Curve Best Yields & Key Metrics | Week 5, 2026

Weekly yield and Curve ecosystem metric updates as of the 29th January, 2026

Market Overview

It’s been another choppy week for the market, with prices moving up, sideways, and back down again. All we can do is keep building and act in good faith, and over time the market should hopefully recognize the value of DeFi, and especially Curve.

Total value locked (TVL) is down 1.8% this week to $2.438B. As always, there are plenty of attractive yields and opportunities available across Curve. See the highlighted yields below, along with this week’s metrics.

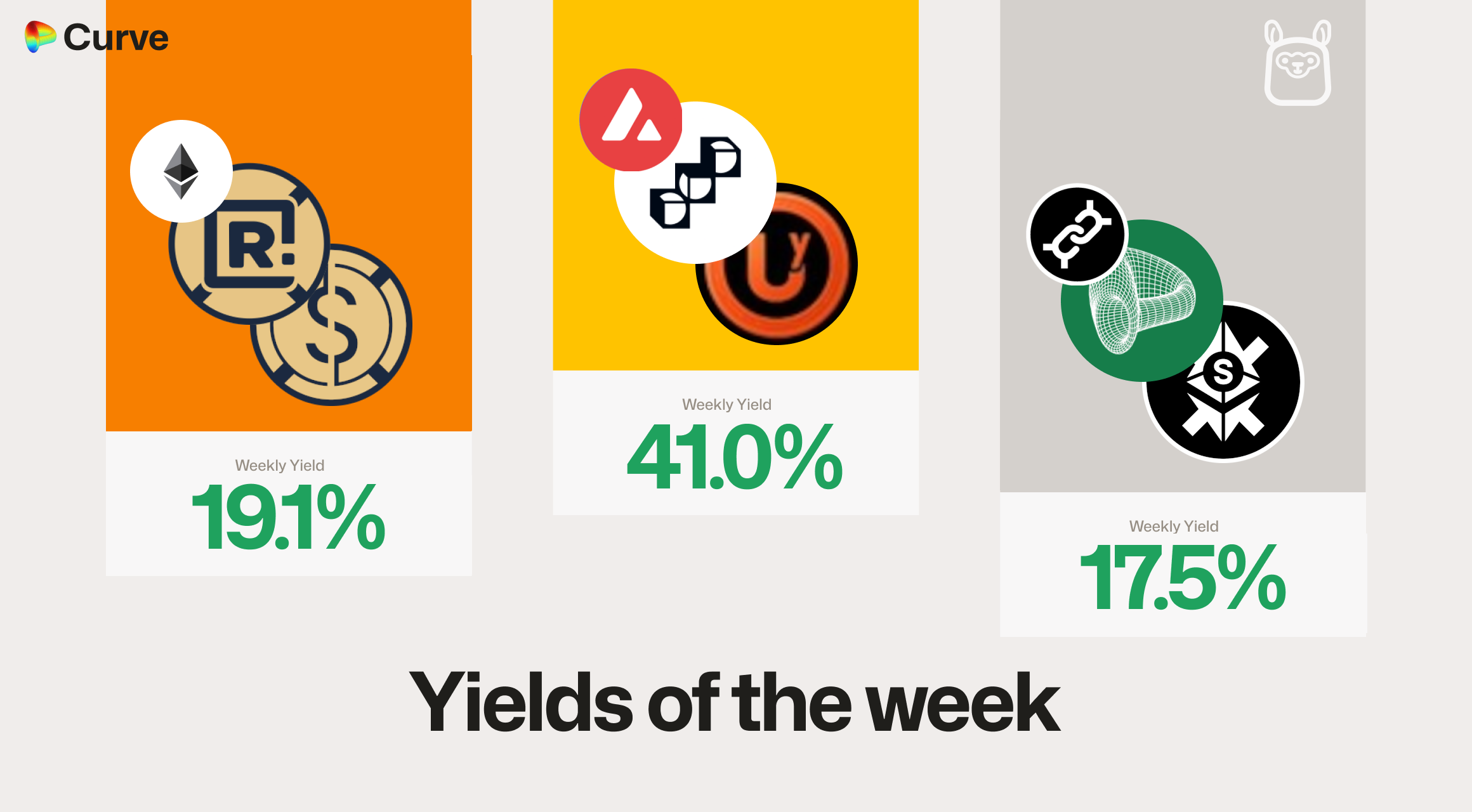

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

All highlighted markets below have more than $10M of TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

