Curve Best Yields & Key Metrics | Week 41, 2025

Weekly yield and Curve ecosystem metric updates as of the 9th October, 2025

Market Overview

Another great week for Curve, with TVL increasing 2.5% to $2.782B. Here's the news:

- Research by Pangea suggests every $1 in YB pool volume is equating to more than $1 of Curve pool volume

- Curve is live on X-layer

- Curve's October monthly recap was released

As always there are some great yields available, see the highlighted opportunities below, and check out the weekly metrics.

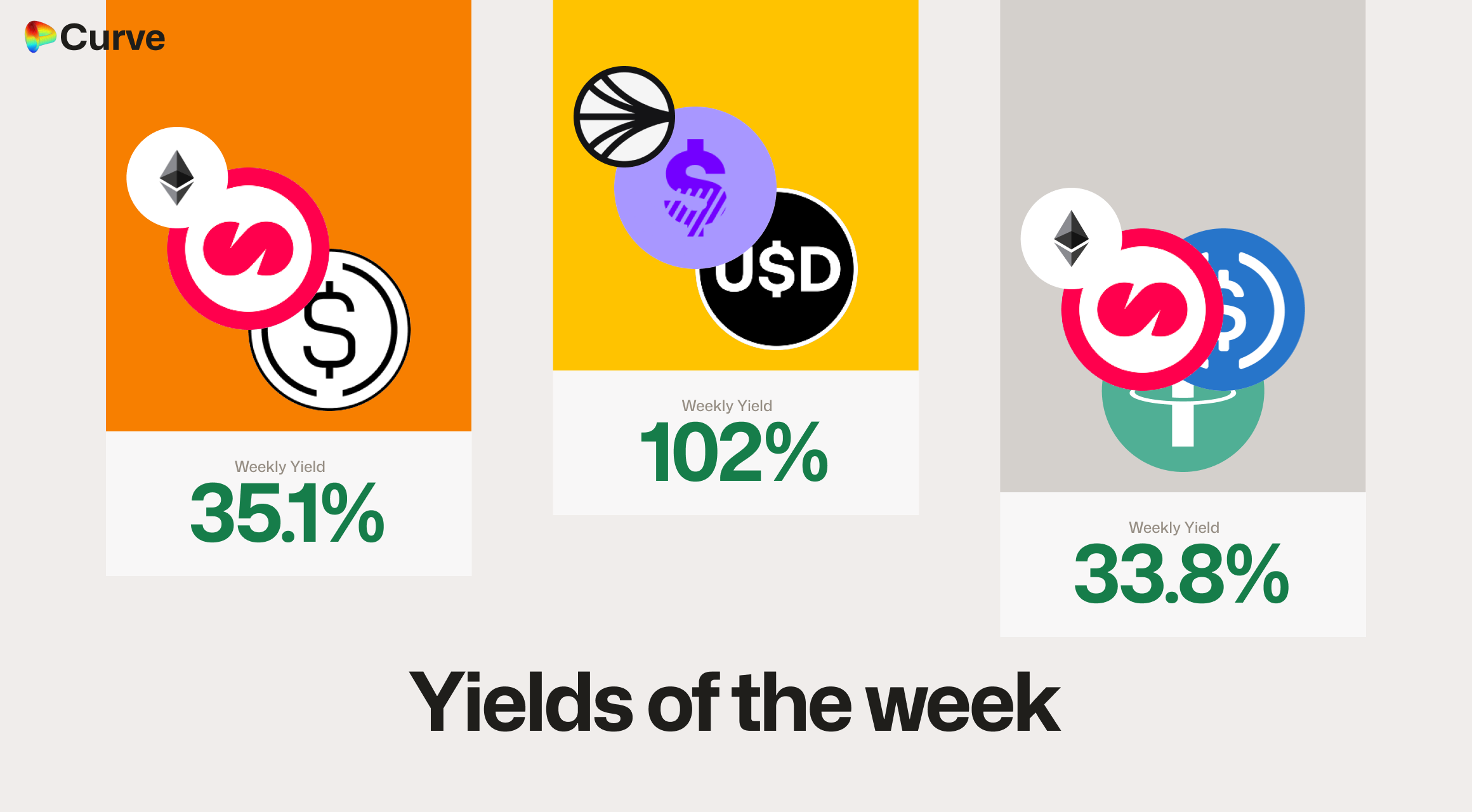

Top Yields

USD Stablecoins

Parallel's USDp pool took the top spot this week, with Mezo's MUSD pools coming in second and third.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDp USDp frxUSD frxUSD |

