Curve Best Yields & Key Metrics | Week 43, 2025

Weekly yield and Curve ecosystem metric updates as of the 23rd October, 2025

Market Overview

Another turbulent week has come and gone, yet Curve continues to hold strong. Total value locked (TVL) sits at $2.769 B, down just 2.0% over the week.

It’s been an active period for governance, with three major proposals currently up for vote:

- Resupply's 5M crvUSD credit line vote for a sreUSD market

- Setting the YB emissions recipient so Curve's YB emissions can be used as voting incentives for crvUSD pools

- Tripling the PegKeeper crvUSD allocations to accommodate for significant growth in pool size and circulating supply

For more on how YieldBasis has positively impacted Curve since launch—and what’s next—see yesterday's article: YieldBasis on Curve: What’s Happened So Far

As always, there are strong yield opportunities across many assets on Curve. Explore some of the week’s highlights and metrics below.

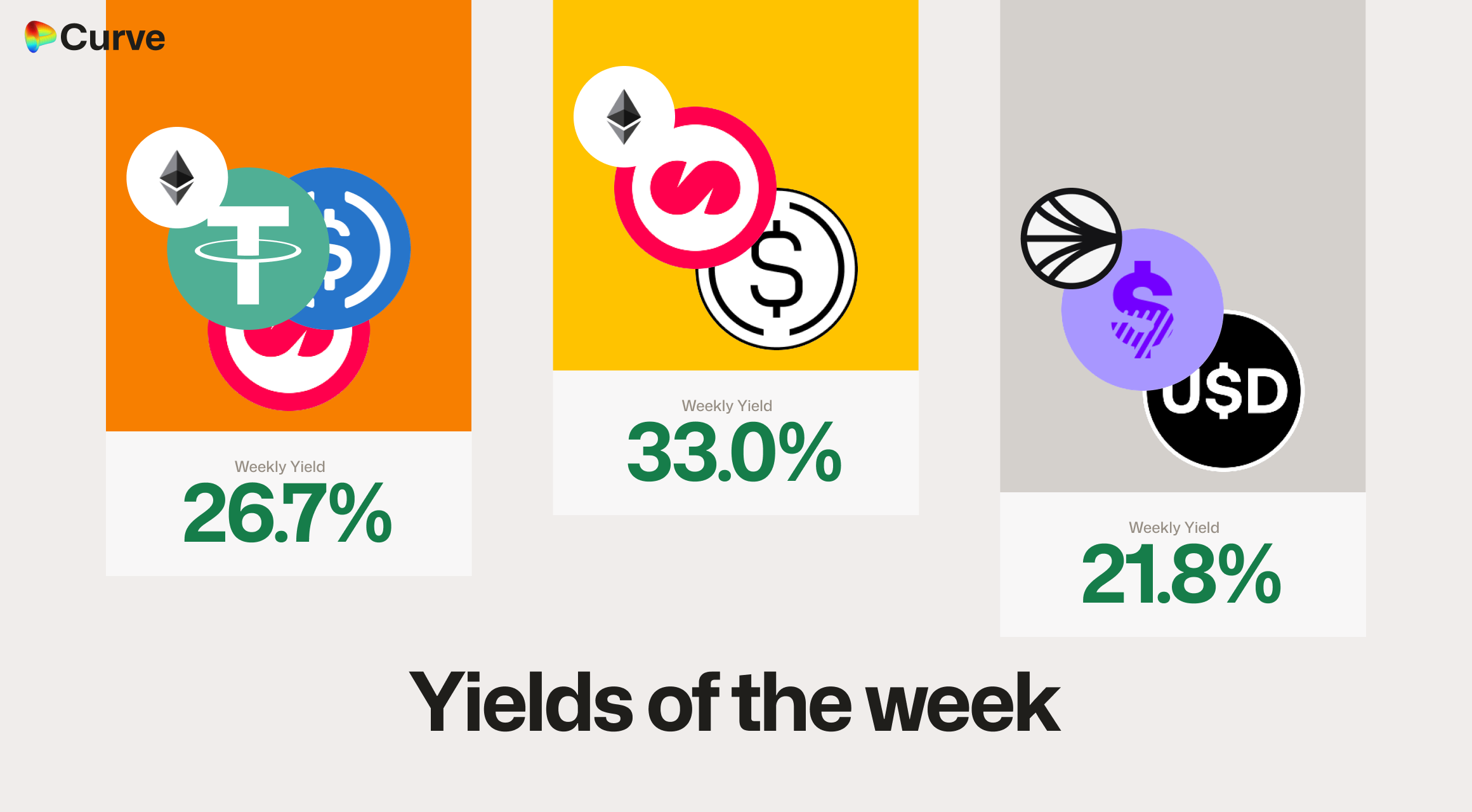

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

MUSD MUSD sUSDe sUSDe |

Pool | 33.0% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 26.7% |

|

USDp USDp frxUSD frxUSD |

Pool | 21.8% |

|

sdUSD sdUSD wstkscUSD wstkscUSD |

Pool | 18.1% |

|

litUSD litUSD sUSDS sUSDS |

Pool | 16.0% |

|

dUSD dUSD frxUSD frxUSD |

Pool | 15.7% |

|

PYUSD PYUSD crvUSD crvUSD |

Pool | 15.2% |

|

sdUSD sdUSD sfrxUSD sfrxUSD |

Pool | 14.8% |

|

mTBILL mTBILL USDC USDC |

Pool | 14.4% |

|

alUSD alUSD USDC USDC |

Pool | 14.4% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

SolvBTC SolvBTC xSolvBTC xSolvBTC |

BTC | 16.7% |

|

LBTC LBTC WBTC WBTC |

BTC | 13.7% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 12.7% |

|

tETH tETH weETH weETH |

ETH | 6.0% |

|

msETH msETH WETH WETH |

ETH | 5.2% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 2.8% |

Other Top Yields

The XAUt/PAXG gold pool continues to deliver strong organic yield for a stableswap pool.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 41.9% |

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 19.0% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 5.8% |

|

USDC USDC WBTC WBTC WETH WETH |

TRICRYPTO | 3.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.4% |

|

XAUt XAUt PAXG PAXG |

GOLD | 1.9% |

|

EURA EURA EURC EURC |

EUR | 1.4% |

Weekly Metrics

crvUSD & scrvUSD

Following recent market-wide liquidations, users appear cautious about taking on new loans, leaving crvUSD supply largely unchanged this week. The peg remains strong, and with YB incentives soon flowing to crvUSD pools, borrowing demand is expected to rise—creating a healthy incentive to mint and deploy crvUSD.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$90.8M | -0.5% |