crvUSD crvUSD sDOLA sDOLA |

$30.4M | 5.4% |

|

reUSD reUSD scrvUSD scrvUSD |

$13M | 4.8% |

|

crvUSD crvUSD sreUSD sreUSD |

$27.5M | 4.1% |

|

USDC USDC crvUSD crvUSD |

$32.4M | 3.7% |

|

USDT USDT crvUSD crvUSD |

$61.5M | 3.7% |

Other Top USD Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Type | Yield |

|---|---|---|---|

|

xpUSD xpUSD yUTY yUTY |

Pool | 41.0% |

|

ynRWAx ynRWAx ynUSDx ynUSDx |

Pool | 19.1% |

|

crvUSD crvUSD sfrxETH sfrxETH |

Llamalend | 17.5% |

|

crvUSD crvUSD asdCRV asdCRV |

Llamalend | 15.4% |

|

sdUSD sdUSD sfrxUSD sfrxUSD |

Pool | 15.4% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.3% |

|

crvUSD crvUSD sfrxUSD sfrxUSD |

Llamalend | 12.7% |

|

pmUSD pmUSD frxUSD frxUSD |

Pool | 12.5% |

|

USDT USDT USDN USDN |

Pool | 12.3% |

Top BTC & ETH Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 7.3% |

|

WETH WETH pufETH pufETH |

ETH | 7.0% |

|

OETH OETH ARM-WETH-stETH ARM-WETH-stETH |

ETH | 5.1% |

|

msETH msETH WETH WETH |

ETH | 4.8% |

|

WBTC WBTC DBIT DBIT |

BTC | 4.6% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 4.5% |

Other Top Yields

All yields have been calculated as if markets have at least $100k TVL

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV CrossCurve CRV |

CRV | 15.6% |

|

CRV CRV yCRV yCRV |

CRV | 11.0% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 7.6% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 5.5% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 4.5% |

|

EURA EURA EURC EURC |

EUR | 2.4% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.7% |

|

EURA EURA EURe EURe |

EUR | 0.6% |

Weekly Metrics

crvUSD & scrvUSD

Following a volatile week and a modest pullback in ETH and BTC prices, some more conservative users closed positions, resulting in a reduction in total crvUSD minted. Meanwhile, scrvUSD yield continued to rise and now sits above the yield on 1-year US government bonds. PegKeepers also continued to generate steady profits for the DAO.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$84.7M | -6.5% |

scrvUSD Yield scrvUSD Yield |

3.5% | +1.4% |

crvUSD in crvUSD in scrvUSD scrvUSD |

21.3% | +1.5% |

crvUSD Price crvUSD Price |

$0.9994 | -$0.0003 |

Avg. Borrow Rate Avg. Borrow Rate |

3.2% | +0.4% |

Peg Stability Reserves Peg Stability Reserves |

$38.2M | - |

PegKeeper Profit PegKeeper Profit |

$2.81k | -$152 |

Llamalend

Llamalend saw a reduction in borrowed amounts this week, largely driven by declining collateral values. Despite this, the TVL of supplied (lent) assets increased, along with the total number of active loans.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $234M | -3.8% |

| 🦙 Supplied | $83M | +0.9% |

| 🦙 Borrowed | $153M | -2.9% |

| 🦙 Collateral | $219M | -3.7% |

| 🦙 Loans | 1313 | +23 |

DEX

Swap counts and volumes were broadly similar to last week. However, a larger share of activity occurred in lower-fee pools, resulting in total fees paid by swappers being 38% lower than the previous week.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.11B | -0.1% |

| 🔄 Volume | $1.70B | +1.8% |

| 🔄 Swaps | 433k | -5.0% |

| 🔄 Total Fees | $239k | -38.4% |

DAO

The DAO recorded a sizeable distribution this week. DEX fees are collected on Mondays, then swapped and forwarded over the following two days, with distributions paid on Thursdays. Strong fee generation earlier in the prior week means some fees from nearly two weeks ago are being distributed now.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.47B | +0.1% |

CRV Locked CRV Locked |

856M | - |

Total veCRV Total veCRV |

789M | -0.3% |

veCRV Distribution veCRV Distribution |

$249k | +102.5% |

CRV Emissions CRV Emissions |

$787k (2.22M CRV) | -12.7% |

Inflation Rate Inflation Rate |

4.927% | -0.004% |

Top Stableswap Pools

PYUSD pools were in particularly high demand this week, alongside USDai and the newly launched USDG stablecoin.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

PYUSD PYUSD USDS USDS |

$611.5M | $6.4k |

| 2 | +2 |  |

DAI DAI USDC USDC USDT USDT |

$91.6M | $13.7k |

| 3 | +9 |  |

USDC USDC RLUSD RLUSD |

$88.5M | $18.1k |

| 4 | +5 |  |

USDC USDC crvUSD crvUSD |

$73.0M | $7.3k |

| 5 | +2 |  |

USDT USDT crvUSD crvUSD |

$72.7M | $7.3k |

| 6 | +37 |  |

PYUSD PYUSD USDC USDC |

$60.9M | $6.6k |

| 7 | +3 |  |

WETH WETH weETH weETH |

$50.5M | $3.1k |

| 8 | -5 |  |

sUSDS sUSDS USDT USDT |

$39.8M | $1.2k |

| 9 | +11 |  |

USDG USDG USDC USDC |

$27.5M | $2.8k |

| 10 | +9 |  |

USDai USDai USDC USDC |

$25.0M | $2.6k |

Top Cryptoswap Pools

There was only minor reshuffling among the top Cryptoswap pools this week, with the CRV Tricrypto pool falling two positions.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$28.2M | $12.3k |

