Inside crvUSD Borrow Rate

Learn how crvUSD borrow rates work, why volatility increased in recent months, and what the latest Curve DAO changes mean for a smoother, more predictable borrowing experience.

Ahead of the Llamalend V2 launch, crvUSD’s borrow rate is undergoing important updates aimed at making the borrowing experience on Llamalend significantly smoother. Curve already offers great features such as liquidation protection and very high LTVs, but user feedback has consistently highlighted one major friction point: borrow-rate volatility. Even when the average cost of borrowing was reasonable, the rapid swings in the rate made the experience unpredictable and often discouraged users from opening loans.

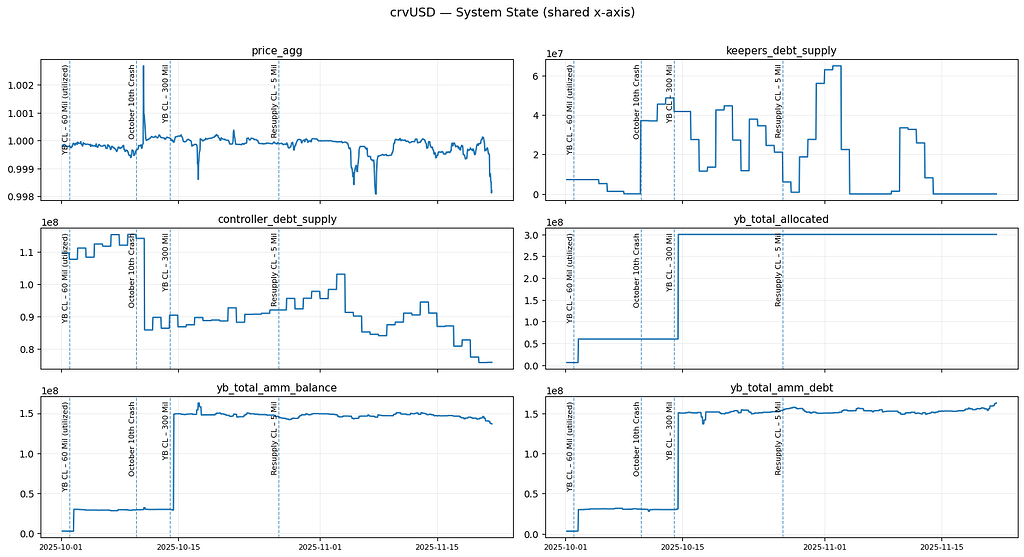

This volatility was further amplified by recent changes around crvUSD. New mint-market integrations such as YieldBasis partly increased the variability of PegKeeper debt and, as a result, contributed to sharper rate fluctuations.

