Five Years of Curve DAO

A Chad hit deploy and, just like that, the Curve DAO was born. veCRV’s veTokenomics and priced vote incentives sparked the Curve Wars, delivered steady real yield, and showed that on-chain, community-led governance can work and scale.

How a Chad Launched the Curve DAO

Five years ago, the Curve DAO went live in a way no one expected. The token and governance contract had been publish ahead of launch for public review. The team was getting ready to deploy. But someone moved first. 0xc4ad, an anonymous community member, hit deploy. The community got excited. The team rushed to verify that the bytecode and parameters matched the public code. It did. The community made it canonical.

And just like that, the Curve DAO was born.

Yo, @CurveFinance ! Saw your DAO is ready to rock and I gots to MAXIMIZE MY ALPHA ! So I went ahead and deployed it for you. Get at me in DM to verify and lets get this party started!! pic.twitter.com/D0KqEg4Ldr

— 0xc4ad (@0xc4ad) August 13, 2020

What the launch changed for DeFi

Curve introduced vote-escrowed tokenomics. By locking your governance token (CRV into veCRV), you get a share of the revenue and governance rights, a powerful combo to pull people into the DAO. With veCRV, you would also gain the power to influence where future CRV emissions went. This created a competition for governance power early on. That contest would later be called the Curve Wars.

The design proved durable and contagious. In the years that followed, projects like Balancer, Frax, Velodrome, Aerodrome, and Pendle shipped their own ve-style systems. Each built on the same idea: aligning incentives and making emissions programmable.

Curve Wars & Vote Incentives

If veCRV made emissions programmable, vote incentives made them priced.

The Curve Wars were a scramble by protocols to accumulate or influence veCRV so they could direct weekly gauge votes toward their own pools. Protocols locked CRV directly, used liquid lockers, or accumulated CVX to access aggregated voting power. For example, as of today, Convex holds ~52.7%, Stake DAO ~14.72%, and Yearn ~10.45%of veCRV voting power. Other protocols, including Liquity and Aave, have also accumulated CRV or CVX as a proxy for veCRV voting power.

Because veCRV holders decide where CRV emissions go through gauge weight votes, and attention is scarce, decisions run on a weekly schedule, with measurable outcomes. Projects also began paying voters to direct voting weight toward specific pools to attract liquidity.

Platforms emerged, used primarily by other protocols, where anyone could post incentives for veCRV holders to vote for specific pools. Put simply, vote incentives let anyone post rewards for veCRV holders to incentivize weekly gauge weight votes toward a chosen pool. That puts a clear price on influence, keeps coordination quick (weights can shift each week), and boosts emissions on the targeted pool so LPing there is more attractive. An easy way to attract (and essentially “rent”) liquidity for a period.

