Curve Best Yields & Key Metrics | Week 44, 2025

Weekly yield and Curve ecosystem metric updates as of the 30th October, 2025

Market Overview

It’s been a productive week for Curve — here’s the news:

- TVL: $2.737 B (-0.7%)

- YB incentives have begun for crvUSD’s leading PegKeeper pools, offering high yields on very safe asset pairs (see below).

- Resupply’s 5M crvUSD mint was approved, deployed, and quickly absorbed by borrowers on the crvUSD/sreUSD lending market.

As always, see below for this week’s top yields, metrics, and winners and losers.

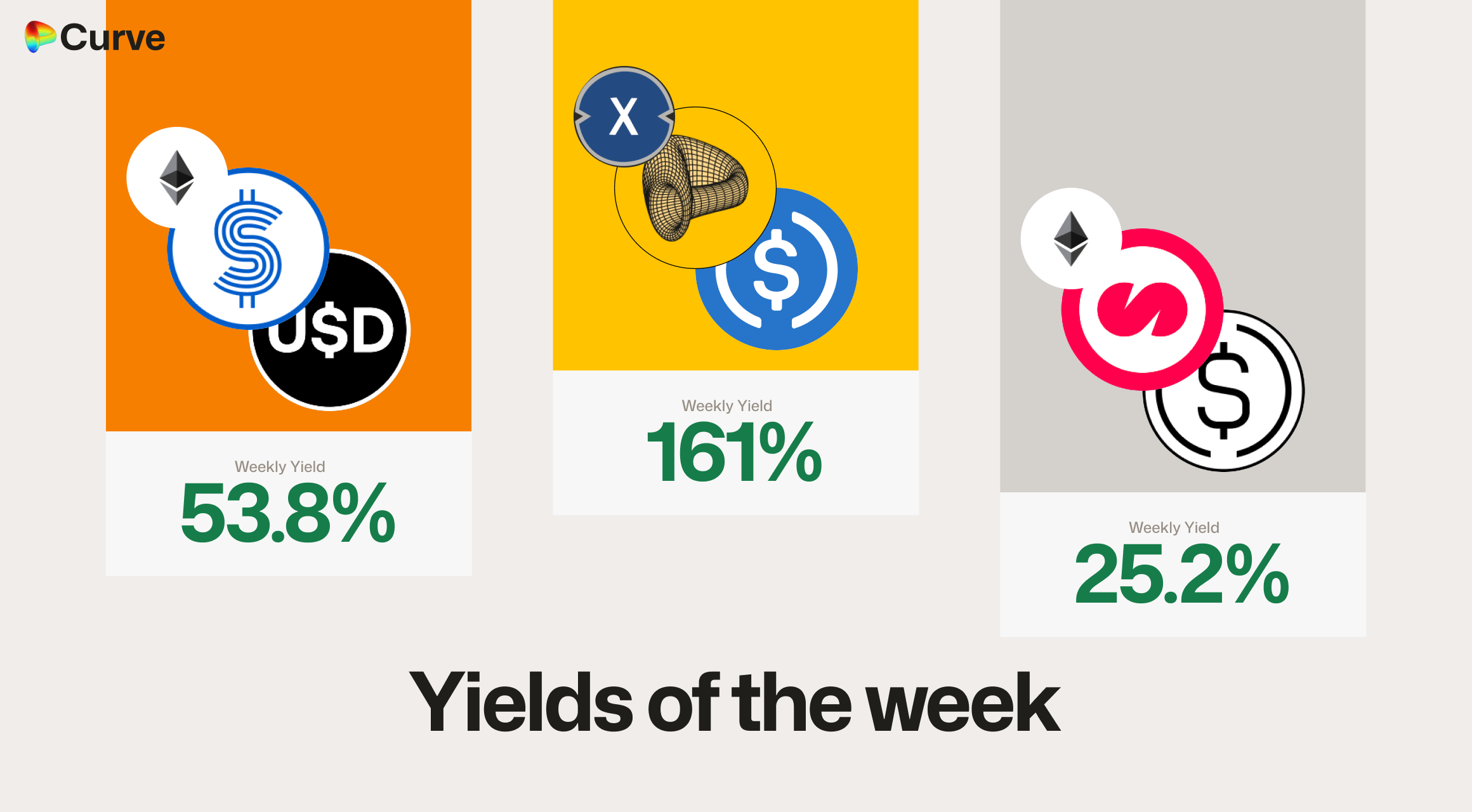

Top Yields

All yields shown below are the unboosted rates offered directly on Curve. However, projects such as Convex, StakeDAO and Yearn all offer additional boosting for these yields.

Premier crvUSD Pools

YB voting incentives started flowing this week, giving all PegKeeper pools strong yields. These are exceptionally high returns for such deep-liquidity pools.