Peg Stability Reserves Peg Stability Reserves |

$37.8M | -$3.9M |

scrvUSD Yield scrvUSD Yield |

2.9% | -4.2% |

crvUSD in crvUSD in scrvUSD scrvUSD |

49.1% | -15.9% |

crvUSD Price crvUSD Price |

$0.9998 | -$0.0007 |

Avg. Borrow Rate Avg. Borrow Rate |

2.0% | +0.7% |

Llamalend

Llamalend's TVL dipped slightly this week as markets look to stabilize following recent volatility and liquidations.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $268M | -4.8% |

| 🦙 Supplied | $89.8M | -3.8% |

| 🦙 Borrowed | $163M | -1.0% |

| 🦙 Collateral | $251M | -4.3% |

| 🦙 Loans | 1395 | -26 |

DEX

After last week’s volatility drove unusually high DEX volumes, both volume and fees have now normalized, with TVL remaining largely unchanged.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.66B | -1.6% |

| 🔄 Volume | $2.06B | -29.7% |

| 🔄 Swaps | 474k | -39.7% |

| 🔄 Total Fees | $416k | -55.5% |

DAO

The value of CRV emissions declined this week following a drop in the CRV token price. The veCRV distribution also returned to typical levels after last week’s unusually high payout.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.42B | +0.3% |

CRV Locked CRV Locked |

863M | -0.3% |

Total veCRV Total veCRV |

786M | -0.2% |

veCRV Distribution veCRV Distribution |

$185k | -49.3% |

CRV Emissions CRV Emissions |

$1.2M (2.22M CRV) | -9.1% |

Inflation Rate Inflation Rate |

4.992% | -0.005% |

Top Stableswap Pools

The top pool lists are back, below are the top weekly Stableswap pools ranked by volume.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +4 |  |

sUSDS sUSDS USDT USDT |

$198.8M | $3.9k |

| 2 | +10 |  |

USDC USDC USDT USDT |

$171.8M | $2.7k |

| 3 | - |  |

PYUSD PYUSD USDS USDS |

$165.7M | $1.9k |

| 4 | -2 |  |

USDC USDC crvUSD crvUSD |

$132.9M | $13.3k |

| 5 | -4 |  |

DAI DAI USDC USDC USDT USDT |

$79.8M | $12.0k |

| 6 | -2 |  |

USDC USDC RLUSD RLUSD |

$78.4M | $16.0k |

| 7 | -1 |  |

USDT USDT crvUSD crvUSD |

$67.8M | $6.8k |

| 8 | +3 |  |

ETH ETH stETH stETH |

$65.1M | $6.5k |

| 9 | +25 |  |

PYUSD PYUSD crvUSD crvUSD |

$41.8M | $4.3k |

| 10 | +6 |  |

USDC USDC fxUSD fxUSD |

$40.8M | $4.2k |

Top Cryptoswap Pools

Here are the top Cryptoswap pools of the week ranked by volume. Notice that the Tricrypto pools (BTC/ETH/USD pools) largely dominate these rankings.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$47.6M | $24.7k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$37.7M | $49.6k |

