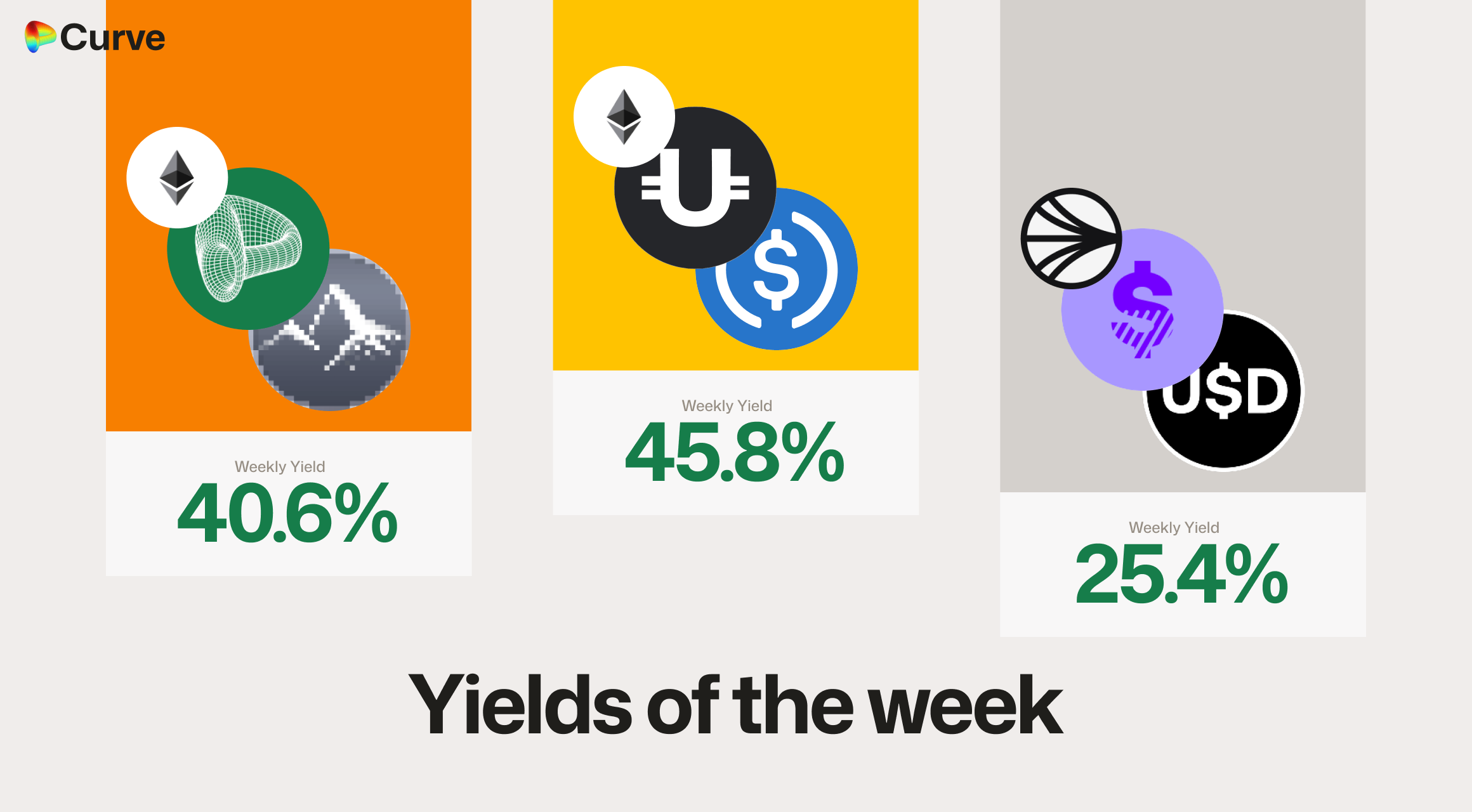

Curve Best Yields & Key Metrics | Week 49, 2025

Weekly yield and Curve ecosystem metric updates as of the 4th December, 2025

Market Overview

It's been a very positive week for Curve, with key metrics seeing significant gains:

- TVL has climbed to $2.528B, marking a strong 6.7% increase.

- New FXSwap Pool: A new pool has launched, facilitating swaps between crvUSD and ZCHF (Swiss Francs). This is Frankencoin's new pool, utilizing the FXSwap pool type which is optimized for low-volatility assets like national currencies.

- crvUSD Minting Optimization: To help borrowers predict costs more easily, parameters in crvUSD minting markets have been optimized to reduce interest rate volatility.

- crvUSD Supply Surge: Minted supply in crvUSD markets increased by 12.6% this week, driven by borrowing rates nearing 0% interest.

See the highlighted yields and all the metrics below.