Voting incentives will continue for these markets, making them an excellent option to park funds and earn some of the safest yields in DeFi.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

PYUSD PYUSD crvUSD crvUSD |

$51.8M | 15.4% |

|

frxUSD frxUSD crvUSD crvUSD |

$14.5M | 15.0% |

|

USDT USDT crvUSD crvUSD |

$15.5M | 13.0% |

|

USDC USDC crvUSD crvUSD |

$53.3M | 9.5% |

Other Top USD Yields

*Note that the scrvUSD/USDC pool on XDC is offering a huge 161% yield; however, the daily limit for bridging scrvUSD to XDC has been reached, so additional bridges may be delayed by up to 24hrs.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD USDC USDC |

Pool | 161.1% |

|

USDaf USDaf frxUSD frxUSD |

Pool | 53.8% |

|

MUSD MUSD sUSDe sUSDe |

Pool | 25.2% |

|

mMEV mMEV USDC USDC |

Pool | 24.8% |

|

USDp USDp frxUSD frxUSD |

Pool | 18.8% |

|

mBASIS mBASIS USDC USDC |

Pool | 18.0% |

|

USDC USDC mRe7YIELD mRe7YIELD |

Pool | 17.8% |

|

USPD USPD USDC USDC |

Pool | 17.3% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

LBTC LBTC WBTC WBTC |

BTC | 14.1% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 9.4% |

|

uniETH uniETH WETH WETH |

ETH | 5.6% |

|

ETH+ ETH+ WETH WETH |

ETH | 5.3% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 2.9% |

|

cbBTC cbBTC tBTC tBTC WBTC WBTC |

BTC | 1.4% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 35.1% |

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 18.5% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 7.1% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 5.8% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.4% |

|

EURA EURA EURC EURC |

EUR | 1.7% |

|

XAUt XAUt PAXG PAXG |

GOLD | 0.9% |

Weekly Metrics

crvUSD & scrvUSD

The crvUSD supply increased by 6% this week as yields for crvUSD pools rose substantially. The amount of crvUSD held in scrvUSD decreased significantly, meaning a greater share of revenue will now flow to veCRV holders.

PegKeeper profit has also been added as a weekly metric. As PegKeepers deploy and withdraw reserves, they effectively sell crvUSD when it’s above $1 and buy it back when it’s below $1 — generating revenue for the Curve DAO.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$96.2M | +6.0% |

scrvUSD Yield scrvUSD Yield |

4.0% | +1.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

37.1% | -12.0% |

crvUSD Price crvUSD Price |

$0.9998 | +$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

2.4% | +0.3% |

Peg Stability Reserves Peg Stability Reserves |

$34.9M | -$2.95M |

PegKeeper Profit PegKeeper Profit |

$6.18k | -$2.42k |

Llamalend

Llamalend's TVL increased substantially this week, aligning with the higher yields on crvUSD pools.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $280M | +4.4% |

| 🦙 Supplied | $96M | +7.0% |

| 🦙 Borrowed | $179M | +9.6% |

| 🦙 Collateral | $266M | +6.2% |

| 🦙 Loans | 1398 | +3 |

DEX

DEX pool volumes increased slightly; however, fees and swaps declined after last week’s higher-than-usual activity, with TVL remaining largely unchanged.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.65B | -0.1% |

| 🔄 Volume | $2.14B | +3.7% |

| 🔄 Swaps | 397k | -16.2% |

| 🔄 Total Fees | $343k | -17.6% |

DAO

veCRV holders are eating well this week after a higher-than-usual distribution, driven by frxETH pool fees being harvested. CRV emissions were also slightly higher this week thanks to the stronger CRV price, while veCRV supply increased due to additional CRV relocks.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.42B | +0.1% |

CRV Locked CRV Locked |

863M | - |

Total veCRV Total veCRV |

796M | +1.2% |

veCRV Distribution veCRV Distribution |

$260k | +40.7% |

CRV Emissions CRV Emissions |

$1.21M (2.22M CRV) | +0.7% |

Inflation Rate Inflation Rate |

4.988% | -0.004% |

Top Stableswap Pools

The top Stableswap pools by volume were largely unchanged this week, with the only major move being the frxUSD/sUSDS pool, which jumped 37 places.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

sUSDS sUSDS USDT USDT |

$545.5M | $9.7k |

| 2 | +1 |  |

PYUSD PYUSD USDS USDS |

$246.4M | $2.9k |

| 3 | -1 |  |

USDC USDC USDT USDT |

$164.1M | $2.2k |

| 4 | - |  |

USDC USDC crvUSD crvUSD |

$80.7M | $8.1k |

| 5 | - |  |

DAI DAI USDC USDC USDT USDT |

$73.2M | $11.0k |

| 6 | - |  |

USDC USDC RLUSD RLUSD |

$72.2M | $14.6k |

| 7 | +37 |  |

frxUSD frxUSD sUSDS sUSDS |

$55.6M | $5.7k |

| 8 | - |  |

ETH ETH stETH stETH |

$47.7M | $4.8k |

| 9 | -2 |  |

USDT USDT crvUSD crvUSD |

$43.1M | $4.3k |

| 10 | - |  |

USDC USDC fxUSD fxUSD |

$40.2M | $4.1k |

Top Cryptoswap Pools

Below, you can see two USDT/WBTC/WETH pools. The pool in position 4 has slightly less volume but over 2x the fees. Notably, the higher-fee pool (TricryptoUSDT) is a 2nd-generation Cryptoswap pool, while the lower-fee pool (Tricrypto2) is a 1st-generation pool. Curve continues to optimize and improve the efficiency of all its products.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$23.2M | $13.1k |

