Curve Best Yields & Key Metrics | Week 7, 2026

Weekly yield and Curve ecosystem metric updates as of the 12th February, 2026

Market Overview

Welcome to another week of yields. Curve's total TVL has decreased slightly this week, down 0.7% to $2.039B.

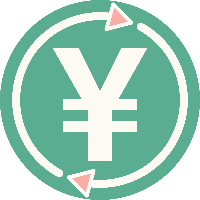

Many new changes are on the way for crvUSD after recent volatility tested the crvUSD peg. See a list of the changes in LlamaRisk's recent thread. It's a great time to buy and supply to the crvUSD pools and scrvUSD, with the PegKeeper PYUSD/crvUSD pool offering a huge 16.1% yield, and even the scrvUSD vault offering over 8% interest.

As always, see all the highlighted yields and weekly metrics below.

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

All highlighted markets below have more than $10M of TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

PYUSD PYUSD crvUSD crvUSD |

$49.2M | 15.5% |

|

pmUSD pmUSD crvUSD crvUSD |

$11.7M | 13.9% |

|

scrvUSD scrvUSD |

$43.8M | 8.1% |

|

reUSD reUSD scrvUSD scrvUSD |

$10.2M | 5.8% |

|

USDT USDT crvUSD crvUSD |

$18.9M | 4.4% |

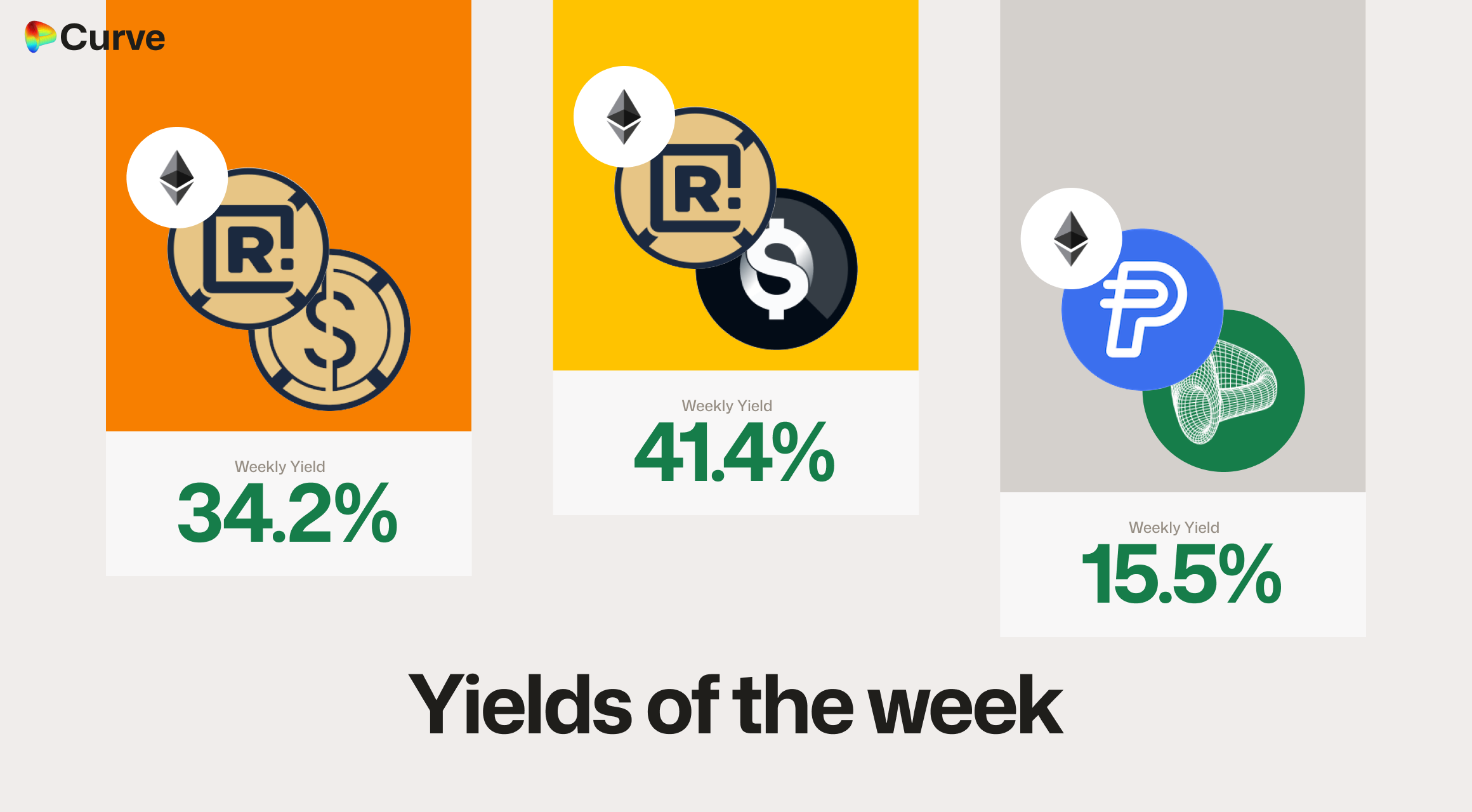

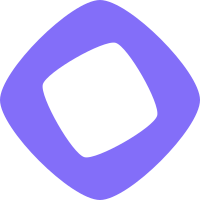

Other Top USD Yields

All yields have been calculated as if markets have at least $100k TVL.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