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Large crvUSD Markets

All the markets highlighted below have more than $10M in TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD |

$42.6M | 7.3% |

|

crvUSD crvUSD sreUSD sreUSD |

$20M | 6.5% |

|

frxUSD frxUSD crvUSD crvUSD |

$32.5M | 5.6% |

|

USDC USDC crvUSD crvUSD |

$114M | 5.4% |

|

crvUSD crvUSD sDOLA sDOLA |

$25.6M | 5.3% |

|

crvUSD crvUSD sfrxUSD sfrxUSD |

$10.2M | 5.0% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDC USDC USDU USDU |

Pool | 45.8% |

|

USDp USDp frxUSD frxUSD |

Pool | 25.4% |

|

alUSD alUSD USDC USDC |

Pool | 19.0% |

|

USDC USDC USDT USDT |

Pool | 18.1% |

|

scrvUSD scrvUSD USDC USDC |

Pool | 16.5% |

|

AZND AZND AUSD AUSD |

Pool | 16.4% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 16.0% |

|

AUSD AUSD USDC USDC USDT0 USDT0 |

Pool | 15.8% |

|

USD3 USD3 sUSDS sUSDS |

Pool | 15.0% |

|

USDFI USDFI frxUSD frxUSD |

Pool | 14.6% |

Top BTC & ETH Yields

The hemiBTC pool below is a new pool, currently with over 300% APR in CRV, however it currently only has a small TVL of $38k, which is why it wasn't highlighted in the title image. Get in fast for the yields!

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | >100% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 13.7% |

|

LBTC LBTC WBTC WBTC |

BTC | 10.8% |

|

tETH tETH wstETH wstETH |

ETH | 9.0% |

|

tETH tETH weETH weETH |

ETH | 7.7% |

|

ETH+ ETH+ WETH WETH |

ETH | 7.6% |

Other Top Yields

With the launch of Frankencoin's new crvUSD/ZCHF pool, we've added some Forex pool yields below.

Note that the ZCHF pool is the new FXSwap pool type, specifically built for efficiency for low-volatility swaps like forex. Its design ensures great prices for traders and maximizes LP profitability automatically. As a Liquidity Provider, you can sit back and relax, earning passive yields with full-range liquidity.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 40.6% |

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 28.5% |

|

CRV CRV sdCRV sdCRV |

CRV | 17.0% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 13.3% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 9.0% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 7.0% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.6% |

|

EURA EURA EURC EURC |

EUR | 2.7% |

Weekly Metrics

crvUSD & scrvUSD

Despite recent market volatility, Curve's peg stability mechanisms for crvUSD have performed exceptionally well.

The recent parameter changes to crvUSD markets are expected to deliver more stable borrowing rates, with further improvements currently being researched.

It is no surprise that the strong performance and current low borrowing rates have driven the crvUSD minted supply to grow by over 12% this week.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$61.7M | +12.6% |

scrvUSD Yield scrvUSD Yield |

7.3% | -0.2% |

crvUSD in crvUSD in scrvUSD scrvUSD |

69.1% | -6.7% |

crvUSD Price crvUSD Price |

$1.0001 | +$0.0003 |

Avg. Borrow Rate Avg. Borrow Rate |

0.2% | -0.1% |

Peg Stability Reserves Peg Stability Reserves |

$93.8M | +$47.6M |

PegKeeper Profit PegKeeper Profit |

$3.99k | +$3.53k |

Llamalend

Llamalend metrics are mostly positive this week. Supplied crvUSD has decreased slightly, as borrowers move to mint from the cheaper minting markets.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $214M | +6.8% |

| 🦙 Supplied | $83.6M | -4.5% |

| 🦙 Borrowed | $133M | +3.8% |

| 🦙 Collateral | $201M | +8.4% |

| 🦙 Loans | 1169 | -7 |

DEX

DEX pool metrics are a mixed bag, on one hand TVL has increased over 7%, however it was a slower than usual week for swaps, volume and fees.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.51B | +7.3% |

| 🔄 Volume | $1.91B | -35.6% |

| 🔄 Swaps | 402k | -27.0% |

| 🔄 Total Fees | $240k | -46.4% |

DAO

Due to the crvUSD rates being so low, and DEX volumes being lower than usual, veCRV holders saw a lower than usual distribution this week. However, the value of CRV emissions increased due to a slight increase in CRV price.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.43B | +0.2% |

CRV Locked CRV Locked |

861M | - |

Total veCRV Total veCRV |

793M | -0.3% |

veCRV Distribution veCRV Distribution |

$97.7k | -62.5% |

CRV Emissions CRV Emissions |

$917k (2.22M CRV) | +3.3% |

Inflation Rate Inflation Rate |

4.965% | -0.004% |

Top Stableswap Pools

weETH and fxUSD made appearances in the list this week, but otherwise it was all the usual suspects here, with USDS pools once again topping the volumes.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

