FXSwap

FXSwap is Curve’s new AMM algorithm for trading volatile and FX-style asset pairs with passive liquidity. Pange analyzed its performance and found that FXSwap delivers strong execution for large trades compared to Uniswap V3.

The introduction of Stableswap in 2020 showed that passively concentrated liquidity works extremely well for pegged assets, where prices of the tokens remain close to each other (like USDC<>USDT, or WETH<>stETH). But for volatile asset pairs with independent prices, AMM performance is still an open challenge. When prices move quickly, liquidity tends to be left behind, making trades inefficient.

FXSwap moves this frontier forward by automating liquidity concentration, as Cryptoswap pools on Curve already do, and by introducing a new mechanism called refueling. Refueling funds the rebalancing budget used when prices drift, allowing the pool to smoothly shift liquidity concentration and keep depth near the current price without active LP management.

To understand how well this new design performs in practice, Pangea conducted an independent analysis comparing FXSwap to Uniswap V3 for BTC/USD flows.

TLDR: FXSwap can deliver materially better execution for large trades, especially during volatility.

What is FXSwap?

FXSwap is Curve’s new AMMfor asset pairs that drift over time, rather than forming a stable pair. This covers both volatile pairs like crypto assets, and lower-volatility foreign exchange and real-world asset pairs. It combines the pricing efficiency of Stableswap with the passive rebalancing framework of Cryptoswap, plus a new mechanism called Refueling. The goal is to provide deep, passive liquidity for asset pairs that are not pegged to each other, without requiring LPs to actively manage ranges.

With FXSwap, liquidity is always deployed in full-range. LPs do not need to choose a price range or rebalance positions as the market moves. Instead, the pool automatically keeps most liquidity concentrated near the current market price, similar to Cryptoswap. This addresses a long-running issue in volatile AMMs: when prices move quickly, liquidity often drifts away from the active price, leading to higher slippage for traders and lower fee capture (or none at all) for LPs. In CLAMMs like Uniswap V3, LPs must monitor the price and manually reposition liquidity. If they do not, their capital sits out of range and stops earning fees.

FXSwap automates this entire process. When the price moves up or down, liquidity is passively re-centered using a combination of pool trading fees and the new Refuel mechanism. Refuels act as an external buffer that subsidizes rebalancing costs during both calm and volatile markets. Rebalancing costs are covered by the pool’s fee flow and, when needed, by externally funded refuels, allowing the pool to maintain depth more consistently. This keeps spreads tight during price discovery and enables passive LPs to always remain in range and always earn fees, without any active management.

Because of these properties, FXSwap is well-suited for pairs such as BTC/USD, ETH/USD, and especially low-volatility assets like fiat FX stablecoins. These are assets with independent market prices that are actively traded off-chain in large size. FXSwap provides an AMM architecture that can support these markets onchain.

As these markets operate, they provide valuable data on how FXSwap performs, which will help optimize parameters and pool configurations over time.

Pangea Research

To evaluate FXSwap’s real-world performance, Pangea analyzed execution quality for USDC → BTC trades across two routes:

- Uniswap V3 WBTC/USDC 0.3% pool

- Curve FXSwap route via crvUSD (USDC → crvUSD → WBTC using Curve’s crvUSD/USDC and YieldBasis WBTC pools)

A key detail is that these pools had similar TVL for most of the measurement window, making this a fair comparison. This means FXSwap’s outperformance is not just better pricing in absolute terms, but better pricing per unit of capital.

Pangea published the full study in a research article here:

— Pangea (@in_pangea) January 9, 2026

Methodology

Pangea collected end-of-block state data from November 1 to December 17. For each block, they asked a simple question:

“If I spend X USDC to buy BTC right now, how much BTC do I receive?”

Multiple trade sizes were evaluated, ranging from small retail trades up to 10 million dollar institutional-size flows. Quotes include swap fees but exclude gas.

Alongside the raw quotes, Pangea analyzed:

- TVL

- pool composition

- liquidity distribution

- price impact during volatility

- speed of recentring after price moves

These datapoints help explain not only which pool performs better, but why the performance diverges.

How Does FXSwap Perform?

