Curve Monthly Recap August, 2025

Curve’s August updates brought faster and better Llamalend UI, the launch of FXSwap with refuel support, YieldBasis governance debates, a new PSR, strong growth on TAC, and SwissStake progress.

Key Highlights of August:

- Llamalend frontend updates alongside with major performance boost

- FXSwap launched after record DAO vote

- YieldBasis credit line proposal sparked active governance debate

- frxUSD PSR onboarded with 3M crvUSD ceiling

- Curve-Core on TAC grew TVL from $5.6M to $30M+

- SwissStake quarterly progress report

Llamalend Frontend Improvements

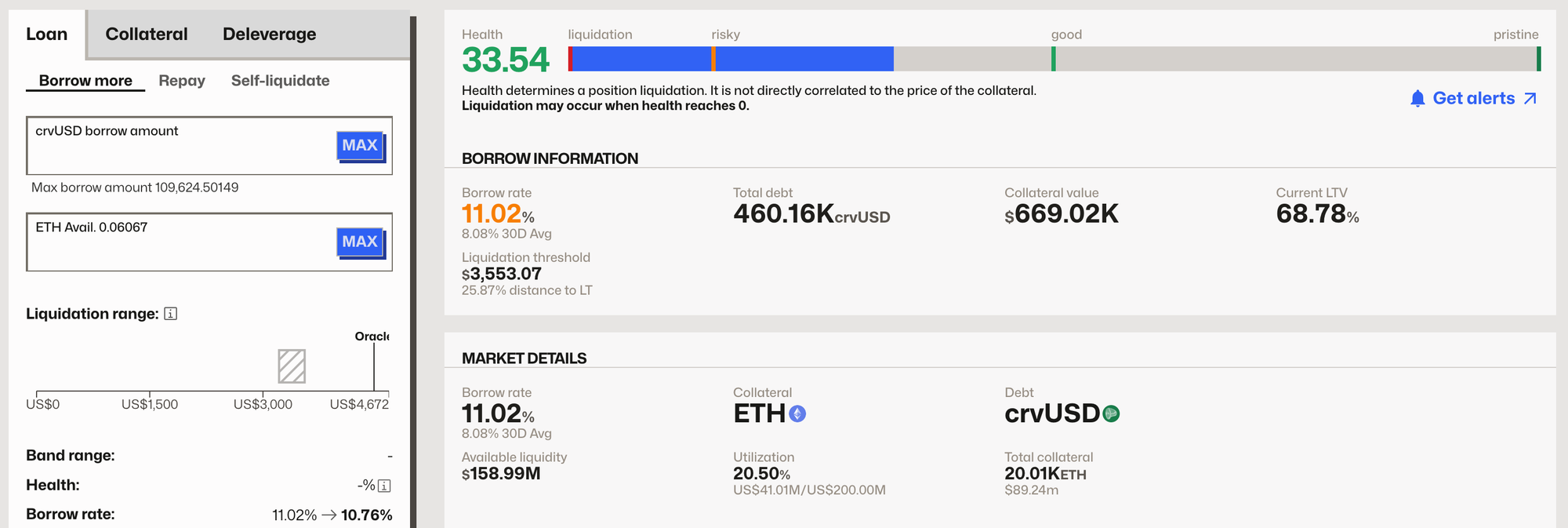

This August, the frontend team rolled out a big round of updates to the Curve UI, with Llamalend receiving most of the attention. The headline change was a major performance boost. By removing Next.js from the stack and streamlining the frontend, the app now loads significantly faster. Pages render almost instantly, making the overall user experience much smoother. Try it out!

