Liquid Lockers and Community Boosts

Liquid lockers like Convex, Yearn, and StakeDAO pool CRV into veCRV, unlocking community boosts and higher yields. They make Curve rewards accessible to all users without the four-year lock.

From veCRV to Liquid Lockers

Locking CRV directly into veCRV is the foundation of Curve governance, but in practice very few users do it themselves. Locking requires a commitment of up to four years, veCRV cannot be transferred or unlocked early, and the main benefit — boosting CRV rewards — only makes sense if a very large amount of veCRV is controlled. For most users, that is out of reach.

To solve this, protocols like Convex, Yearn, and StakeDAO pool CRV from their users and lock it as veCRV. Within each platform, this creates a large “communal” veCRV position. When users later deposit LP tokens into these platforms, they unlock boosts that would otherwise be unattainable and at a fraction of the costs. Effectively, the LP tokens get staked in Curve gauges under the pooled veCRV of the host protocol.

This system of pooled veCRV is what makes community boosts possible and accessible to everyone — to understand why, it helps to first look at how boosting works.

Community Boosts Explained

The real draw of liquid lockers is that they turn boosting into a community benefit. Here’s how it works:

- Normally, to earn boosted CRV rewards, users would need to lock a huge amount of veCRV relative to their LP position. See an example further below.

- Each liquid locker pools veCRV from its own users and applies it as one giant boost.

- When users deposit Curve LP tokens into these protocols, the tokens are staked into the Curve gauge as one big position under the platform’s veCRV boost. Redistributing the CRV rewards on a pro-rata basis.

- This lets all depositors earn boosted CRV rewards, even if they hold no veCRV directly.

In other words, liquid lockers make it possible for users of all sizes to benefit from the same rewards that would otherwise only be available to the very largest veCRV holders. The trade-off is that users give up direct control and these platforms take a small fee on the yield earned.

Another trade-off is that liquid locker tokens like cvxCRV, yCRV, and sdCRV are transferable and sellable, but not redeemable for the underlying CRV. Once CRV is deposited into a locker, it is locked as veCRV permanently, effectively acting as a CRV supply sink. Exiting requires selling the derivative token on the market, which may trade at a discount or premium to CRV depending on supply and demand.

To see how this plays out in practice, here’s a snapshot of CRV rewards for the scrvUSD/reUSD pool across Curve and its major liquid lockers (as of 10th September 2025):

| Platforms | Boost | CRV Rewards (APR/APY) | TVL ($) |

|---|---|---|---|

| Unboosted CRV Rewards | - | 6.93% APR | - |

| Convex | 2.12x | 15.98% APR | $32.1M |

| StakeDAO | 2.50x | 16.59% APR | $11.12M |

| Yearn | 2.21x | 14.93% APY | 7.22M |

These figures change over time. Boost levels depend on how much veCRV each platform controls and how much TVL is deposited. The more liquidity that flows into a given platform, the harder it becomes to reach the maximum 2.5x boost.

To put this into perspective, fully boosting a $100,000 position in the crvUSD/reUSD pool would require 1,550,505 veCRV. That equals locking 1,550,505 CRV for four years or 6,202,020 CRV for one year. At the time of writing, with CRV trading around $0.7955, this is clearly out of reach for most individual users. This is why pooled community boosts through liquid lockers have become the norm. Try out the calculator here!

