Curve Best Yields & Key Metrics | Week 6, 2026

Weekly yield and Curve ecosystem metric updates as of the 5th February, 2026

Market Overview

There's no point sugar-coating it, it has been a brutal week. Many thanks to everyone who's still here ❤️

Curve's TVL is down 15.9%, currently at $2.05B. This is slightly better than the wider DeFi ecosystem which saw a 17.1% drawdown.

The peg of crvUSD was tested, and for very brief periods it did fall to around $0.99. It's clear the systems will need some optimizing moving forward (tweet from mich). As of writing, the price is sitting around $0.993, and is recovering. There's also some great yield available in the PYUSD/crvUSD pool with 15.1% APR.

As always, there are some great yields available; see below for the highlighted opportunities and weekly metrics.

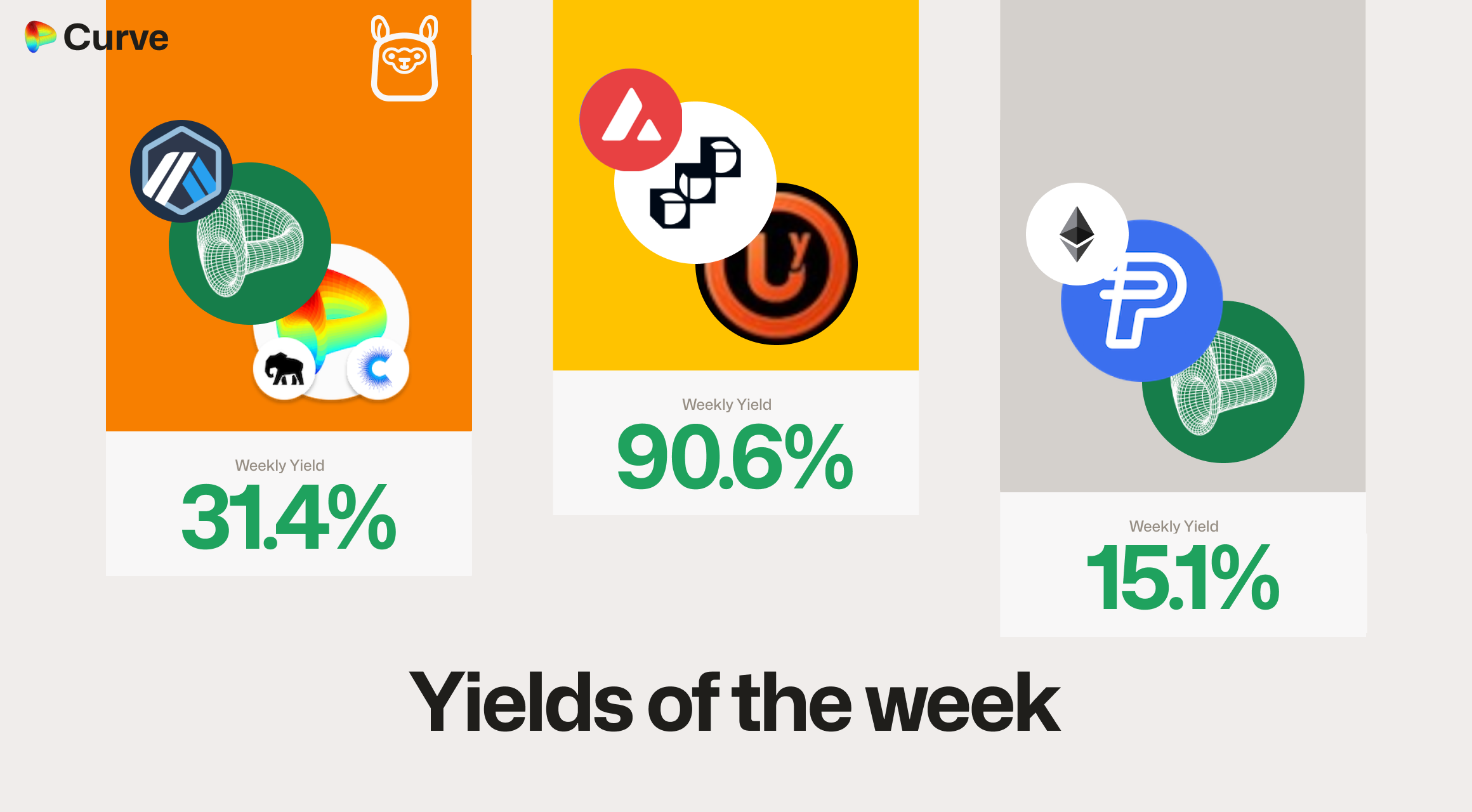

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

All highlighted markets below have more than $10M of TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