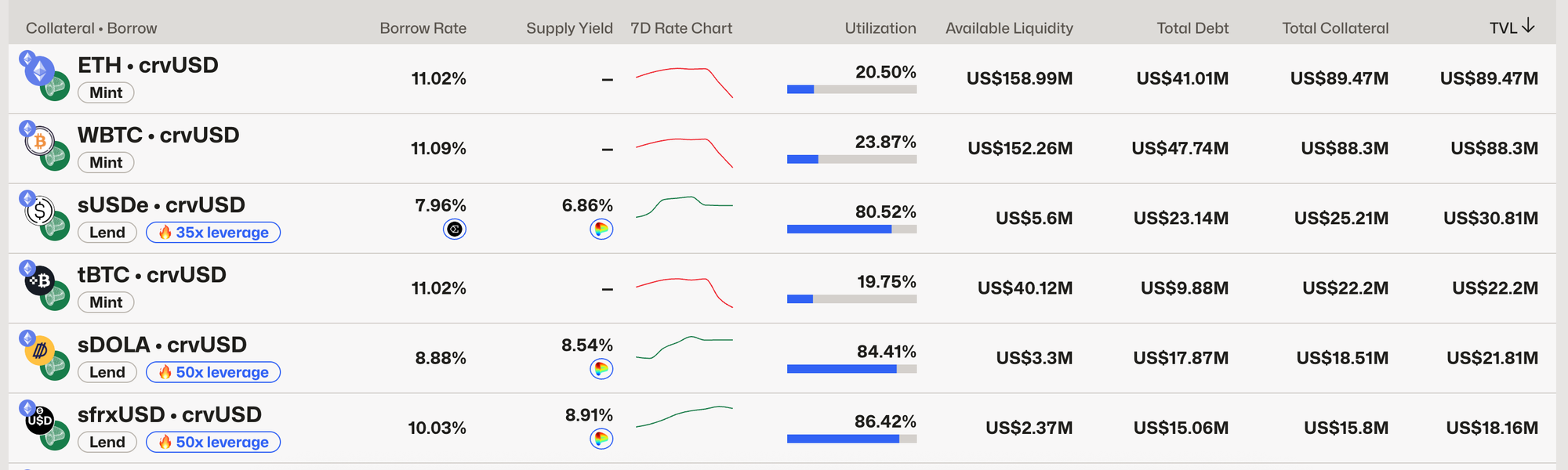

The Llamalend markets page keeps on being improved and received its share of updates. It now includes expanded filtering options that allow users to toggle between views of liquidity, utilization, total debt, collateral, TVL, borrow rates, supply yields, and short-term rate charts. This makes it far easier for users to compare markets and identify opportunities, whether borrowing or lending.