Pool | 101.9% |

|

MUSD MUSD sUSDe sUSDe |

Pool | 35.1% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 33.8% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 31.0% |

|

dUSD dUSD frxUSD frxUSD |

Pool | 27.0% |

|

mMEV mMEV USDC USDC |

Pool | 25.1% |

|

litUSD litUSD sUSDS sUSDS |

Pool | 23.7% |

|

sdUSD sdUSD wstkscUSD wstkscUSD |

Pool | 22.8% |

|

axlUSDT axlUSDT USDt USDt |

Pool | 21.8% |

Top BTC & ETH Yields

The LBTC/WBTC pool on Etherlink is offering some huge BTC yield this week at 13.2%.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

LBTC LBTC WBTC WBTC |

BTC | 13.2% |

|

WETH WETH pufETH pufETH |

ETH | 5.4% |

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 4.9% |

|

pufETH pufETH wstETH wstETH |

ETH | 4.9% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.4% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 2.0% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 34.4% |

|

CrossCurve CRV2 CrossCurve CRV2 |

CRV | 19.7% |

|

USD₮0 USD₮0 WBTC WBTC WETH WETH |

TRICRYPTO | 11.3% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 5.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.7% |

|

EURA EURA EURC EURC |

EUR | 2.6% |

Weekly Metrics

crvUSD & scrvUSD

The amount of crvUSD minted increased by 5% this week, and this borrowing demand pushed the borrow rate to 13%. The good news is that this high borrow rate is keeping the scrvUSD yield elevated, at 11.7% APY.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$116M | +5.0% |

Peg Stability Reserves Peg Stability Reserves |

$91.7k | -$7.19M |

scrvUSD Yield scrvUSD Yield |

11.7% | +0.8% |

crvUSD in crvUSD in scrvUSD scrvUSD |

50.4% | -0.1% |

crvUSD Price crvUSD Price |

$0.9994 | -$0.0006 |

Avg. Borrow Rate Avg. Borrow Rate |

13.0% | +4.1% |

Llamalend

Llamalend saw its borrowed figure increase by 4.8%, while only seeing a smaller 1.6% increase in collateral, and a reduction in total loans open. This suggests users staying in the market are borrowing more, and taking on more risk.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $348M | +0.2% |

| 🦙 Supplied | $106M | -0.5% |

| 🦙 Borrowed | $203M | +4.8% |

| 🦙 Collateral | $329M | +1.6% |

| 🦙 Loans | 1509 | -20 |

DEX

DEX pools saw a great week, with swap numbers and total volumes down, however the most important metrics of total fees and TVL were up on the week.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.61B | +2.3% |

| 🔄 Volume | $1.93B | -37.5% |

| 🔄 Swaps | 455k | -7.7% |

| 🔄 Total Fees | $520k | +7.9% |

DAO

This is the last ever week CRV inflation will be above 5%. Next week it will fall to 4.996%. It will continue falling gradually forever, just as programmed.

The veCRV distribution was down slightly after last weeks higher than usual amount, however the price of CRV increased over the week, leading to a higher $ value of CRV emissions.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.41B | +0.2% |

CRV Locked CRV Locked |

865M | -0.1% |

Total veCRV Total veCRV |

785M | -0.4% |

veCRV Distribution veCRV Distribution |

$238k | -17.0% |

CRV Emissions CRV Emissions |

$1.69M (2.22M CRV) | +13.2% |

Inflation Rate Inflation Rate |

5.001% | -0.005% |

DEX Winners & Losers

Fees Winners & Losers

The top pools here are all the YB BTC pools, which are built on top of Curve's technology. They show the power of the new FXSwap pools, which are the future of volatile swaps on Curve. Let the Curve team know if you would like your own FXSwap pool for your project.

