Curve Best Yields & Key Metrics | Week 50, 2025

Weekly yield and Curve ecosystem metric updates as of the 11th December, 2025

Market Overview

Don't worry that the year is almost over, because Curve yields will be around for another 300 years, keep earning with Curve. Here's the weekly news:

- TVL has increased 0.2% to $2.529B.

- crvUSD is getting a change in monetary policy

- The $1B crvUSD loan vote to YieldBasis is ongoing, but set to pass overwhelmingly with the highest quorum ever seen in a veCRV vote.

See all the highlighted yields and metrics below.

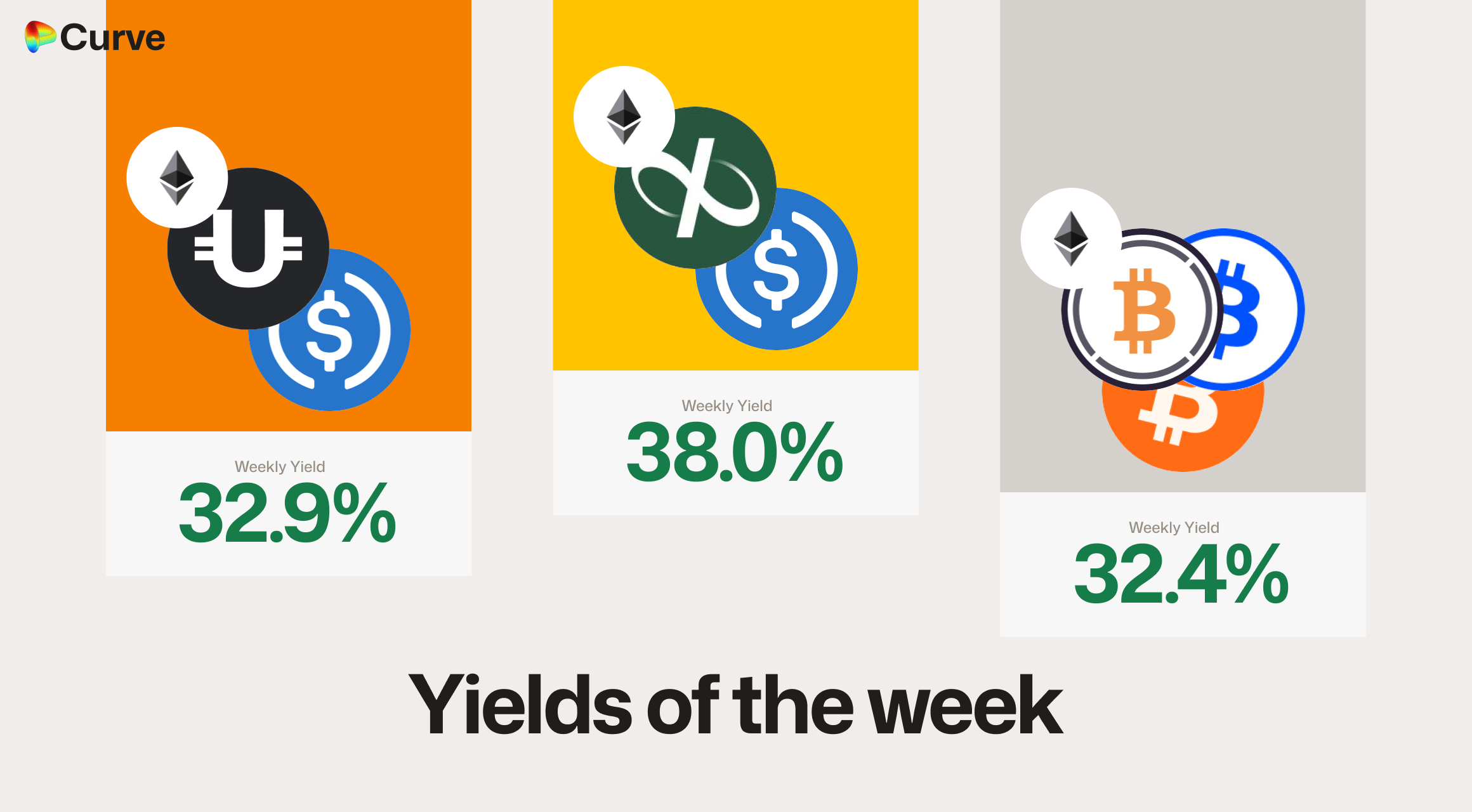

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

High TVL crvUSD Yields

All pools and lending markets below have at least $10M TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