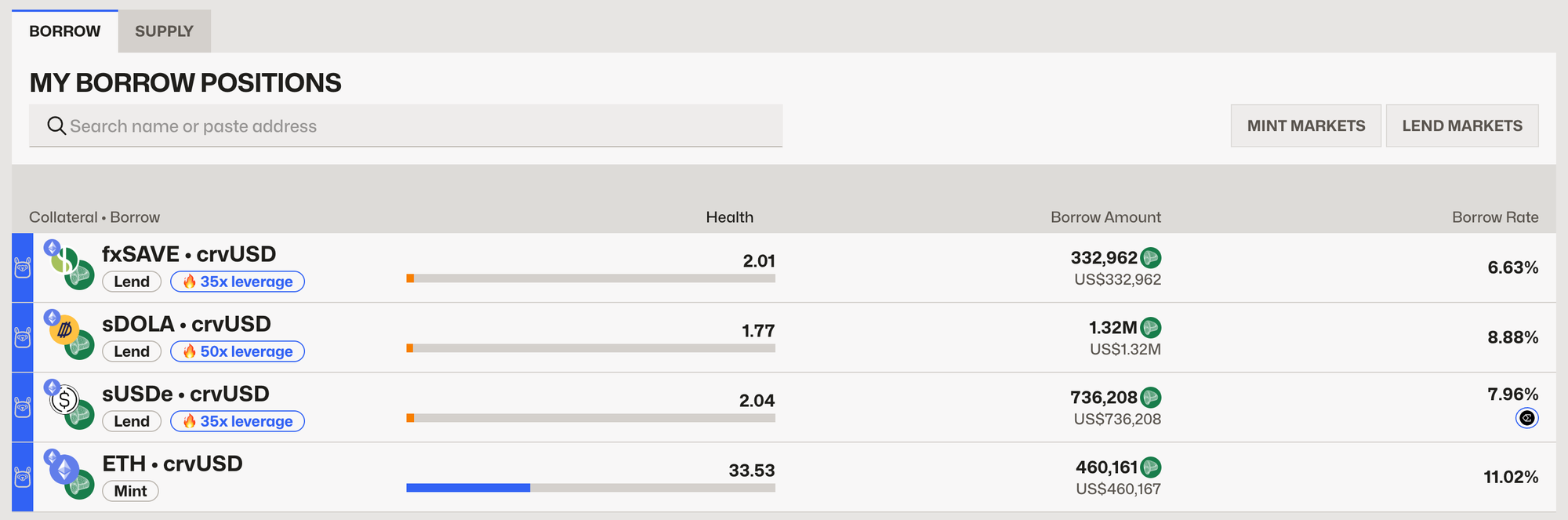

Another quality-of-life improvement is the new positions table at the top of the page. This provides a clean overview of all active loans, showing position health, borrow amounts, and rates at a glance. Tracking multiple positions has become far more convenient for users.

Individual position cards were also redesigned. They now display more detailed borrower and market information, giving users a clearer picture of both their own positions and overall market conditions without extra navigation.

Alongside these headline changes, numerous smaller fixes and refinements were introduced, like tooltips and yield breakdown wherever possible, smoothing out rough edges and making Llamalend more intuitive to use.

FXSwap (Refuel Implementation)

Curve also introduced FXSwap, a new design that expands Curve into new market opportunities such as supporting future onchain FX markets for non-USD denominated assets. Despite the name, FXSwap is not limited to forex pairs and can also be applied to other volatile and low-volatility assets such as non-USD stablecoins or gold. The new algorithm makes volatile-asset pools more efficient and sustainable. This improved take on Cryptoswap (the former algorithm for volatile-asset pools such as EUR<>USDC) lets pools add a refuel budget so they can track market price and rebalance liquidity more smoothly.

For LPs, refuels offset part of the impermanent loss, making liquidity provision more attractive, profitable, and sustainable. Traders benefit from tighter spreads and smoother execution thanks to highly concentrated liquidity. In short, LPs keep more of what they earn, and traders get better rates. A win-win for everyone in the market.

Here’s the idea: concentrated liquidity gives great prices, but when the market moves the pool has to shift its liquidity, which can hurt LPs. With FXSwap, anyone (projects, treasuries, power users) can add refuels to the pool. This refuel is a drip-released buffer the AMM can tap when it needs to move the liquidity concentration. The result is tighter spreads for traders and less wear and tear on LPs when prices drift. Learn more about the technicalities here.

BUT: Refuel is not simply a token handout. Think of it like topping up the engine oil so the machine runs cleanly. Teams can use real revenue to keep their markets sharp instead of leaning on short-term emissions.

In short: FXSwap enables Curve to support FX markets onchain by keeping concentrated liquidity aligned with the market, powered by a simple refuel buffer. Traders enjoy tighter execution while LPs hold onto more of their yield without the need to manage rebalancing. It is still early days for FXSwap, and pools will be tuned one by one (fees, parameters, assets).

