Curve Monthly Recap June, 2025

June 2025 was an eventful month at Curve, with major pool optimizations, the launch of a DAO Treasury, and the first rollout of the new Llamalend UI. At ETH Belgrade, Curve also introduced the Block Oracle, advancing cross-chain messaging.

Key Highlights of June:

- Focus on Pool Parameter Optimizations

- DAO Treasury Voted In

- New Llamalend UI Rolling Out

- Curve @ ETH Belgrade: From Curve Block Oracle to Yield Basis

- Resupply Exploit

Pool Parameter Optimizations

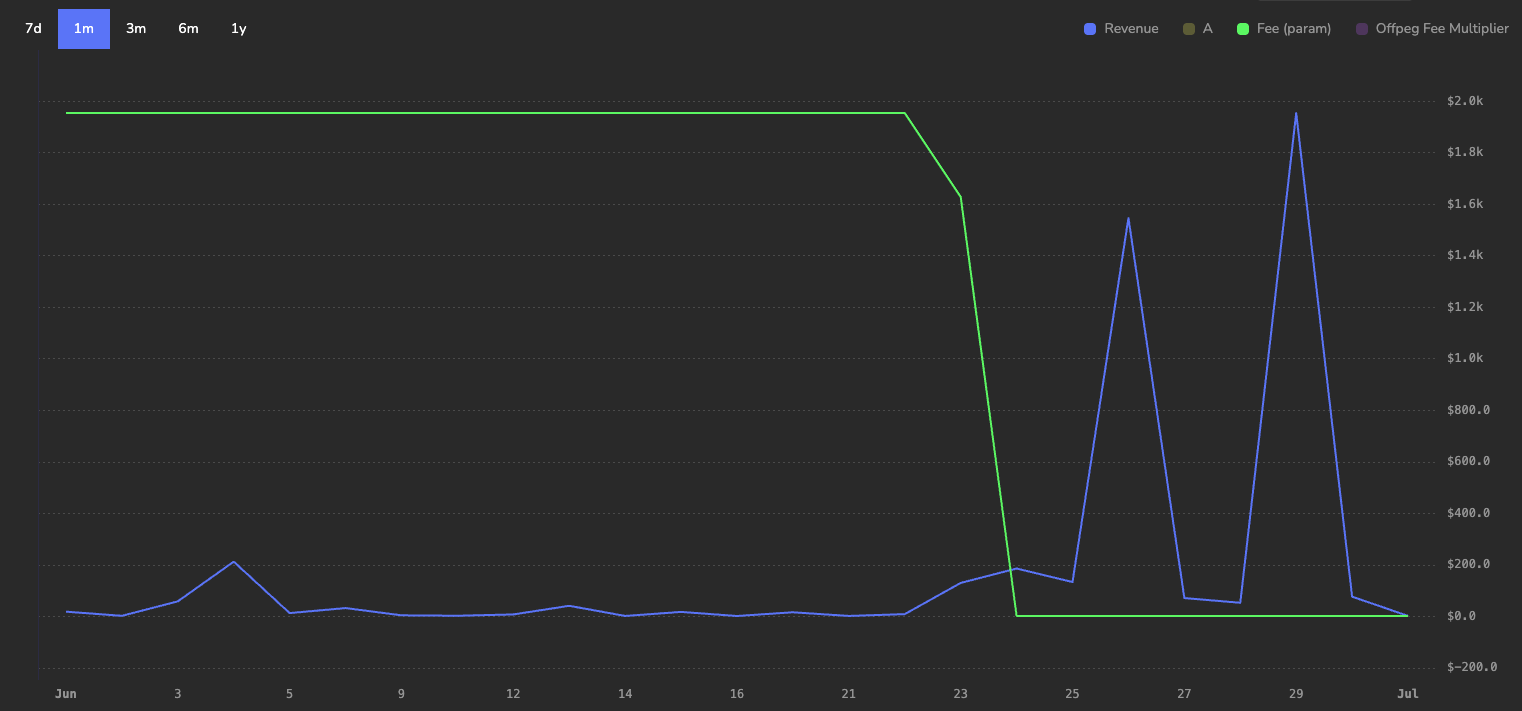