The Curve Wars

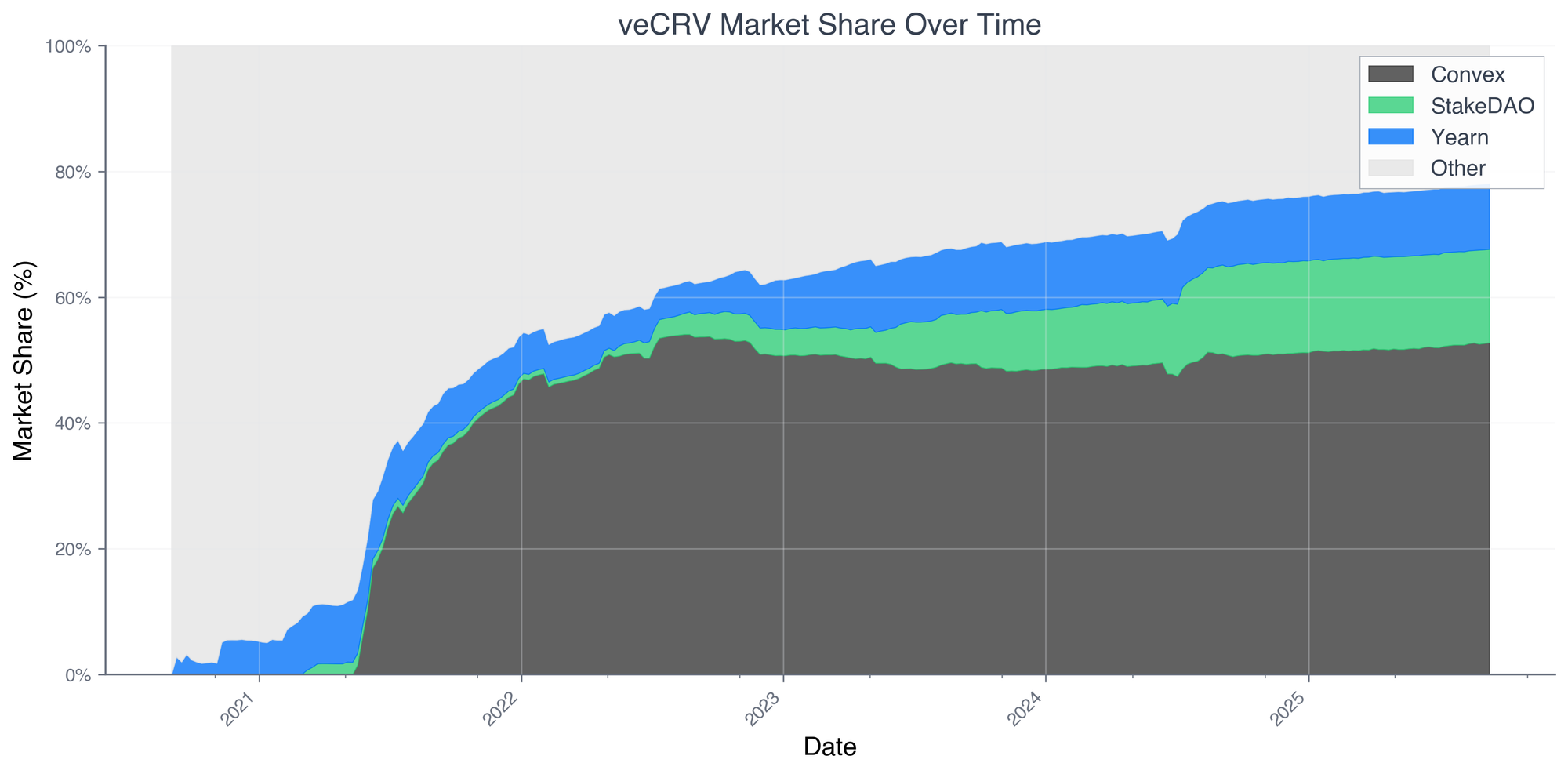

Liquid lockers became especially important during the so-called Curve Wars. Yearn was the first to build a liquid locker for CRV, followed by StakeDAO, and shortly after Convex. When Convex entered in 2021, it began accumulating CRV at scale and quickly became the dominant player. Protocols competing for Curve gauge votes realized that large veCRV positions held the keys to liquidity. Incentives and bribes poured in to sway voting power, creating a new meta-game around Curve governance.

Today, Yearn, StakeDAO, and Convex each run their own lockers and compete to attract CRV deposits. A bigger veCRV base means stronger boosts and more influence, and together these three DAOs hold the overwhelming majority of veCRV, shaping how Curve incentives are distributed.