YieldBasis: Discussions Ahead of the Launch

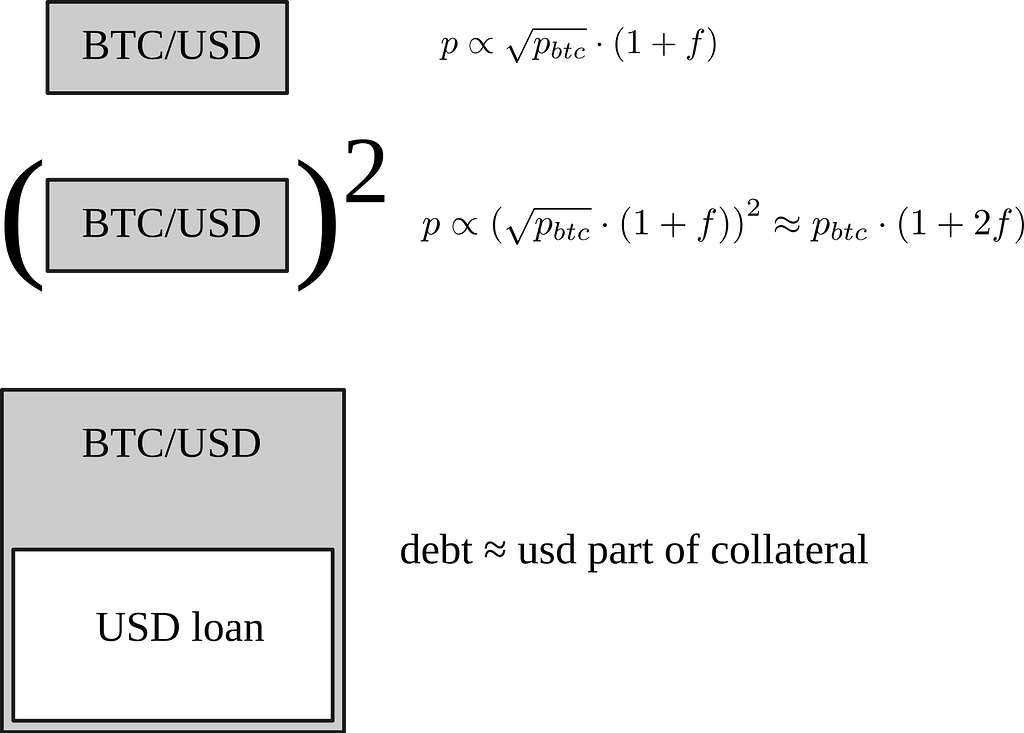

YieldBasis is a protocol built on top of Curve that aims to eliminate IL by keeping a constant 2× compounding leverage. Users can single-side deposit BTC, which is then paired with an equal dollar value of crvUSD sourced from a dedicated crvUSD CDP credit line.

To enable this, YieldBasis kicked off a discussion in Curve Governance for a 60M crvUSD credit line (a pre-mint borrowing cap similar to PegKeepers), targeting three BTC pools (WBTC, cbBTC, tBTC) with $10M deposit caps each - i.e., $30M of BTC deposits live, with the other $30M kept as buffer so the AMM can maintain 2× leverage if BTC price goes up (it would need to borrow more crvUSD as price rises).

What’s in it for Curve?

In exchange for the crvUSD facility, YB proposes directing ~20% of total YB token inflation to Curve, which can be used to incentivise crvUSD pools. Additional value is expected from stableswap routing (e.g., BTC<>crvUSD trades often pair with a crvUSD<>USDC/USDT hop on Curve, generating fees shared with veCRV and LPs). Modeling in the post estimates Curve’s total take at ~35–65% of what veYB earns, depending on parameters and competitive routing in practice.

Risks and Proposed Safeguards

A 60M crvUSD credit line introduces tail risks. If YieldBasis were exploited, Curve could face bad debt and peg pressure, though audits and a bug bounty help reduce this. There is also economic-model risk if live markets diverge from backtests, which could lead to underperformance. In that case, Curve could simply scale down the allocation without bad debt. Finally, competitive routing risk exists if other venues launch highly concentrated, low-fee crvUSD<>USDC/USDT pools, which could siphon volume from Curve.

To address these issues, community members have suggested a cautious rollout. Wavey proposes a phased credit line of $10M → $20M → $60M, with each step requiring DAO approval and KPI checks such as peg stability and routing share. He also recommends raising Curve’s share of YB emissions from ~20% to ~35% to better align incentives. LlamaRisk outlines a similar framework with a guardian multisig, bug bounty, and transparency dashboards as pre-launch safeguards, followed by a stepwise rollout (20M → 40M → 60M) over 4–8 weeks, gated by KPIs like rebalancing solvency, ≥50% BTC–stable routing through Curve, no peg or security issues, and Curve earning at least 35% of veYB fees.

The discussions have been extensive, and the community will see the final shape of YieldBasis’ proposal once it moves to an on-chain vote.

frxUSD PSR Onboarded

Curve governance moved to onboard a Peg Stabilization Reserve (PSR) for the frxUSD<>crvUSD pool with a 3M crvUSD ceiling. The PSR is the mechanism that helps keep crvUSD stable by minting or withdrawing crvUSD when the pool drifts off peg. For frxUSD, the proposal also raised the caller reward share to 50% to better cover gas and encourage timely upkeep.