PYUSD PYUSD crvUSD crvUSD |

$23.7M | 15.1% |

|

scrvUSD scrvUSD |

$30.5M | 11.7% |

|

reUSD reUSD scrvUSD scrvUSD |

$12M | 7.2% |

|

USDT USDT crvUSD crvUSD |

$25.4M | 5.6% |

|

USDC USDC crvUSD crvUSD |

$27.6M | 4.8% |

Other Top USD Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Type | Yield |

|---|---|---|---|

|

xpUSD xpUSD yUTY yUTY |

Pool | 90.6% |

|

crvUSD crvUSD asdCRV asdCRV |

Llamalend | 31.4% |

|

sdUSD sdUSD sfrxUSD sfrxUSD |

Pool | 28.5% |

|

ynRWAx ynRWAx ynUSDx ynUSDx |

Pool | 23.2% |

|

msUSD msUSD FRAX FRAX USDC USDC |

Pool | 18.3% |

|

crvUSD crvUSD sfrxETH sfrxETH |

Llamalend | 13.6% |

|

frxUSD frxUSD msUSD msUSD |

Pool | 13.6% |

|

crvUSD crvUSD sfrxUSD sfrxUSD |

Llamalend | 12.8% |

Top BTC & ETH Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

msETH msETH WETH WETH |

ETH | 18.5% |

|

msETH msETH OETH OETH |

ETH | 13.7% |

|

WETH WETH pufETH pufETH |

ETH | 11.9% |

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 7.8% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 4.6% |

|

tBTC tBTC WBTC WBTC |

BTC | 1.5% |

Other Top Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CRV CRV yCRV yCRV |

CRV | 11.5% |

|

CRV CRV crvUSD crvUSD |

CRV | 10.4% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 8.4% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 5.9% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 5.2% |

|

EURA EURA EURC EURC |

EUR | 1.9% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.3% |

Weekly Metrics

crvUSD & scrvUSD

The crvUSD minted has been hit hard. The peg was pressured by YieldBasis pools selling crvUSD as the BTC price dropped (actual stablecoin demand is causing issues). Because of this, the system is trying to stabilize itself by firstly emptying the PegKeepers and now raising the interest rates.

The concern is not that crvUSD will death spiral; YieldBasis alone cannot cause a death spiral because of pool dynamics. It's just unknown how long it will take for the peg to completely recover.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$37.2M | -56.1% |

scrvUSD Yield scrvUSD Yield |

11.7% | +8.2% |

crvUSD in crvUSD in scrvUSD scrvUSD |

82.0% | +60.7% |

crvUSD Price crvUSD Price |

$0.993 | -$0.0064 |

Avg. Borrow Rate Avg. Borrow Rate |

37.8% | +34.6% |

Peg Stability Reserves Peg Stability Reserves |

$0 | -$38.2M |

PegKeeper Profit PegKeeper Profit |

$2.25k | -$562 |

Llamalend

Llamalend metrics are below. It was a tough week for borrowing and lending llamas.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $132M | -43.3% |

| 🦙 Supplied | $66.9M | -19.4% |

| 🦙 Borrowed | $76M | -50.5% |

| 🦙 Collateral | $104M | -52.5% |

| 🦙 Loans | 1117 | -196 |

DEX

Pools are always positive to look at during volatile weeks. While TVL did come down, it was an absolutely huge week for volumes, swaps, and fees paid.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.92B | -9.0% |

| 🔄 Volume | $3.65B | +115.1% |

| 🔄 Swaps | 700k | +61.6% |

| 🔄 Total Fees | $688k | +187.8% |

DAO

The great news is the veCRV distribution. Because of the fee revenue and crvUSD borrowing fees increasing, the veCRV distribution was almost double last week's stellar week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.47B | +0.1% |

CRV Locked CRV Locked |

857M | +0.1% |

Total veCRV Total veCRV |

788M | -0.1% |

veCRV Distribution veCRV Distribution |

$475k | +91.0% |

CRV Emissions CRV Emissions |

$662k (2.22M CRV) | -15.9% |

Inflation Rate Inflation Rate |

4.922% | -0.005% |

Top Stableswap Pools

The DAI/USDC/USDT pool made over $45k this week, all of which flows straight to the DAO. The crvUSD pools also did huge volumes because of the stress test on the peg.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

PYUSD PYUSD USDS USDS |

$459.2M | $4.7k |

| 2 | - |  |

DAI DAI USDC USDC USDT USDT |

$300.5M | $45.1k |

| 3 | +2 |  |

USDT USDT crvUSD crvUSD |

$289.5M | $29.0k |

| 4 | - |  |

USDC USDC crvUSD crvUSD |

$212.0M | $21.2k |

| 5 | +12 |  |

msETH msETH WETH WETH |

$172.9M | $69.1k |

| 6 | -3 |  |

USDC USDC RLUSD RLUSD |

$136.0M | $28.0k |

| 7 | +9 |  |

ETH ETH stETH stETH |

$134.0M | $13.4k |

| 8 | +22 |  |

msUSD msUSD FRAX FRAX USDC USDC |

$121.6M | $48.6k |

| 9 | +20 |  |

FRAX FRAX USDe USDe |

$110.2M | $14.1k |

| 10 | -2 |  |

sUSDS sUSDS USDT USDT |

$109.6M | $3.3k |

Top Cryptoswap Pools

There were some huge fees and volumes through all the Tricrypto pools.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$54.3M | $32.9k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$41.9M | $27.8k |

