Curve Best Yields & Key Metrics | Week 46, 2025

Weekly yield and Curve ecosystem metric updates as of the 13th November, 2025

Market Overview

Markets have stabilized this week, and TVL has started to increase once again. Curve currently has a TVL of $2.532B, up 1.4% from last week.

There's never been a better time to set and forget your yields within a crvUSD pool, or stay extra comfy and simply stake crvUSD into scrvUSD.

As always Curve has some of the best yields available in DeFi, and this week is no different. Check out the top highlighted yields and all the weekly metrics below.

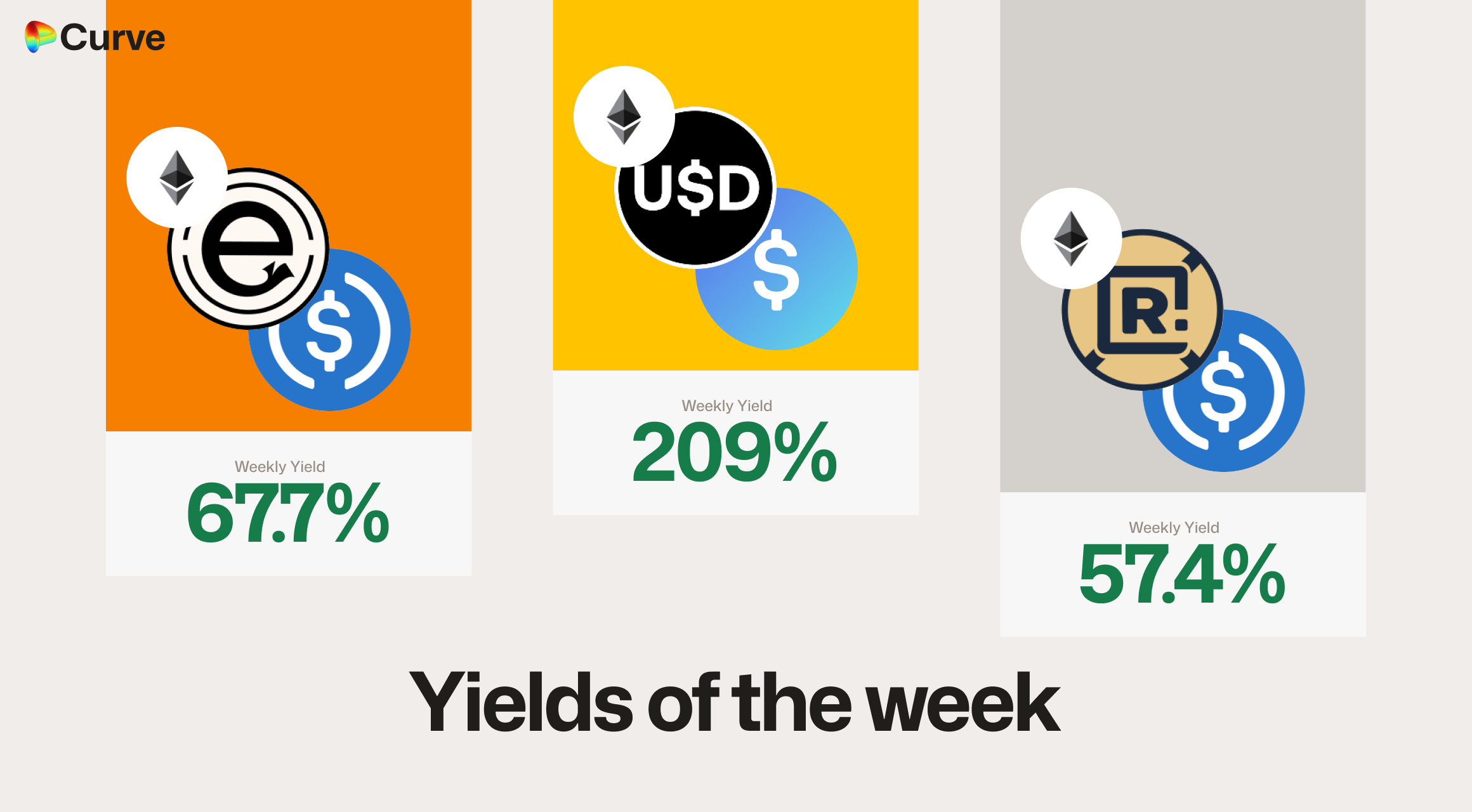

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

These pools offer some great yields for even the biggest LPs, paired with some of the safest USD stablecoins available. The risk/reward is hard to beat.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

