Curve Best Yields & Key Metrics | Week 48, 2025

Weekly yield and Curve ecosystem metric updates as of the 28th November, 2025

Market Overview

Markets have stabilized, and Curve has seen a positive week, here's the news:

- TVL has increased to $2.369B, up 0.5% week over week

- Curve is live on Monad, with some great yields available, some shown below

- 650k crvUSD has been minted to fund the FastBridge, which will help users bypass the 7 day delays on L2 native bridges

- Read the deep dive into Llamalend's Liquidation Protection and how it could help protect you and your loans

Read on for all the highlighted yields and weekly metrics.

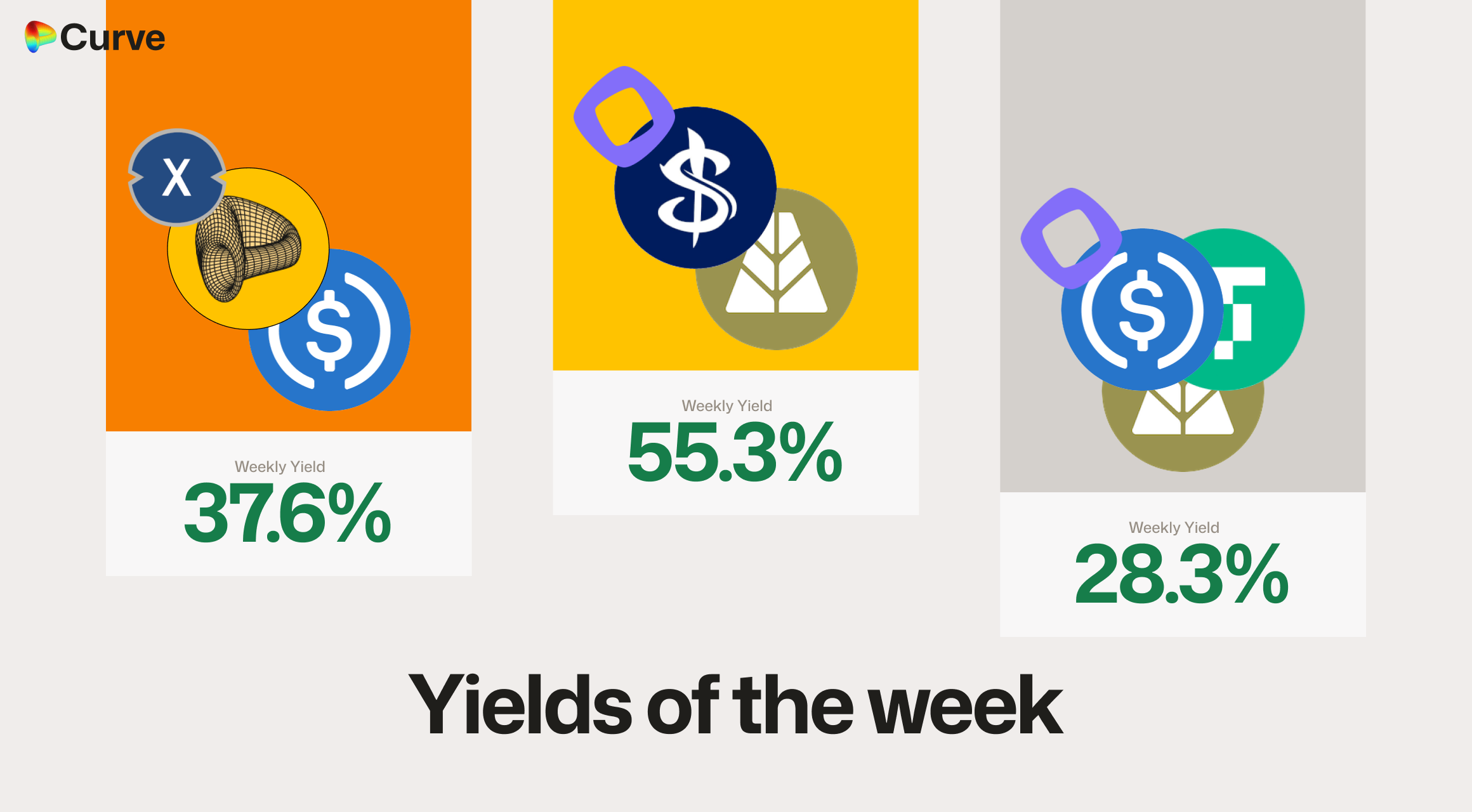

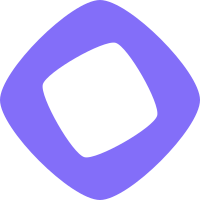

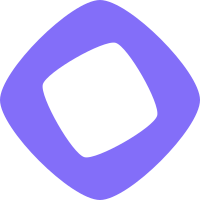

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Yields

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD |

$41.6M | 7.5% |

|

frxUSD frxUSD crvUSD crvUSD |

$24.1M | 7.5% |

|

USDC USDC crvUSD crvUSD |

$34.4M | 6.7% |

|

USDT USDT crvUSD crvUSD |

$70.3M | 6.6% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

AZND AZND AUSD AUSD |

Pool | 55.3% |

|

scrvUSD scrvUSD USDC USDC |

Pool | 37.6% |

|

AUSD AUSD USDC USDC USDT0 USDT0 |

Pool | 28.3% |

|

USDC USDC USDT USDT |

Pool | 25.4% |

|

USDFI USDFI frxUSD frxUSD |

Pool | 21.0% |

|

USDp USDp frxUSD frxUSD |

Pool | 19.5% |

|

alUSD alUSD USDC USDC |

Pool | 18.1% |

|

crvUSD crvUSD WETH WETH |

Llamalend | 16.3% |

|

ynUSDx ynUSDx USDC USDC |

Pool | 14.9% |

|

axlUSDT axlUSDT USDt USDt |

Pool | 14.9% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

scETH scETH frxETH frxETH |

ETH | 18.6% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 13.1% |

|

LBTC LBTC WBTC WBTC |

BTC | 12.0% |

|

ETH+ ETH+ WETH WETH |

ETH | 10.2% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.0% |

|

WBTC WBTC DBIT DBIT |

BTC | 1.6% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 36.4% |

|

CRV CRV sdCRV sdCRV |