crvUSD crvUSD sreUSD sreUSD |

$19.8M | 8.3% |

|

crvUSD crvUSD fxSAVE fxSAVE |

$10.1M | 6.4% |

|

crvUSD crvUSD sDOLA sDOLA |

$26.6M | 5.7% |

|

reUSD reUSD scrvUSD scrvUSD |

$17.3M | 5.3% |

|

frxUSD frxUSD crvUSD crvUSD |

$38.2M | 5.0% |

|

USDC USDC crvUSD crvUSD |

$105M | 4.0% |

Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

iUSD iUSD USDC USDC |

Pool | 38.0% |

|

USDC USDC USDU USDU |

Pool | 32.9% |

|

crvUSD crvUSD sUSDS sUSDS |

Llamalend | 22.0% |

|

ebUSD ebUSD USDC USDC |

Pool | 19.1% |

|

alUSD alUSD USDC USDC |

Pool | 17.9% |

|

USDC USDC USDT USDT |

Pool | 17.1% |

|

scrvUSD scrvUSD USDC USDC |

Pool | 16.5% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 15.6% |

Top BTC & ETH Yields

The HemiBTC pool has a huge yield of 32.4% this week, and its TVL has increased to over $400k.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 32.4% |

|

LBTC LBTC WBTC WBTC |

BTC | 9.7% |

|

dgnETH dgnETH ETH+ ETH+ |

ETH | 9.6% |

|

msETH msETH OETH OETH |

ETH | 9.6% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 8.3% |

|

ETH+ ETH+ WETH WETH |

ETH | 8.2% |

Other Top Yields

People like the Frankencoin's ZCHF/crvUSD yields, with the TVL has tripling in a week. It's no wonder, as the new FXSwap pool technology is the same that YieldBasis was built upon.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 27.4% |

|

CRV CRV sdCRV sdCRV |

CRV | 13.9% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 11.2% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 11.0% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 8.9% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 7.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.2% |

|

EURA EURA EURe EURe |

EUR | 2.3% |

Weekly Metrics

crvUSD & scrvUSD

Another great week again for crvUSD minting, with over $6M minted. It's no wonder as borrow rates have remained under 1% for a few weeks now.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$68.8M | +11.4% |

scrvUSD Yield scrvUSD Yield |

1.4% | -6.0% |

crvUSD in crvUSD in scrvUSD scrvUSD |

42.7% | -26.4% |

crvUSD Price crvUSD Price |

$1.0 | -$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

0.4% | +0.2% |

Peg Stability Reserves Peg Stability Reserves |

$72.3M | -$21.4M |

PegKeeper Profit PegKeeper Profit |

$0 | -$3.99k |

Llamalend

Llamalend metrics have largely been positive, with only the amount of crvUSD supplied reducing slightly.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $220M | +2.8% |

| 🦙 Supplied | $83M | -0.7% |

| 🦙 Borrowed | $138M | +3.8% |

| 🦙 Collateral | $206M | +2.3% |

| 🦙 Loans | 1161 | -8 |

DEX

DEX pools saw a marginal increase in TVL, however it was a slow week for pools, as many assets saw low volatility and low trade volumes.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.52B | +0.1% |

| 🔄 Volume | $1.31B | -31.4% |

| 🔄 Swaps | 361k | -10.2% |

| 🔄 Total Fees | $237k | -1.3% |

DAO

Due to cheap crvUSD minting rates and low volatility creating low DEX fees, the DAO saw a smaller than usual veCRV distribution, but all other metrics largely remained the same.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.43B | +0.2% |

CRV Locked CRV Locked |

860M | -0.1% |

Total veCRV Total veCRV |

792M | -0.1% |

veCRV Distribution veCRV Distribution |

$92.4k | -5.5% |

CRV Emissions CRV Emissions |

$885k (2.22M CRV) | -3.5% |

Inflation Rate Inflation Rate |

4.96% | -0.005% |

Top Stableswap Pools

Once again USDS pools topped the list for the top stableswap pools by volume. The DAI/USDC/USDT pool saw lower than usual volumes as well; however all other pools stayed similar to previous weeks.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

PYUSD PYUSD USDS USDS |

$131.5M | $1.4k |

| 2 | - |  |

sUSDS sUSDS USDT USDT |

$99.2M | $1.7k |

| 3 | +11 |  |

USDC USDC RLUSD RLUSD |

$95.1M | $19.3k |

| 4 | -1 |  |

USDC USDC USDT USDT |

$86.8M | $1.3k |

| 5 | +1 |  |

USDC USDC crvUSD crvUSD |

$83.1M | $8.3k |

| 6 | +1 |  |

USDT USDT crvUSD crvUSD |

$74.3M | $7.4k |

| 7 | -2 |  |

ETH ETH stETH stETH |

$47.7M | $4.8k |

| 8 | +2 |  |

WETH WETH weETH weETH |

$42.6M | $2.6k |

| 9 | -5 |  |

DAI DAI USDC USDC USDT USDT |

$41.3M | $6.2k |

| 10 | +2 |  |

USDai USDai USDC USDC |

$40.7M | $4.1k |

Top Cryptoswap Pools

There was no change at all within the rankings of the top Cryptoswap pools by volume this week.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$25.8M | $14.7k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$19.4M | $11.5k |

