Curve ✗ Resupply: A Proposal to Mint 5M crvUSD

A new Curve DAO proposal would mint and supply 5M crvUSD directly into the sreUSD Llamalend market. Introduced by Resupply, it expands crvUSD utility, supports reUSD market growth, and generates additional yield for the DAO.

Following the recent crvUSD minting approvals for YieldBasis, a new proposal has been introduced by Resupply, a lending protocol built on top of Llamalend. The proposal would mint and supply 5 million crvUSD directly into the sreUSD Llamalend market and is currently undergoing a DAO vote with about two days remaining:

What is Resupply?

Resupply is a decentralized stablecoin protocol that leverages the liquidity and stability of Curve’s lending markets to improve capital efficiency. Built on top of Llamalend, , it allows users to borrow reUSD against crvUSD supplied to lending markets on Curve, turning idle collateral into productive liquidity.

The protocol issues two stablecoins: reUSD, its core stablecoin, and sreUSD, a yield-bearing version that earns protocol revenue based on platform performance and the stability of reUSD’s peg.

What’s the Proposal About?

The Curve DAO is voting on a proposal to mint and supply 5 million crvUSD through a factory contract capable of minting directly into Curve lending markets, starting with the sreUSD market.

In practice, the DAO would mint 5 million crvUSD and supply it to the sreUSD lending market on Llamalend. This introduces a new minting model that uses lending pairs instead of traditional collateralized minting pairs. Lending markets follow independent monetary policies that are not tied to the crvUSD price, making them strategically useful for targeted use cases.

Why Do This?

The proposal aims to strengthen the overall Resupply system by improving the dynamics between reUSD, sreUSD, and crvUSD.

Because many users leverage their positions, reUSD has tended to trade slightly below $1. This persistent discount discourages new leverage since users effectively sell reUSD below peg and realize an immediate loss.

A few weeks ago, Resupply introduced sreUSD, the yield-bearing version of reUSD, to help ease this imbalance. The token receives a fixed portion of Resupply’s platform revenue, and the system allocates additional protocol revenue to it whenever reUSD trades below $1. While this has helped, the effect has not been strong enough to restore balance on its own.

By minting and supplying 5 million crvUSD to the sreUSD Llamalend market, the DAO would introduce several reinforcing effects:

- Higher borrowing capacity and liquidity: The additional 5 million crvUSD increases the total supply available for lending, which lowers borrowing rates and makes borrowing against sreUSD more attractive. This stimulates market activity and demand for sreUSD.

- Reduced sell pressure on reUSD: With deeper lending liquidity, users can convert reUSD → sreUSD, use it as collateral, and borrow crvUSD directly from Llamalend instead of selling reUSD on the market. This reduces sell pressure and supports a healthier reUSD market structure.

- Restored leverage efficiency: The increased liquidity allows users to “loop” their positions again — borrowing crvUSD against sreUSD without first selling reUSD — which reactivates Resupply’s core leverage mechanism and supports sustainable growth.

Together, these effects improve market efficiency and create healthier conditions for both reUSD and sreUSD to scale, while aligning the incentives of Resupply and Curve.

What’s in It for Curve?

Generally speaking, all assets supplied to Llamalend generate yield, including the 5 million crvUSD allocated through this proposal. The contracts are designed so that anyone can permissionlessly claim the accrued profits, ensuring transparency and decentralization. All revenue generated from this activity flows directly back to the Curve DAO, while Resupply does not take any share of the proceeds.