As part of the onboarding, the pair was added to the PSR Regulator and to crvUSD monetary policies, and its oracle was included in the aggregated crvUSD price basket. For context, existing PSR assets include USDC, USDT, and PYUSD with current ceilings of 45M, 15M, and 15M crvUSD. LlamaRisk also shared due diligence in the governance thread, covering peg mechanics, oracle setup, and operational considerations.

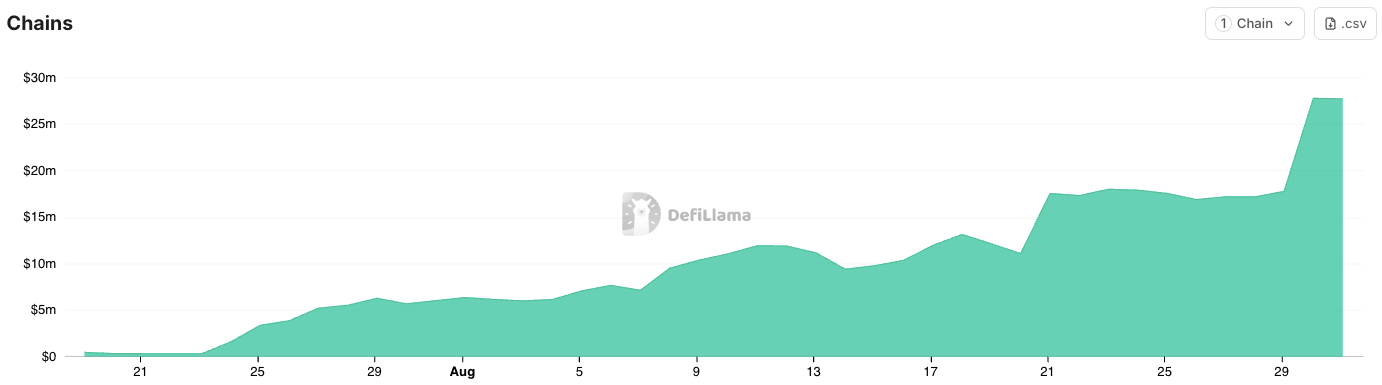

Curve on TAC

The Curve-Lite deployment on TAC saw strong momentum in August. Curve-Core is a lightweight, fast-to-deploy instance of the Curve DEX, and its launch on TAC quickly attracted users and capital. Total value locked jumped by more than 500% during the month, climbing from $5.6M to over $30M.

SwissStake Quarterly Progress Report

SwissStake, a key driver of Curve’s ecosystem, published its March to May 2025 progress report. The update builds on their 2024 Curve DAO grant and showcases steady advances across cross-chain infrastructure, Llamalend, and cryptoswap.

A major milestone this quarter was the rollout of the Curve Block Oracle, built to support secure and DAO-controlled cross-chain deployments. SwissStake also added oracle propagation using storage proofs, including support for the scrvUSD price oracle.

On the Llamalend side, the team laid the foundation for LP token collateral. While this has not been rolled out yet, the system is already technically capable of supporting it. The focus has now shifted to Llamalend v2, which is set to bring a wide range of upgrades. At present, Llamalend only supports markets where crvUSD is either the collateral or the borrowable asset. With v2, that restriction will be lifted. The new version will feature out-of-the-box support for LP tokens, PT tokens, and other interesting assets, greatly expanding the types of markets that can be created. In addition, the team has already implemented fee routing to the DAO, ensuring that lending activity feeds more directly into Curve governance.

For Cryptoswap, SwissStake focused on upgrades that allow external refuels to influence liquidity distribution. This is especially relevant for FX and low-volatility markets where efficient liquidity allocation is key.

Beyond protocol development, the team also pushed forward on internal tooling and frontend improvements, expanded their analytics stack, and launched Cyfrin Updraft, a developer certification program.