Curve Best Yields & Key Metrics | Week 45, 2025

Weekly yield and Curve ecosystem metric updates as of the 6th November, 2025

Market Overview

It was a tough week across DeFi and crypto markets. We were very saddened to see Balancer, a respected peer protocol to Curve, suffer a major exploit. In the aftermath, Curve understandably saw some TVL outflows and now sits at $2.50 B, down 8.7% from last week.

Even so, Curve held up notably better than the broader DeFi market, which declined 13.3% over the same period. Despite the volatility, there are still strong yield opportunities available, you can find all these, along with other highlights and weekly metrics, detailed below.

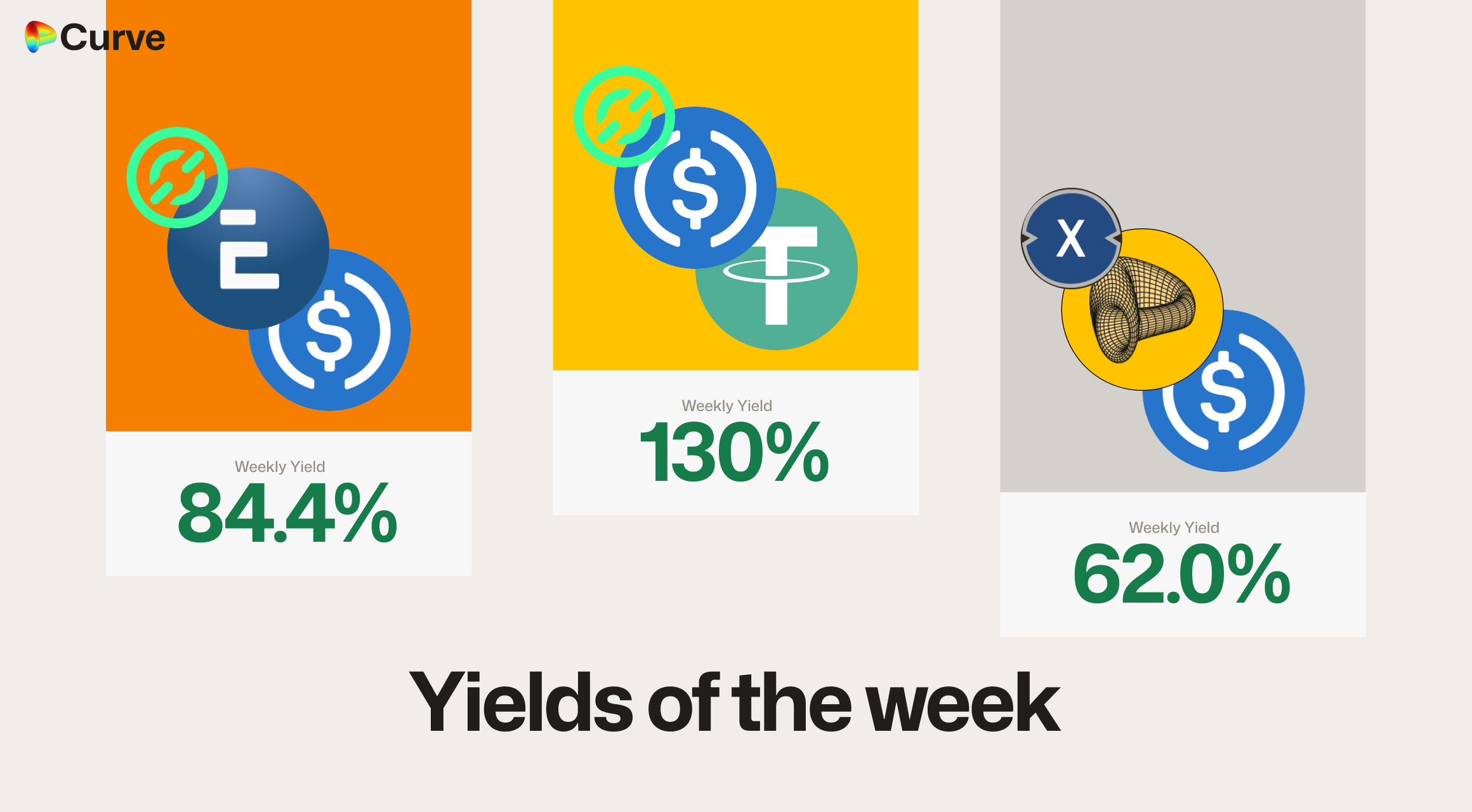

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

frxUSD frxUSD crvUSD crvUSD |

$17M | 8.6% |

|

USDT USDT crvUSD crvUSD |

$24.7M | 6.5% |

|

USDC USDC crvUSD crvUSD |

$26.9M | 6.0% |

Top USD Yields

It’s important to do your own research on the assets listed below. Inclusion here is not an endorsement of safety. Some pools include USD investment fund assets, which can offer very high yields but also carry significant risks, as recent events have highlighted. Always take the time to understand the underlying assets before investing.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDC USDC USDT USDT |