Note: next week we will remove these YB pools from any further calculations of fees and volumes, as they only indirectly benefit Curve.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD cbBTC cbBTC |

$5.83M | $58.3k | +$53.2k |

| 2 |  |

crvUSD crvUSD tBTC tBTC |

$5.38M | $53.8k | +$50.5k |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$4.88M | $48.8k | +$43.9k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

CRV CRV crvUSD crvUSD |

$2.01M | $5.1k | -$12k |

| -2 |  |

frxETH frxETH frxUSD frxUSD tBTC tBTC |

$2.01M | $5.1k | -$12k |

| -1 |  |

USDC USDC USDf USDf |

$29.5M | $9.06k | -$30.9k |

Volume Winners & Losers

After last week's huge volumes, we've seen some cooling across the biggest volume pools, which is normal. However, weETH, RLUSD, and fxUSD all showed increased demand.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

WETH WETH weETH weETH |

$90.6M | $4.7k | +$31.7M |

| 2 |  |

USDC USDC RLUSD RLUSD |

$154M | $30.7k | +$25.8M |

| 3 |  |

USDC USDC fxUSD fxUSD |

$94M | $9.49k | +$16.7M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC USDf USDf |

$29.5M | $9.06k | -$104M |

| -2 |  |

sUSDS sUSDS USDT USDT |

$70.3M | $921 | -$118M |

| -1 |  |

PYUSD PYUSD USDS USDS |

$318M | $3.26k | -$439M |

TVL Winners & Losers

The crvUSD/USDC pool's TVL regularly fluctuates from PegKeeper's deploying and withdrawing their allocated crvUSD reserves to the pool.

While the sUSDai pool has almost doubled it's TVL, and the new Dialectic ETH pools by Makina have also seen huge inflows.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

sUSDai sUSDai USDC USDC |

$35.5M | +$16.9M |

| 2 |  |

WETH WETH DETH DETH |

$38.2M | +$14M |

| 3 |  |

USDC USDC DUSD DUSD |

$35.2M | +$11.2M |

| ... | ... | ... | ... | ... |

| -1 |  |

ynETHx ynETHx WETH WETH |

$4.22M | -$3.18M |

| 0 |  |

DOLA DOLA USR USR |

$35.3M | -$4M |

| 1 |  |

USDC USDC crvUSD crvUSD |

$14.9M | -$4.9M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Regular old ETH and WBTC markets were the winners this week, with both markets minting substantial amounts of crvUSD.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD ETH ETH |

$71M | $40.2M | +$2.9M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$97.7M | $50.2M | +$2.72M |

| 3 |  |

crvUSD crvUSD wstETH wstETH |

$17.6M | $9.29M | +$127k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD LBTC LBTC |

$279k | $130k | -$443 |

| -2 |  |

crvUSD crvUSD cbBTC cbBTC |

$3M | $1.55M | -$157k |

| -1 |  |

crvUSD crvUSD tBTC tBTC |

$23.9M | $9.62M | -$214k |

Lend Markets - Borrowing Winners & Losers

fxSAVE continues to show it's strength, as does sDOLA and sreUSD. Reassuringly, there were no large outflows from any lend market this week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$12M | $10.3M | +$2.35M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.3M | $24.4M | +$589k |

| 3 |  |

crvUSD crvUSD sreUSD sreUSD |

$8.99M | $7.77M | +$527k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$15.6M | $12.5M | -$19.3k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$499k | $369k | -$58.9k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$14.9M | $12.6M | -$247k |

Lend Markets - Supplying Winners & Losers

From the metrics we saw the total supplied to lending markets was almost unchanged this week. However, there did seem to be some rotation between markets, which is shown below.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$12M | $10.3M | +$2.48M |

| 2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$15.6M | $12.5M | +$644k |

| 3 |  |

crvUSD crvUSD WETH WETH |

$3.96M | $3.15M | +$349k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.3M | $24.4M | -$560k |

| -2 |  |

crvUSD crvUSD WBTC WBTC |

$5.09M | $4.65M | -$615k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$14.9M | $12.6M | -$3.16M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.