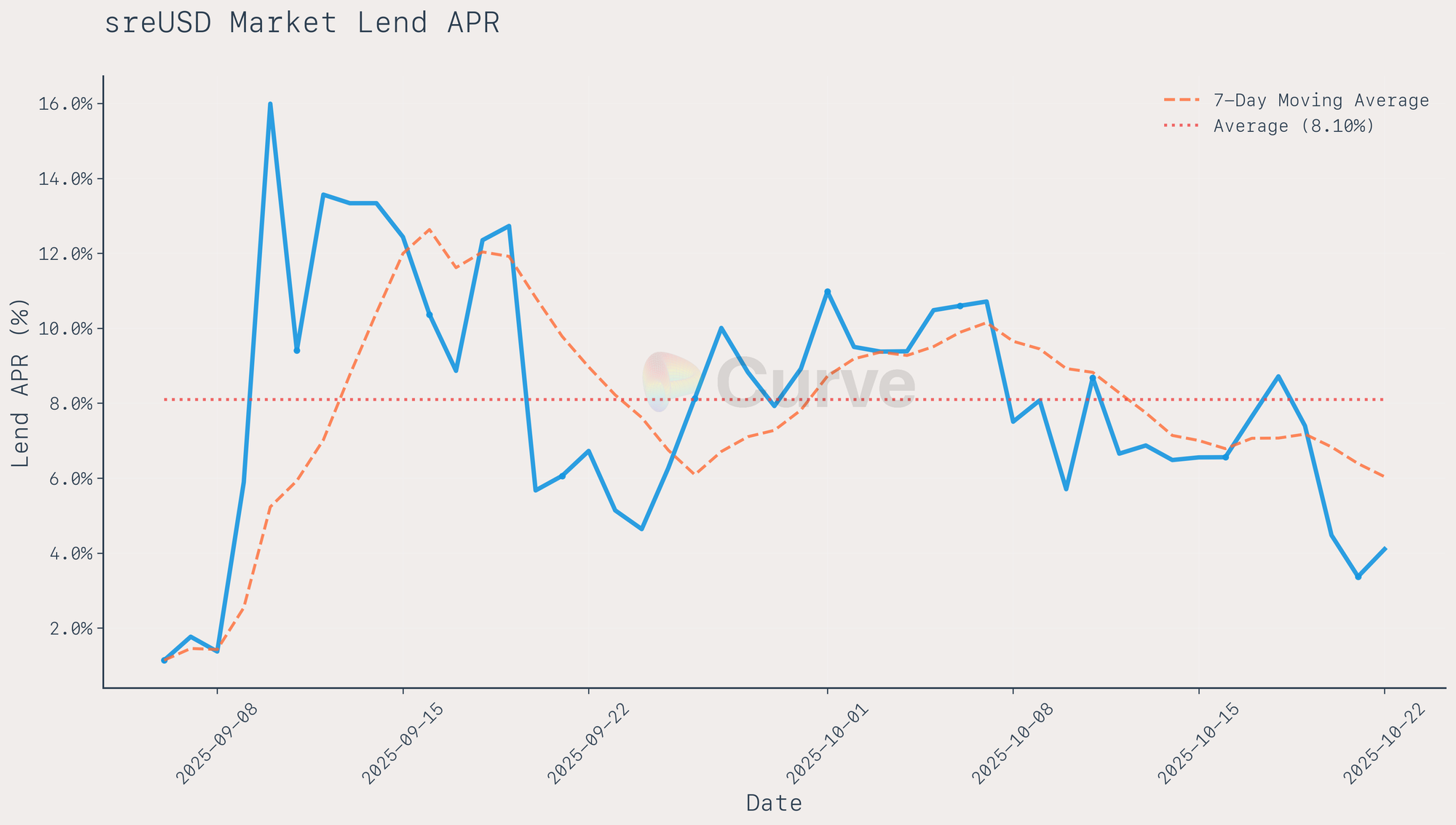

For Curve, this setup creates a new and more stable source of protocol revenue. Unlike traditional crvUSD borrowing, which depends on market price movements and PegKeeper activity, Llamalend lending rates are determined purely by market utilization — how much of the supplied liquidity is borrowed. This mechanism avoids the sharp rate fluctuations seen in other markets and provides a steadier income stream for the DAO.

Based on the average sreUSD market supply rate of around 8.1%, the DAO could expect an annual return of approximately $405,000 from this 5 million crvUSD allocation. Beyond the additional revenue, the structure also diversifies Curve’s earning sources, introducing a yield stream that is more predictable and less exposed to market volatility.

Design and Security of the System

The smart contracts introduced by the proposal were developed by the Resupply team and are intentionally kept simple. They mint crvUSD, supply it to the Llamalend market, and include logic for withdrawing generated profit back to the DAO.

To ensure safety, the system was audited by Electi (formerly yAudit) and ChainSecurity, with all reports publicly available on GitHub.

Control over the contracts (and the minted crvUSD) remains entirely with the Curve DAO. Any changes, such as increasing the minted amount or adding new markets, must go through a DAO vote. Resupply cannot redirect or modify the allocation independently.