Curve Monthly Recap September, 2025

September was big for Curve: FXSwap outshines tricrypto, YieldBasis kicks off, Plasma rockets to $25M in a week, Spark drops PYUSD<>USDS ($80M TVL), savings-crvUSD smashes 9% APY, and CRV hits Robinhood.

Key Highlights of September:

- First FXSwap pools in production, outperforming tricrypto

- YieldBasis launches their pools on Curve

- Plasma live with Curve day one, $25M TVL in week one

- Spark added PYUSD<>USDS pool (PayPal partnership), $80M TVL

- Savings-crvUSD yields hit record highs above 9% APY

- CRV listed on Robinhood for U.S. retail access

FXSwap In Production

Curve introduced a new pool design last month: FXSwap, optimized for swaps between two correlated assets. Built as an upgrade to Cryptoswap, FXSwap is designed for low-volatility pairs such as BTC<>crvUSD, EUR<>USD, or GOLD<>USD.

The new design adds a refuel mechanism that allows pools to rebalance liquidity smoothly when markets move. Refuels act like a drip-released buffer that offsets impermanent loss for LPs while keeping spreads tight for traders. The result: LPs retain more yield and traders get better execution, without relying on short-term emissions to keep markets aligned.

Early results highlight the design’s efficiency. As noted by a Curve developer on X, the crvUSD<>WBTC pool with only $2M TVL is already offering better exchange rates than the original tricrypto pool with $27M TVL. This efficiency positions FXSwap as a likely new standard for correlated asset trading on Curve, with broader applications once integrations and pool caps expand.

The new version of twocrypto is very efficient! I'm proud of our work at @CurveFinance.

— heswithme (@heswithme_eth) September 26, 2025

The crvUSD-wBTC pool on @yieldbasis, with $2M TVL, offers better rates than the og tricrypto ($27M TVL). These pools will be the primary place to swap bitcoin once deposit caps are raised. pic.twitter.com/25xvPJ02jQ

YieldBasis Launch

YieldBasis, a protocol built on Curve and powered by the new FXSwap pools, launched on September 24. It enables BTC liquidity provision without impermanent loss by maintaining 2x compound leverage.

The launch of YieldBasis followed the execution of DAO proposal #1206, which approved a 60M crvUSD credit line used to maintain a 2x compounding leverage in the system. Three BTC markets — WBTC, cbBTC, and tBTC — opened with $1M caps each, all filling instantly. Thanks to the leverage mechanism, this translated into a $6M TVL increase on Curve across the three pools.

Cryptopools at @CurveFinance related to @yieldbasis are heating up. Looks like all organic volume so far - DEX aggregators and arbitrage pic.twitter.com/s0IYfRgs5J

— Michael Egorov (@newmichwill) September 29, 2025

During the rollout, minor deposit issues were identified. A follow-up governance proposal (#1213) went live to adjust pool parameters and passed on October 2. As a result, pool caps were raised to $10M per pool — and once again filled within minutes (another +26M in TVL for Curve).

Plasma Launch

Plasma officially launched on September 25, marking the debut of a new layer for incentivized liquidity. Curve deployed its DEX infrastructure on day one, providing deep and reliable liquidity for all trades on the chain. The launch began with Merkle-distributed incentives, fueling rapid adoption: within just a week, Plasma attracted over $25M in TVL.

Ecosystem integrations followed quickly. Gearbox enabled users to leverage Curve LP positions on Plasma up to 12x, while Gluex, a DEX aggregator, integrated Curve pools into its liquidity module, giving traders access to Curve’s deep liquidity and routing trades for the best available rates.

Spark Liquidity Layer - “It just works!”

Spark Protocol expanded its liquidity layer on Curve this month with a new PYUSD<>USDS pool, launched through a PayPal–Spark partnership. Just over a week after launch, the pool is already sitting at $80M in TVL and has facilitated more than $850M in trading volume.

This addition builds on Spark’s existing presence on Curve, where the sUSDS<>USDT pool already holds over $51M in TVL. Together, these markets strengthen the secondary liquidity backing Spark’s stablecoin ecosystem.

As MonetSupply, Head of Strategy at Spark, explained, Spark chose Curve for its rock-solid infrastructure, universal integrations, and ease of use for liquidity providers — ensuring deep, reliable, and efficient markets for its stablecoins.

With Spark deepening its Curve integrations, Curve further solidifies its role as reliable, efficient base-layer infrastructure for stablecoin liquidity.

trust and safety- curve is rock solid infra and we feel comfortable holding 8-9 figures in curve smart contracts

— monetsupply.eth (@MonetSupply) September 25, 2025

integrations- whether users go to curve frontend or an aggregator/wallet, they’ll always have access to curve liquidity

usability- curve just works, very easy to…

Savings-crvUSD Yield at Record Heights!

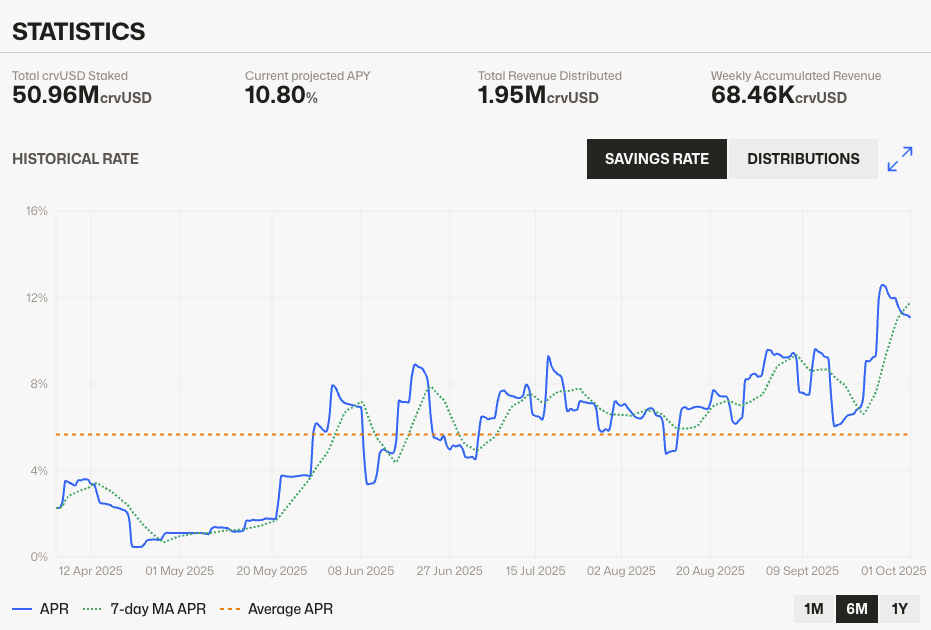

Over the past six months, savings-crvUSD yields have steadily climbed, reaching record highs above 10% APY. In September 2025, the average APY was a staggering 9.08% — placing it among the highest-yielding stablecoins alongside savings-reUSD and fxSAVE.

CRV on Robinhood

On September 18, Curve’s governance token CRV was listed on Robinhood, giving millions of U.S. retail users the ability to purchase and trade CRV directly through one of the most widely used investing apps.

$CRV is now available to trade on Robinhood and Robinhood Legend. pic.twitter.com/rVeUb78Wao

— Robinhood (@RobinhoodApp) September 18, 2025