| 2 | +2 |  |

USDT USDT WBTC WBTC WETH WETH |

$23.3M | $10.3k |

| 3 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$13.4M | $16.5k |

| 4 | -2 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$12.9M | $15.7k |

| 5 | - |  |

WETH WETH cbETH cbETH |

$3.6M | $1.1k |

| 6 | - |  |

WETH WETH CVX CVX |

$2.7M | $9.5k |

DEX Winners & Losers

Fees Winners & Losers

RLUSD recorded the largest increase in fees this week. The MIM and DUSD pools saw the steepest declines, which was expected following last week’s oracle misconfiguration affecting DUSD.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$88.5M | $18.1k | +$12.5k |

| 2 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$12.9M | $15.7k | +$7.99k |

| 3 |  |

PYUSD PYUSD USDC USDC |

$60.9M | $6.57k | +$6.13k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$13M | $1.3k | -$6.2k |

| -2 |  |

USDC USDC DUSD DUSD |

$1.6M | $214 | -$48k |

| -1 |  |

MIM MIM DAI DAI USDC USDC USDT USDT |

$238k | $95.3 | -$111k |

Volume Winners & Losers

PYUSD was the most in-demand stablecoin this week, adding a substantial $471M in weekly volume. RLUSD also performed strongly, more than tripling its volume compared to last week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$612M | $6.45k | +$415M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$88.5M | $18.1k | +$61M |

| 3 |  |

PYUSD PYUSD USDC USDC |

$60.9M | $6.57k | +$56.6M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC USDT USDT |

$14.4M | $328 | -$73.8M |

| -2 |  |

sUSDS sUSDS USDT USDT |

$39.8M | $1.16k | -$143M |

| -1 |  |

MIM MIM DAI DAI USDC USDC USDT USDT |

$238k | $95.3 | -$277M |

TVL Winners & Losers

PYUSD once again led the week, with TVL in the PYUSD/USDC pool nearly doubling. pmUSD pools also continued to steadily attract new liquidity.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDC USDC |

$32.3M | +$14.4M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$73.7M | +$1.99M |

| 3 |  |

pmUSD pmUSD crvUSD crvUSD |

$9.72M | +$1.97M |

| ... | ... | ... | ... | ... |

| -3 |  |

BOLD BOLD USDC USDC |

$4.59M | -$3.88M |

| -2 |  |

frxUSD frxUSD crvUSD crvUSD |

$29.8M | -$6.96M |

| -1 |  |

USDS USDS stUSDS stUSDS |

$11M | -$8.65M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Following last week’s minting market update, wstETH has seen strong demand. Users appear to be rotating away from vanilla WETH into ETH staking derivatives, allowing them to earn yield while borrowing.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD wstETH wstETH |

$23.6M | $14.1M | +$5.36M |

| 2 |  |

crvUSD crvUSD weETH weETH |

$345k | $184k | +$28.5k |

| 3 |  |

crvUSD crvUSD tBTC tBTC |

$10.7M | $7.18M | +$24.4k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$29.8M | $19.3M | -$858k |

| -2 |  |

crvUSD crvUSD cbBTC cbBTC |

$3.69M | $2.4M | -$3.46M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$66.3M | $36.9M | -$6.8M |

Lend Markets - Borrowing Winners & Losers

sreUSD remained in high demand, accounting for over 8% of new borrows this week. The asdCRV market also performed well, with borrowing increasing by more than 64%.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$27.5M | $20.8M | +$1.66M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$30.4M | $27.1M | +$217k |

| 3 |  |

crvUSD crvUSD asdCRV asdCRV |

$291k | $185k | +$72.4k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD CRV CRV |

$4.15M | $3.27M | -$122k |

| -2 |  |

crvUSD crvUSD WBTC WBTC |

$814k | $538k | -$181k |

| -1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$6.52M | $6.23M | -$305k |

Lend Markets - Supplying Winners & Losers

sreUSD also led the week in new supply, growing by over 13%. The asdCRV market similarly had a strong week, with supplied liquidity increasing by 37%.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$27.5M | $20.8M | +$3.19M |

| 2 |  |

crvUSD crvUSD asdCRV asdCRV |

$291k | $185k | +$78.9k |

| 3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$208k | $159k | +$38.7k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD CRV CRV |

$4.15M | $3.27M | -$184k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$6.52M | $6.23M | -$390k |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$30.4M | $27.1M | -$1.61M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.