Curve Best Yields & Key Metrics | Week 42, 2025

Weekly yield and Curve ecosystem metric updates as of the 16th October, 2025

Market Overview

It's been a tough week for all markets, but Curve saw growth. TVL increased 1.8% to $2.832B, a rise largely driven by the YieldBasis deposit cap increase and in stark contrast to the 9.0% drop observed across all of DeFi, according to DefiLlama.

Following the DAOs vote to increase YieldBasis's crvUSD credit line to $300M, YB's pools (which utilize Curve's FXSwap technology) almost instantly hit their deposit cap. The YB token generation event then took place, including an airdrop available to all veCRV holders who voted for the YB proposals.

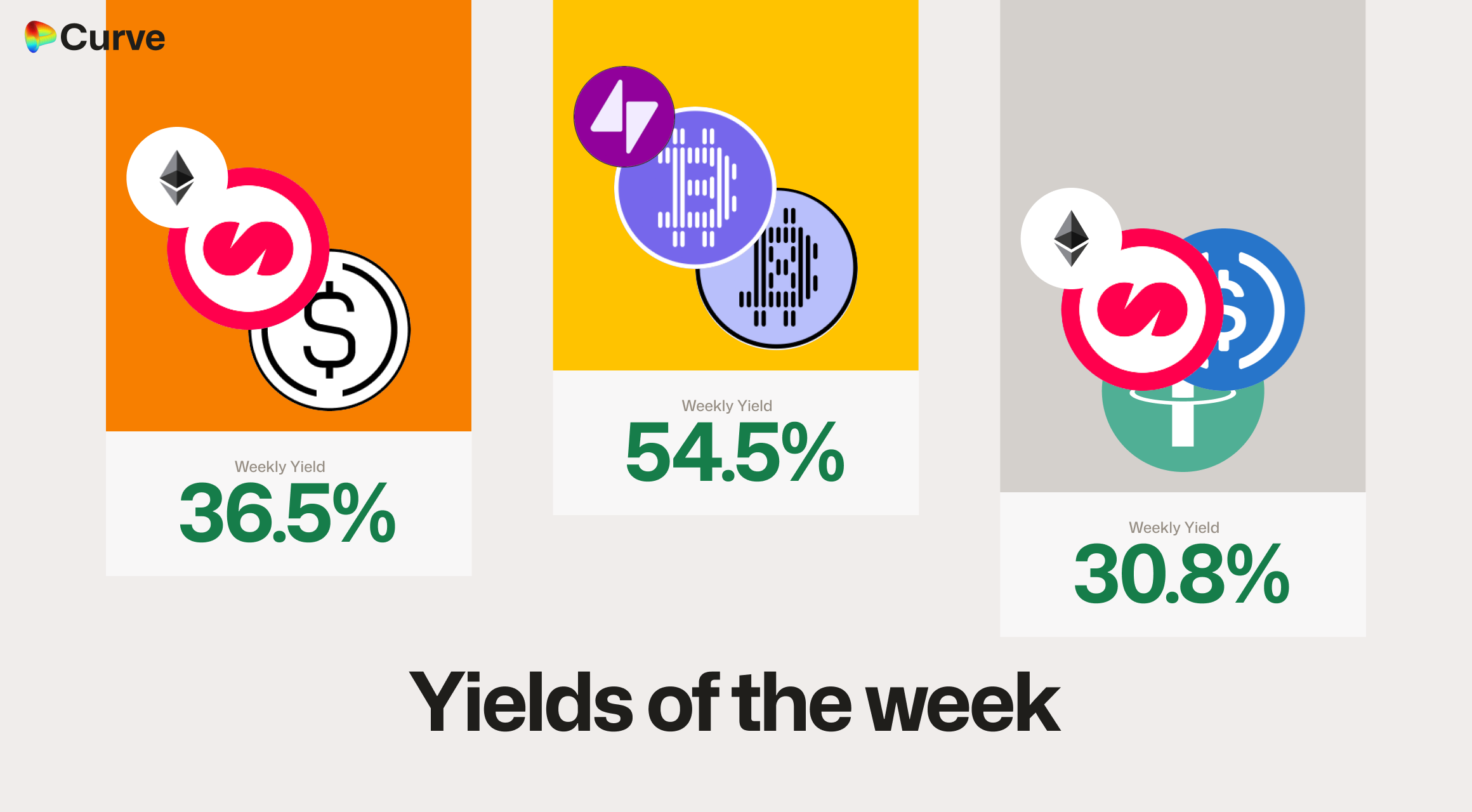

There are some great yields available this week, with solvBTC surprisingly topping the charts. See the highlighted yields and metrics below.

