Curve Monthly Recap October, 2025

Curve governance expanded YieldBasis capacity, increased PegKeeper limits, and supported new liquidity programs. crvUSD remained stable during major market volatility, and Curve deployed to new networks while maintaining strong user activity.

Key Highlights of September:

- YieldBasis credit line expanded from 60M to 300M crvUSD

- PegKeeper capacity increased to 300M to support crvUSD stability

- $YB emissions redirected to vote incentives for major crvUSD pools

- 5M crvUSD minted into the sreUSD LlamaLend market via Resupply

- LlamaRisk launched the first crvUSD Optimizer Vault on Arbitrum

- $10M incentives program on XDC Network

- Curve deployed on OKX's X-Layer

All about YieldBasis: Vote Incentives, Airdrop and expanded PegKeeper capacities

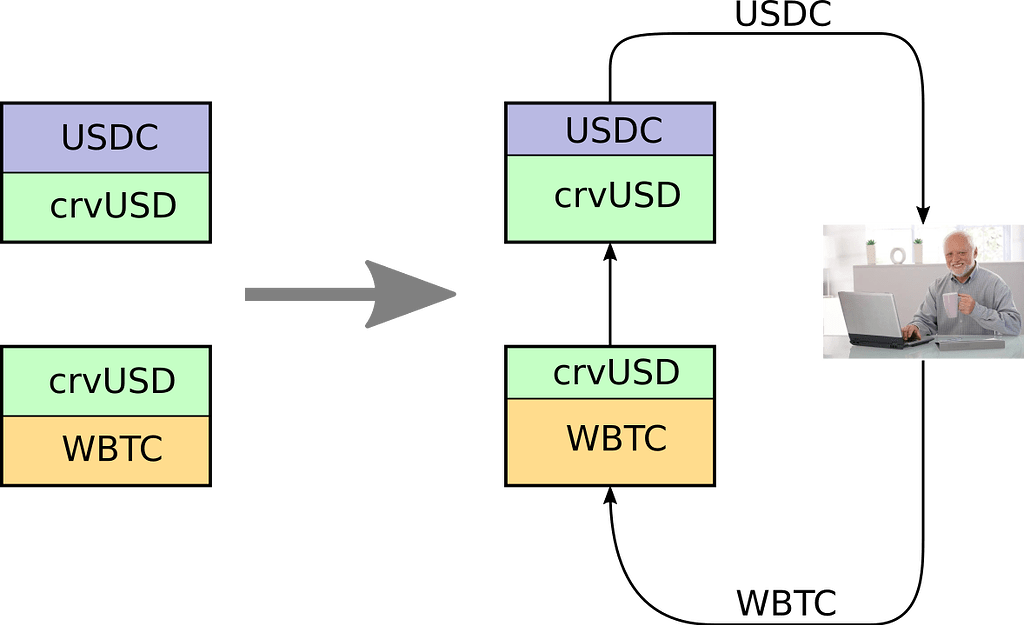

On October 7, Curve governance voted to expand YieldBasis’ crvUSD credit line from 60M to 300M. After the proposal passed on October 14, the three $100M market caps filled almost immediately, adding roughly $300M in new TVL to Curve pools. This demand reflects the rapid uptake of YieldBasis as a leveraged liquidity mechanism within the Curve ecosystem.

Following the vote, Michael Egorov, founder of Curve and YieldBasis, published a roadmap outlining additional proposals required to scale the protocol responsibly. The proposals focused on system liquidity and stability parameters, including PegKeeper capacity increases and the introduction of $YB token incentives for Curve governance voting.

$YB Vote Incentives

On October 27, the DAO approved a proposal to redirect $YB emissions to a new permissionless contract that automatically distributes tokens between Votium and Votemarket. These platforms provide incentives to users who vote for certain gauges with their veCRV voting power. More gauge votes increase gauge weight, which results in higher CRV emissions going to the corresponding liquidity pools. The initial targeted pools are:

These incentives are designed to run long-term and the mechanism won't change as long as the Curve DAO does not pass another vote to e.g. change the recipient of the YB emissions or change the allocation (e.g. by adding or removing pools).