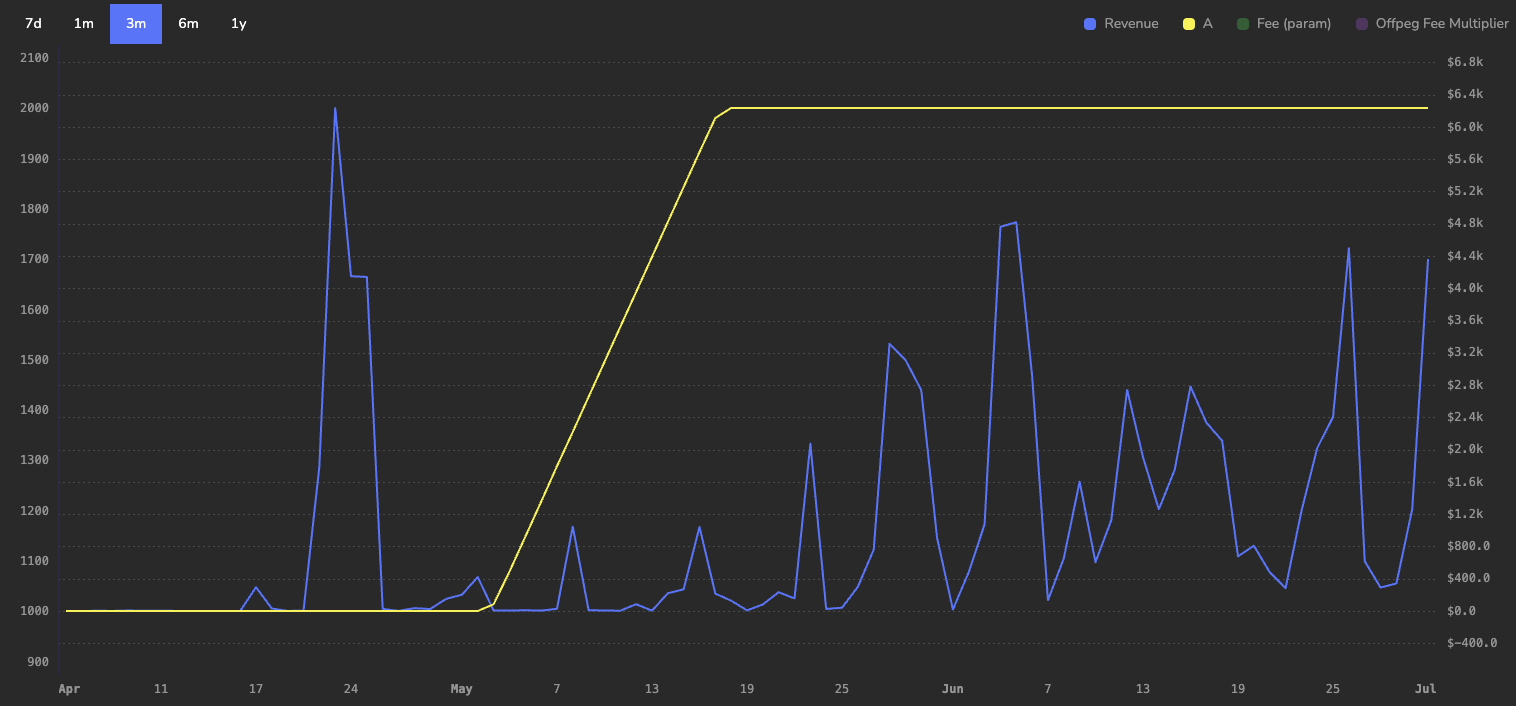

Throughout the month of June, numerous pool parameter changes were proposed and implemented with the goal of making Curve liquidity pools more efficient and increasing DAO revenue. Most notably, adjustments were made to the stETH-ng pool, which holds over $30 million in TVL. Despite its size, the pool consistently experienced low trading volume due to a high fee structure. After reducing the fee from 0.04% to 0.008%, the pool not only saw a significant uptick in volume, but also began generating around $500 per day in revenue for the DAO.