| 2 | +2 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$16.0M | $9.3k |

| 3 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$15.1M | $9.0k |

| 4 | -2 |  |

USDT USDT WBTC WBTC WETH WETH |

$13.5M | $20.6k |

| 5 | - |  |

crvUSD crvUSD YB YB |

$5.8M | $20.8k |

| 6 | +1 |  |

WETH WETH CVX CVX |

$3.3M | $11.4k |

DEX Winners & Losers

Fees Winners & Losers

sUSDS pools were the big winners in terms of fees this week, while Cryptoswap pools landed in the loser category due to a decline in volatility from last week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$545M | $9.75k | +$5.82k |

| 2 |  |

frxUSD frxUSD sUSDS sUSDS |

$55.6M | $5.66k | +$5.19k |

| 3 |  |

ARB ARB USDC USDC |

$2.25M | $6.74k | +$4.15k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$16M | $9.35k | -$8.2k |

| -2 |  |

USDC USDC WBTC WBTC WETH WETH |

$23.2M | $13.1k | -$11.6k |

| -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$13.5M | $20.6k | -$29.1k |

Volume Winners & Losers

Both USDS and sUSDS pools led the week in volume growth, contributing nearly $500M in additional volume for Curve from these assets alone.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$545M | $9.75k | +$347M |

| 2 |  |

PYUSD PYUSD USDS USDS |

$246M | $2.86k | +$80.7M |

| 3 |  |

frxUSD frxUSD sUSDS sUSDS |

$55.6M | $5.66k | +$50.9M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC WBTC WBTC WETH WETH |

$23.2M | $13.1k | -$24.3M |

| -2 |  |

USDT USDT crvUSD crvUSD |

$43.1M | $4.31k | -$24.8M |

| -1 |  |

USDC USDC crvUSD crvUSD |

$80.7M | $8.07k | -$52.3M |

TVL Winners & Losers

With the addition of higher yields for crvUSD pools, they were the big winners this week.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

frxUSD frxUSD crvUSD crvUSD |

$14.5M | +$12.9M |

| 2 |  |

DOLA DOLA sUSDe sUSDe |

$69.4M | +$12.2M |

| 3 |  |

PYUSD PYUSD crvUSD crvUSD |

$51.8M | +$10.7M |

| ... | ... | ... | ... | ... |

| -3 |  |

reUSD reUSD scrvUSD scrvUSD |

$39.2M | -$5.05M |

| -2 |  |

uniBTC uniBTC cbBTC cbBTC |

$240k | -$10.5M |

| -1 |  |

DOLA DOLA USR USR |

$16.2M | -$11.3M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

A great week for crvUSD minting markets, with substantial growth across the board and almost no outflows from any market.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$67.5M | $40.8M | +$3.25M |

| 2 |  |

crvUSD crvUSD tBTC tBTC |

$23.9M | $10.8M | +$1.12M |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$68.8M | $33.8M | +$538k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD weETH weETH |

$324k | $150k | +$42.4 |

| -2 |  |

crvUSD crvUSD LBTC LBTC |

$563k | $350k | -$19.5k |

| -1 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$6.54M | $3.87M | -$61k |

Lend Markets - Borrowing Winners & Losers

The crvUSD/sreUSD lending market has issued over $5M in new loans after the Curve DAO voted to mint an additional 5M crvUSD. The crvUSD/sDOLA market also saw a $4.7M increase in borrows from last week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$14.1M | $12.9M | +$5.37M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$26.3M | $24.2M | +$4.74M |

| 3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$14.5M | $12.5M | +$268k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$933k | $549k | -$6.63k |

| -2 |  |

crvUSD crvUSD sUSDS sUSDS |

$211k | $123k | -$20.4k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$8.83M | $7.52M | -$668k |

Lend Markets - Supplying Winners & Losers

Here we can clearly see the additional 5M crvUSD minted by the DAO deployed to the crvUSD/sreUSD market, along with solid growth in the crvUSD/sDOLA market.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$14.1M | $12.9M | +$5.04M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$26.3M | $24.2M | +$2.15M |

| 3 |  |

crvUSD crvUSD CRV CRV |

$4.17M | $3.3M | +$167k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WBTC WBTC |

$5.51M | $4.82M | -$184k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$10.8M | $9.51M | -$196k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$8.83M | $7.52M | -$697k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.