frxUSD frxUSD crvUSD crvUSD |

$25.6M | 5.7% |

|

USDT USDT crvUSD crvUSD |

$55.5M | 4.9% |

|

USDC USDC crvUSD crvUSD |

$32.5M | 4.7% |

|

PYUSD PYUSD crvUSD crvUSD |

$6.53M | 2.2% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

frxUSD frxUSD msUSD msUSD |

Pool | 209.5% |

|

ebUSD ebUSD USDC USDC |

Pool | 67.7% |

|

ynRWAx ynRWAx USDC USDC |

Pool | 57.4% |

|

scrvUSD scrvUSD USDC USDC |

Pool | 46.1% |

|

USDC USDC USDT USDT |

Pool | 32.5% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 27.1% |

|

USDT0 USDT0 USDe USDe |

Pool | 23.3% |

|

USDp USDp frxUSD frxUSD |

Pool | 20.7% |

|

USDT0 USDT0 sUSDe sUSDe |

Pool | 17.0% |

|

axlUSDT axlUSDT USDt USDt |

Pool | 16.7% |

Top BTC & ETH Yields

There's some great yields available this week for BTC and ETH pools, with CrossCurve's frxETH FRAXTAL pool currently offering 98% yield, but as it only has $24k TVL, we normalize yields at a minimum $100k TVL.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve frxETH FRAXTAL CrossCurve frxETH FRAXTAL |

ETH | 23.9% |

|

LBTC LBTC WBTC WBTC |

BTC | 14.1% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 12.2% |

|

msETH msETH WETH WETH |

ETH | 6.4% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.1% |

|

cbBTC cbBTC tBTC tBTC WBTC WBTC |

BTC | 2.4% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 26.6% |

|

CRV CRV crvUSD crvUSD |

CRV | 14.1% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 7.8% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.1% |

|

EURA EURA EURC EURC |

EUR | 2.1% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.5% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD supply increased 6.4% this week through Curve’s minting markets as borrowing rates moved lower. If BTC and ETH markets remain stable, and as YieldBasis YB incentives continue flowing to crvUSD pools, further growth in crvUSD supply is very likely.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$94.8M | +6.4% |

scrvUSD Yield scrvUSD Yield |

8.3% | +4.5% |

crvUSD in crvUSD in scrvUSD scrvUSD |

37.3% | +3.6% |

crvUSD Price crvUSD Price |

$0.9999 | +$0.0005 |

Avg. Borrow Rate Avg. Borrow Rate |

2.6% | -9.9% |

Peg Stability Reserves Peg Stability Reserves |

$28.9M | +$28.9M |

PegKeeper Profit PegKeeper Profit |

$1.13k | -$4.18k |

Llamalend

Llamalend's TVL has increased this week, while the amount of crvUSD supplied decreased. It is likely that users shifted to the premier crvUSD pools, where the current risk–reward profile is more attractive.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $240M | +2.2% |

| 🦙 Supplied | $78.1M | -8.1% |

| 🦙 Borrowed | $163M | +0.8% |

| 🦙 Collateral | $230M | +3.4% |

| 🦙 Loans | 1283 | -69 |

DEX

DEX pools saw an increase in TVL this week along with higher swap counts, while volume and fees decreased as markets stabilized, which is the expected pattern after volatility eases.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.46B | +1.5% |

| 🔄 Volume | $2.76B | -19.4% |

| 🔄 Swaps | 526k | +5.7% |

| 🔄 Total Fees | $418k | -23.0% |

DAO

The DAO saw a very significant distribution this week, up 62% over last week. All other metrics have remained steady.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.42B | +0.2% |

CRV Locked CRV Locked |

863M | - |

Total veCRV Total veCRV |

791M | -0.4% |

veCRV Distribution veCRV Distribution |

$317k | +62.6% |

CRV Emissions CRV Emissions |

$1.04M (2.22M CRV) | +1.4% |

Inflation Rate Inflation Rate |

4.978% | -0.005% |

Top Stableswap Pools

Sky's USDS pools have once again topped the week in terms of volumes.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

sUSDS sUSDS USDT USDT |

$735.2M | $10.0k |

| 2 | +2 |  |

PYUSD PYUSD USDS USDS |

$224.2M | $2.7k |

| 3 | +2 |  |

USDC USDC RLUSD RLUSD |

$219.7M | $48.7k |

| 4 | -1 |  |

USDC USDC USDT USDT |

$212.3M | $2.5k |

| 5 | -3 |  |

DAI DAI USDC USDC USDT USDT |

$175.0M | $26.2k |

| 6 | +2 |  |

ETH ETH stETH stETH |

$94.6M | $9.5k |

| 7 | -1 |  |

USDT USDT crvUSD crvUSD |

$93.5M | $9.3k |

| 8 | -1 |  |

USDC USDC crvUSD crvUSD |

$67.6M | $6.8k |

| 9 | - |  |

USDC USDC fxUSD fxUSD |

$57.8M | $6.0k |

| 10 | +1 |  |

ETH ETH stETH stETH |

$55.1M | $4.4k |

Top Cryptoswap Pools

As usual the Tricrypto pools topped the week, however it's great to see the STG pool as a new addition to the top Cryptoswap pools by volumes.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$27.8M | $16.4k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$23.3M | $13.2k |