Another great example is the parameter optimization for the RLUSD/USDC pool (a stablecoin issued by Ripple). In this case, the key driver of adoption wasn't a fee adjustment, but rather an increase in the pool’s A parameter, which deepens liquidity and improves trading efficiency.

These are just two of many examples, but a clear trend is emerging: ongoing and focused parameter optimization (with a special thanks to Philipp) is playing a crucial role in improving pool efficiency and boosting DAO revenue. These optimizations are based on millions of simulated trades to determine the most effective parameters. If you're interested in the simulation methodology, be sure to check out the governance forum, where all results are published and discussed before being put to an on-chain vote.

New DAO Treasury Voted In

On June 27, 2025, the Curve DAO voted to establish a dedicated Treasury, allocating it 10% of all DAO revenue. These funds belong to the DAO and remain entirely under its control. With a successful governance vote, they can be used for any purpose the DAO chooses, such as development, research, risk assessment, bad debt insurance, bug bounties, audits, or anything else the DAO deems appropriate. Check the governance forum post here.

In comparison to the community fund, these new Treasury assets do not require a one-year vesting period, which makes the usage of these funds much more convenient.

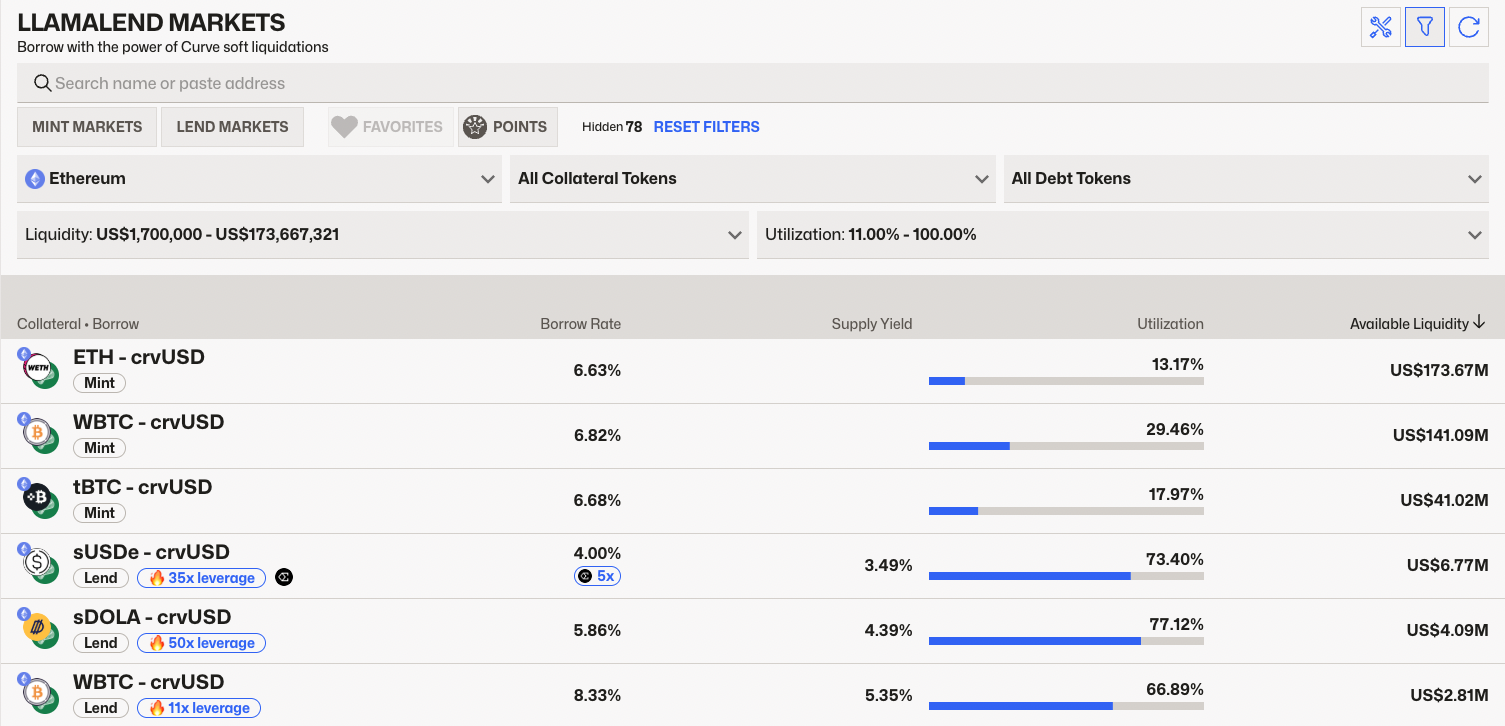

Llamalend UI

While the frontend developers are busy overhauling the entire Llamalend UI, a first progressive rollout took place at the end of June. Mint and Lend markets are now merged into a single page with granular filtering options for chains, collateral tokens, and much more.

While this is not the final version and the page will continue to undergo improvements, please go ahead and test it out yourself. Your feedback is invaluable to us!

Check out the new Llamalend UI below:

Curve @ ETH Belgrade

On June 4, 2025, Curve Finance hosted its first-ever BEL‑CRV Ecosystem Day during Belgrade Blockchain Week, alongside the ETH Belgrade conference. The builder‑focused event brought together over 150 developers, researchers, and DeFi users for a full day of panels and keynotes on cross-chain infrastructure, yield-bearing stablecoins, governance, and more.

Curve Block Oracle

