Curve Best Yields & Key Metrics | Week 38, 2025

Weekly yield and Curve ecosystem metric updates as of the 18th September, 2025

Market Overview

It was a positive week for Curve, here's the news:

- TVL has increased to $2.645B, up 1.8% this week.

- Minted crvUSD is up 5.7% for the week.

- The governance vote for YieldBasis's crvUSD loan is live and ongoing. If it passes, YB is clear to launch next week.

As always, Curve has some great yields available. Check out the highlighted opportunities and metrics below.

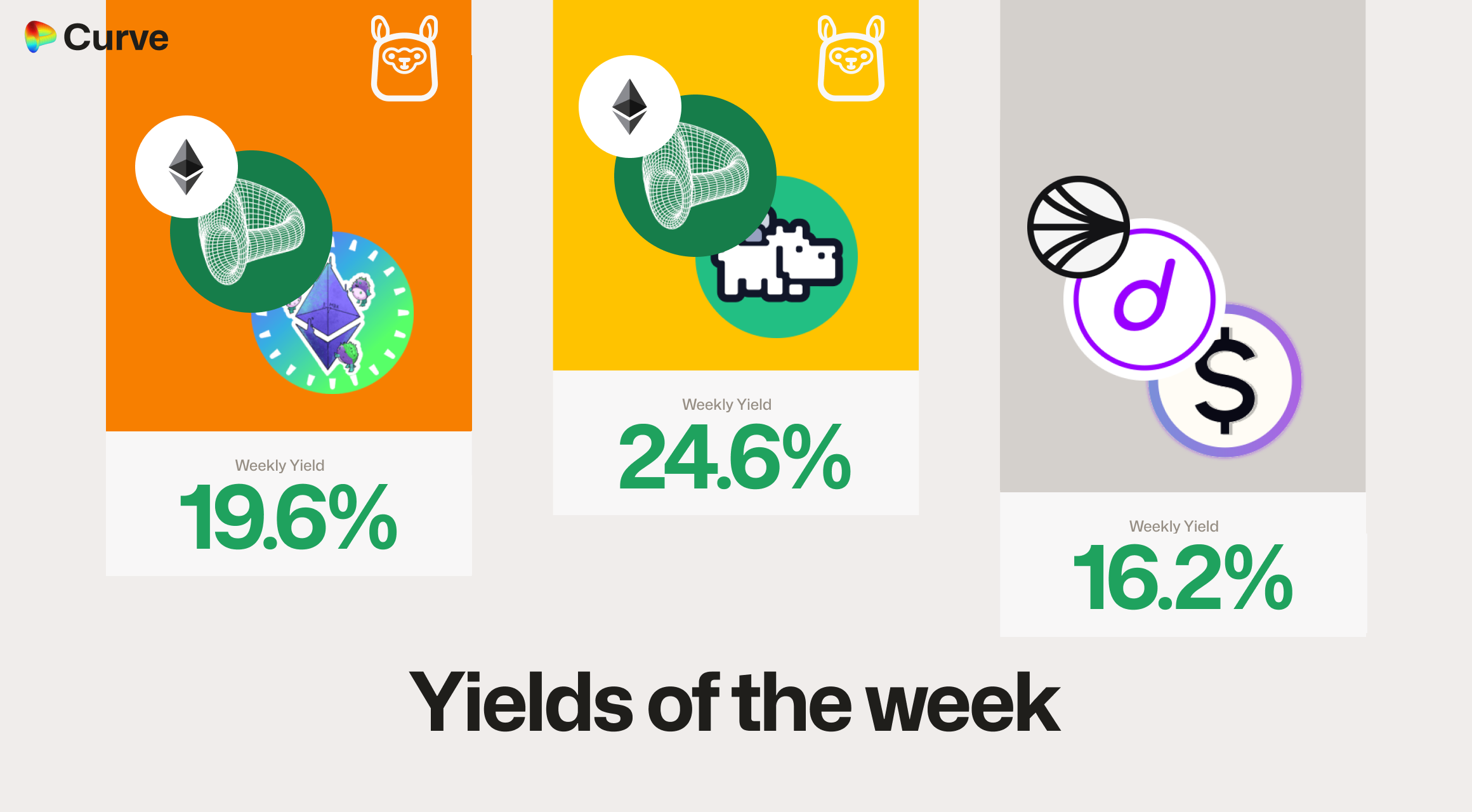

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD sreUSD sreUSD |

Llamalend | 24.6% |

|

crvUSD crvUSD pufETH pufETH |

Llamalend | 19.6% |

|

sdUSD sdUSD wstkscUSD wstkscUSD |

Pool | 16.2% |

|

alUSD alUSD USDC USDC |

Pool | 15.4% |

|

frxUSD frxUSD USDe USDe |

Pool | 15.0% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.6% |

|

crvUSD crvUSD EYWA EYWA |

Llamalend | 13.4% |

|

WETH WETH USDC USDC |

Pool | 12.5% |

|

sdUSD sdUSD sfrxUSD sfrxUSD |

Pool | 12.5% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 5.7% |

|

sfrxETH sfrxETH rsETH rsETH |

ETH | 5.5% |

|

uniETH uniETH frxETH frxETH |

ETH | 5.0% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.6% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 1.8% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 1.8% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 22.9% |

|

CRV CRV crvUSD crvUSD |

CRV | 14.3% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.7% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 6.2% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.2% |

|

EURA EURA EURC EURC |

EUR | 2.3% |

Weekly Metrics

crvUSD & scrvUSD