CRV | 16.1% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 8.6% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.3% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 2.8% |

|

EURA EURA EURC EURC |

EUR | 2.5% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.2% |

Weekly Metrics

crvUSD & scrvUSD

Unfortunately some large loans were closed this week, which has meant the crvUSD supply has contracted. However, this creates a great opportunity for new borrowers with the low rates available.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$54.8M | -32.5% |

scrvUSD Yield scrvUSD Yield |

7.5% | -2.8% |

crvUSD in crvUSD in scrvUSD scrvUSD |

75.9% | +30.3% |

crvUSD Price crvUSD Price |

$0.9998 | - |

Avg. Borrow Rate Avg. Borrow Rate |

0.4% | -11.5% |

Peg Stability Reserves Peg Stability Reserves |

$46.2M | +$46.2M |

PegKeeper Profit PegKeeper Profit |

$457 | -$1.83k |

Llamalend

Llamalend metrics have decreased, mostly due to the decrease in crvUSD supply.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $201M | -13.4% |

| 🦙 Supplied | $88M | -5.8% |

| 🦙 Borrowed | $128M | -18.4% |

| 🦙 Collateral | $186M | -13.1% |

| 🦙 Loans | 1176 | -26 |

DEX

DEX pools have seen a mostly positive week, with TVL and volume both increasing.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.34B | +2.5% |

| 🔄 Volume | $2.96B | +21.5% |

| 🔄 Swaps | 551k | -3.8% |

| 🔄 Fees Paid | $447k | -5.6% |

DAO

The DAO has seen another great week in terms of veCRV APR and distributions, with the fee APR alone closing in on the inflation rate. If voting incentives are included, CRV APR is around 13.5%.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.43B | +0.2% |

CRV Locked CRV Locked |

862M | - |

Total veCRV Total veCRV |

796M | +0.6% |

veCRV Distribution veCRV Distribution |

$261k (4.3% APR) | +7.1% |

CRV Emissions CRV Emissions |

$888k (2.22M CRV) | -8.1% |

Inflation Rate Inflation Rate |

4.969% | -0.005% |

Top Stableswap Pools

USDS pools once again moved to the top of the list this week, after a brief hiatus last week.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +6 |  |