$YB Airdrop to Curve Governance

On October 15th, YieldBasis airdropped 5M $YB tokens to veCRV holders who voted “YES” on proposals 1206, 1213, and 1222, all of which were important to the development and launch of YieldBasis.

YB airdrop with @yieldbasis is happening!

— Michael Egorov (@newmichwill) October 15, 2025

- To @CurveFinance veCRV voters who supported proposals important for YB: 5M YB - choose claim() here https://t.co/xIvLF8Nys2;

- To Early LPs - 5.625M, amounts are as if they farmed a constant stream during this airdrop season;

- If…

Increased PegKeeper capacity

To support recent growth in YieldBasis activity and maintain stability across crvUSD markets, Curve governance voted to increase PegKeeper capacity from approximately 103M to 300M. Increasing PegKeeper limits allows the system to absorb larger market movements and maintain the crvUSD peg as lending activity scales.

PegKeepers are a core stabilization mechanism in the crvUSD system. They help maintain the peg by automatically supplying or removing crvUSD liquidity from specific pools when price deviates from the target range. More information is available here: Peg Stabilization Reserve (PSR)

| PegKeeper | Old Capacity | New Capacity |

|---|---|---|

| crvUSD/USDC | 45M | 135M |

| crvUSD/USDT | 45M | 135M |

| crvUSD/pyUSD | 15M | 45M |

| crvUSD/frxUSD | 3M | 9M |

Resupply Credit Line

On October 27, Curve governance passed Vote 1237, minting 5M crvUSD into the sreUSD LlamaLend market through the Resupply program. Resupply proposals are used to expand lending capacity in LlamaLend markets when demand increases and risk parameters allow it. This allocation supports borrowing activity, liquidity depth, and overall efficiency within the crvUSD lending ecosystem.

LlamaRisk crvUSD Optimizer Vault on Arbitrum

LlamaRisk launched the first crvUSD Optimizer Vault on IPOR Fusion, introducing automated yield optimization for crvUSD holders on Arbitrum. The vault allocates deposits into StakeDAO v2 strategies with Convex integration and uses IPOR’s autocompounding logic to automatically reinvest rewards.

Risk controls are handled by LlamaRisk, which manages exposure limits and allocation caps. The vault currently distributes capital across WBTC, WETH, and ARB LlamaLend markets. This provides users with a streamlined way to access leveraged crvUSD strategies with risk parameters managed at the protocol level.

The first LlamaRisk crvUSD Optimizer Vault on IPOR Fusion is now live on Arbitrum!

— LlamaRisk (@LlamaRisk) October 2, 2025

Big thanks to our partners @CurveFinance, @StakeDAOHQ, and @ipor_io. Curve Finance powers $crvUSD, one of the most trusted stablecoins in DeFi, StakeDAO brings a proven platform for staking and… pic.twitter.com/5BE6hNHWLC

October 10: crvUSD Stability and Oracle Performance

On October 10, crypto markets experienced the largest liquidation event in history, with more than $19B liquidated following geopolitical developments related to U.S.–China trade policy.

Despite extreme volatility, crvUSD remained stable, trading between 0.996 and 1.012 (excluding single-block MEV effects), supported by PegKeeper intervention.

How big was the effect of the Friday crypto crash on @CurveFinance crvUSD? It's important to measure properly: using state prices at the end of block.

— Michael Egorov (@newmichwill) October 16, 2025

If you exclude 1- and 2-block sandwiches, price fluctuated from 0.996 to 1.012 during that time, fixed by PegKeepers pic.twitter.com/SEaoYu7kjN

During the event, several platforms mis-priced stablecoins due to oracle issues. Curve’s on-chain, liquidity-based oracle system continued to report accurate prices, demonstrating resilience during stress conditions.

