its liquidation protection range, something that would normally result in an immediate liquidation on most lending platforms.

The graphic shows the user’s liquidation protection from 13–24 November 2025. The “oracle price” refers to Llamalend’s EMA oracle, not spot price. The green and blue bars represent the liquidation range ($3,200–$2,900) and the user’s shifting collateral composition.

Status at the Start

On 13 November 2025 the user held 9,942.545 ETH (valued at 31,390,004.75 USD) as collateral and had borrowed 27,510,720.93 crvUSD. Market conditions were already unstable and volatility was rising quickly.

Entering Liquidation Protection

On 13 November at around 20:30 UTC, the price of ETH fell into the user’s liquidation protection range. The loan entered the range with 3.02 health, and the system started converting ETH into crvUSD to protect the position.

Inside the range, price fluctuated repeatedly. The user’s health rose and fell with price but continued trending downward. This is expected. Losses accumulate inside the liquidation protection range whenever trades occur, both when price goes down and when it recovers. This erodes collateral over time, impacting the position's ability to survive volatility.

This slow decline is part of how liquidation protection works: it replaces sudden, all-at-once liquidations (often with large penalties) with a smooth, controlled process.

Repaying Some Debt

Over the next three days, as health moved closer to zero, the user took action. Across four transactions, the user paid off around 1.2 million crvUSD debt to improve the position's health and increasing its odds of surviving.

This increased health from roughly 1.14 to 5.78, creating a much larger safety buffer. Liquidation protection kept the loan alive long enough for the user to intervene, even though the price stayed inside the liquidation range for more than a week during extreme volatility.

The loan remained open the entire time.

Market Crashes Further

On 20 November, ETH dropped sharply to around 2,600 USD. At this point, the oracle price fell below the user’s entire liquidation protection range. LLAMMA had now converted all remaining ETH into crvUSD.

Once fully converted:

- No additional losses occurred because the collateral was entirely stable and outside the liquidation range

- The loan remained protected as long as price stayed below the liquidation range

However, this state is temporary. If ETH rises back into the protection range, LLAMMA begins converting crvUSD back into ETH, which reintroduces losses impacting health. If health drops to zero during this recovery, liquidation can still occur on the way up.

Monitoring health during a rebound is just as important as monitoring it during the decline.

An Interesting Surprise: Market-Making Profits

When a loan enters liquidation protection, its collateral sits inside LLAMMA, the automated market maker that performs conversions. LLAMMA uses bands, similar to concentrated liquidity. A large borrower often owns most of the liquidity in the active bands, so unusually large trades can temporarily improve the user’s position.

That is exactly what happened here.

Between blocks 23844310 and 23844327, the user’s health increased from 0.64 to 1.9 due to one massive trade routed through LLAMMA.

The Key Trades in Block 23844318:

| Tx Hash | Sold | Amount Sold | Bought | Amount Bought | Notes |

|---|---|---|---|---|---|

| dd2609a7…785ba | WETH | 3,509.06 | crvUSD | 9,299,110.10 | Huge WETH → crvUSD buy; dominates volume |

| a3586ba1…8179 | crvUSD | 1,255,357.62 | WETH | 469.18 | crvUSD → WETH sell |

The first trade was unusually impactful:

- Effective price paid: 2,650.03 crvUSD per ETH

- Chainlink ETH oracle at the same block: 2,846.42 USD

Routing such a large trade through LLAMMA temporarily shifted its internal price. Because the user provided most of the liquidity in that band, this deviation increased the total value of their collateral.

The user owned most of the liquidity in the active LLAMMA band. When the huge WETH to crvUSD trade hit the AMM at an unfavorable price, the user effectively sold ETH above the oracle price. This increased their collateral value and boosted loan health before arbitrage trades corrected the price.

