Curve Monthly Recap May, 2025

May 2025 was a busy month at Curve. Let’s take a closer look at everything that happened:

Key Highlights of May:

- Curve TVL exceeded $2.4 billion at the month's peak

- crvUSD celebrated its 2-year anniversary with record supply

- veCRV Locking Fully Permissionless Now

- DNS attacks on curve[.]fi led to migration to new domain curve.finance

- Partnership announced with Cyfrin Updraft for developer growth

- Hyperliquid and Plume

Protocol Updates & Milestones

crvUSD Turns 2 Years — And Hits All-Time Highs

May marked the second anniversary of crvUSD, Curve’s native stablecoin. Since launching in May 2023, crvUSD has steadily grown into a foundational piece of Curve’s lending ecosystem. Designed as the spiritual successor to DAI, crvUSD is a truly decentralized stablecoin powered by LLAMMA, a unique liquidation engine that protects your collateral during market volatility, giving you more time and flexibility to react.

This month, both crvUSD and Savings crvUSD not only reached new all-time highs in circulating supply, but overall ecosystem adoption has also increased. crvUSD is now widely used across DeFi protocols and even for everyday spending, including through crypto credit cards, enabling users to access liquidity without selling their tokens.

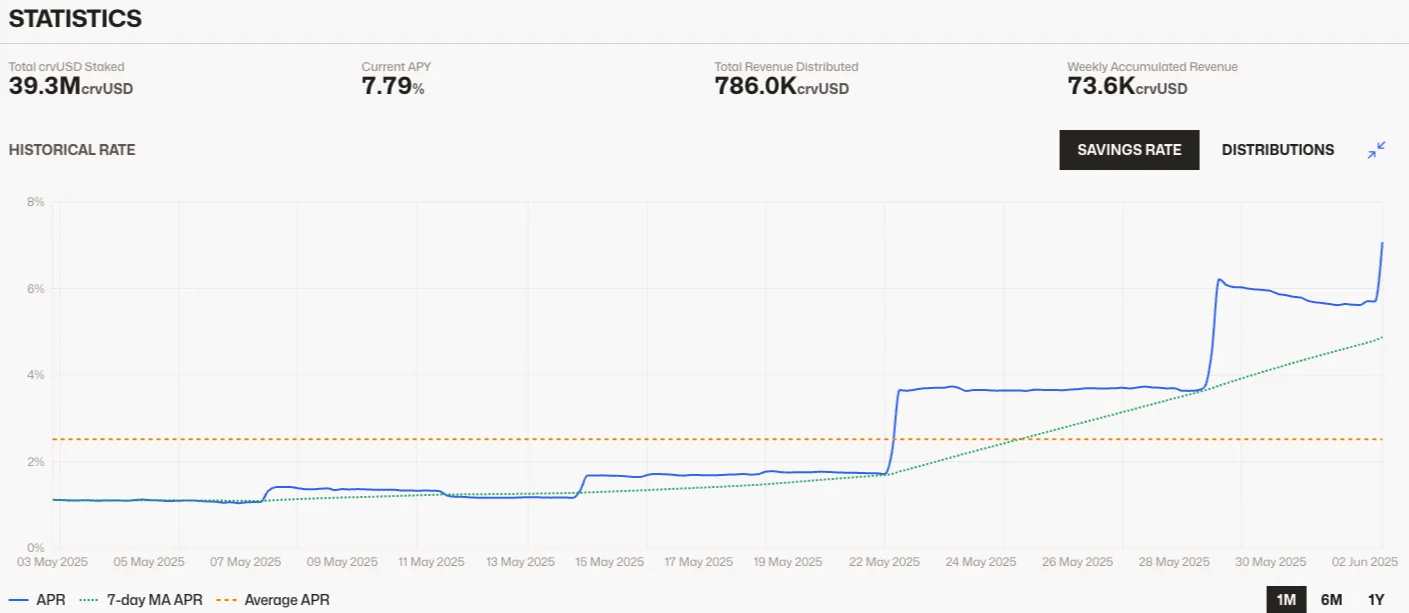

With interest rates across DeFi rising again, Savings crvUSD has also resumed printing rewards for their holders. The current APY for simply holding scrvUSD is 7.79% and trending upward. That's some real yield!!

USDM Pegkeeper Removed Following Token Deprecation

Following the announcement that Mountain Protocol will be acquired by Anchorage Digital, USDM was officially deprecated. In response, Curve governance passed proposal 1055 to remove the crvUSD/USDM PegKeeper and exclude USDM from the crvUSD price aggregator. While the pool itself remains live, the PegKeeper was unwound and its debt brought to zero, effectively ending protocol-level support for the pair.

LBTC Debt Ceiling Raised for crvUSD Minting

In proposal 1066, the DAO voted to increase the debt limit for LBTC collateral. This change the debt limit of crvUSD to be minted against LBTC to 20m, responding to growing demand for Bitcoin-backed stablecoin positions.

