Curve Live on Hyperliquid

Curve Finance is now live on HyperEVM, an EVM environment for the Hyperliquid blockchain launched by the Hyper Foundation.

The deployment initially started as a Curve-Lite instance, a minimal version of the DEX with frontend support. Following strong traction, it has been upgraded to a full Curve DEX deployment, with all standard features and API support available.

This marks it as the second Curve-Lite deployment to graduate to a full version. Users can now access Curve’s full suite of efficient trading tools on one of the fastest chains in the ecosystem.

What Curve Brings to HyperEVM

- Full DEX deployment: Core Stableswap and Cryptoswap contracts are live, delivering the efficiency and reliability Curve is known for.

- Permissionless Pools: Anyone can launch pools for stable or volatile assets, enabling low-slippage, capital-efficient trading.

- Integrated Frontend & API: Curve’s familiar interface and backend API are fully live, supporting both users and developers with seamless access, stats and tooling.

About Hyperliquid's HyperEVM

HyperEVM is a novel Ethereum Virtual Machine (EVM) environment built natively onto the Hyperliquid blockchain. This combines the flexibility of EVM smart contracts with the performance of a high-speed trading layer. Key features include:

- Fast Execution: HyperEVM splits throughput into fast blocks (2-second finality) for time-sensitive transactions and large blocks (1-minute intervals) for complex operations like contract deployments. This design is an interesting way to optimize for both speed and scalability.

- Hyperliquid Integration: HyperEVM integrates with Hyperliquid’s existing on-chain financial system, enabling protocols like Curve, deployed on HyperEVM, to interact with the Hyperliquid L1 perpetual exchange.

Current State and Next Steps

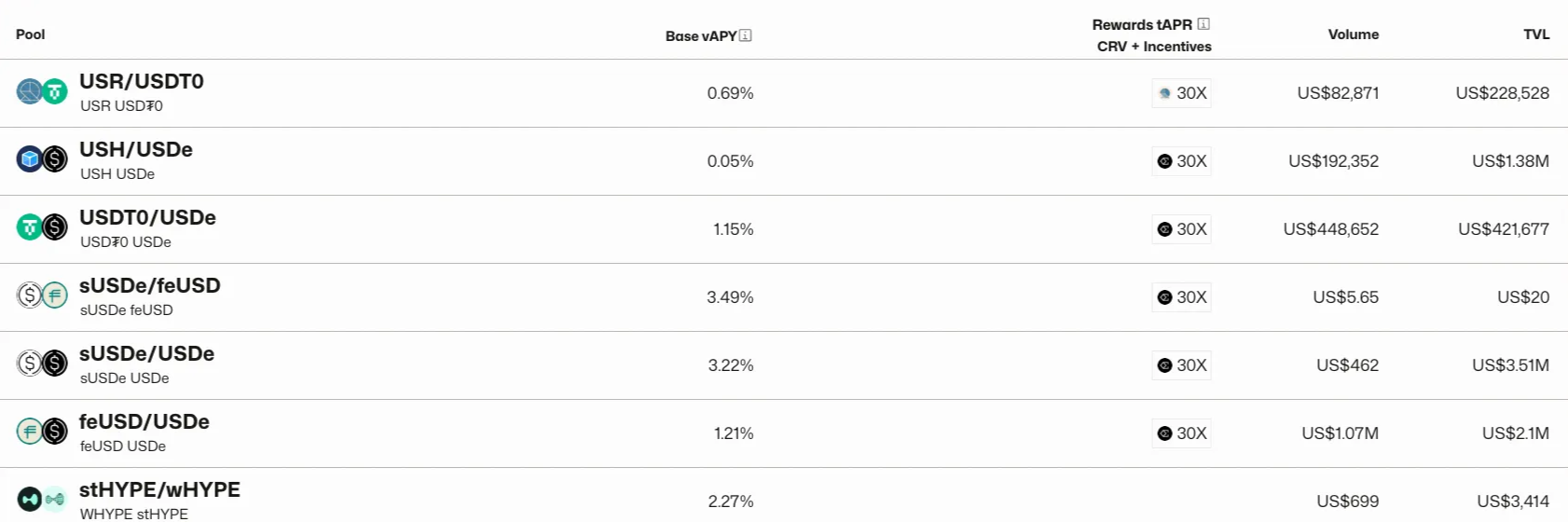

Curve pools on Hyperliquid currently hold over $12 million in liquidity and see high pool utilization with multi-million dollar daily trading volumes, showcasing the efficient design of Curve’s stablepools. Part of this traction comes from external incentives, with protocols like Ethena and Resolv distributing points to selected pools.

The final step is getting the CRV token ready on HyperEVM. This will enable the DAO to vote on emissions for pools on Hyperliquid, fully activating Curve’s incentive and governance framework on the network.