Curve Best Yields & Key Metrics | Week 40, 2025

Weekly yield and Curve ecosystem metric updates as of the 2nd October, 2025

Market Overview

What a week for Curve! Total Value Locked (TVL) surged by 9.4% to reach $2.704B, propelled by significant growth and volume across the DEX pools.

In a testament to high demand, YieldBasis optimized parameters in their three BTC pools and increased their caps to $10M, and all pools hit these caps in under 20 minutes!

The yields are incredible this week. Let's dive into some of the standout opportunities and key metrics from across the ecosystem.

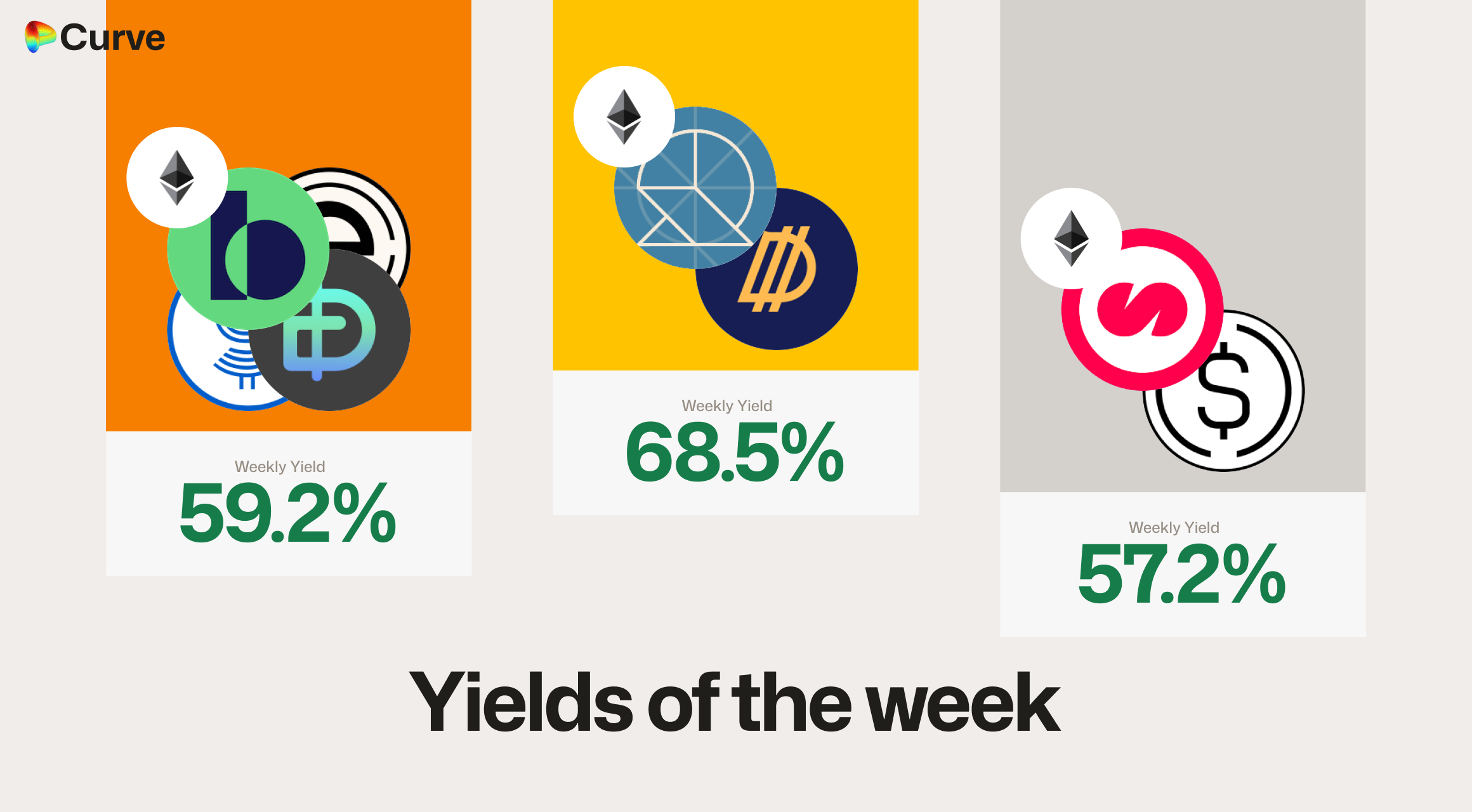

Top Yields

Note yields shown are available directly on Curve, other partner projects like Convex, StakeDAO and Yearn may allow you to boost yields more than listed here.

