Curve Best Yields & Key Metrics | Week 51, 2025

Weekly yield and Curve ecosystem metric updates as of the 18th December, 2025

Market Overview

It’s the final week of yields before Christmas, and as always, there is plenty of yield to go around for all the good boys and girls in DeFi.

While the broader DeFi space weathered a 5.6% decrease this week, Curve’s TVL remained resilient, climbing 0.6% to $2.546B. Outperforming the general market by over 6% is a massive win heading into the holidays.

Check out all the highlighted opportunities and core metrics below.

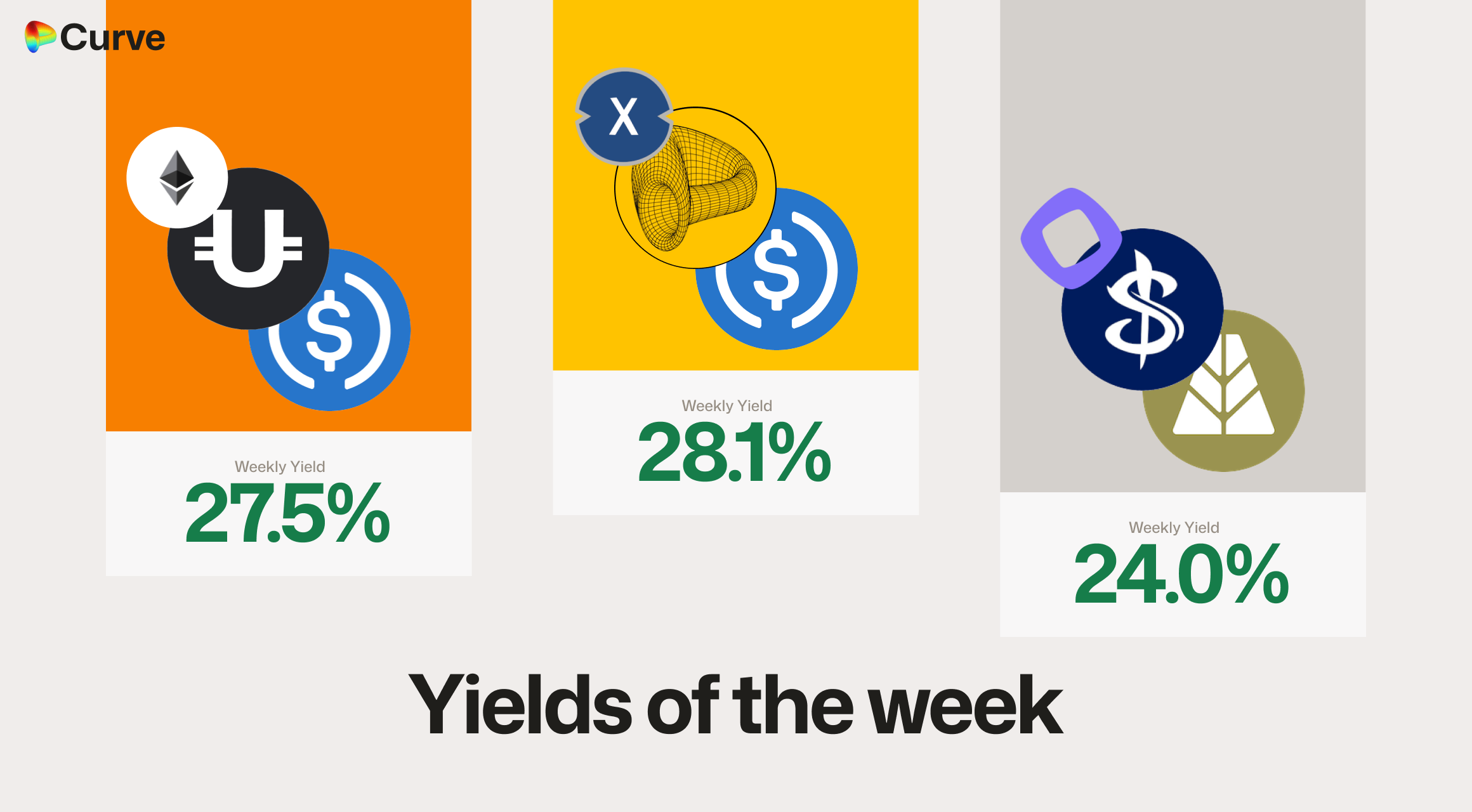

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Large crvUSD Markets

All highlighted markets below have more than $10M of TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