ynRWAx ynRWAx OUSD OUSD |

Pool | 41.4% |

|

ynRWAx ynRWAx ynUSDx ynUSDx |

Pool | 34.2% |

|

ynRWAx ynRWAx USDC USDC |

Pool | 24.8% |

|

OUSD OUSD MUSD MUSD |

Pool | 20.2% |

|

pmUSD pmUSD frxUSD frxUSD |

Pool | 16.9% |

|

crvUSD crvUSD fxSAVE fxSAVE |

Llamalend | 16.0% |

|

crvUSD crvUSD asdCRV asdCRV |

Llamalend | 16.0% |

|

USD3 USD3 scrvUSD scrvUSD |

Pool | 13.0% |

Top BTC & ETH Yields

All yields have been calculated as if markets have at least $100k TVL.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

OETH OETH ARM-WETH-stETH ARM-WETH-stETH |

ETH | 10.4% |

|

ETH ETH cbETH cbETH |

ETH | 8.1% |

|

ynETHx ynETHx WETH WETH |

ETH | 5.7% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 5.6% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 3.4% |

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 3.4% |

Other Top Yields

All yields have been calculated as if markets have at least $100k TVL.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CRV CRV crvUSD crvUSD |

CRV | 10.8% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 9.6% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 4.8% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 4.7% |

|

USD₮0 USD₮0 WBTC WBTC WETH WETH |

TRICRYPTO | 4.6% |

|

EURA EURA EURe EURe |

EUR | 2.6% |

|

EURA EURA EURC EURC |

EUR | 1.6% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.2% |

Weekly Metrics

crvUSD & scrvUSD

Another tough week for crvUSD, as supply contracts as expected due to the peg decreasing, incentivizing borrowers to buy back crvUSD below $1 and make a profit by closing their loans.

Interestingly, the crvUSD in scrvUSD has increased significantly and is sitting at over 100% of the minted crvUSD currently. This is possible because of the 15M crvUSD minted to the sreUSD market, as well as some of the YB allocation being temporarily within other markets until their pools rebalance.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$25.6M | -31.1% |

scrvUSD Yield scrvUSD Yield |

8.1% | -3.7% |

crvUSD in crvUSD in scrvUSD scrvUSD |

170.9% | +88.9% |

crvUSD Price crvUSD Price |

$0.9979 | +$0.0049 |

Avg. Borrow Rate Avg. Borrow Rate |

17.3% | -20.6% |

Peg Stability Reserves Peg Stability Reserves |

$4.44M | - |

PegKeeper Profit PegKeeper Profit |

$0 | -$2.25k |

Llamalend

Llamalend metrics are down across the board, as expected with the recent price falls and liquidity crunch.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $120M | -9.2% |

| 🦙 Supplied | $65.8M | -1.6% |

| 🦙 Borrowed | $63.2M | -16.8% |

| 🦙 Collateral | $91.9M | -11.8% |

| 🦙 Loans | 1012 | -105 |

DEX

Curve's DEX has had another stellar week. After last week's huge volumes and fees, this week is also very positive. Even though metrics are down from last week, they are up compared to the average.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.07B | -1.6% |

| 🔄 Volume | $2.29B | -37.4% |

| 🔄 Swaps | 666k | -4.9% |

| 🔄 Total Fees | $584k | -15.1% |

DAO

The DAO saw another very significant distribution, amidst big volatility in the markets causing high trading volumes and fees, and high borrowing rates.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.48B | +0.1% |

CRV Locked CRV Locked |

858M | +0.1% |

Total veCRV Total veCRV |

786M | -0.2% |

veCRV Distribution veCRV Distribution |

$320k | -32.5% |

CRV Emissions CRV Emissions |

$550k (2.22M CRV) | -17.0% |

Inflation Rate Inflation Rate |

4.916% | -0.006% |

Top Stableswap Pools

PYUSD/USDS once again won the week for volumes, with the DAI/USDC/USDT pool coming in second.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

