Curve Monthly Recap July, 2025

July 2025: Crosschain Boosts gain adoption, Curve ships to Telegram via TAC, scrvUSD yield climbs, LLAMMA protects positions, wstETH steadies on Curve liquidity, and a ~$30M swap confirms 3pool depth.

Key highlights of July

- Sidechain Boosts!

- Launch on TAC: Curve is live on TAC (EVM on TON) with a wallet-native Mini-App.

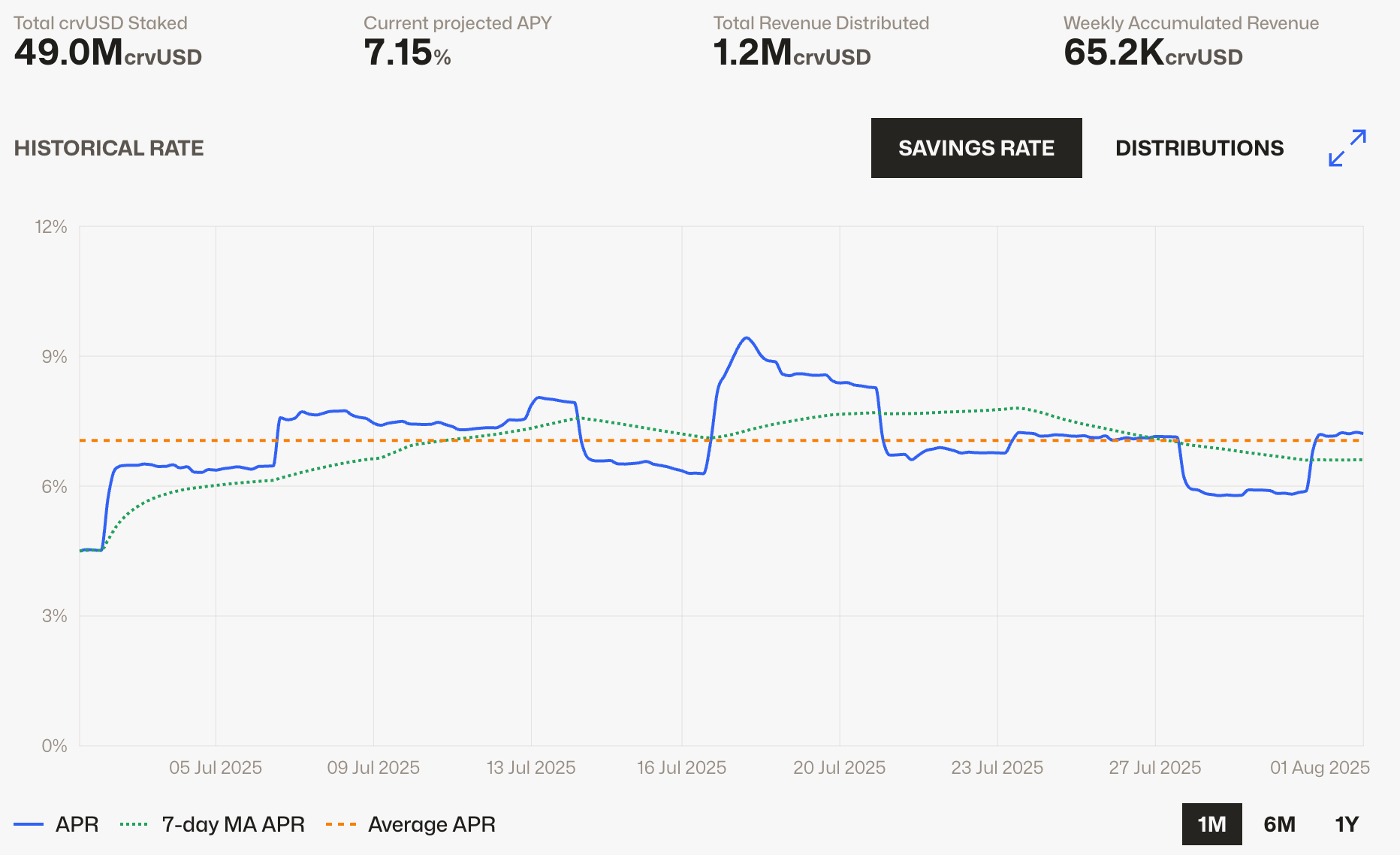

- scrvUSD Yield Is UP: the savings rate printed multi-week highs (c. 9% at peak) before settling near ~7% by month-end.