Pool | 130.0% |

|

mMEV mMEV USDC USDC |

Pool | 84.4% |

|

scrvUSD scrvUSD USDC USDC |

Pool | 62.0% |

|

USDp USDp frxUSD frxUSD |

Pool | 23.8% |

|

USDC USDC mRe7YIELD mRe7YIELD |

Pool | 18.0% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 15.8% |

|

mBASIS mBASIS USDC USDC |

Pool | 15.6% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

LBTC LBTC WBTC WBTC |

BTC | 15.7% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 11.1% |

|

tETH tETH weETH weETH |

ETH | 5.7% |

|

tETH tETH wstETH wstETH |

ETH | 5.3% |

|

WBTC WBTC tBTC tBTC |

BTC | 1.2% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 1.1% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 19.3% |

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 11.6% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 7.0% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.7% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.2% |

|

EURA EURA EURC EURC |

EUR | 2.9% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.8% |

Weekly Metrics

crvUSD & scrvUSD

After briefly surpassing $100M in crvUSD minted on Curve, declines in ETH and BTC prices led many users to close loans and reduce supply. This initially pushed borrowing rates lower, but they have since risen again as new demand returns. The scrvUSD yield will adjust upward shortly to help balance demand across the system.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$89.1M | -7.4% |

scrvUSD Yield scrvUSD Yield |

3.8% | -0.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

33.7% | -3.4% |

crvUSD Price crvUSD Price |

$0.9994 | -$0.0004 |

Avg. Borrow Rate Avg. Borrow Rate |

12.5% | +10.1% |

Peg Stability Reserves Peg Stability Reserves |

$22.2k | -$34.9M |

PegKeeper Profit PegKeeper Profit |

$5.3k | -$873 |

Llamalend

The market has been turbulent this week, with many users taking a conservative approach and closing loans in response. Even so, Llamalend held up well and continued to operate smoothly throughout the volatility. As sentiment improves, activity and borrowing demand are expected to strengthen again.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $235M | -16.0% |

| 🦙 Supplied | $85M | -11.5% |

| 🦙 Borrowed | $161M | -9.8% |

| 🦙 Collateral | $222M | -16.5% |

| 🦙 Loans | 1352 | -46 |

DEX

Trading volumes, swaps, and fees all increased this week, which is typical during periods of higher volatility. TVL did decline, largely reflecting the drop in BTC and ETH prices, but overall trading activity across Curve remains strong.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.42B | -8.7% |

| 🔄 Volume | $3.43B | +60.2% |

| 🔄 Swaps | 498k | +25.4% |

| 🔄 Total Fees | $543k | +58.3% |

DAO

veCRV distributions have returned to normal levels following last week’s unusually high payout. CRV emissions are lower this week, reflecting the recent decrease in CRV’s price, which moved in line with most other DeFi tokens across the broader market.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.42B | +0.2% |

CRV Locked CRV Locked |

863M | - |

Total veCRV Total veCRV |

794M | -0.2% |

veCRV Distribution veCRV Distribution |

$195k | -25.2% |

CRV Emissions CRV Emissions |

$1.03M (2.22M CRV) | -14.5% |

Inflation Rate Inflation Rate |

4.983% | -0.005% |

Top Stableswap Pools

The DAO earned $42.2k in fees from the DAI/USDC/USDT pool this week, as it remains the only pool with 100% admin fees. Liquidity utilization was high across many other pools as well, driving strong volumes.

RLUSD was the standout performer for fees, generating nearly 4× its previous week’s revenue.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

sUSDS sUSDS USDT USDT |

$801.6M | $9.9k |

| 2 | +3 |  |

DAI DAI USDC USDC USDT USDT |

$281.4M | $42.2k |

| 3 | - |  |

USDC USDC USDT USDT |

$262.4M | $2.9k |

| 4 | -2 |  |

PYUSD PYUSD USDS USDS |

$251.8M | $2.6k |

| 5 | +1 |  |

USDC USDC RLUSD RLUSD |

$227.8M | $48.1k |

| 6 | +3 |  |

USDT USDT crvUSD crvUSD |

$135.1M | $13.5k |

| 7 | -3 |  |

USDC USDC crvUSD crvUSD |

$118.7M | $11.9k |

| 8 | - |  |

ETH ETH stETH stETH |

$94.7M | $9.5k |

| 9 | +1 |  |

USDC USDC fxUSD fxUSD |

$66.7M | $6.9k |

| 10 | +8 |  |

reUSD reUSD scrvUSD scrvUSD |

$61.2M | $16.0k |

Top Cryptoswap Pools

It’s no surprise to see all the Tricrypto pools among the top performers this week with the volatility, and the USDC pool leading the group. The new-generation USDT/WBTC/WETH pool (TricryptoUSDT) once again generated substantially higher fees than the first-generation Tricrypto2 pool, although, the first-generation pool had slightly higher volumes.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$46.3M | $26.9k |