| 3 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$25.1M | $56.7k |

| 4 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$19.4M | $15.2k |

| 5 | +2 |  |

GHO GHO cbBTC cbBTC WETH WETH |

$2.9M | $9.0k |

| 6 | +2 |  |

crvUSD crvUSD tBTC tBTC wstETH wstETH |

$2.9M | $8.9k |

DEX Winners & Losers

Fees Winners & Losers

Metronome's msETH and msUSD won the week for an increase in fees. There were no huge declines in fees though, with the loser only reducing their weekly fees by $4k.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

msETH msETH WETH WETH |

$173M | $69.1k | +$64.5k |

| 2 |  |

msUSD msUSD FRAX FRAX USDC USDC |

$122M | $48.6k | +$46.1k |

| 3 |  |

USDT USDT WBTC WBTC WETH WETH |

$25.1M | $56.7k | +$40.2k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

PYUSD PYUSD USDS USDS |

$459M | $4.67k | -$1.77k |

| -2 |  |

PYUSD PYUSD USDC USDC |

$32.2M | $3.28k | -$3.29k |

| -1 |  |

USDS USDS stUSDS stUSDS |

$1.83M | $1.88k | -$4.34k |

Volume Winners & Losers

crvUSD topped the week for added volume week on week, with the 3pool being a close 2nd.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDT USDT crvUSD crvUSD |

$290M | $29k | +$217M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$300M | $45.1k | +$209M |

| 3 |  |

msETH msETH WETH WETH |

$173M | $69.1k | +$161M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDG USDG USDC USDC |

$13.7M | $1.39k | -$13.8M |

| -2 |  |

PYUSD PYUSD USDC USDC |

$32.2M | $3.28k | -$28.7M |

| -1 |  |

PYUSD PYUSD USDS USDS |

$459M | $4.67k | -$152M |

TVL Winners & Losers

The AUSD pool came from nothing and increased to $25M TVL, winning the week for added TVL, with the PYUSD/crvUSD pool in second with it earning currently over 15% yield.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDC USDC AUSD AUSD |

$25M | +$25M |

| 2 |  |

PYUSD PYUSD crvUSD crvUSD |

$23.7M | +$21.9M |

| 3 |  |

PYUSD PYUSD USDC USDC |

$34.1M | +$1.74M |

| ... | ... | ... | ... | ... |

| -3 |  |

OETH OETH WETH WETH |

$51.4M | -$21.4M |

| -2 |  |

USDT USDT crvUSD crvUSD |

$25.4M | -$36M |

| -1 |  |

ETH ETH stETH stETH |

$91.5M | -$39M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

It was a rough week for crvUSD minting markets unfortunately. The increase in borrowing rates fulfilled their role and forced many borrowers to repay their loans, creating a large reduction in crvUSD supply.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$331k | $150k | -$916 |

| 2 |  |

crvUSD crvUSD weETH weETH |

$327k | $153k | -$30.5k |

| 3 |  |

crvUSD crvUSD LBTC LBTC |

$72.6k | $43.6k | -$113k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD wstETH wstETH |

$4.54M | $2.41M | -$11.7M |

| -2 |  |

crvUSD crvUSD WETH WETH |

$5.87M | $4.24M | -$15M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$33.9M | $20.5M | -$16.5M |

Lend Markets - Borrowing Winners & Losers

The asdCRV market saw some strong borrowing increases, but many markets saw large reductions.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD asdCRV asdCRV |

$492k | $403k | +$219k |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$707k | $546k | +$17.2k |

| 3 |  |

crvUSD crvUSD ycvxCRV ycvxCRV |

$31.5k | $12.9k | +$8.02k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$1.4M | $284k | -$5.95M |

| -2 |  |

crvUSD crvUSD sreUSD sreUSD |

$24M | $11M | -$9.79M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$23.8M | $13.2M | -$13.9M |

Lend Markets - Supplying Winners & Losers

The asdCRV market also saw some strong increases in supplied crvUSD, but many markets also saw outflows due to the pressure on the peg forcing repayments and a supply reduction of crvUSD.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD asdCRV asdCRV |

$492k | $403k | +$202k |

| 2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$719k | $543k | +$55.6k |

| 3 |  |

crvUSD crvUSD wstETH wstETH |

$707k | $546k | +$46.8k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sreUSD sreUSD |

$24M | $11M | -$3.52M |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$1.4M | $284k | -$5.12M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$23.8M | $13.2M | -$6.64M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.