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

DOLA DOLA wstUSR wstUSR |

Pool | 68.5% |

|

USDFI USDFI USDaf USDaf ebUSD ebUSD BOLD BOLD |

Pool | 59.2% |

|

MUSD MUSD sUSDe sUSDe |

Pool | 57.2% |

|

USDFI USDFI frxUSD frxUSD |

Pool | 47.1% |

|

litUSD litUSD sUSDS sUSDS |

Pool | 46.5% |

|

MUSD MUSD USDC USDC USDT USDT |

Pool | 40.4% |

|

axlUSDT axlUSDT USDt USDt |

Pool | 39.0% |

|

ynUSDx ynUSDx USDC USDC |

Pool | 29.3% |

|

sfrxUSD sfrxUSD frxUSD frxUSD |

Pool | 27.3% |

|

litUSD litUSD sfrxUSD sfrxUSD |

Pool | 26.4% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

LBTC LBTC WBTC WBTC |

BTC | 15.5% |

|

WETH WETH wstETH wstETH |

ETH | 7.2% |

|

WETH WETH wrsETH wrsETH |

ETH | 7.2% |

|

uniETH uniETH frxETH frxETH |

ETH | 6.3% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.5% |

|

uniBTC uniBTC M-BTC M-BTC |

BTC | 3.1% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 29.6% |

|

CrossCurve CRV2 CrossCurve CRV2 |

CRV | 16.8% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.3% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 5.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 5.0% |

|

EURA EURA EURC EURC |

EUR | 1.9% |

Weekly Metrics

crvUSD & scrvUSD

The scrvUSD yield remains high for another week. The borrow rate has decreased to 8.8%, and the peg stability reserves have begun to refill. In the future with more liquidity available in crvUSD pools, we should see these fluctuations in borrowing rates subside.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$111M | -2.3% |

Peg Stability Reserves Peg Stability Reserves |

$7.28M | +$6.57M |

scrvUSD Yield scrvUSD Yield |

10.9% | -1.7% |

crvUSD in crvUSD in scrvUSD scrvUSD |

50.3% | +6.1% |

crvUSD Price crvUSD Price |

$1.0000 | - |

Avg. Borrow Rate Avg. Borrow Rate |

8.8% | -3.2% |

Llamalend

Loan metrics remained mostly steady this week, with only small declines in supplied, borrowed, and total number of loans.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $347M | -0.6% |

| 🦙 Supplied | $107M | -3.5% |

| 🦙 Borrowed | $194M | -3.1% |

| 🦙 Collateral | $324M | -0.7% |

| 🦙 Loans | 1529 | -38 |

DEX

The DEX had a fantastic week, with a huge 80% increase in volume. This led to a 46% rise in total fees and a significant increase in TVL.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.55B | +11.1% |

| 🔄 Volume | $3.09B | +79.9% |

| 🔄 Swaps | 493k | +25.3% |

| 🔄 Total Fees | $482k | +46.6% |

DAO

Total veCRV increased this week as users relocked their CRV. veCRV holders were rewarded with an almost 20% increase in distributed revenue. The value of the CRV token was down an average of 10% during the week, leading to a lower dollar value of emissions.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.41B | +0.2% |

CRV Locked CRV Locked |

866M | - |

Total veCRV Total veCRV |

788M | +0.4% |

veCRV Distribution veCRV Distribution |

$287k | +17.9% |

CRV Emissions CRV Emissions |

$1.5M (2.22M CRV) | -10.0% |

Inflation Rate Inflation Rate |

5.006% | -0.005% |

DEX Winners & Losers

Fees Winners & Losers

Falcon's USDf had a great week across multiple metrics, including fees, driven largely by hype surrounding their FF token launch. Also, the week's volatility meant Tricrypto pools saw good fee generation and volumes.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDf USDf |