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

MUSD MUSD sUSDe sUSDe |

Pool | 36.5% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 30.8% |

|

USDp USDp frxUSD frxUSD |

Pool | 23.7% |

|

mMEV mMEV USDC USDC |

Pool | 20.9% |

|

USDC USDC mRe7YIELD mRe7YIELD |

Pool | 20.7% |

|

sdUSD sdUSD wstkscUSD wstkscUSD |

Pool | 19.5% |

|

dUSD dUSD frxUSD frxUSD |

Pool | 17.7% |

|

mBASIS mBASIS USDC USDC |

Pool | 17.6% |

|

litUSD litUSD sUSDS sUSDS |

Pool | 17.3% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 16.2% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

SolvBTC SolvBTC xSolvBTC xSolvBTC |

BTC | 54.5% |

|

CrossCurve WETH ARB CrossCurve WETH ARB |

ETH | 29.2% |

|

LBTC LBTC WBTC WBTC |

BTC | 14.2% |

|

CrossCurve WETH CrossCurve WETH |

ETH | 6.9% |

|

msETH msETH WETH WETH |

ETH | 6.8% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.2% |

Other Top Yields

Gold is a very in demand asset currently, and so with the new Better Gold Pool seeing strong demand and organic yield generation, we've included it below.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 40.2% |

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 20.2% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 7.7% |

|

USD₮0 USD₮0 WBTC WBTC WETH WETH |

TRICRYPTO | 7.0% |

|

XAUt XAUt PAXG PAXG |

GOLD | 4.6% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.5% |

|

EURA EURA EURe EURe |

EUR | 2.3% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD saw a severe decline in minted supply on Curve this week, as users anxiously closed loans following the flash crash. This brief dip in supply caused crvUSD to temporarily trade slightly above its peg, prompting PegKeepers to deploy significant reserves to the market and quickly stabilize the price.

With rates this low, it is a great time to borrow. All crvUSD minting markets are functioning perfectly following the volatility.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$91.3M | -21.1% |

Peg Stability Reserves Peg Stability Reserves |

$41.7M | +$41.7M |

scrvUSD Yield scrvUSD Yield |

7.1% | -4.5% |

crvUSD in crvUSD in scrvUSD scrvUSD |

65.2% | +14.8% |

crvUSD Price crvUSD Price |

$1.0001 | +$0.0003 |

Avg. Borrow Rate Avg. Borrow Rate |

1.3% | -11.5% |

Llamalend

Llamalend unfortunately saw some liquidations and a small amount of bad debt during the flash crash, due to the rapid drop in prices and the simultaneous spike in gas costs. This explains the drop in all Llamalend metrics this week; however, with borrow rates remaining so low, new borrowers should reappear once the dust settles.

This also presents a great learning opportunity for effectively parametrizing lending markets for safety, and Llamalend is becoming stronger and more robust after this event.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $284M | -19.0% |

| 🦙 Supplied | $93.6M | -11.7% |

| 🦙 Borrowed | $165M | -18.7% |

| 🦙 Collateral | $263M | -20.5% |

| 🦙 Loans | 1423 | -86 |

DEX

DEX pools saw huge volumes and fees this week due to the volatility. Total TVL also increased, a rise largely attributed to YB pools, which added approximately $240M.

Note: YB pools are included in these TVL and volume calculations; however, their pool fees have been excluded as they flow directly to the YB protocol.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.71B | +3.5% |

| 🔄 Volume | $2.93B | +51.7% |

| 🔄 Swaps | 786k | +72.7% |

| 🔄 Total Fees | $936k | +80.1% |

DAO

With the decline in altcoins this week, the CRV price also declined, which in turn decreased the value of CRV emissions. However, the veCRV distribution increased by over 50%, and CRV inflation is now forever below 5%.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.41B | +0.1% |