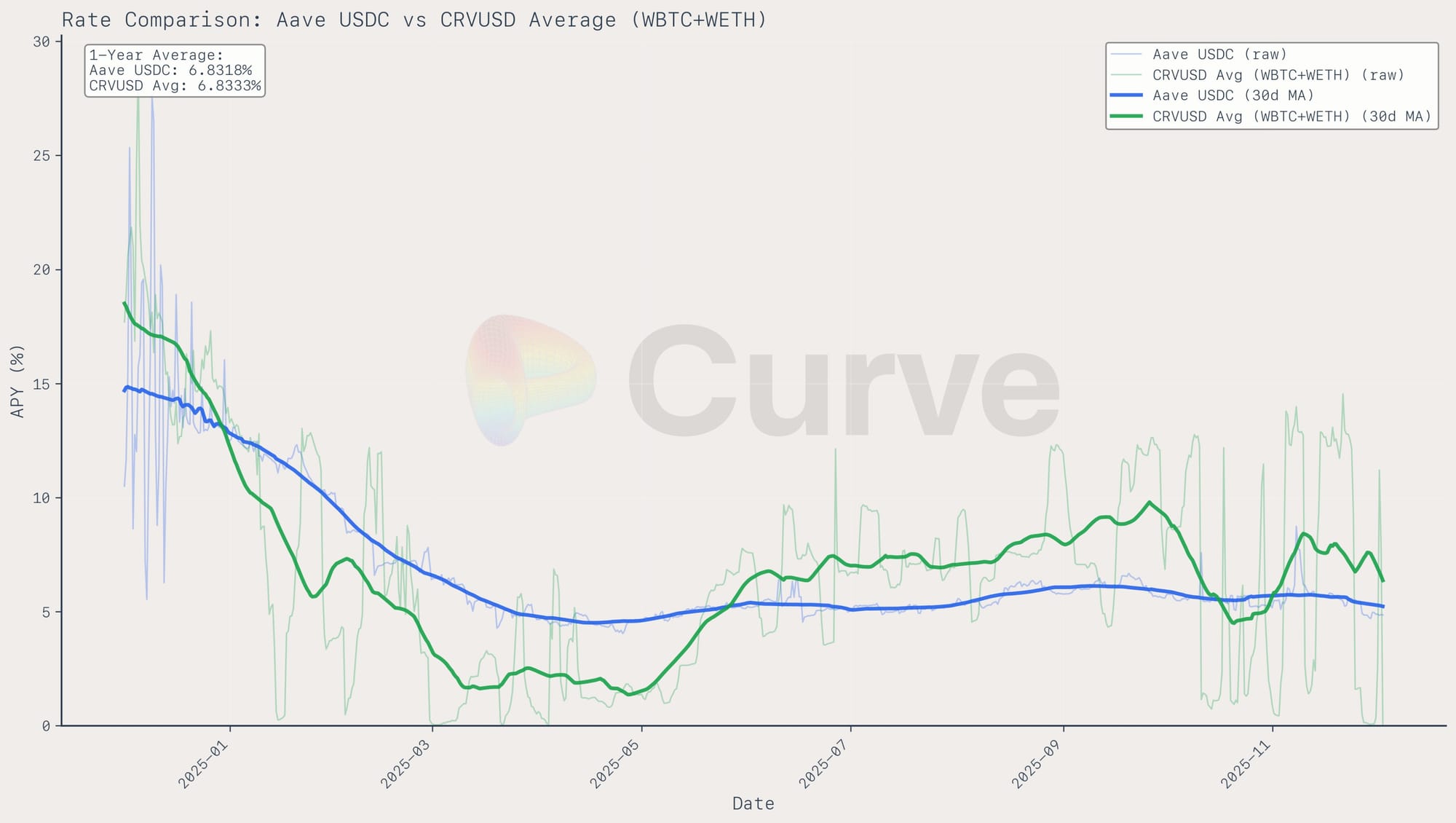

Importantly, while the rate often felt high, perception did not match reality. When comparing the effective cost of borrowing USDC on Aave versus borrowing crvUSD on Curve using WBTC or WETH as collateral, the average borrow rate over the past year was identical at 6.83 percent.

Recognizing this, and with the goal of making borrowing more stable and intuitive, LlamaRisk and Pangea conducted a detailed analysis and proposed a series of targeted improvements. Curve DAO approved these changes on December 3rd, following the governance proposal outlined here:

crvUSD Borrow Rates Explained

The crvUSD borrow rate is the primary tool Curve uses to help maintain the stablecoin’s peg. If borrowing becomes too cheap, users can mint crvUSD and sell it, pushing the price below $1. If borrowing becomes too expensive, users avoid taking loans, reducing usage and weakening competitiveness.

To balance this, the monetary policy adjusts the borrow rate dynamically based on market conditions, most importantly the price of crvUSD:

- Above peg (> $1.00): rates decrease to incentivize borrowing and selling crvUSD, bringing the price back down.

- Below peg (< $1.00): rates increase to incentivize users to buy crvUSD and repay loans, pushing the price back up.

This makes crvUSD’s peg mechanism primarily incentive-driven, not intervention-driven.