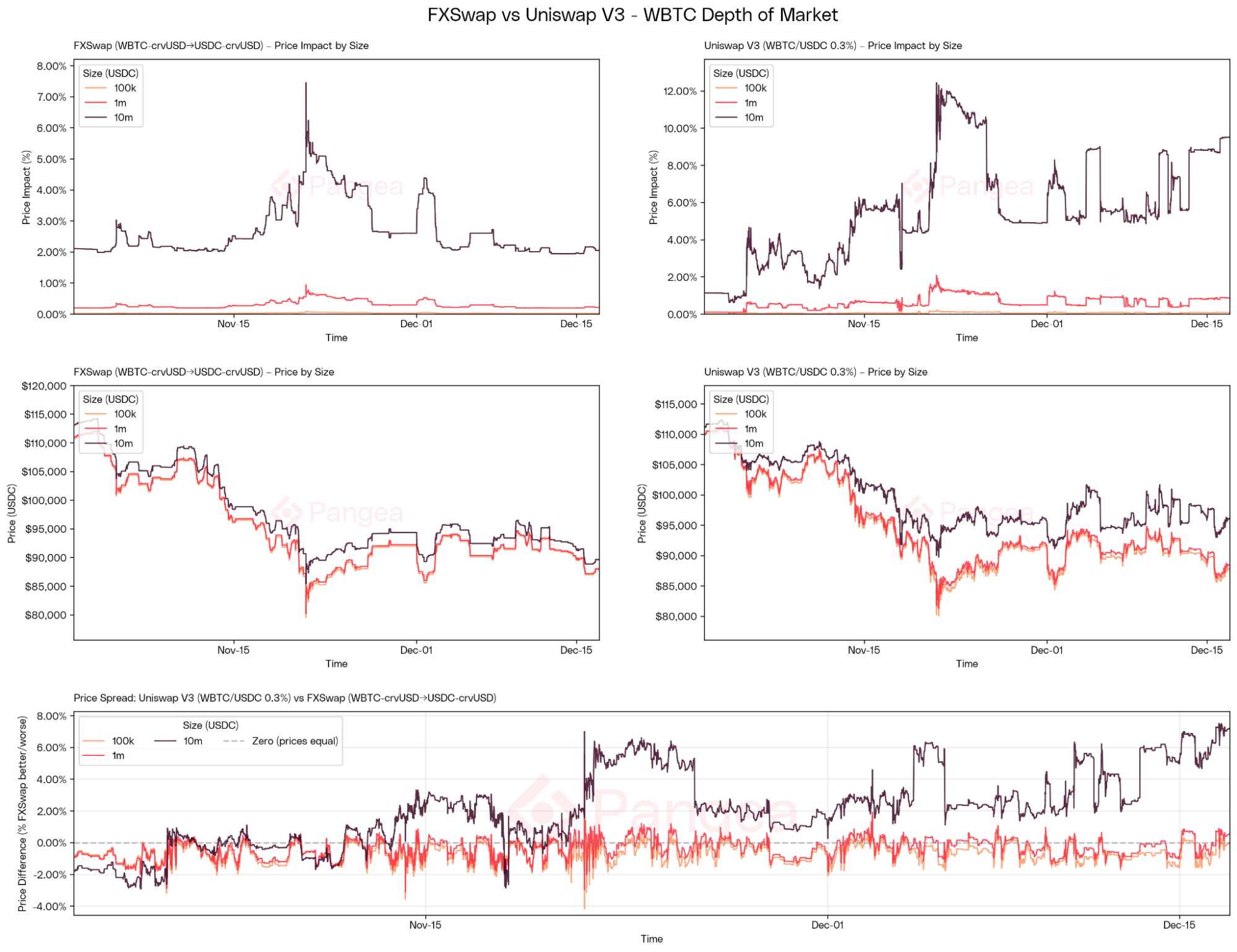

For large trades, FXSwap performed significantly better than the Uniswap V3 pool.

For a 10 million dollar trade, FXSwap provided the better execution price in approximately 80% of blocks, with an average improvement of about 2%.

In some blocks, execution through Uniswap was over 7% worse for the same trade size.

This shows FXSwap delivers more effective depth per dollar of TVL, even compared to a mature concentrated-liquidity design.

For smaller trades, Uniswap often remained slightly better due to lower fees as YieldBasis BTC FXSwap pools use a static 1% fee to fund automatic liquidity management and refuelling. As a result, retail-sized trades often route through Uniswap, while larger institutional flows benefit more from FXSwap’s deeper book.