| 3 | +1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$20.8M | $15.1k |

| 4 | -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$16.4M | $29.3k |

| 5 | +4 |  |

STG STG USDC USDC |

$3.6M | $11.9k |

| 6 | - |  |

WETH WETH CVX CVX |

$3.3M | $11.7k |

DEX Winners & Losers

Fees Winners & Losers

In terms of raw fees paid by swappers, USDf saw the largest increase this week. The STG and ALCX Cryptoswap pools followed closely, supported by price increases in their underlying assets.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDf USDf |

$38.9M | $14.4k | +$7.67k |

| 2 |  |

STG STG USDC USDC |

$3.63M | $11.9k | +$5.14k |

| 3 |  |

ALCX ALCX FRAX FRAX USDC USDC |

$2.02M | $8.22k | +$4.49k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDT USDT WBTC WBTC WETH WETH |

$16.4M | $29.3k | -$11.5k |

| -2 |  |

crvUSD crvUSD YB YB |

$2.34M | $9.1k | -$12.1k |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$175M | $26.2k | -$16k |

Volume Winners & Losers

USDf and cbBTC/tBTC both saw a resurgence in volume this week. The 4pool on Base (three types of USDC plus crvUSD) also recorded very strong volumes and high liquidity utilization.

In contrast, the DAI/USDC/USDT pool on Ethereum, which has a higher fee and is designed for larger swaps, typically cools down when volatility is low, which is why it appears as the loser this week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDf USDf |

$38.9M | $14.4k | +$20.7M |

| 2 |  |

tBTC tBTC cbBTC cbBTC |

$20.5M | $2.17k | +$11.2M |

| 3 |  |

USDC USDC USDbC USDbC axlUSDC axlUSDC crvUSD crvUSD |

$13.7M | $137 | +$7.29M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC crvUSD crvUSD |

$67.6M | $6.76k | -$51.1M |

| -2 |  |

sUSDS sUSDS USDT USDT |

$735M | $10k | -$66.3M |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$175M | $26.2k | -$106M |

TVL Winners & Losers

The crvUSD PegKeeper pools naturally experience TVL fluctuations as PegKeepers deposit or withdraw liquidity to help maintain the peg, which explains the larger swings seen in these pools.

We also welcome the NUSD/USDC pool, a new which saw a huge $10M inflow within the last few days.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDT USDT crvUSD crvUSD |

$55.5M | +$30.8M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$62M | +$13.1M |

| 3 |  |

NUSD NUSD USDC USDC |

$10.6M | +$10.6M |

| ... | ... | ... | ... | ... |

| -3 |  |

USD0 USD0 USD0++ USD0++ |

$29.2M | -$6.22M |

| -2 |  |

PYUSD PYUSD crvUSD crvUSD |

$6.53M | -$8.97M |

| -1 |  |

USDC USDC DUSD DUSD |

$27.2M | -$10M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

It was a positive week for crvUSD minting markets, with broad increases across most markets, and only minor declines in a few select markets.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$66.1M | $36.4M | +$3.68M |

| 2 |  |

crvUSD crvUSD cbBTC cbBTC |

$4.95M | $2.79M | +$1.21M |

| 3 |  |

crvUSD crvUSD wstETH wstETH |

$8.66M | $3.92M | +$815k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$548k | $150k | +$127 |

| -2 |  |

crvUSD crvUSD LBTC LBTC |

$365k | $248k | -$82k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$60M | $38.8M | -$171k |

Lend Markets - Borrowing Winners & Losers

crvUSD remains in high demand in the sreUSD market, where borrowers could still loop profitably to boost their yield until recently. Other stablecoin markets saw outflows, as borrowing rates rose above the yields available on those assets.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$12.8M | $11.3M | +$324k |

| 2 |  |

crvUSD crvUSD WETH WETH |

$1.58M | $1.3M | +$122k |

| 3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$10.8M | $9.48M | +$109k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$12.2M | $11.4M | -$271k |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$5.71M | $4.68M | -$1.2M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$18.7M | $17.5M | -$3.12M |

Lend Markets - Supplying Winners & Losers

Nearly all lending markets saw net crvUSD outflows this week. Lenders remain cautious, and the current risk–reward profile in the crvUSD pools is difficult to beat.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sUSDS sUSDS |

$185k | $123k | +$13.7k |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$4.67M | $4.09M | +$11k |

| 3 |  |

crvUSD crvUSD IBTC IBTC |

$60.1k | $60.1k | +$703 |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$12.2M | $11.4M | -$747k |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$5.71M | $4.68M | -$1.19M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$18.7M | $17.5M | -$3.96M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.