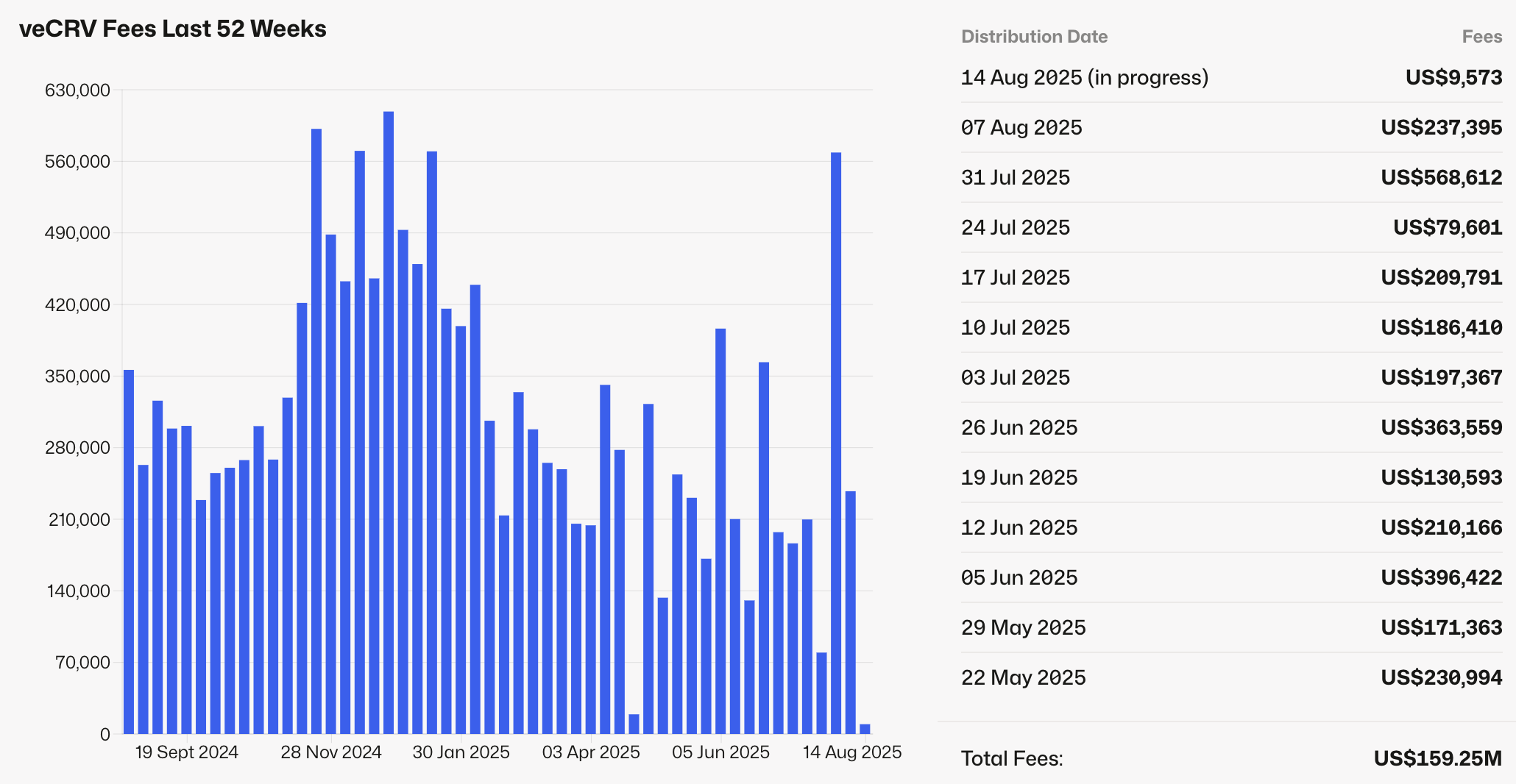

Five years of weekly revenue

Here is what five years of holding veCRV got you:

- $159.25M in real yield ($) to veCRV, paid across 256 consecutive weeks

- $622.07k average payout per week (about $33.38M per year) and peaking at $4.47M in a single week

- Paid in 3CRV initially (LP token with a mix of USDT, USDC and DAI), now in crvUSD to better align incentives

On a per-unit basis, one veCRV held from day one would have earned approximately $0.524 in 3CRV/crvUSD rewards. Even more if you include additional airdrops to veCRV holders such as CVX, Ellipsis, and many others.

And by design, fee distribution is permissionless. Anyone can call the contracts to trigger distribution. No multisig or manual approval is required.

The result is governance that pays. Lock, vote, and share fees from protocol activity. Five years in, the loop still clears each week.