The Big Three

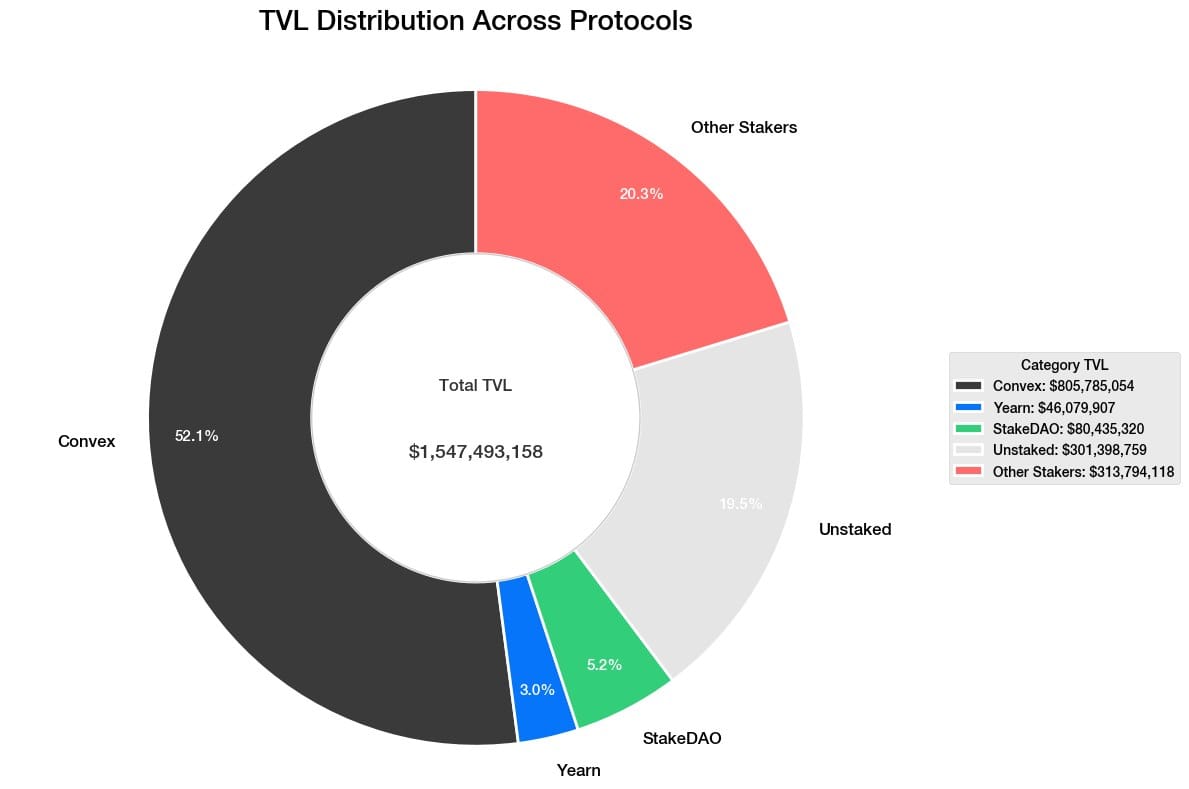

The three largest liquid lockers — Convex, Yearn, and StakeDAO — each control their own massive veCRV holdings. Together, they dominate Curve governance, with each platform competing in its own way to attract users, CRV locks and TVL.

Convex (cvxCRV)

Convex is the largest liquid locker with around 53% of all veCRV. Users deposit CRV and receive cvxCRV, while the CRV is locked as veCRV. cvxCRV is transferable and can be staked on Convex to earn Curve admin fees plus platform incentives. Convex charges a 17% performance fee on CRV revenue. The distribution is 10% to cvxCRV stakers, 4.5% to CVX stakers, 2% to the treasury, and 0.5% to harvest callers. Users give up direct CRV voting rights, which are exercised via vlCVX, but Convex’s large veCRV base delivers strong communal boosts and competitive yields.

StakeDAO (sdCRV)

StakeDAO issues sdCRV when users deposit CRV, which is locked as veCRV. sdCRV is transferable and can be staked for rewards from Curve fees, CRV emissions, SDT incentives, and vote incentives, or paired in sdCRV/CRV liquidity. sdCRV holders can replicate Curve governance votes through StakeDAO, earning vote incentives and indirect governance influence. StakeDAO charges a 17% performance fee on rewards of which 6% go to veSDT, 5.5% to the treasury, 5% to sdCRV, and 0.5% as caller incentives. Interestingly, they control around 14% of veCRV, plus an additional 41M veCRV delegated from the founder of Curve, which they can use for boosting as per SDGP-57.

Yearn (yCRV)

Yearn’s locker issues yCRV when users lock CRV through Yearn. yCRV is transferable and can be deposited into Yearn vaults that auto-compound rewards. At the time of writing, they hold 10.5% of voting power. Their yCRV has a 10% performance fee. Yearn manages voting, so users do not retain direct Curve voting rights, but it provides a simple, automated path to boosted rewards through its pooled veCRV base.

Liquid Lockers vs. Locking CRV Directly

Locking CRV directly into veCRV gives users the full range of benefits: voting power, boosts, and a share of Curve’s revenue, without paying fees to a third party. For large holders and protocols, direct veCRV positions are powerful because they provide both influence in governance and the ability to maximize rewards.

For most individual users, however, the trade-offs are heavy. veCRV is non-transferable, the lock cannot be undone before its expiry, and reaching meaningful boost levels requires a very large amount of CRV. Direct veCRV is also only redeemable at the end of the lock, whereas liquid locker tokens can be sold on the market at any time (though often at a discount to the actual value of CRV).

Liquid lockers were created to make these benefits more accessible. By pooling CRV together, they make communal boosts available to everyone, provide a liquid token that can be traded at any time, and often deliver higher yields.

Conclusion

Liquid lockers solved the impracticality of locking CRV individually for smaller users. In doing so, they not only created community boosts but also reshaped governance in Curve and gave rise to new markets around incentives and voting power.

For users, the main takeaway is simple: adding liquidity on Curve earns CRV rewards, and liquid lockers offer an easy path to boosted yields without committing to a four-year lock. Direct veCRV remains valuable for those who want to retain their maximum governance power and long-term influence, but for most, liquid lockers are the practical gateway into Curve’s reward system.