Curve Best Yields & Key Metrics | Week 47, 2025

Weekly yield and Curve ecosystem metric updates as of the 21st November, 2025

Market Overview

There's no easy to way to say it, it was a very rough week for crypto markets. However, Curve has fared quite well, with TVL only down 6.9% to $2.362B.

The Curve ecosystem continues to move forward. Resupply's increased crvUSD credit line proposal was successful and it is now in use within the sreUSD lending market. Furthermore, a vote for a further increase to YieldBasis's crvUSD credit line is will begin soon.

As always, there are great yields available. Check out the highlighted yields and all the weekly metrics below.

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Yields

The scrvUSD yield was higher than any of the PegKeeper pools this week, which is why it has been added to this list and highlighted below.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD |

$36.9M | 10.4% |

|

USDT USDT crvUSD crvUSD |

$27.6M | 6.0% |

|

frxUSD frxUSD crvUSD crvUSD |

$23.6M | 5.9% |

|

USDC USDC crvUSD crvUSD |

$28.2M | 5.4% |

|

PYUSD PYUSD crvUSD crvUSD |

$2.82M | 3.2% |

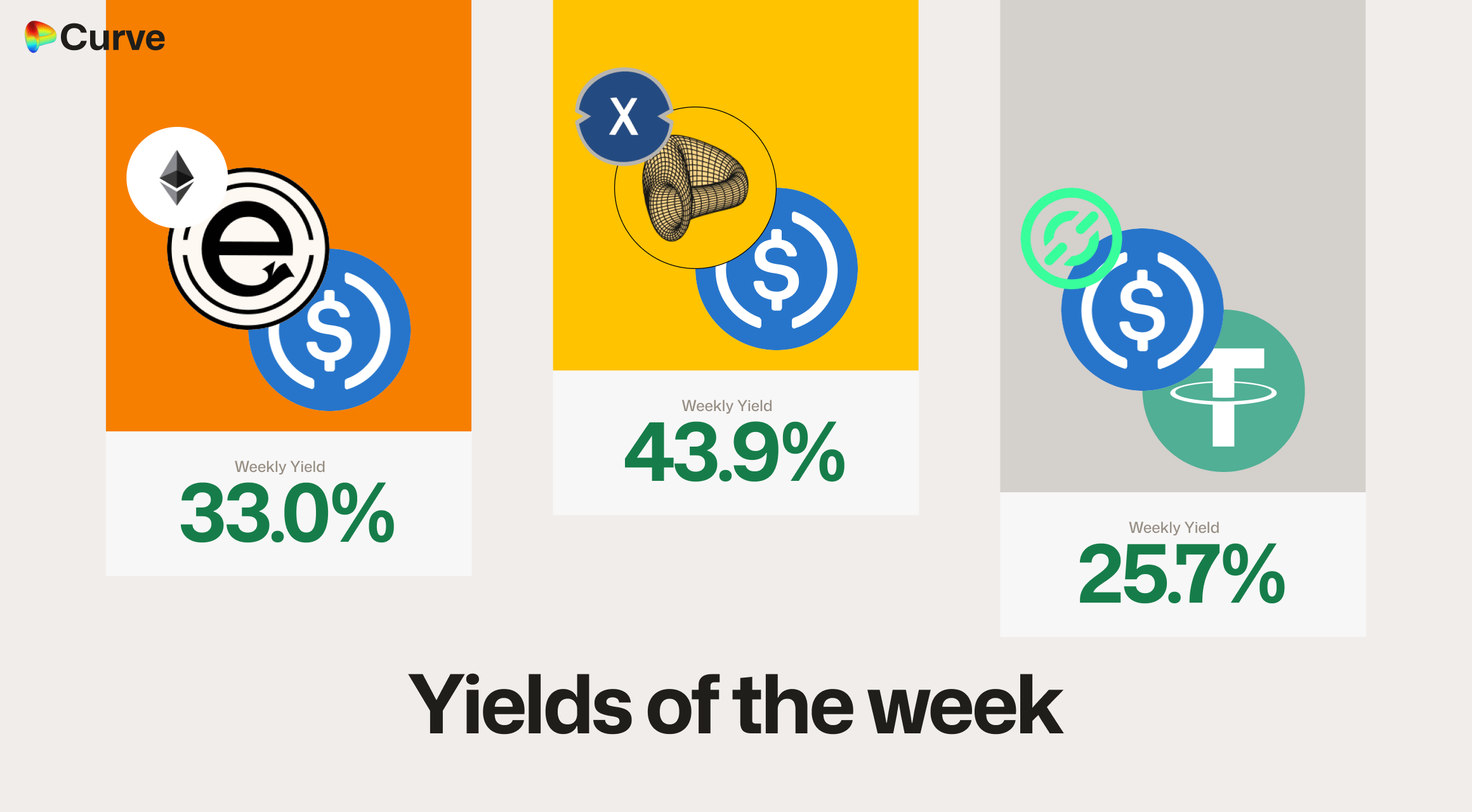

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD USDC USDC |

Pool | 43.9% |

|

ebUSD ebUSD USDC USDC |

Pool | 33.0% |

|

USDC USDC USDT USDT |

Pool | 25.7% |

|

USDp USDp frxUSD frxUSD |

Pool | 20.2% |

|

alUSD alUSD USDC USDC |

Pool | 19.4% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 19.3% |

|

USDFI USDFI frxUSD frxUSD |

Pool | 16.9% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 15.8% |

|

USDT0 USDT0 USDe USDe |

Pool | 15.0% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

scETH scETH frxETH frxETH |

ETH | 31.3% |

|

LBTC LBTC WBTC WBTC |

BTC | 13.4% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 13.1% |

|

msETH msETH WETH WETH |

ETH | 8.3% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 2.6% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 1.7% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 36.8% |

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 15.2% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 9.7% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 7.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 2.7% |

|

EURA EURA EURC EURC |

EUR | 2.0% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.3% |

Weekly Metrics

crvUSD & scrvUSD

When ETH and BTC experience sharp declines, users typically close their loans, leading to a decrease in borrowing. This dynamic explains the decrease in crvUSD minted this week.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$81.1M | -14.4% |

scrvUSD Yield scrvUSD Yield |

10.4% | +2.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

45.5% | +8.2% |

crvUSD Price crvUSD Price |

$0.9994 | -$0.0005 |

Avg. Borrow Rate Avg. Borrow Rate |

11.9% | +9.3% |

Peg Stability Reserves Peg Stability Reserves |

$22.2k | -$28.9M |

