Curve Monthly Recap January, 2026

In January 2026, Curve shipped crvUSD monetary policy rate changes alongside FXSwap’s launch, frontend upgrades, new integrations like YieldXYZ, and ongoing governance and risk work.

2026 Backlook

A lot happened across the Curve ecosystem in 2025. For a full overview of last year’s milestones and developments, take a look here:

crvUSD Borrow Rate Changes

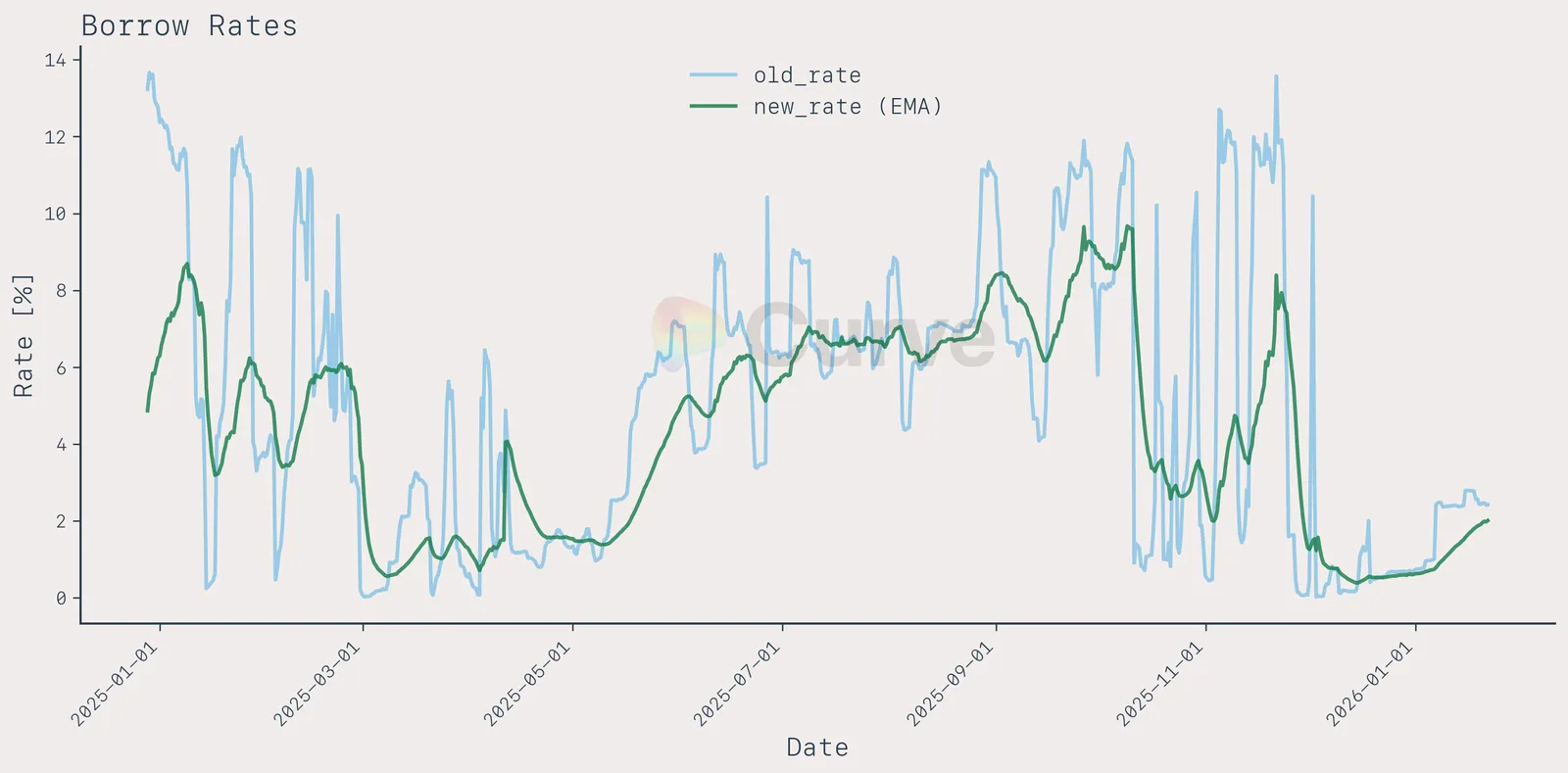

A major change landed in early January with an update to the crvUSD monetary policy.

The new policy smooths borrow rates by shifting short-term peg defense primarily to PegKeepers and applying rate smoothing over time. This significantly reduces abrupt rate movements caused by PegKeeper activity, while preserving strong incentives to maintain the peg.

Backtesting shows a much more stable rate profile under the new model:

It is important to note that borrow rate swings can still occur in response to crvUSD price movements. If the price of crvUSD trades below peg and PegKeeper liquidity is depleted, the system may need to raise borrow rates to incentivize borrowers to buy and repay crvUSD. This dynamic was observed in late January and early February; a separate analysis will follow.

Read the full breakdown here:

FXSwap

Curve officially introduced FXSwap, a new AMM algorithm designed for uncorrelated but low-volatility asset pairs (such as Forex pairs USD and EURC). It leverages the mathematical efficiency of Stableswap within the dynamic rebalancing framework of Cryptoswap, along with some new innovations.

FXSwap is currently used by YieldBasis pools and had been running in several other pilot pools like ZCHF<>crvUSD for months prior to its formal introduction. The introduction was accompanied by in-depth research from Pangea comparing its performance to other concentrated liquidity AMMs, highlighting FXSwap’s strong capital efficiency and robustness.