The amount of crvUSD minted increased by over 5% this week. The peg stability reserves bought back $14M of deployed crvUSD to profit from the very slight depeg and keep the crvUSD peg firm. Because of this slight depeg, the borrow rate has also increased.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$115M | +5.7% |

Peg Stability Reserves Peg Stability Reserves |

$957k | -$14.9M |

scrvUSD Yield scrvUSD Yield |

6.5% | -3.2% |

crvUSD in crvUSD in scrvUSD scrvUSD |

47.6% | -3.5% |

crvUSD Price crvUSD Price |

$0.9996 | -$0.0006 |

Avg. Borrow Rate Avg. Borrow Rate |

11.9% | +5.5% |

Llamalend

Llamalend's metrics are up across the board this week. Interestingly, the number of loans actually decreased, which suggests the increase is from current users growing their position sizes and supplied amounts.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $382M | +5.6% |

| 🦙 Supplied | $109M | +6.7% |

| 🦙 Borrowed | $201M | +5.6% |

| 🦙 Collateral | $359M | +5.3% |

| 🦙 Loans | 1570 | -2 |

DEX

All metrics are higher this week, with the largest increase being the generated fees.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.43B | +1.1% |

| 🔄 Volume | $1.62B | +11.4% |

| 🔄 Swaps | 380k | +10.9% |

| 🔄 Total Fees | $328k | +25.0% |

DAO

DAO metrics stayed steady, the CRV price did lift slightly, which increased the value of emissions, but overall these metrics remain very similar to last week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.4B | +0.3% |

CRV Locked CRV Locked |

866M | -0.2% |

Total veCRV Total veCRV |

789M | -0.1% |

veCRV Distribution veCRV Distribution |

$188k | -1.1% |

CRV Emissions CRV Emissions |

$1.75M (2.22M CRV) | +2.3% |

Inflation Rate Inflation Rate |

5.015% | -0.005% |

DEX Winners & Losers

All metrics are compared to their previous week's value.