PegKeeper Profit PegKeeper Profit |

$2.29k | +$1.16k |

Llamalend

Llamalend has seen a significant increase with the amount supplied, mostly due increases in the sDOLA and sreUSD markets.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $233M | -3.3% |

| 🦙 Supplied | $93.4M | +19.5% |

| 🦙 Borrowed | $157M | -3.5% |

| 🦙 Collateral | $215M | -6.6% |

| 🦙 Loans | 1202 | -81 |

DEX

DEX pool's were a mixed bag. TVL and volumes were down, but number of swaps and total fees paid by swappers increased.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.29B | -6.9% |

| 🔄 Volume | $2.44B | -11.8% |

| 🔄 Swaps | 573k | +8.9% |

| 🔄 Fees Paid | $474k | +13.5% |

DAO

veCRV holders still saw a substantial distribution this week of over $244k, even though it was down on last week's huge figure. The value of CRV emissions decreased due to CRV price declining.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.43B | +0.2% |

CRV Locked CRV Locked |

862M | -0.1% |

Total veCRV Total veCRV |

791M | - |

veCRV Distribution veCRV Distribution |

$244k | -23.1% |

CRV Emissions CRV Emissions |

$966k (2.22M CRV) | -7.5% |

Inflation Rate Inflation Rate |

4.974% | -0.005% |

Top Stableswap Pools

In high volatility weeks the 3pool normally tops the list, and this week is no different. crvUSD pools were also in very high demand.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +4 |  |

DAI DAI USDC USDC USDT USDT |

$254.9M | $38.2k |

| 2 | +5 |  |

USDT USDT crvUSD crvUSD |

$199.9M | $20.0k |

| 3 | - |  |

USDC USDC RLUSD RLUSD |

$175.0M | $39.8k |

| 4 | +4 |  |

USDC USDC crvUSD crvUSD |

$130.9M | $13.1k |

| 5 | +8 |  |

WETH WETH weETH weETH |

$127.4M | $9.1k |

| 6 | - |  |

ETH ETH stETH stETH |

$127.2M | $12.7k |

| 7 | -6 |  |

sUSDS sUSDS USDT USDT |

$125.5M | $2.3k |

| 8 | -6 |  |

PYUSD PYUSD USDS USDS |

$121.7M | $1.3k |

| 9 | - |  |

USDC USDC fxUSD fxUSD |

$86.8M | $9.4k |

| 10 | - |  |

ETH ETH stETH stETH |

$85.3M | $6.8k |

Top Cryptoswap Pools

Tricrypto pools made up the entire top 6 Cryptoswap pools by volume this week, underscoring the high demand for liquidity between ETH, BTC, and USD stablecoins.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$55.4M | $30.8k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$34.0M | $20.0k |

| 3 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$29.5M | $55.0k |

| 4 | -1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$20.2M | $13.3k |

| 5 | +2 |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$3.0M | $2.4k |

| 6 | +5 |  |

crvUSD crvUSD tBTC tBTC wstETH wstETH |

$2.7M | $7.9k |

DEX Winners & Losers

Fees Winners & Losers

Tricrypto fees are inherently volatile, fluctuating with asset volatility. This week, high volatility brought high demand for liquidity, and this translated directly into strong fees for LPs in these pools.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDT USDT WBTC WBTC WETH WETH |