At ETH Belgrade, Curve developer Roman Agureev presented a modular, open-source framework for secure multichain messaging. The system is built using storage proofs and bridge-agnostic transport, and is already live across more than 20 networks. Curve is initially using the framework to safely transfer token prices like the one for scrvUSD to other chains, but the potential use cases extend far beyond that.

There is also a live view of the Curve Block Oracle, available below.

Questions about Curve Block Oracle? Ping Roman or Michael K on Telegram, or open a GitHub issue.

Yield Basis

Curve founder Michael Egorov also introduced Yield Basis, a protocol designed to eliminate impermanent loss (IL) and provide sustainable yield for tokenized BTC and other large assets. Yield Basis is built on top of Curve’s infrastructure, leveraging Cryptoswap, crvUSD and its lending architecture all at once.

Resupply Exploit

On June 26th, Resupply — a protocol built on top of Curve that has driven significant demand for crvUSD in recent weeks and months — experienced a security vulnerability in a newly added market, creating bad debt in the protocol. A large portion of the bad debt has already been covered by the Resupply and Convex treasuries, as well as personal funds by one of the core devs, C2tP. The team has outlined a clear path forward.

We have published our post-mortem on the exploit in the wstUSR market as well as the recovery plan. Please use the links below.

— Resupply (@ResupplyFi) June 28, 2025

Post-mortem: https://t.co/NbCrnyPmvn

Recovery Plan:https://t.co/exTLY1RKiQ

This recent incident also sparked a broader discussion around how to manage protocols building on top of Curve, such as whether there should be a dedicated auditing team for protocols built on top of Curve.

Most important part. Do you think that a special Curve-specific team for auditing projects built on top of @CurveFinance is a good idea? Please comment! https://t.co/QQFJZpxNW5

— Michael Egorov (@newmichwill) June 29, 2025

From parameter tuning to new infrastructure and protocol launches, June brought a lot of movement across the Curve ecosystem. These updates continue to push toward better capital efficiency and strengthen Curve’s position as the settlement layer for stablecoins and on-chain liquidity.

Sign up below to get all the monthly recaps, weekly yields and other breaking news stories straight into your inbox.