Peg Stabilization Reserve (PSR)

The Peg Stabilization Reserve (PSR), formerly known as PegKeepers, complements the interest-rate mechanism. It allows permissionless minting or withdrawing of crvUSD into specific pools depending on the price and balances of the pools:

- Above $1.00: PSR mints crvUSD into pools, increases liquidity, and pushes the price down.

- Below $1.00: PSR withdraws crvUSD from pools, reduces liquidity, and pushes the price up.

The size of the PSR directly affects rate dynamics. A larger reserve tends to lower borrow rates, while a smaller reserve tends to raise them.

Rates in Depth and What Is Changing

Let’s get a bit more technical to understand the upcoming changes.

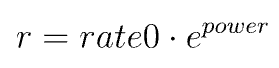

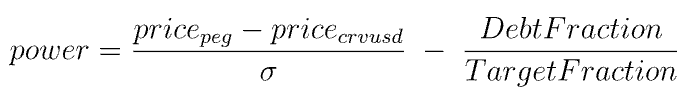

crvUSD’s borrow rate is set by the following monetary policy formula:

where

and

The price term behaves predictably. The recent volatility came mainly from the debt fraction term. When total crvUSD debt falls, PegKeeperDebt/TotalDebt ratio naturally becomes larger and more unstable. Because this term is subtracted in the formula, even small swings in PSR balance caused disproportionately large swings in the final borrow rate.

The expansion of mint-market credit lines like YieldBasis amplified this effect. These markets introduce issuance and repayment flows outside the normal PSR mint and burn loop, which caused the PSR to fluctuate more aggressively.

What Was Approved and Why It Matters

To stabilize the borrow rate and improve competitiveness, Curve DAO voted in two key parameter changes on December 3rd (Proposal #1269):

- Increasing

TargetFractionfrom 0.20 to 0.2667, which reduces how strongly the rate responds to changes in PSR size. This directly smooths the main source of volatility without changing the core peg mechanism. - Lowering

rate0by 10 percent, which makes borrowing cheaper and more competitive. This encourages more borrowing activity and increases total system debt, which also stabilizes the PSR ratio and reduces rate fluctuations.

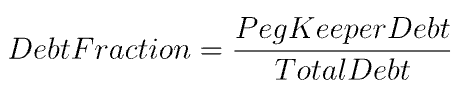

These changes represent the first step in a broader effort to modernize crvUSD’s monetary policy. A third lever, EMA smoothing for the borrow rate, is already being explored and is likely to become the next improvement to the system. Smoothing would reduce short-term spikes by averaging rates over time, while keeping the monetary policy responsive to meaningful shifts in crvUSD demand. One approach currently being worked on is applying a longer-term EMA specifically to the PegKeeper debt ratio, smoothing the term PegKeeperDebt/TotalDebt.

Curve founder Michael Egorov suggested using a three-week EMA for this ratio, which would significantly dampen short-lived fluctuations in PSR activity while still preserving responsiveness to crvUSD price changes.

Work on EMA smoothing will continue in parallel with monitoring the newly approved parameters. Once the short-term impact of the recent updates is understood, EMA smoothing is expected to be the next major refinement to further stabilize the borrow rate.

Conclusion

The approved adjustments to crvUSD’s monetary policy are an important step toward making Llamalend borrowing more predictable and user-friendly. By reducing sensitivity to PSR movements and lowering the baseline borrowing rate, Curve has smoothed out the biggest source of volatility while preserving the self-correcting peg mechanism that makes crvUSD unique.

These upgrades directly improve the borrowing experience. Llamalend users can expect steadier rates and clearer incentives, especially as Llamalend V2 expands access to new collateral types and markets.

Curve will continue monitoring the system and is prepared to refine the parameters further to ensure that crvUSD remains stable, scalable, and competitive across the broader DeFi landscape. The direction is clear: a smoother, more reliable borrowing experience that unlocks Llamalend’s full potential.