sUSDS sUSDS USDT USDT |

$660.2M | $12.0k |

| 2 | +6 |  |

PYUSD PYUSD USDS USDS |

$335.0M | $3.8k |

| 3 | -1 |  |

USDT USDT crvUSD crvUSD |

$167.1M | $16.7k |

| 4 | -3 |  |

DAI DAI USDC USDC USDT USDT |

$148.8M | $22.3k |

| 5 | -2 |  |

USDC USDC RLUSD RLUSD |

$141.6M | $29.9k |

| 6 | - |  |

ETH ETH stETH stETH |

$128.6M | $12.9k |

| 7 | +12 |  |

cUSDO cUSDO USDC USDC |

$112.3M | $31.7k |

| 8 | +3 |  |

USDC USDC USDT USDT |

$103.8M | $1.3k |

| 9 | -5 |  |

USDC USDC crvUSD crvUSD |

$101.5M | $10.1k |

| 10 | +10 |  |

USDai USDai USDC USDC |

$76.7M | $7.9k |

Top Cryptoswap Pools

The YB pool entered the top 6 pools for Cryptoswap this week in terms of volume, and Tricrypto pools dominated otherwise.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$60.9M | $33.5k |

| 2 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$34.6M | $55.6k |

| 3 | -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$30.7M | $17.6k |

| 4 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$18.1M | $13.0k |

| 5 | +1 |  |

crvUSD crvUSD tBTC tBTC wstETH wstETH |

$3.2M | $7.8k |

| 6 | +2 |  |

crvUSD crvUSD YB YB |

$2.5M | $8.4k |

DEX Winners & Losers

Fees Winners & Losers

cUSDO saw an absolutely huge 689% increase in fees this week, topping the winners. The 3pool was the biggest loser this week, which is not surprising given its liquidity is most in demand during high volatility weeks.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

cUSDO cUSDO USDC USDC |

$112M | $31.7k | +$27.1k |

| 2 |  |

sUSDS sUSDS USDT USDT |

$660M | $12k | +$9.73k |

| 3 |  |

USDai USDai USDC USDC |

$76.7M | $7.86k | +$5.62k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

WETH WETH weETH weETH |

$33.8M | $3.21k | -$5.87k |

| -2 |  |

USDC USDC RLUSD RLUSD |

$142M | $29.9k | -$9.96k |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$149M | $22.3k | -$15.9k |

Volume Winners & Losers

After a week of low volume last week, the USDS pools won the week with massive increases in volume.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$660M | $12k | +$535M |

| 2 |  |

PYUSD PYUSD USDS USDS |

$335M | $3.76k | +$213M |

| 3 |  |

cUSDO cUSDO USDC USDC |

$112M | $31.7k | +$94.4M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC fxUSD fxUSD |

$36.2M | $3.75k | -$50.6M |

| -2 |  |

WETH WETH weETH weETH |

$33.8M | $3.21k | -$93.5M |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$149M | $22.3k | -$106M |

TVL Winners & Losers

Due to some big crvUSD loans being closed this week, the PegKeepers have deployed significant reserves, increasing the TVL of their respective pools.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDT USDT crvUSD crvUSD |

$70.3M | +$42.7M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$76.4M | +$10.9M |

| 3 |  |

USDC USDC crvUSD crvUSD |

$34.4M | +$6.18M |

| ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$134M | -$3.11M |

| -2 |  |

USDC USDC DUSD DUSD |

$21.7M | -$3.64M |

| -1 |  |

sUSDai sUSDai USDC USDC |

$5.92M | -$3.77M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

A few big loans were unfortunately closed this week, but this has created a great opportunity for new borrowers with borrowing rates less than 1% at the time of writing.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD LBTC LBTC |

$367k | $241k | - |

| 2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$473k | $150k | +$286 |

| 3 |  |

crvUSD crvUSD weETH weETH |

$242k | $136k | -$3.84k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WBTC WBTC |

$50.5M | $28.3M | -$488k |

| -2 |  |

crvUSD crvUSD tBTC tBTC |

$12.6M | $8.23M | -$862k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$23M | $9.81M | -$24.4M |

Lend Markets - Borrowing Winners & Losers

Compared to the minting markets, the lending markets have held up better, which is a positive sign.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$24.6M | $20.4M | +$82.1k |

| 2 |  |

crvUSD crvUSD CRV CRV |

$3.89M | $3.26M | +$72.6k |

| 3 |  |

crvUSD crvUSD asdCRV asdCRV |

$117k | $63.4k | +$32.9k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$998k | $676k | -$228k |

| -2 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.5M | $17.1M | -$798k |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$3.19M | $2.69M | -$1.29M |

Lend Markets - Supplying Winners & Losers

There were some outflows as borrowing reduced and loans were closed.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD asdCRV asdCRV |

$117k | $63.4k | +$57.5k |

| 2 |  |

crvUSD crvUSD IBTC IBTC |

$65.7k | $61.4k | +$4.87k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$898k | $618k | +$2.8k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.5M | $17.1M | -$634k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$12.6M | $11.3M | -$1M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$3.19M | $2.69M | -$1.51M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.