| 3 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$29.0M | $15.4k |

| 4 | -1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$24.7M | $17.5k |

| 5 | +6 |  |

crvUSD crvUSD YB YB |

$7.1M | $24.0k |

| 6 | +2 |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$3.9M | $3.5k |

DEX Winners & Losers

Fees Winners & Losers

YieldBasis’s YB/crvUSD pool led the week with the largest increase in fees, followed by the PYUSD/crvUSD pool after the introduction of direct YB incentives. The BTC/ETH/USD pools saw lower fees, mainly reflecting a return to normal levels after last week’s spike.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD YB YB |

$7.07M | $24k | +$11.1k |

| 2 |  |

PYUSD PYUSD crvUSD crvUSD |

$41.8M | $4.25k | +$2.78k |

| 3 |  |

USDai USDai USDC USDC |

$20.1M | $5.27k | +$1.47k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC WBTC WBTC WETH WETH |

$47.6M | $24.7k | -$34.4k |

| -2 |  |

USDT USDT WBTC WBTC WETH WETH |

$37.7M | $49.6k | -$91k |

| -1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$24.7M | $17.5k | -$95.4k |

Volume Winners & Losers

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDT USDT |

$172M | $2.66k | +$98.4M |

| 2 |  |

sUSDS sUSDS USDT USDT |

$199M | $3.93k | +$77.9M |

| 3 |  |

PYUSD PYUSD crvUSD crvUSD |

$41.8M | $4.25k | +$28.7M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

msETH msETH WETH WETH |

$28.8M | $11.5k | -$58.6M |

| -2 |  |

USDe USDe USDC USDC |

$20.2M | $2.08k | -$77.4M |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$79.8M | $12k | -$156M |

TVL Winners & Losers

With 14% APR available on the PYUSD/crvUSD pool, it's no wonder the TVL has increased by a factor of 4.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD crvUSD crvUSD |

$41.1M | +$30.2M |

| 2 |  |

DOLA DOLA wstUSR wstUSR |

$17M | +$6.17M |

| 3 |  |

USDC USDC RLUSD RLUSD |

$52.6M | +$2.86M |

| ... | ... | ... | ... | ... |

| -2 |  |

cbBTC cbBTC WBTC WBTC |

$4.99M | -$5.25M |

| -1 |  |

DOLA DOLA sUSDe sUSDe |

$57.2M | -$6.08M |

| 0 |  |

ETH ETH stETH stETH |

$179M | -$6.85M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Borrowing in crvUSD markets saw minor shifts among users, but overall levels were steady week-on-week.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$68.6M | $33.2M | +$2.5M |

| 2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$6.78M | $3.94M | +$270k |

| 3 |  |

crvUSD crvUSD LBTC LBTC |

$607k | $370k | +$240k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD weETH weETH |

$326k | $150k | -$1.13M |

| -2 |  |

crvUSD crvUSD tBTC tBTC |

$21.2M | $9.73M | -$1.14M |

| -1 |  |

crvUSD crvUSD WETH WETH |

$59.7M | $37.6M | -$1.29M |

Lend Markets - Borrowing Winners & Losers

sreUSD demand continues to rise, with borrowing up more than 10% this week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$9.04M | $7.54M | +$808k |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$5.69M | $4.82M | +$170k |

| 3 |  |

crvUSD crvUSD CRV CRV |

$4M | $3.15M | +$81.9k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$11M | $9.41M | -$322k |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$9.52M | $8.19M | -$594k |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$24.1M | $19.5M | -$940k |

Lend Markets - Supplying Winners & Losers

Users largely rotated capital within stablecoin lending markets this week, with sreUSD emerging as the biggest gainer.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$9.04M | $7.54M | +$1.02M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$5.69M | $4.82M | +$201k |

| 3 |  |

crvUSD crvUSD USDe USDe |

$606k | $184k | +$153k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$11M | $9.41M | -$321k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$24.1M | $19.5M | -$351k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$9.52M | $8.19M | -$3.57M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.