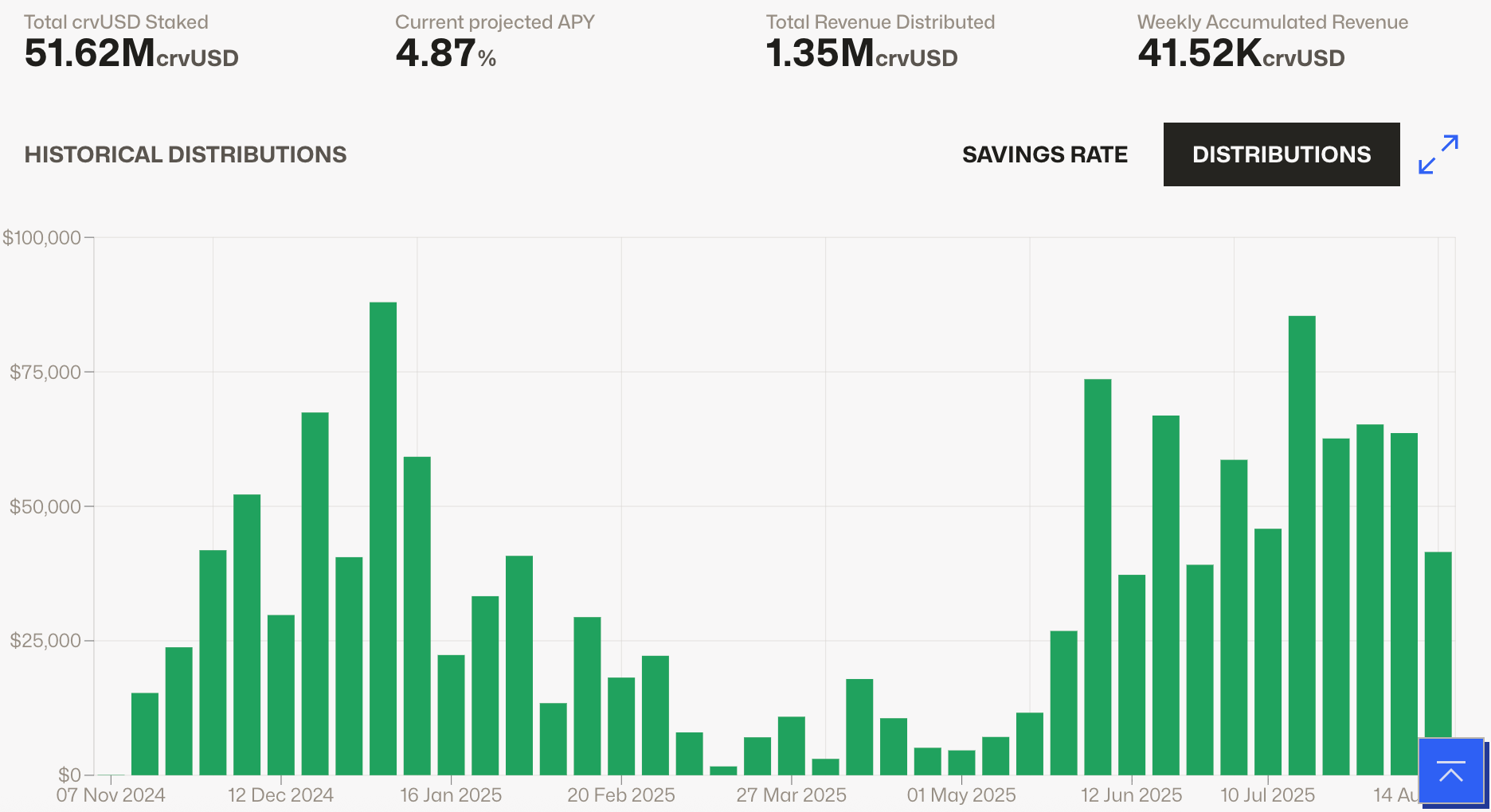

Revenue to scrvUSD

Then came scrvUSD, the savings version of Curve's decentralized stablecoin crvUSD. Borrowers who mint crvUSD pay interest, and that interest funds the savings rate paid to scrvUSD holders. A total of 1.35M crvUSD has been distributed to scrvUSD since the launch in October 2024, resulting in a 9 month average yield of approximately 6%.

The newest payout route in the DAO, scrvUSD shifts a share of the borrower interest to savers. By soaking up crvUSD and encouraging new minting, it can grow the total interest pie even as payouts are split between veCRV and scrvUSD.