PYUSD PYUSD USDS USDS |

$300.9M | $3.2k |

| 2 | -1 |  |

sUSDS sUSDS USDT USDT |

$300.2M | $4.5k |

| 3 | +5 |  |

USDC USDC USDT USDT |

$149.5M | $1.7k |

| 4 | - |  |

DAI DAI USDC USDC USDT USDT |

$118.9M | $17.8k |

| 5 | +1 |  |

ETH ETH stETH stETH |

$110.0M | $11.0k |

| 6 | +3 |  |

USDC USDC crvUSD crvUSD |

$105.7M | $10.6k |

| 7 | -4 |  |

USDT USDT crvUSD crvUSD |

$86.6M | $8.7k |

| 8 | +4 |  |

ETH ETH stETH stETH |

$51.4M | $4.1k |

| 9 | +5 |  |

USDC USDC fxUSD fxUSD |

$44.8M | $5.4k |

| 10 | +5 |  |

WETH WETH weETH weETH |

$28.4M | $2.1k |

Top Cryptoswap Pools

Just a small reshuffle between the top Cryptoswap pools this week.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$20.4M | $13.1k |

| 2 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$14.5M | $9.8k |

| 3 | +1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$13.7M | $7.6k |

| 4 | -2 |  |

USDT USDT WBTC WBTC WETH WETH |

$5.5M | $17.9k |

| 5 | +1 |  |

crvUSD crvUSD YB YB |

$1.8M | $7.0k |

| 6 | +2 |  |

WETH WETH CVX CVX |

$1.8M | $5.8k |

DEX Winners & Losers

Fees Winners & Losers

With the unfortunate hack on yETH due to it's custom Stableswap pool logic, the pool saw high usage. However, luckily, because this was a custom pool with unique logic, no other Stableswap pools are at risk.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

stETH stETH frxETH frxETH |

$19.1M | $7.63k | +$6.91k |

| 2 |  |

WETH WETH yETH yETH |

$5.74M | $1.81k | +$1.7k |

| 3 |  |

USDC USDC fxUSD fxUSD |

$44.8M | $5.42k | +$1.67k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC RLUSD RLUSD |

$20.8M | $4.19k | -$25.7k |

| -2 |  |

cUSDO cUSDO USDC USDC |

$12.6M | $3.63k | -$28k |

| -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$5.55M | $17.9k | -$37.7k |

Volume Winners & Losers

Curve's strategic USD reserves pool saw high volumes this week, and frxETH to stETH liquidity was also in high demand.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDT USDT |

$149M | $1.75k | +$45.7M |

| 2 |  |

stETH stETH frxETH frxETH |

$19.1M | $7.63k | +$17.3M |

| 3 |  |

USDC USDC fxUSD fxUSD |

$44.8M | $5.42k | +$8.61M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

cUSDO cUSDO USDC USDC |

$12.6M | $3.63k | -$99.7M |

| -2 |  |

USDC USDC RLUSD RLUSD |

$20.8M | $4.19k | -$121M |

| -1 |  |

sUSDS sUSDS USDT USDT |

$300M | $4.48k | -$360M |

TVL Winners & Losers

Flows in and out of PegKeeper pools mean they showed up at the top and bottom of this list. With the stETH pool also having significant increases in TVL due to the ETH price once again increasing.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDC USDC crvUSD crvUSD |

$114M | +$79.8M |

| 2 |  |

ETH ETH stETH stETH |

$143M | +$8.32M |

| 3 |  |

frxUSD frxUSD crvUSD crvUSD |

$32.5M | +$6.24M |

| ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC DUSD DUSD |

$19.5M | -$2.18M |

| -2 |  |

USDG USDG USDL USDL |

$3M | -$3M |

| -1 |  |

USDT USDT crvUSD crvUSD |

$40.8M | -$29.6M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

After significant falls in the ETH price, leading to closed loans, borrowers have started appearing and taking advantage of the near 0% interest rates available.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$33.3M | $16.9M | +$7.05M |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$7.4M | $3.36M | +$385k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$5.99M | $3.76M | +$153k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD LBTC LBTC |

$377k | $240k | -$265 |

| -2 |  |

crvUSD crvUSD cbBTC cbBTC |

$2.07M | $1.3M | -$17.4k |

| -1 |  |

crvUSD crvUSD tBTC tBTC |

$12.2M | $7.49M | -$737k |

Lend Markets - Borrowing Winners & Losers

Both sreUSD and sDOLA markets continue to show strength week on week from borrowers, even as some other stablecoin markets see outflows.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$20M | $18.1M | +$1.03M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$25.6M | $20.8M | +$443k |

| 3 |  |

crvUSD crvUSD asdCRV asdCRV |

$156k | $93.9k | +$30.5k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$9.95M | $9.22M | -$189k |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$4.27M | $3.79M | -$520k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$10.2M | $9.05M | -$2.28M |

Lend Markets - Supplying Winners & Losers

The sDOLA market also saw a significant increase to it's loaned crvUSD supply.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$25.6M | $20.8M | +$1.03M |

| 2 |  |

crvUSD crvUSD asdCRV asdCRV |

$156k | $93.9k | +$38.5k |

| 3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$341k | $219k | +$22.4k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sreUSD sreUSD |

$20M | $18.1M | -$474k |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$4.27M | $3.79M | -$875k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$10.2M | $9.05M | -$2.35M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.