While we share these suggestions privately with any partner we work with across both DeFi and CeFi, want to surface this publicly so there is zero doubt going forward on what we view as appropriate oracle design and risk management for USDe: pic.twitter.com/lb4OeaGn9Y

— G | Ethena (@gdog97_) October 12, 2025

This reinforces Curve’s design philosophy: real-trade and real-liquidity oracles provide superior reliability compared to external price feeds.

XDC Rewards Program

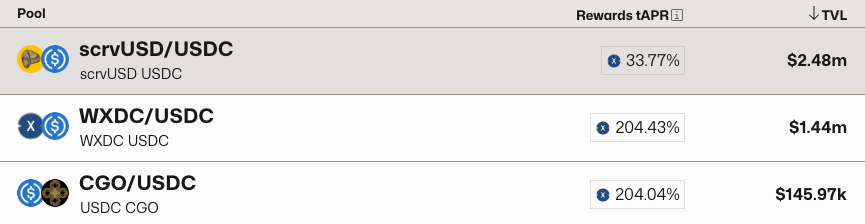

On October 29, the XDC Network launched a $10M Surge incentives program, with Curve included as one of the initial participating platforms. During Epoch 001, the program distributed a total of $1.25M in WXDC through Merkl, incentivizing liquidity for the following Curve pools:

Incentives were designed to deepen liquidity across the network and attract additional stablecoin and cross-chain capital. Demand for crvUSD on XDC increased significantly following the program launch, and daily bridge limits were reached as users moved funds to participate in the rewards.

Curve on X-Layer

Curve launched its DEX on X-Layer, OKX’s Layer-2 network built using the Optimism stack. X Layer offers low transaction costs and full EVM compatibility, providing an additional environment for Curve users and liquidity providers to access the protocol. This deployment expands Curve’s multichain presence and availability across rollup ecosystems.

Curve is live on X Layer.

— Curve Finance (@CurveFinance) October 9, 2025

Stablecoins move fast here.https://t.co/4o1yjD5QVP pic.twitter.com/PoZMoYEQd3

Curve User Observation

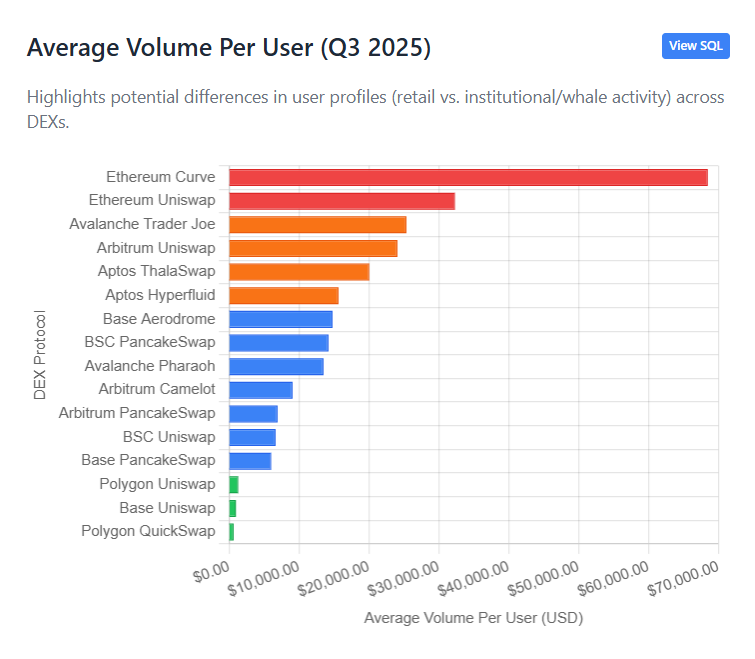

A new industry metric released for Q3 2025 showed Curve ranked number one in Average Trading Volume per User with almost $70,000, recording nearly twice the user trading volume of Uniswap.

This highlights that Curve continues to attract high-value users and institutional-scale volume, reinforcing its position as foundational liquidity infrastructure in DeFi.