Fees Winners & Losers

Ripple's RLUSD/USDC pool had the largest increase in fees this week, with the DAI/USDC/USDT pool a close second and PayPal's PYUSD/USDC pool in third.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC RLUSD RLUSD |

$98.4M | $19.7k | +$12.8k |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$122M | $18.3k | +$11k |

| 3 |  |

PYUSD PYUSD USDC USDC |

$131M | $13.1k | +$7.93k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sUSDe sUSDe sUSDS sUSDS |

$12.5M | $2.5k | -$3.52k |

| -2 |  |

WETH WETH INV INV |

$620k | $2.92k | -$4.61k |

| -1 |  |

ELG ELG USDT0 USDT0 |

$620k | $2.92k | -$4.61k |

Volume Winners & Losers

The PYUSD/USDC and DAI/USDC/USDT pools saw a substantial volume increase this week. However, some pools that have been performing well recently saw huge drops in their volumes, such as the sUSDS/USDT and USDT/USDC pools.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDC USDC |

$131M | $13.1k | +$79.3M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$122M | $18.3k | +$73.3M |

| 3 |  |

USDC USDC RLUSD RLUSD |

$98.4M | $19.7k | +$64.2M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDai USDai USDC USDC |

$39.1M | $3.91k | -$19.3M |

| -2 |  |

USDC USDC USDT USDT |

$52.1M | $521 | -$82.7M |

| -1 |  |

sUSDS sUSDS USDT USDT |

$78.9M | $789 | -$277M |

TVL Winners & Losers

TVL in ETH pools was up this week, mostly due to the increase in ETH's price. On the other hand, the crvUSD/USDC pool was the biggest loser, losing just under 50% of its TVL, largely because $14M of Peg Stability Reserves were withdrawn.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

ETH ETH stETH stETH |

$217M | +$11.5M |

| 2 |  |

OETH OETH WETH WETH |

$117M | +$6.95M |

| 3 |  |

USD0 USD0 USD0++ USD0++ |

$50.4M | +$5.25M |

| ... | ... | ... | ... | ... |

| -3 |  |

sUSDai sUSDai USDC USDC |

$10.7M | -$4.41M |

| -2 |  |

deUSD deUSD USDC USDC |

$8.89M | -$5.65M |

| -1 |  |

USDC USDC crvUSD crvUSD |

$16.3M | -$15.7M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

crvUSD minting markets saw over $5M of new borrows this week, with wstETH being the growth winner.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD wstETH wstETH |

$19.6M | $9.19M | +$3.31M |

| 2 |  |

crvUSD crvUSD tBTC tBTC |

$27M | $11.7M | +$1.76M |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$7.5M | $2.49M | +$745k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD LBTC LBTC |

$761k | $419k | +$179 |

| -2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$726k | $149k | +$77.1 |

| -1 |  |

crvUSD crvUSD weETH weETH |

$5.42M | $1.26M | -$23.2k |

Lend Markets - Borrowing Winners & Losers

It has become a weekly tradition now that the lend markets with the largest supply increases are also the markets with the largest borrowing increases. Demand and supply seem to be moving in unison.

The biggest growth stories this week are the fxSAVE and sreUSD markets, both of which grew substantially in percentage terms.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$30M | $24.8M | +$3.24M |

| 2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$7.58M | $6.02M | +$2.58M |

| 3 |  |

crvUSD crvUSD sreUSD sreUSD |

$2.74M | $2.25M | +$2.14M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$15.3M | $12.6M | -$477k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$1.42M | $1.22M | -$579k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$24.4M | $19.3M | -$1.84M |

Lend Markets - Supplying Winners & Losers

The weekly winners and losers here are once again almost the same as the winners and losers from the borrowing markets.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$30M | $24.8M | +$4.43M |

| 2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$7.58M | $6.02M | +$3.17M |

| 3 |  |

crvUSD crvUSD sreUSD sreUSD |

$2.74M | $2.25M | +$2.61M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDS sUSDS |

$1.77M | $1.23M | -$470k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$1.42M | $1.22M | -$607k |

| -1 |  |

crvUSD crvUSD sUSDe sUSDe |

$24.4M | $19.3M | -$2.33M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.