Curve Best Yields & Key Metrics | Week 39, 2025

Weekly yield and Curve ecosystem metric updates as of the 25th September, 2025

Market Overview

Crypto markets are down across the board this week; here are the key updates for Curve:

- TVL decreased 6.3% to $2.476B, outperforming the average 8.2% decline across the DeFi sector.

- scrvUSD made its debut among the top yields this week, offering 12.6%.

- Using a credit line from Curve, YieldBasis successfully launched and has reached its initial $1M deposit limit for its three markets (WBTC, tBTC, and cbBTC).

- Curve is now live on Plasma.

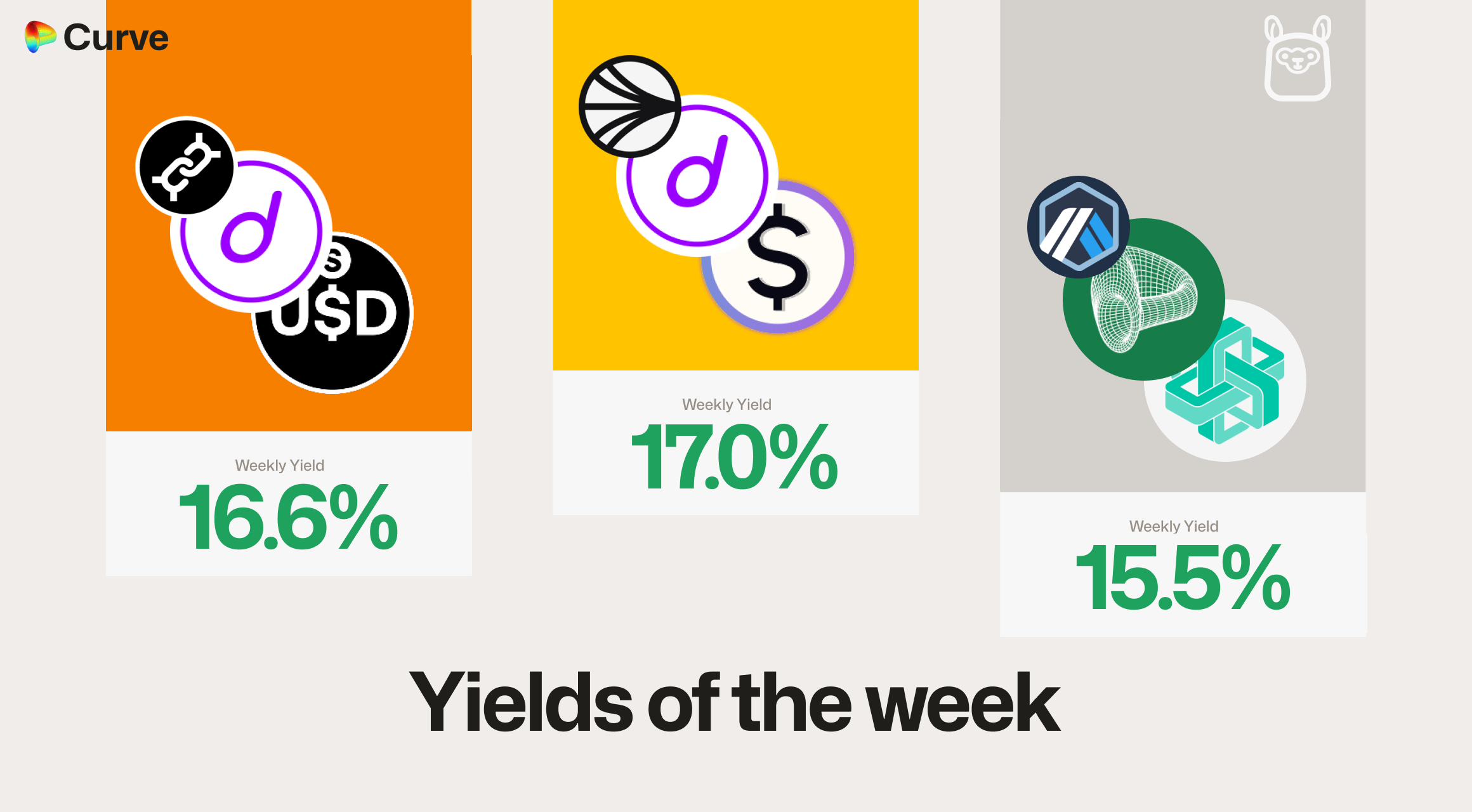

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

sdUSD sdUSD wstkscUSD wstkscUSD |

Pool | 17.0% |

|

sdUSD sdUSD sfrxUSD sfrxUSD |

Pool | 16.6% |

|

crvUSD crvUSD EYWA EYWA |

Llamalend | 15.5% |

|

crvUSD crvUSD sfrxUSD sfrxUSD |

Llamalend | 15.0% |

|

alUSD alUSD USDC USDC |

Pool | 13.4% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.3% |

|

crvUSD crvUSD WETH WETH |

Llamalend | 12.6% |

|

scrvUSD scrvUSD |

scrvUSD | 12.6% |

|

USDC USDC DAI DAI |

Pool | 12.5% |

|

DAI DAI USD₮0 USD₮0 |

Pool | 12.5% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

ynETHx ynETHx WETH WETH |

ETH | 5.5% |

|

msETH msETH WETH WETH |

ETH | 4.9% |

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 4.3% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.1% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 1.6% |

|

WBTC WBTC tBTC tBTC |

BTC | 1.3% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 26.9% |

|

CrossCurve CRV2 CrossCurve CRV2 |

CRV | 18.5% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 5.9% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 5.4% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.5% |

|

EURA EURA EURC EURC |

EUR | 2.0% |

Weekly Metrics

crvUSD & scrvUSD

Borrow rates remain high, however, the crvUSD peg has now recovered to exactly $1. Consequently, rates should begin to decline, and peg stability reserves will slowly be deployed.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$113M | -2.1% |