crvUSD crvUSD sreUSD sreUSD |

$20.9M | 6.0% |

|

crvUSD crvUSD sDOLA sDOLA |

$28.5M | 5.3% |

|

reUSD reUSD scrvUSD scrvUSD |

$17.1M | 4.8% |

|

crvUSD crvUSD fxSAVE fxSAVE |

$10.1M | 4.8% |

|

frxUSD frxUSD crvUSD crvUSD |

$41.2M | 4.7% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD USDC USDC |

Pool | 28.1% |

|

USDC USDC USDU USDU |

Pool | 27.5% |

|

AZND AZND AUSD AUSD |

Pool | 24.0% |

|

alUSD alUSD USDC USDC |

Pool | 20.4% |

|

USDp USDp frxUSD frxUSD |

Pool | 15.9% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.3% |

|

ebUSD ebUSD USDC USDC |

Pool | 12.1% |

|

frxUSD frxUSD msUSD msUSD |

Pool | 11.9% |

|

HAI HAI BOLD BOLD |

Pool | 10.9% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 32.6% |

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 14.4% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 9.6% |

|

dgnETH dgnETH ETH+ ETH+ |

ETH | 9.3% |

|

ETH+ ETH+ WETH WETH |

ETH | 7.6% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 1.7% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 22.6% |

|

CRV CRV sdCRV sdCRV |

CRV | 14.5% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 9.3% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 8.0% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 7.3% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 6.3% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.0% |

|

EURA EURA EURC EURC |

EUR | 2.3% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD supply from minting markets rose to $69.4M (+0.9%) despite a volatile week. The standout story, however, is the PegKeepers, which generated $7.7k in profit over the last seven days.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$69.4M | +0.9% |

scrvUSD Yield scrvUSD Yield |

1.7% | +0.3% |

crvUSD in crvUSD in scrvUSD scrvUSD |

38.5% | -4.2% |

crvUSD Price crvUSD Price |

$0.9998 | -$0.0002 |

Avg. Borrow Rate Avg. Borrow Rate |

2.2% | +1.8% |

Peg Stability Reserves Peg Stability Reserves |

$32M | -$40.3M |

PegKeeper Profit PegKeeper Profit |

$7.7k | +$7.7k |

Llamalend

Llamalend metrics are a mixed bag this week. While total TVL dipped due to declining collateral prices, core usage metrics (supplied assets, borrowed assets, and total loan counts) all trended upward.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $215M | -2.1% |

| 🦙 Supplied | $85M | +2.4% |

| 🦙 Borrowed | $139M | +0.9% |

| 🦙 Collateral | $200M | -2.9% |

| 🦙 Loans | 1177 | +16 |

DEX

DEX pools saw a minor TVL decline, but all other growth metrics remain overwhelmingly positive across the board.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.51B | -0.2% |

| 🔄 Volume | $1.53B | +16.7% |

| 🔄 Swaps | 425k | +17.8% |

| 🔄 Total Fees | $240k | +1.4% |

DAO

The DAO saw a significant 23.3% jump in veCRV distributions compared to last week. CRV emissions fell slightly, following the recent decline in CRV price, while all other metrics remained steady.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.44B | +0.1% |

CRV Locked CRV Locked |

861M | - |

Total veCRV Total veCRV |

793M | - |

veCRV Distribution veCRV Distribution |

$114k | +23.3% |

CRV Emissions CRV Emissions |

$842k (2.22M CRV) | -4.8% |

Inflation Rate Inflation Rate |

4.955% | -0.005% |

Top Stableswap Pools

The main highlight this week is the surge in crvUSD usage: it facilitated over $400M in volume and was involved in one out of every four swaps on Curve over the week.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

sUSDS sUSDS USDT USDT |

$135.9M | $1.9k |

| 2 | +2 |  |

USDC USDC USDT USDT |

$131.0M | $1.6k |

| 3 | - |  |

USDC USDC RLUSD RLUSD |

$118.8M | $24.6k |

| 4 | +2 |  |

USDT USDT crvUSD crvUSD |

$106.9M | $10.7k |

| 5 | -4 |  |

PYUSD PYUSD USDS USDS |

$103.7M | $1.1k |

| 6 | -1 |  |

USDC USDC crvUSD crvUSD |

$99.3M | $9.9k |

| 7 | +2 |  |

DAI DAI USDC USDC USDT USDT |

$83.4M | $12.5k |

| 8 | - |  |

WETH WETH weETH weETH |

$51.5M | $3.0k |

| 9 | +9 |  |

USDC USDC fxUSD fxUSD |

$39.6M | $4.1k |

| 10 | +9 |  |

frxUSD frxUSD crvUSD crvUSD |

$30.6M | $3.3k |

Top Cryptoswap Pools

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$33.4M | $17.4k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$31.3M | $15.6k |