| 3 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$13.6M | $7.9k |

| 4 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$12.7M | $25.4k |

| 5 | - |  |

crvUSD crvUSD YB YB |

$3.4M | $11.7k |

| 6 | - |  |

WETH WETH CVX CVX |

$2.3M | $7.2k |

| 7 | - |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$1.9M | $1.4k |

| 8 | - |  |

crvUSD crvUSD tBTC tBTC wstETH wstETH |

$1.4M | $4.1k |

| 9 | +5 |  |

wstETH wstETH rETH rETH sfrxETH sfrxETH |

$987.1k | $429.3 |

| 10 | +1 |  |

USD₮0 USD₮0 WBTC WBTC WETH WETH |

$911.6k | $634.8 |

DEX Winners & Losers

Fees Winners & Losers

RLUSD saw a huge increase in fees this week, possibly to due to an up-spike in demand from Ripple's stock sale news. It's also great to see YB here on this list, as large fees for veYB holders start flowing, creating demand.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$95.1M | $19.3k | +$15.1k |

| 2 |  |

USDT USDT WBTC WBTC WETH WETH |

$12.7M | $25.4k | +$7.46k |

| 3 |  |

crvUSD crvUSD YB YB |

$3.36M | $11.7k | +$4.69k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

stETH stETH frxETH frxETH |

$7.3M | $2.92k | -$4.71k |

| -2 |  |

ETH ETH stETH stETH |

$47.7M | $4.77k | -$6.23k |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$41.3M | $6.2k | -$11.6k |

Volume Winners & Losers

RLUSD also topped the winners in terms of volume, with the USDai coin in 2nd, and USDS pools losing compared to last week's volumes, but interestingly they still led the week in terms of total volume.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$95.1M | $19.3k | +$74.3M |

| 2 |  |

USDai USDai USDC USDC |

$40.7M | $4.14k | +$17.1M |

| 3 |  |

WETH WETH weETH weETH |

$42.6M | $2.59k | +$14.2M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

DAI DAI USDC USDC USDT USDT |

$41.3M | $6.2k | -$77.6M |

| -2 |  |

PYUSD PYUSD USDS USDS |

$132M | $1.36k | -$169M |

| -1 |  |

sUSDS sUSDS USDT USDT |

$99.2M | $1.68k | -$201M |

TVL Winners & Losers

A triple crown for the RLUSD/USDC pool this week, as it also increased its TVL the most out any pool. As usual, the crvUSD PegKeeper pools had normal fluctuations in TVL from their PegKeeper depositing/withdrawing liquidity actions.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$82.9M | +$6.78M |

| 2 |  |

frxUSD frxUSD crvUSD crvUSD |

$38.2M | +$5.75M |

| 3 |  |

TBTC TBTC renBTC renBTC WBTC WBTC sBTC sBTC |

$4.85M | +$4.63M |

| ... | ... | ... | ... | ... |

| -3 |  |

USD0 USD0 bUSD0 bUSD0 |

$22.6M | -$4.06M |

| -2 |  |

DOLA DOLA wstUSR wstUSR |

$42.3M | -$5.21M |

| -1 |  |

USDC USDC crvUSD crvUSD |

$105M | -$9.2M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

No market had a net outflow for the week, a huge achievement for crvUSD and its dynamic and automatic system.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$39.7M | $21.7M | +$4.83M |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$9.95M | $4.8M | +$1.44M |

| 3 |  |

crvUSD crvUSD cbBTC cbBTC |

$2.86M | $1.8M | +$505k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD LBTC LBTC |

$380k | $252k | +$12.1k |

| -2 |  |

crvUSD crvUSD weETH weETH |

$262k | $138k | +$2.56k |

| -1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$508k | $150k | +$37.7 |

Lend Markets - Borrowing Winners & Losers

The sDOLA market continues its march with another positive and huge increase in the amount borrowed, at the same time that other stablecoin markets saw outflows.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$26.6M | $21.5M | +$730k |

| 2 |  |

crvUSD crvUSD CRV CRV |

$4.07M | $3.23M | +$146k |

| 3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$10.1M | $9.35M | +$134k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$4.09M | $3.38M | -$417k |

| -2 |  |

crvUSD crvUSD sreUSD sreUSD |

$19.8M | $17.2M | -$886k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$9.1M | $7.89M | -$1.16M |

Lend Markets - Supplying Winners & Losers

As always, the supply and amount borrowed seem to move together, with this table perfectly mimicking the borrowed winners & losers chart.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$26.6M | $21.5M | +$1M |

| 2 |  |

crvUSD crvUSD CRV CRV |

$4.07M | $3.23M | +$191k |

| 3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$10.1M | $9.35M | +$149k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$4.09M | $3.38M | -$187k |

| -2 |  |

crvUSD crvUSD sreUSD sreUSD |

$19.8M | $17.2M | -$254k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$9.1M | $7.89M | -$1.15M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.