Peg Stability Reserves Peg Stability Reserves |

$713k | -$244k |

scrvUSD Yield scrvUSD Yield |

12.6% | +6.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

44.5% | -3.1% |

crvUSD Price crvUSD Price |

$1.0000 | +$0.0002 |

Avg. Borrow Rate Avg. Borrow Rate |

12.1% | +0.3% |

Llamalend

Llamalend TVL is down, but this seems to be mostly due to collateral values decreasing, as loans and borrowed amounts seem to be sticky in comparison.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $350M | -8.4% |

| 🦙 Supplied | $111M | +1.6% |

| 🦙 Borrowed | $199M | -0.8% |

| 🦙 Collateral | $326M | -9.1% |

| 🦙 Loans | 1568 | -1 |

DEX

TVL is down, however swaps and volumes increased. Interestingly, the total swapping fees remained the almost exactly the same at $328k, up only $107 this week compared to last week.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.29B | -5.5% |

| 🔄 Volume | $1.72B | +6.1% |

| 🔄 Swaps | 394k | +3.6% |

| 🔄 Total Fees | $328k | - |

DAO

veCRV holders saw a substantial increase in generated fees this week, up over 29% from last week to $243k. While a decline in the CRV token price affected emission values, other key metrics remained steady.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.41B | +0.2% |

CRV Locked CRV Locked |

866M | - |

Total veCRV Total veCRV |

785M | -0.4% |

veCRV Distribution veCRV Distribution |

$243k | +29.3% |

CRV Emissions CRV Emissions |

$1.66M (2.22M CRV) | -5.0% |

Inflation Rate Inflation Rate |

5.011% | -0.005% |

DEX Winners & Losers

ETH pools in general were the big losers this week. With the decline in ETH price came a decline in liquidity demand, especially between stETH and ETH. The 3pool (DAI/USDC/USDT pool) had a great week however, as did sUSDe pools.

Fees Winners & Losers

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sDAI sDAI sUSDe sUSDe |

$40.5M | $8.11k | +$5.56k |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$157M | $23.5k | +$5.28k |

| 3 |  |

sUSDe sUSDe sUSDS sUSDS |

$38.4M | $7.68k | +$5.17k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

reUSD reUSD scrvUSD scrvUSD |

$26.4M | $5.28k | -$4.59k |

| -2 |  |

USDT USDT WBTC WBTC WETH WETH |

$5.48M | $11.1k | -$9.12k |

| -1 |  |

ETH ETH stETH stETH |

$99.9M | $9.99k | -$12.5k |

Volume Winners & Losers

sUSDS and PYUSD saw great volumes this week, while reUSD and stETH pools struggled compared to last week's figures.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$149M | $1.49k | +$70.5M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$157M | $23.5k | +$35.2M |

| 3 |  |

PYUSD PYUSD USDC USDC |

$166M | $16.6k | +$34.5M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

reUSD reUSD scrvUSD scrvUSD |

$26.4M | $5.28k | -$22.9M |

| -2 |  |

ETH ETH stETH stETH |

$42.6M | $3.41k | -$30.3M |

| -1 |  |

ETH ETH stETH stETH |

$99.9M | $9.99k | -$125M |

TVL Winners & Losers

PYUSD and USDS got their own Strategic Reserves pool this week, leading to $25.2M of extra TVL.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$25.2M | +$25.2M |

| 2 |  |

DOLA DOLA sUSDe sUSDe |

$45.7M | +$3.14M |

| 3 |  |

USDC USDC crvUSD crvUSD |

$19.2M | +$2.9M |

| ... | ... | ... | ... | ... |

| -1 |  |

WETH WETH superOETHb superOETHb |

$98M | -$11.1M |

| 0 |  |

OETH OETH WETH WETH |

$102M | -$13.7M |

| 1 |  |

ETH ETH stETH stETH |

$190M | -$27M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

WBTC was the preferred asset during the week's volatility, with plain WETH seeing the largest borrowing outflows.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$89M | $46.9M | +$301k |

| 2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$6.69M | $2.57M | +$77.2k |

| 3 |  |

crvUSD crvUSD weETH weETH |

$4.76M | $1.27M | +$3.9k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD wstETH wstETH |

$17.4M | $8.96M | -$234k |

| -2 |  |

crvUSD crvUSD LBTC LBTC |

$256k | $130k | -$289k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$75.2M | $39.1M | -$2.1M |

Lend Markets - Borrowing Winners & Losers

The sreUSD market saw a $4.4M increase in crvUSD supply this week, which spurred over $3.3M in new borrowing as users engaged in profitable yield looping. It also appears that borrowers have migrated from the older sDOLA market to the new, larger market.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$7.36M | $5.57M | +$3.32M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$30M | $25.7M | +$971k |

| 3 |  |

crvUSD crvUSD CRV CRV |

$4.99M | $3.86M | +$94k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$3.5M | $2.4M | -$533k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$1.25M | $213k | -$1M |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$22.9M | $18.2M | -$1.15M |

Lend Markets - Supplying Winners & Losers

As borrowers closed loans for ETH and it's derivatives, crvUSD supply seems to have moved to other markets.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$7.36M | $5.57M | +$4.4M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$30M | $25.7M | +$383k |

| 3 |  |

crvUSD crvUSD ynETHx ynETHx |

$157k | $70.7k | +$83.5k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$3.5M | $2.4M | -$277k |

| -2 |  |

crvUSD crvUSD wstETH wstETH |

$2.25M | $1.84M | -$285k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$22.9M | $18.2M | -$1.46M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.