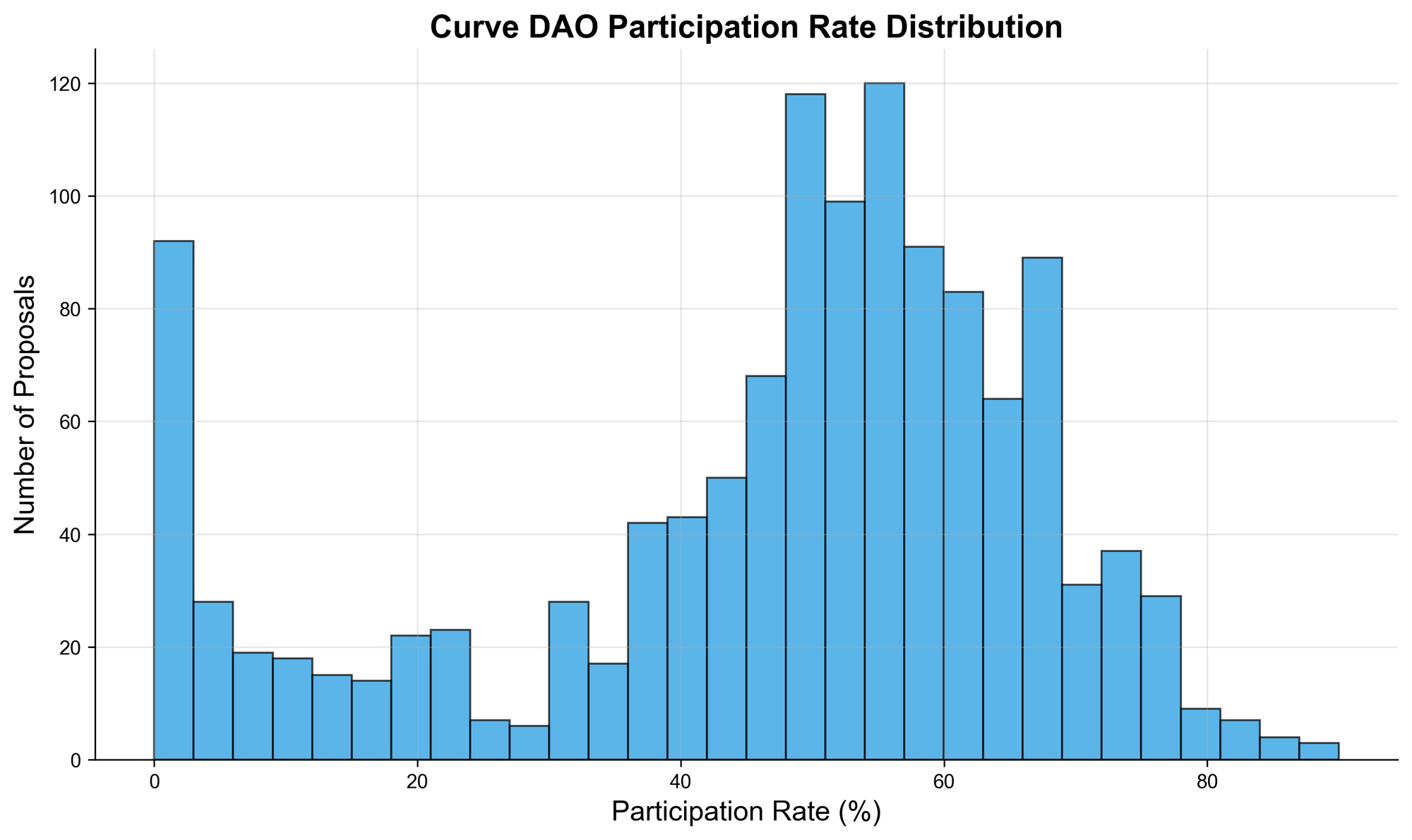

Governance

The governance model launched with the DAO has also held for five years without interruption. Every major change is put to a public vote, and participation has stayed high enough to keep quorum almost every time. The result is a DAO that is both active and broad, not dominated by a few voters.

In that time, the community has handled 1,276 proposals with an average participation rate of ~46.7% (peaking near 90%), and hit quorum ~97.6% of the time. Voters have cast ~384.6B CRV, averaging ~301.4M CRV per proposal.

An average support rate of ~93.2% shows consistent alignment among voters. Combined with large turnouts and fully public decision-making, shows the decentralization is real.

Most notable DAO votes

In five years the DAO has made calls that shaped Curve’s direction. From funding Swiss Stake AG to keep core development moving, to backing LlamaRisk’s ongoing risk oversight. More recently, the DAO approved a mechanism to redirect 10% of protocol revenue to a community fund, laying the groundwork for long-term sustainability and future growth. Votes like these show how the community can move fast on big decisions when it matters.

Curve as a building block

We should also not forget that the DAO governs infrastructure that other protocols depend on. Reliable parameters, predictable emissions, and open deployment frameworks, along with the core efficiencies Curve brings, mean other teams can plan around Curve for the long term. That trust is why some of the most active protocols in DeFi have chosen to integrate directly with Curve.

- Yearn, Convex Finance, and Stake DAO aggregate veCRV voting power to boost rewards for Curve LPs, provide liquid lockers, and add auto-compounding so users capture more yield with less effort.

- Resupply builds on Curve’s lending layer and lets users borrow against assets supplied to Curve lending markets, improving capital efficiency.

- Spectra uses Curve’s AMMs to power yield trading markets.

There are many other solid projects building on top of Curve, made possible in large part by the Curve DAO’s consistent support and involvement.

Conclusion

Curve built more than a DEX or lending layer. It built a rules-based revenue machine and a market for coordinationwith transparent, credibly neutral rules. Revenue is shared automatically with those who commit (veCRV) and those who save (scrvUSD). With active governance, thousands of votes with consistent quorum prove it. That’s why Curve is successful, and why others build on top.

On to the next five.