CRV Locked CRV Locked |

865M | - |

Total veCRV Total veCRV |

788M | +0.4% |

veCRV Distribution veCRV Distribution |

$365k | +50.2% |

CRV Emissions CRV Emissions |

$1.32M (2.22M CRV) | -22.3% |

Inflation Rate Inflation Rate |

4.997% | -0.005% |

DEX Winners & Losers

Fees Winners & Losers

The biggest increase in fees this week were all Tricrypto pools, as swappers paid for access to the deep liquidity these pools offer across each of their three assets.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDT USDT WBTC WBTC WETH WETH |

$71.7M | $141k | +$125k |

| 2 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$47.8M | $113k | +$102k |

| 3 |  |

USDC USDC WBTC WBTC WETH WETH |

$90.2M | $59k | +$46.8k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

cUSDO cUSDO USDC USDC |

$26.5M | $7.4k | -$4.12k |

| -2 |  |

USDC USDC DAI DAI |

$204k | $610 | -$4.5k |

| -1 |  |

DAI DAI USD₮0 USD₮0 |

$199k | $598 | -$4.93k |

Volume Winners & Losers

The biggest increase in volume this week came from the 3Pool. It's also great to see the crvUSD/USDC pool among the top volume winners, as the YB pools continue to increase demand for crvUSD liquidity.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

DAI DAI USDC USDC USDT USDT |

$236M | $35.3k | +$115M |

| 2 |  |

USDC USDC crvUSD crvUSD |

$145M | $14.5k | +$89.6M |

| 3 |  |

USDe USDe USDC USDC |

$97.6M | $10.2k | +$84.7M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

cUSDO cUSDO USDC USDC |

$26.5M | $7.4k | -$31M |

| -2 |  |

USDC USDC fxUSD fxUSD |

$56.9M | $6.01k | -$37.1M |

| -1 |  |

PYUSD PYUSD USDS USDS |

$144M | $1.71k | -$174M |

TVL Winners & Losers

The biggest TVL increases came from the three YB pools, with each pool increasing by $40M in BTC and $40M in crvUSD.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$101M | +$80.3M |

| 2 |  |

crvUSD crvUSD cbBTC cbBTC |

$101M | +$80M |

| 3 |  |

crvUSD crvUSD tBTC tBTC |

$101M | +$79.9M |

| ... | ... | ... | ... | ... |

| -3 |  |

yUSD yUSD syrupUSDC syrupUSDC |

$0 | -$9.28M |

| -2 |  |

ETH ETH stETH stETH |

$188M | -$17.4M |

| -1 |  |

sUSDai sUSDai USDC USDC |

$12.7M | -$23M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Mostly there were net outflows from crvUSD minting markets; however, the tBTC market saw a $1.2M increase in its borrowed amount, and sfrxETH saw an increase of $170k as well.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD tBTC tBTC |

$23.2M | $10.9M | +$1.23M |

| 2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$6.71M | $3.66M | +$170k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$640k | $150k | +$186 |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$64.5M | $38.9M | -$989k |

| -2 |  |

crvUSD crvUSD wstETH wstETH |

$10.3M | $4.08M | -$5.21M |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$66.6M | $30.7M | -$19.5M |

Lend Markets - Borrowing Winners & Losers

Only small increases in borrowing markets existed this week, as users sought a flight to safety and closed leveraged and loan positions.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$1.52M | $1.06M | +$27.6k |

| 2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$14.9M | $12.5M | +$18.4k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$896k | $623k | +$14.1k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$2.24M | $1.62M | -$1.52M |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$13.1M | $8.78M | -$3.84M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$24.7M | $20.4M | -$4.02M |

Lend Markets - Supplying Winners & Losers

The WBTC lend market on Ethereum still saw a strong increase in crvUSD supplied, as did the ycvxCRV market relative to its TVL.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$5.49M | $4.65M | +$362k |

| 2 |  |

crvUSD crvUSD ycvxCRV ycvxCRV |

$129k | $89.1k | +$16.4k |

| 3 |  |

crvUSD crvUSD tBTC tBTC |

$11.2k | $8.47k | +$1.68k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$2.24M | $1.62M | -$1.72M |

| -2 |  |

crvUSD crvUSD sUSDe sUSDe |

$13.1M | $8.78M | -$1.79M |

| -1 |  |

crvUSD crvUSD sDOLA sDOLA |

$24.7M | $20.4M | -$3.6M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.