$133M | $40k | +$24.1k |

| 2 |  |

USDT USDT WBTC WBTC WETH WETH |

$21.2M | $25.3k | +$14.2k |

| 3 |  |

frxETH frxETH frxUSD frxUSD tBTC tBTC |

$3.97M | $17.1k | +$12k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$69.8M | $6.98k | -$3.01k |

| -2 |  |

WETH WETH CVX CVX |

$3.18M | $10.8k | -$6.42k |

| -1 |  |

PYUSD PYUSD USDC USDC |

$37.9M | $3.79k | -$12.8k |

Volume Winners & Losers

The PayPal and Spark PYUSD/USDS pool saw an incredible $758M in volume as Curve becomes the default swap venue for these stablecoins, with users migrating away from the PYUSD/USDC pool.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$758M | $7.58k | +$668M |

| 2 |  |

USDC USDC USDf USDf |

$133M | $40k | +$80.5M |

| 3 |  |

USDai USDai USDC USDC |

$91.5M | $9.15k | +$66.5M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sUSDe sUSDe sUSDS sUSDS |

$23.9M | $4.78k | -$14.5M |

| -2 |  |

ETH ETH stETH stETH |

$69.8M | $6.98k | -$30.1M |

| -1 |  |

PYUSD PYUSD USDC USDC |

$37.9M | $3.79k | -$128M |

TVL Winners & Losers

USDf and the PYUSD/USDS pool were the big TVL winners for the week. We can also see a YieldBasis pool among the top gainers, reflecting its successful launch.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$80.2M | +$55M |

| 2 |  |

USDC USDC USDf USDf |

$52.1M | +$18.7M |

| 3 |  |

crvUSD crvUSD cbBTC cbBTC |

$20M | +$18M |

| ... | ... | ... | ... | ... |

| -1 |  |

DAI DAI USDC USDC USDT USDT |

$177M | -$7.32M |

| 0 |  |

USDL USDL USDC USDC |

$705 | -$9.91M |

| 1 |  |

cUSDO cUSDO USDC USDC |

$20.9M | -$10.7M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

We're observing users strategically moving capital in response to changing borrowing rates, which in turn helps to balance those rates. As crvUSD liquidity increases in time, we should see less rate volatility, making Curve an even more attractive borrowing venue.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$95.2M | $47.6M | +$736k |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$18.3M | $9.16M | +$204k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$7.13M | $3.45M | +$82.5k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD cbBTC cbBTC |

$3.17M | $1.71M | -$119k |

| -2 |  |

crvUSD crvUSD WETH WETH |

$70.2M | $37.4M | -$1.69M |

| -1 |  |

crvUSD crvUSD tBTC tBTC |

$23.8M | $9.83M | -$1.79M |

Lend Markets - Borrowing Winners & Losers

fxSAVE was the big winner this week due to its highly negative borrowing rate, allowing users to leverage and earn extra yield. The same dynamic was seen with sreUSD.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$9.73M | $7.98M | +$2.08M |

| 2 |  |

crvUSD crvUSD sreUSD sreUSD |

$8.71M | $7.24M | +$1.67M |

| 3 |  |

crvUSD crvUSD WETH WETH |

$3.61M | $2.68M | +$275k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WFRAX WFRAX |

$844k | $389k | -$175k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.9M | $24M | -$1.77M |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$18M | $12.9M | -$5.3M |

Lend Markets - Supplying Winners & Losers

This week showed a truly symbiotic relationship: as borrowers looped to access extra yield, more capital entered the market to supply them.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$9.73M | $7.98M | +$2.4M |

| 2 |  |

crvUSD crvUSD sreUSD sreUSD |

$8.71M | $7.24M | +$1.35M |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$5.71M | $4.56M | +$274k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sDOLA sDOLA |

$258k | $186k | -$988k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$28.9M | $24M | -$1.14M |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$18M | $12.9M | -$4.87M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.