| 3 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$14.0M | $10.2k |

| 4 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$9.1M | $20.9k |

| 5 | +2 |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$2.6M | $2.5k |

| 6 | +2 |  |

crvUSD crvUSD tBTC tBTC wstETH wstETH |

$2.0M | $6.0k |

DEX Winners & Losers

Fees Winners & Losers

The 3pool led the pack for fee growth this week, followed closely by Ripple’s RLUSD.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

DAI DAI USDC USDC USDT USDT |

$83.4M | $12.5k | +$6.31k |

| 2 |  |

USDC USDC RLUSD RLUSD |

$119M | $24.6k | +$5.31k |

| 3 |  |

USDT USDT WBTC WBTC WETH WETH |

$31.3M | $15.6k | +$4.1k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDT USDT WBTC WBTC WETH WETH |

$9.15M | $20.9k | -$4.45k |

| -2 |  |

reUSD reUSD scrvUSD scrvUSD |

$6.96M | $1.79k | -$5.04k |

| -1 |  |

crvUSD crvUSD YB YB |

$1.17M | $4.04k | -$7.66k |

Volume Winners & Losers

The Curve Strategic Reserves (USDC/USDT) and the 3pool led volume growth. Meanwhile, Lido’s stETH pool saw a decline in activity as validator entry and exit queues have shortened.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDT USDT |

$131M | $1.64k | +$44.2M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$83.4M | $12.5k | +$42.1M |

| 3 |  |

sUSDS sUSDS USDT USDT |

$136M | $1.93k | +$36.7M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDai USDai USDC USDC |

$19.7M | $1.99k | -$21.1M |

| -2 |  |

PYUSD PYUSD USDS USDS |

$104M | $1.08k | -$27.8M |

| -1 |  |

ETH ETH stETH stETH |

$15.2M | $1.52k | -$32.4M |

TVL Winners & Losers

Large inflows and outflows were driven by PegKeepers removing liquidity from the USDC pool and depositing into the USDT pool. YieldBasis’s cbBTC pool was the week's standout performer, doubling its TVL.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD cbBTC cbBTC |

$222M | +$117M |

| 2 |  |

USDT USDT crvUSD crvUSD |

$61.4M | +$21.3M |

| 3 |  |

sUSDS sUSDS stUSDS stUSDS |

$62M | +$7.54M |

| ... | ... | ... | ... | ... |

| -3 |  |

OETH OETH WETH WETH |

$71.1M | -$8.42M |

| -2 |  |

ETH ETH stETH stETH |

$128M | -$15.5M |

| -1 |  |

USDC USDC crvUSD crvUSD |

$45.8M | -$59.3M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

As LTVs tightened slightly for the WETH market, users rotated into wstETH and BTC-backed markets.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$56.4M | $31.5M | +$3M |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$11M | $6.1M | +$1.3M |

| 3 |  |

crvUSD crvUSD cbBTC cbBTC |

$2.99M | $1.95M | +$142k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$5.45M | $3.81M | -$59.1k |

| -2 |  |

crvUSD crvUSD tBTC tBTC |

$11.3M | $7.34M | -$226k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$32.1M | $18.2M | -$3.53M |

Lend Markets - Borrowing Winners & Losers

The sDOLA market continues to climb and increase demand, adding $1.4M in TVL this week. Conversely, the sUSDe market continued its decline in popularity as yields compressed.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.5M | $22.9M | +$1.4M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$3.16M | $2.65M | +$107k |

| 3 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.9M | $17.3M | +$53.4k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$725k | $425k | -$114k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$10.1M | $9.18M | -$172k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$3.49M | $2.88M | -$500k |

Lend Markets - Supplying Winners & Losers

sDOLA again led crvUSD lend supplied growth with a $1.87M increase, while sreUSD also saw a strong showing with a $1.14M gain.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.5M | $22.9M | +$1.87M |

| 2 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.9M | $17.3M | +$1.14M |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$3.16M | $2.65M | +$139k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD USDe USDe |

$56.7k | $21.1k | -$49.2k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$8.6M | $7.78M | -$499k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$3.49M | $2.88M | -$592k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.