PYUSD PYUSD USDS USDS |

$773.4M | $8.8k |

| 2 | - |  |

DAI DAI USDC USDC USDT USDT |

$282.7M | $42.4k |

| 3 | +2 |  |

msETH msETH WETH WETH |

$136.2M | $54.5k |

| 4 | - |  |

USDC USDC crvUSD crvUSD |

$135.7M | $13.6k |

| 5 | +2 |  |

ETH ETH stETH stETH |

$135.6M | $13.6k |

| 6 | +5 |  |

USDC USDC USDT USDT |

$133.2M | $3.2k |

| 7 | -4 |  |

USDT USDT crvUSD crvUSD |

$131.8M | $13.2k |

| 8 | -2 |  |

USDC USDC RLUSD RLUSD |

$127.4M | $27.2k |

| 9 | +1 |  |

sUSDS sUSDS USDT USDT |

$107.2M | $3.0k |

| 10 | -2 |  |

msUSD msUSD FRAX FRAX USDC USDC |

$93.3M | $37.3k |

Top Cryptoswap Pools

Got to love the Tricrypto pools, filling the top six Cryptoswap pools once again.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$44.2M | $27.5k |

| 2 | -1 |  |

USDC USDC WBTC WBTC WETH WETH |

$42.0M | $26.6k |

| 3 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$27.0M | $57.3k |

| 4 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$17.3M | $15.0k |

| 5 | - |  |

GHO GHO cbBTC cbBTC WETH WETH |

$3.2M | $9.1k |

| 6 | +4 |  |

USD₮0 USD₮0 WBTC WBTC WETH WETH |

$2.7M | $1.8k |

DEX Winners & Losers

Fees Winners & Losers

PYUSD and USDS were both in high demand. With crvUSD's peg stabilizing back close to $1, the crvUSD/USDT pool was the biggest loser due to the decrease in volatility from the restoring peg.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDC USDC |

$85.4M | $9.25k | +$5.97k |

| 2 |  |

USDS USDS stUSDS stUSDS |

$6.08M | $6.42k | +$4.54k |

| 3 |  |

PYUSD PYUSD USDS USDS |

$773M | $8.81k | +$4.14k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

msUSD msUSD FRAX FRAX USDC USDC |

$93.3M | $37.3k | -$11.3k |

| -2 |  |

msETH msETH WETH WETH |

$136M | $54.5k | -$14.6k |

| -1 |  |

USDT USDT crvUSD crvUSD |

$132M | $13.2k | -$15.8k |

Volume Winners & Losers

PYUSD won the week for added volumes, with the PegKeeper pools seeing lower volumes due to the price of crvUSD stabilizing back toward $1.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$773M | $8.81k | +$314M |

| 2 |  |

PYUSD PYUSD USDC USDC |

$85.4M | $9.25k | +$53.2M |

| 3 |  |

USDC USDC USDT USDT |

$133M | $3.19k | +$30.4M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

frxUSD frxUSD crvUSD crvUSD |

$28.7M | $5.95k | -$39.9M |

| -2 |  |

USDC USDC crvUSD crvUSD |

$136M | $13.6k | -$76.3M |

| -1 |  |

USDT USDT crvUSD crvUSD |

$132M | $13.2k | -$158M |

TVL Winners & Losers

The high incentives for the PYUSD/crvUSD pool doubled its TVL, winning the week for added TVL.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD crvUSD crvUSD |

$49.2M | +$25.5M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$84.7M | +$13.7M |

| 3 |  |

PYUSD PYUSD USDC USDC |

$41.8M | +$7.72M |

| ... | ... | ... | ... | ... |

| -3 |  |

frxUSD frxUSD crvUSD crvUSD |

$14.6M | -$7.82M |

| -2 |  |

aDAI aDAI aUSDC aUSDC aUSDT aUSDT |

$2.39M | -$8.23M |

| -1 |  |

USDC USDC USDf USDf |

$3.51M | -$18.2M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

All crvUSD markets were red, as markets work as expected to stabilize the crvUSD peg.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$316k | $149k | -$294 |

| 2 |  |

crvUSD crvUSD weETH weETH |

$293k | $144k | -$9.39k |

| 3 |  |

crvUSD crvUSD LBTC LBTC |

$2.84 | $1.01 | -$43.6k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD tBTC tBTC |

$7.15M | $5.12M | -$1.25M |

| -2 |  |

crvUSD crvUSD WETH WETH |

$3.98M | $2.69M | -$1.55M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$28.9M | $14.2M | -$6.3M |

Lend Markets - Borrowing Winners & Losers

sreUSD saw an increase in borrowing, as users found they could borrow crvUSD and deposit it into the PYUSD/crvUSD pool, or even directly into scrvUSD, and arbitrage the rate to earn extra yield.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$26.6M | $12.4M | +$1.36M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$1.75M | $1.53M | +$1.03M |

| 3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$366k | $366k | +$81.7k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$2.53M | $2.13M | -$353k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$4.15M | $3.46M | -$1.2M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$21.7M | $11.6M | -$1.63M |

Lend Markets - Supplying Winners & Losers

Interestingly, sreUSD also saw an increase in the amount supplied, as users potentially made use of the new Resupply market parameters for leverage.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$26.6M | $12.4M | +$2.61M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$1.75M | $1.53M | +$1.1M |

| 3 |  |

crvUSD crvUSD asdCRV asdCRV |

$639k | $412k | +$147k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$4.15M | $3.46M | -$798k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$366k | $366k | -$1.03M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$21.7M | $11.6M | -$2.14M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.