Continuous Curve Frontend Improvements

Frontend development continued at a steady pace, with a strong focus on performance improvements and reducing technical debt. This work lays the foundation for the upcoming Llamalend V2 launch and enables faster iteration going forward.

Users will soon be able to test the new UI/UX, and feedback will be especially valuable during this phase.

For users who want early access, Curve has shipped a Beta UI where new features are tested before reaching production. To enable it, scroll to the footer of the Curve interface and click the 🦙 icon on the right.

Found an issue or have suggestions? Please submit feedback here: UI/UX Feedback

crvUSD Optimizer Vault curated by LlamaRisk

LlamaRisk’s curated crvUSD optimizer vault, built in partnership with IPOR and StakeDAO, gained strong traction throughout January.

After quickly reaching its initial 1M crvUSD deposit cap, the vault was expanded to 2M. It offers a user-friendly way to put crvUSD to work by allocating capital across optimized strategies, with rewards automatically compounded.

Check out the vault here:

Liquity Airdrop for Curve LPs

Liquity’s V2 fork on Flare Networks is allocating 2.75% of its token supply to BOLD users, including Curve liquidity providers.

The incentive program begins on January 21st and runs through Q4 2026, rewarding long-term participation.

A $850k airdrop for Liquity V2 users 🏦@enosys_global, the Liquity V2 fork on @FlareNetworks, is allocating 412.5 APS (2.75% of supply) to BOLD users.

— Liquity (@LiquityProtocol) January 19, 2026

At ~$2k / APS, that is ~$850,000 ‼️ of value flowing to $BOLD LPs.

This airdrop alone adds ~ 3% APR for BOLD.

10+ airdrops… pic.twitter.com/BP0A1ZbGJv

YieldBasis Hybrid Vaults

> Note: Hybrid Vaults are still under audit and not yet live.

YieldBasis pools have been filling rapidly since launch, with each TVL cap increase reaching capacity within minutes. Demand for impermanent-loss-free yield significantly exceeds what the protocol can safely accept today.

To protect crvUSD stability and ensure safe use of Curve infrastructure, YieldBasis currently limits total TVL. This creates a scaling challenge: users want to deposit more BTC or ETH, but the protocol requires additional crvUSD support to safely expand capacity.

Hybrid Vaults aim to solve this by directly linking TVL onboarding with crvUSD peg support. By depositing crvUSD or scrvUSD alongside BTC or ETH, users contribute to peg stability while unlocking higher personal deposit caps.

In practice, this mechanism:

- increases crvUSD demand and circulation

- creates buy pressure on crvUSD

- encourages PegKeepers to fill

- lowers borrow rates for minting crvUSD

- supports controlled expansion of crvUSD supply

Technical details can be found here:

Curve integration with YieldXYZ

Curve has been integrated into the YieldXYZ API, providing direct access to Curve yields across nine networks.

The integration includes:

- Savings-crvUSD (scrvUSD)

- Llamalend markets

- Curve LP yields

YieldXYZ returns full pool metadata to users, including APR, TVL, volume, fees, and LP token pricing, making this a highly convenient aggregation layer.

Our clients have access to @curvefinance yields directly through the @yield_xyz API. Yield opportunities include:

— Yield.xyz (@yield_xyz) January 13, 2026

→ Savings $crvUSD vault

→ 41 Llamalend market yields

→ LP yields across 9 networks

Here’s how it works (1/5) 🧵 pic.twitter.com/wCfvmmRznp

Trustless Force

January also highlighted Trustless Force, a community-driven initiative focused on advancing trustless solutions on Ethereum.

Built around the belief that code should replace trust wherever possible, the initiative brings together users, builders, and advocates to increase awareness, adoption, and usability of trust-minimized systems.

The effort is being shaped alongside ecosystem participants including Curve Finance, protocol_fx, and Liquity. Curve BD Martin Krung recently joined a livestream discussion to explore the initiative’s goals and broader implications for Ethereum-native finance.

You trust code.

— Trustless Force (@TrustlessForce) January 23, 2026

You prefer trustless solutions.

You like value-aligned folks.

Be part of the Trustless Force.

Make a difference.

Show up.

Next Wed., 3pm CET on @leviathan_news

Join the Force with @CurveFinance, @protocol_fx and @LiquityProtocol. pic.twitter.com/5sHUdOeNO5

LlamaRisk Progress Update

LlamaRisk published a progress update covering its work from July to December 2025, outlining continued efforts as a core service provider to Curve DAO.

Working with @CurveFinance since 2021. Here’s our latest update on our progress. 🦙

— LlamaRisk (@LlamaRisk) January 12, 2026

We focused on proactive risk management, $crvUSD stability, oracle upgrades, governance, YieldBasis research & market optimization, strengthening Curve’s resilience, and LlamaLend v2 prep.… pic.twitter.com/eQcmpNFZV8

Over the period, LlamaRisk focused on proactive risk management during volatile market conditions, preparation for Llamalend v2, and ongoing optimization of crvUSD stability. This included monetary policy research, PegKeeper management, oracle upgrades, and the introduction of a structured framework for safely deprecating underperforming markets.

Key highlights included securing a 250k OP grant to support Llamalend v2 incentives, navigating the October flash crash and multiple depeg events with minimal protocol impact, strengthening oracle infrastructure across lending markets, and submitting over two dozen governance proposals spanning Llamalend, crvUSD, and AMM operations.

Llamarisk also made progress on new collateral research (including Pendle and Spectra PTs), debt ceiling methodologies, and tooling that will enable more continuous, data-driven risk management as Curve’s lending infrastructure scales into 2026.