$29.5M | $55k | +$25.7k |

| 2 |  |

USDC USDC WBTC WBTC WETH WETH |

$55.4M | $30.8k | +$14.4k |

| 3 |  |

DAI DAI USDC USDC USDT USDT |

$255M | $38.2k | +$12k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC RLUSD RLUSD |

$175M | $39.8k | -$8.91k |

| -2 |  |

STG STG USDC USDC |

$862k | $2.8k | -$9.07k |

| -1 |  |

USDC USDC USDf USDf |

$2.8M | $1.03k | -$13.3k |

Volume Winners & Losers

The crvUSD/USDT pool was the largest winner for the week, doubling its volume as users demanded the deep BTC liquidity that YieldBasis pools provide.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDT USDT crvUSD crvUSD |

$200M | $20k | +$106M |

| 2 |  |

WETH WETH weETH weETH |

$127M | $9.08k | +$94.6M |

| 3 |  |

DAI DAI USDC USDC USDT USDT |

$255M | $38.2k | +$79.9M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

PYUSD PYUSD USDS USDS |

$122M | $1.31k | -$102M |

| -2 |  |

USDC USDC USDT USDT |

$67M | $1.16k | -$145M |

| -1 |  |

sUSDS sUSDS USDT USDT |

$125M | $2.29k | -$610M |

TVL Winners & Losers

ETH stablecoin pools experienced a Total Value Locked (TVL) decline as ETH lost approximately 20% over the week. Following this, crvUSD pools saw outflows as PegKeepers withdrew their supplied liquidity. Despite these factors, some strong inflows were still recorded this week, led by the USDai pool on Arbitrum.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDai USDai USDC USDC |

$13.3M | +$11.9M |

| 2 |  |

DOLA DOLA wstUSR wstUSR |

$46.4M | +$11.6M |

| 3 |  |

USDC USDC RLUSD RLUSD |

$65.4M | +$3.44M |

| ... | ... | ... | ... | ... |

| -3 |  |

OETH OETH WETH WETH |

$74.6M | -$14.8M |

| -2 |  |

ETH ETH stETH stETH |

$138M | -$23.5M |

| -1 |  |

USDT USDT crvUSD crvUSD |

$27.6M | -$27.9M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Both the tBTC and weETH markets recorded a net increase in borrowing this week. Given the tumultuous nature of the previous week, any increase across any market is a significant accomplishment.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD tBTC tBTC |

$14.5M | $9.09M | +$677k |

| 2 |  |

crvUSD crvUSD weETH weETH |

$270k | $140k | +$2.44k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$471k | $150k | +$83.3 |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD cbBTC cbBTC |

$2.29M | $1.52M | -$1.27M |

| -2 |  |

crvUSD crvUSD WETH WETH |

$47.9M | $34.2M | -$4.57M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$49.1M | $28.8M | -$7.63M |

Lend Markets - Borrowing Winners & Losers

Borrowers have appeared to slurp up the new liquidity from the sreUSD market with their additional $8.35M of supplied crvUSD capital. Also, the sDOLA market also saw a noticeable increase in borrowing. Fortunately, no significant outflows were observed in any market.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$21.1M | $17.9M | +$6.58M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$25M | $20.3M | +$2.73M |

| 3 |  |

crvUSD crvUSD USDe USDe |

$217k | $121k | +$100k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$5.79M | $4.41M | -$271k |

| -2 |  |

crvUSD crvUSD WBTC WBTC |

$1.21M | $664k | -$293k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$1.24M | $904k | -$400k |

Lend Markets - Supplying Winners & Losers

Following the successful vote and execution of Resupply's extra 10M crvUSD credit line, the majority of this new capital has been deployed to the sreUSD market. The sDOLA market also saw significant organic growth. Importantly, there were no significant outflows from any market this week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$21.1M | $17.9M | +$8.35M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$25M | $20.3M | +$6.32M |

| 3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$13.6M | $11.3M | +$1.45M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD wstETH wstETH |

$1.04M | $833k | -$125k |

| -2 |  |

crvUSD crvUSD WBTC WBTC |

$1.21M | $664k | -$198k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$1.24M | $904k | -$337k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.