Integrating Pectra: Permissionless veCRV Locking

Curve governance approved a major upgrade to protocol accessibility by removing the veCRV locking whitelist — a restriction that previously limited CRV locking to EOAs and a few approved smart contracts like Convex, Yearn etc. With proposal 1062 now passed, any smart contract can permissionlessly lock CRV into veCRV. This opens the door for broader participation from multisigs, DAOs, and automated vaults that were previously excluded from Curve’s governance and fee-sharing system.

The change was also motivated by Ethereum’s upcoming Pectra upgrade, which includes EIP-7702 — a proposal that could blur the lines between EOAs and smart contracts. Removing the whitelist now future-proofs veCRV against compatibility issues and positions Curve for more seamless integration with evolving Ethereum account standards.

Security

DNS Attacks and New Domain Migration

May 2025 tested Curve Finance’s resilience with two external security incidents, both stemming from vulnerabilities in centralized Web2 services, not from Curve itself. On May 5, the official Twitter account @CurveFinance was briefly compromised to promote a fake airdrop. More critically, on May 12, attackers hijacked the DNS records of the curve[dot]fi domain, redirecting users to a phishing site designed to steal wallet funds.

Crucially, no smart contracts, backend systems, or protocol infrastructure were affected - only the domain-level routing was compromised. Curve’s contracts remained fully secure throughout and even processed over $400 million in volume, despite the frontend being inaccessible during the incident. This highlights the deep integration of Curve’s liquidity infrastructure across DeFi. In response, the team swiftly migrated to a new permanent domain: curve.finance.

These events reinforce Curve’s commitment to security as its top priority and highlight the systemic risks of depending on centralized Web2 providers. They also demonstrate the importance of decentralized alternatives like ENS and IPFS, which offer a more trustless and resilient foundation for Web3 applications. For more insight, check out this exclusive interview with Curve founder Michael Egorov on BeInCrypto, where he discusses DeFi security and the path forward.

Nonetheless, Curve is more committed than ever to improving the security of its infrastructure.

Integrations & Ecosystem

June is shaping up to be an exciting month for Curve in terms of external presence. On June 4th, Curve is hosting an Ecosystem Day during Belgrade Blockchain Week! A few tickets are still available, but registration closes in 24 hours! Grab yours here: blocklive.io/bel-crv.

And that’s not all: On June 27th, Curve will also be present at StableSummit in Cannes, where it was recently honored as Ambassador of the Year. Rumor has it there might even be some early alpha about YieldBasis. 👀

At Stable Summit, the map is simple: all routes lead to Curve.@CurveFinance, our Ambassador of the Year, is the front page of DeFi — offering deep liquidity, protocol-level trust, and “the most decentralised” stablecoin. Curve supports stablecoin issuers and builders across the… pic.twitter.com/nCvh3DOdXs

— Stable Summit 🦫 (@stable_summit) May 19, 2025

Continued Llamalend Growth Due To Resupply

The launch of Resupply in March 2025 has had a significant and sustained impact on the Curve ecosystem. Resupply enables users to borrow reUSD against yield-bearing stablecoin collateral, such as supplied crvUSD to Llamalend markets, without giving up their yield.

As a result, LlamaLend has experienced ten consecutive weeks of TVL growth since Resupply's debut, reaching $184 million by the end of May. TVL increased from just $36 million to over five times that amount in a short span. This influx of liquidity has greatly improved capital efficiency and helped lower average borrowing rates across the platform.

90,000 OP Grant Approved to Bootstrap Lending & Liquidity

Curve governance passed proposal 1053 to accept a 90,000 OP grant from Optimism, aimed at accelerating adoption of Llamalend and its associated liquidity pools on the Optimism network. The grant will be used to incentivize lending markets and deepen stablecoin liquidity, supporting the rollout of crvUSD and related strategies on L2. This marks another step in Curve’s ongoing expansion into the Optimism ecosystem.

Developer Certification with Cyfrin Updraft

On May 9, Curve Finance announced a strategic partnership with Cyfrin Updraft to reinforce its leadership in DeFi and support the growth of developer talent. As part of this collaboration, they launched a scholarship program offering free Solidity certification exams. The initiative aims to expand technical talent within the Curve ecosystem, with future plans to include Vyper certification. 🐍

Selected developers will receive vouchers for free SSCD+ certification exams from Cyfrin Updraft, enabling them to validate their skills and gain priority access to future opportunities in the ecosystem. Curve is also piloting the integration of Updraft certificates into its hiring process to streamline recruitment and onboarding.

Hyperliquid Gears Up

Although Curve-Lite was deployed on Hyperliquid earlier this year, it wasn’t until May when ERC20 transfers went live that activity meaningfully ramped up. With the infrastructure now fully operational and Ethena points incentives driving participation, Curve’s Hyperliquid deployment quickly gained traction, surpassing $11 million in TVL.

Curve Deploys on Plume

The Curve ecosystem expanded further with the deployment of Plume, a new blockchain environment optimized for DeFi-native applications. Plume’s launch sets the stage for more composability and gas-efficient liquidity strategies.