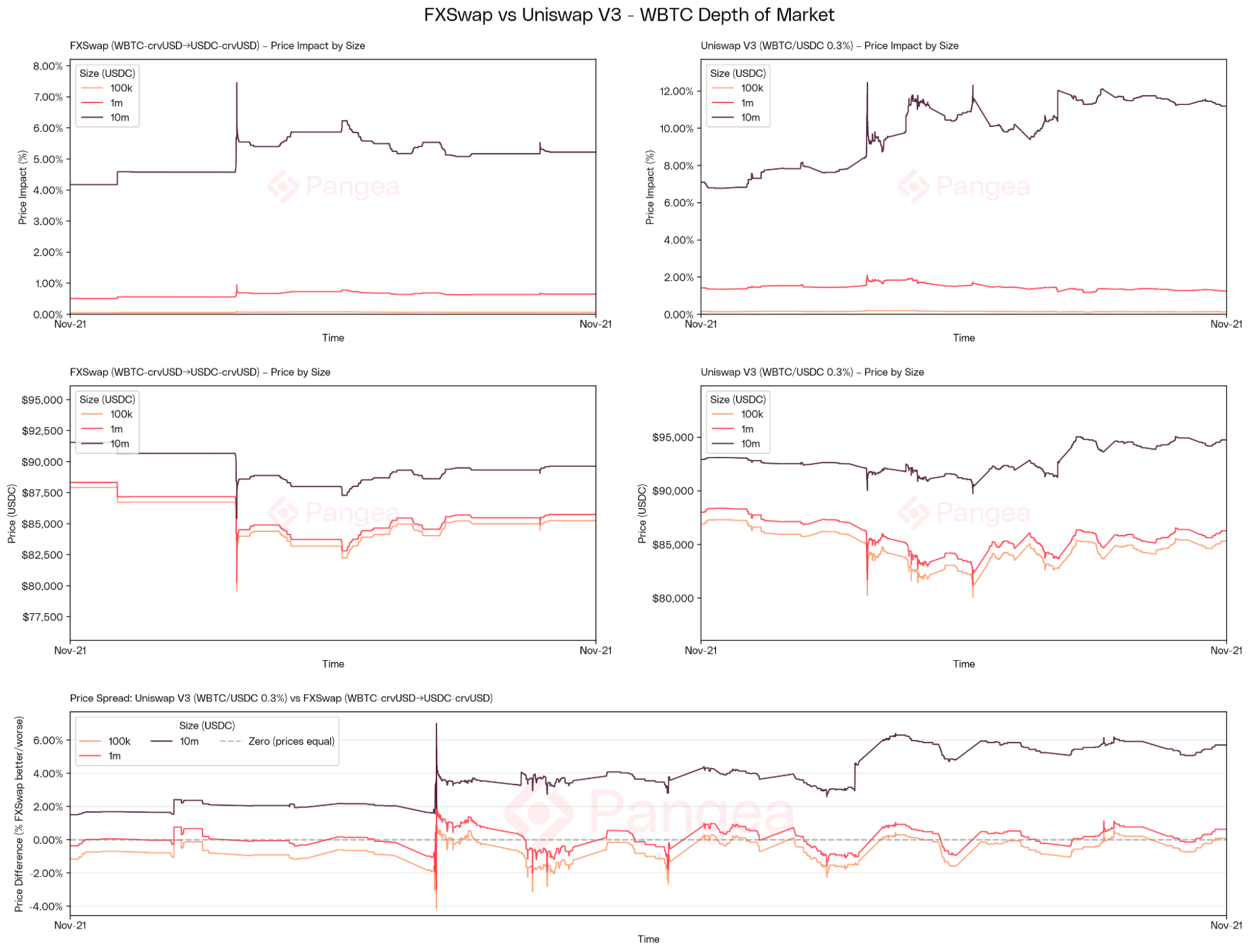

Volatility Case Study: November 21

A particularly informative moment occurred on November 21, when BTC fell below 83,000 dollars. During the move, both pools temporarily lost liquidity concentration as the price dropped, but their responses diverged:

- The Uniswap pool experienced price impact above 12% for a 10 million dollar swap and stayed elevated for a sustained period.

- The FXSwap pool peaked near 7.5%, then stabilized around 5% to 6% as it recentred liquidity automatically.

This highlights a core design difference. Uniswap depends on LPs manually moving liquidity back into range, while FXSwap automates this process through its refuelling mechanism.

cbBTC Pool Results

Pangea also examined the YieldBasis cbBTC pool, which benefits from fast, fee-free redemptions via Coinbase. This allows arbitrageurs to keep the pool more accurately priced and quickly refuelled. After a December cap increase to 200 million dollars, the cbBTC FXSwap pool delivered approximately 1% price impact on 10 million dollar trades, which is extremely low for a volatile crypto pair.

Conclusion

Pangea’s analysis suggests that FXSwap represents a meaningful advance in volatile AMM design. By automating liquidity concentration and socializing the cost of rebalancing, FXSwap delivers deeper execution for large trades without requiring LP micromanagement. FXSwap is also fully passive for LPs. Liquidity is always in range, always used, and always earning fees.

As FXSwap rolls out to additional markets, including foreign exchange between different fiat-pegged stablecoins, the design opens the door to deeper and more reliable on-chain execution for assets that previously traded primarily on centralized venues.

As liquidity deepens and more data accumulates, FXSwap can and will play a growing role in bringing spot FX and other large markets on-chain.