| 2 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$25.0M | $16.7k |

| 3 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$21.1M | $40.8k |

| 4 | -2 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$20.5M | $17.6k |

| 5 | - |  |

crvUSD crvUSD YB YB |

$6.0M | $21.2k |

| 6 | - |  |

WETH WETH CVX CVX |

$5.1M | $16.2k |

DEX Winners & Losers

Fees Winners & Losers

It’s great to see the winning two pools this week both being stablecoin pools, especially during such a volatile market. Each generated around 4× their usual fees, showing strong stability and sustained trading demand through the market turbulence.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$228M | $48.1k | +$33.5k |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$281M | $42.2k | +$31.2k |

| 3 |  |

USDT USDT WBTC WBTC WETH WETH |

$21.1M | $40.8k | +$20.3k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

WETH WETH ARB ARB |

$169k | $508 | -$2.77k |

| -2 |  |

frxUSD frxUSD sUSDS sUSDS |

$23M | $2.36k | -$3.29k |

| -1 |  |

ARB ARB USDC USDC |

$668k | $2k | -$4.74k |

Volume Winners & Losers

Once again, the sUSDS pool led the week in volume growth. The 3pool (DAI/USDC/USDT) also performed strongly, remaining one of the deepest liquidity pools for single swaps in all of DeFi and consistently seeing high demand during periods of volatility.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$802M | $9.95k | +$256M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$281M | $42.2k | +$208M |

| 3 |  |

USDC USDC RLUSD RLUSD |

$228M | $48.1k | +$156M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

WETH WETH weETH weETH |

$28.6M | $2.21k | -$10.6M |

| -2 |  |

OETH OETH WETH WETH |

$2.98M | $353 | -$11.5M |

| -1 |  |

frxUSD frxUSD sUSDS sUSDS |

$23M | $2.36k | -$32.6M |

TVL Winners & Losers

The crvUSD pools were the main TVL losers this week, though primarily due to PegKeepers withdrawing liquidity rather than a decline in user confidence.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

WBTC WBTC uniBTC uniBTC |

$15.5M | +$9.56M |

| 2 |  |

USDT USDT crvUSD crvUSD |

$24.7M | +$9.2M |

| 3 |  |

DOLA DOLA wstUSR wstUSR |

$29.1M | +$8.79M |

| ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$157M | -$21.6M |

| -2 |  |

USDC USDC crvUSD crvUSD |

$26.9M | -$26.3M |

| -1 |  |

PYUSD PYUSD crvUSD crvUSD |

$15.5M | -$36.3M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

There were no major gainers this week. The only increase in borrowing came from debt accumulation in the older sfrxETH market, while other markets experienced outflows.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$532k | $150k | +$40.4 |

| 2 |  |

crvUSD crvUSD weETH weETH |

$269k | $136k | -$14.6k |

| 3 |  |

crvUSD crvUSD LBTC LBTC |

$494k | $330k | -$20.7k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD wstETH wstETH |

$6.93M | $3.1M | -$1.43M |

| -2 |  |

crvUSD crvUSD WETH WETH |

$58.4M | $38.9M | -$1.9M |

| -1 |  |

crvUSD crvUSD tBTC tBTC |

$15M | $8.38M | -$2.47M |

Lend Markets - Borrowing Winners & Losers

There were a few positive signs this week, with smaller markets showing modest borrowing increases. However, many markets still saw overall outflows, reflecting continued caution among borrowers.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD IBTC IBTC |

$59.4k | $59.4k | +$51.2k |

| 2 |  |

crvUSD crvUSD tBTC tBTC |

$150k | $82.5k | +$49.3k |

| 3 |  |

crvUSD crvUSD asdCRV asdCRV |

$63.2k | $37.8k | +$14.6k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$6.89M | $5.88M | -$1.64M |

| -2 |  |

crvUSD crvUSD sreUSD sreUSD |

$13.1M | $11M | -$1.93M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$22.7M | $20.7M | -$3.55M |

Lend Markets - Supplying Winners & Losers

Some markets recorded small increases in supply, though most lenders continued to reduce exposure and withdraw liquidity in line with the broader risk-off sentiment.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$977k | $606k | +$37k |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$1.45M | $924k | +$26.4k |

| 3 |  |

crvUSD crvUSD WETH WETH |

$951k | $513k | +$17.6k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$12.9M | $11.7M | -$1.56M |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$6.89M | $5.88M | -$1.94M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$22.7M | $20.7M | -$3.63M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.