- Power of Llamalend & LLAMMA: How Curve’s liquidation mechanism saves position from liquidation.

- wstETH liquidity scare avoided: a “liquidity crisis that didn’t happen” thanks to Curve pools.

- Notable on-chain Curve swap: a single ~$30M stablecoin swap tapped Curve’s 3pool and Strategic Reserves.

- Michael becomes a Ethereum Torch Bearer

- First half of 2025 in numbers!

Crosschain Boosts

While Boosting infrastructure on sidechains/L2s has been live for a while, in July the first major integrators began using it. StakeDAO (and partly Convex) now deliver boosted Curve yields beyond Ethereum mainnet. And StakeDAO’s OnlyBoost optimizer allocates LP positions across StakeDAO, Yearn, and Convex to capture the highest effective boost per pool.

Boosting is utilized on more chains! https://t.co/oPVLtc1twz

— Curve Finance (@CurveFinance) July 29, 2025

Cross-chain boosts became possible with the deployment of the Curve Block Oracle public-good infrastructure. A dashboard showing live storage proofs and veCRV balances across chains can be found here: https://curvefi.github.io/storage-proofs/

Curve ships to Telegram via TAC

Curve is now live on TAC, the EVM layer on TON, with a Telegram Mini-App. Users can swap or provide liquidity from a Telegram wallet, no extensions or bridges needed, and TAC is backing early pools with incentives. TAC mainnet itself went live mid-July.

Curve’s most mobile-native surface yet, swaps and LP inside Telegram, opening a direct line to Telegram’s massive audience.

scrvUSD Yield Up again

With borrow rates across DeFi rising, including for crvUSD, the scrvUSD savings yield moved higher accordingly. It climbed from ~4.5% at the beginning of June to briefly >9%, before settling around ~7%. All this yield for simply holding a stablecoin!

The higher yield coincided with growth in scrvUSD supply from ~$45M to ~$50M.

The Power of Llamalend & LLAMMA

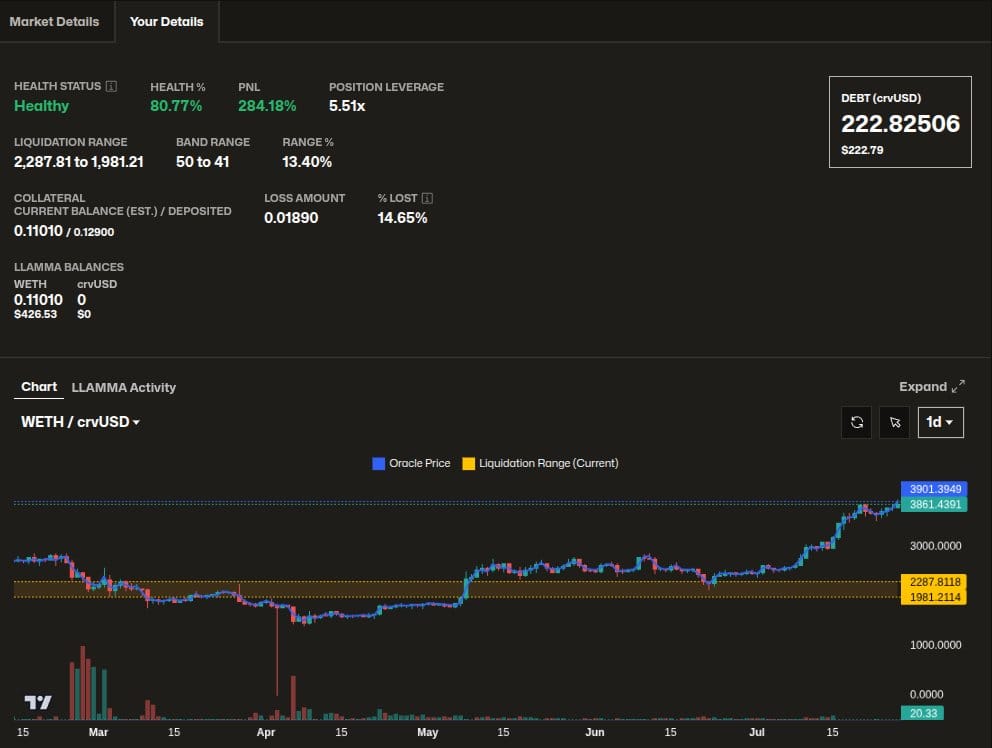

A clear real-world example comes from @ilivinskiy: a 5× leveraged ETH position opened around $3,000 survived a drop to ~$1,500. It entered Llamalend’s liquidation protection zone in early March, stayed there for about a month, exited to the downside, later re-entered, and eventually exited on the upside. All without the loan being closed or liquidated.