Follow-Up Arbitrage Activity (Blocks 23844319 – 23844328)

Arbitrage traders quickly restored LLAMMA’s price toward the real ETH market price.

| Block | Trades | crvUSD Sold | WETH Sold | Total Volume (USD) | Net Flow Direction |

|---|---|---|---|---|---|

| 23844319 | 5 | 4,437,569 | 0 | 4,437,569 | crvUSD → WETH |

| 23844320 | 8 | 1,390,670 | 0 | 1,390,670 | crvUSD → WETH |

| 23844321–23844328 | 44 | 1,712,835 | 0 | 1,712,835 | crvUSD → WETH |

These trades gradually arbitraged LLAMMA’s price back to the spot ETH price.

Impact on the Loan's Collateral Value

| Block | Date & Time | Total Collateral Value |

|---|---|---|

| 23844310 - 23844317 | 2025-11-21 02:08:59 | 28,243,659.55 |

| 23844318 | 2025-11-21 02:09:23 | 29,119,794.21 |

| 23844319 | 2025-11-21 02:09:35 | 28,709,456.80 |

| 23844320 | 2025-11-21 02:09:47 | 28,644,318.83 |

The large trade increased collateral value by about 1M USD. Follow-up arbitrage reduced this by about 600k USD, leaving the user with a net gain of roughly 400k USD, a rare but possible outcome for large LLAMMA liquidity providers.

Closing the Position

On November 24th, while the position was still below the liquidation protection range, the user chose to close the loan manually.

To close the position, 26,412,885 crvUSD from the collateral was used to repay the outstanding debt. The remaining 2,185,149 crvUSD was sent back to the user’s wallet.

At this point, the collateral consisted entirely of crvUSD because the loan had already moved through the full liquidation protection range, converting all 9,942.545 ETH into stable collateral. The total collateral value at closure was 28,598,034.72 crvUSD, compared to 31,390,004.75 USD when liquidation protection began, which corresponds to an overall reduction of about 8.9%.

Notably, this reduction is broadly in line with the underlying ETH price movement inside the protection range itself — roughly $3,200 down to $2,900, a decline of about 9.9%. While LLAMMA losses don’t always match the size of the market move exactly (since they depend on band count, AMM curvature, and the price path), the similarity here provides helpful context for interpreting the outcome.

LLAMMA not only reduced the downside but even delivered about a 1% relative gain compared to simply holding ETH — a remarkable outcome that highlights the value of liquidation protection.

But crucially, the user was not liquidated — they only incurred partial conversion losses instead of losing the entire position plus penalties, as would happen in a traditional liquidation.

A subtle but important detail: ETH buying power was largely preserved

Although the user ended with an 8.9% loss in USD terms, the picture looks very different when viewed in ETH terms. By the time the loan was closed, the remaining 28.6 million crvUSD in collateral was enough to buy roughly 10,034 ETH at the prevailing price of about $2,850 per ETH.

In other words, the remaining collateral at closure was enough to buy more ETH than the position originally held as collateral, which started with 9,942 ETH.

The user did repay 1.2 million crvUSD earlier, when ETH was around 3,100 dollars, which corresponds to about 387 ETH in value at the time. Including this repayment gives an effective starting exposure of around 10,329 ETH. Compared to this figure, the closing value represents almost the same ETH exposure despite a major market crash and seven days inside liquidation protection.

This illustrates one of the understated strengths of liquidation protection: it may preserve a user’s ability to regain nearly the same amount of collateral at much lower prices, rather than losing everything in an instant-liquidation event.

Conclusion

This loan stayed open for seven full days inside liquidation protection range during one of the most volatile market periods of late 2025. Despite repeated price swings, crashes, recoveries, and arbitrage activity, the position’s health never reached zero, and the position was never fully liquidated.

Liquidation protection turned what would normally have been an instant liquidation into a long, manageable process. The user had:

- time to react even during sharp crashes

- multiple opportunities to repay or adjust

- protection during extended periods below their traditional “liquidation price”

- the ability to exit the loan voluntarily on their own terms

Even after passing through the entire protection range and converting fully to crvUSD, the loan remained open until the user chose to close it manually.

This case demonstrates the power of liquidation protection:

It transforms liquidation from a sudden, irreversible event into a gradual, survivable process that gives users real control over their positions, even in the most extreme market conditions.