Llamalend uses LLAMMA (Lending-Liquidating AMM Algorithm). Instead of a hard liquidation at a single price, collateral is rebalanced gradually inside a protection range, shifting between collateral and crvUSD as price moves. That buys time to repay or wait for a bounce, and avoids the “one-and-done” liquidations common on fixed-threshold systems.

TL;DR: Even through a heavy drawdown, the user kept the position alive for months. On many other protocols, it likely would have been fully liquidated much earlier.

Resilience in Need: Curve helped avoid a wstETH liquidity crisis

As Aave saw large ETH withdrawals due to whale activity, some levered wstETH/ETH farmers experienced increased borrow rates for ETH and were forced to unwind their positions and sell wstETH at the same time, pushing the wstETH price off the ~1:1 peg. Arbitrageurs bought the discount and redeemed via Lido, swelling the validator exit queue (~$2.2B, ~11 days). On tight “range” AMMs like Uniswap, liquidity vanishes once price leaves the bands around the peg where most LPs provide their liquidity.

But the last frontier of crypto still holds: Curve’s stableswap keeps liquidity at every price (deepest near 1:1), so routes stayed efficient and avaliable, and the wobble didn’t become a full depeg with cascading effects across the lending markets.

All praise to passive, always in-range concentrated liquidity (no manual rebalancing needed).

Some people did not quite understand, so this needs explanation.

— Curve Finance (@CurveFinance) July 24, 2025

Concentrated liquidity in ranges (like Uniswap3 and others doing that) tend to have liquidity from price A to price B. And this range of prices for stable pairs is VERY tight.

Asset sometimes like to go out of… https://t.co/oaGKiRBr4K

Curve’s EMA-based oracles also held up under stress, smoothing short-lived spikes and feeding reliable prices to crvUSD and Llamalend. That kept positions tied to their fair value.

On-chain moment: $30M swap

Curve flagged a ~$30M stablecoin trade (USDT → USDC) executed via CoWSwap and Kyber, with ~$16.6M routed through 3pool (across two legs) and ~$2M through Strategic USD Reserves. It’s a good snapshot of Curve as neutral routing liquidity even when the RFQ is external.

And a reminder: 3pool remains Ethereum’s most reliable stablecoin liquidity. It’s sheer depth makes it the default pool for trades with size. Even when other protocols undercut swap fees to win order flow, slippage and execution risk dominate, so large routes still go through Curve.

https://etherscan.io/tx/0x84dddf028b9abc41602474391bfedffff716a87117784b67cfa6cd7276c4c9bf/

10 Years of Ethereum: Michael becomes a Torch Bearer

The Ethereum Torch, an NFT passed wallet-to-wallet over the 10 days leading up to Ethereum’s 10-year anniversary, reached Michael Egorov (@newmichwill) on July 24 as the fifth torchbearer.

Michael emphasized Ethereum’s next step: real-world integration via resilient, transparent core infrastructure, not hype metrics. He highlighted building on Vyper for clarity and security, and argued the future of DeFi will be defined by trust. Something even whole nations can rely on.

1/8 @ethereum is turning 10 years old: the time flies! Over that time, it has grown from an idea to the foundation of the new financial system. https://t.co/rTBIdyIOxx

— Michael Egorov (@newmichwill) July 24, 2025

First Half of 2025 in Numbers

Curve Finance delivered a solid H1 2025: TVL ended at $2.16B ($2.04B on Ethereum) while trading volume rose to $62.53B from $56.48B in H2 2024. Builder activity remained strong with 1,078 new liquidity pools (847 in H2 2024) and ~40,000 active users across the DEX and Llamalend (not counting users via aggregators).

Curve’s Liquidation Protection was a standout in H1 2025: $107.6M of positions entered liquidation protection and only $31.9M ended up being hard liquidated, saving users $75.6M (up 82% from $41.5M in H2 2024). Unlike regular liquidations, LLAMMA gradually converts collateral into crvUSD as prices fall and, if prices recover, automatically converts it back to restore the initial collateral, avoiding instant liquidations and giving borrowers time to repay debt or close positions.