Curve Best Yields & Key Metrics | Week 34, 2025

Weekly yield and Curve ecosystem metric updates as of the 21st August, 2025

Market Overview

Well, after a few weeks of up only, we had a down week. There was still a lot of positive news for Curve though, here's what you need to know:

- After a record TVL for 2025 last week, TVL has moderated slightly, down 6.0% to $2.715B.

- Yield basis is getting ready to launch, with thorough discussion happening around their current Curve governance proposal.

- Binance has integrated Curve directly into their wallet.

- The new smart contracts for Cryptoswap pools have been released, this version will be called FxSwap, because it enables efficient use cases like forex pools, better BTC/USD swaps, and more.

See all the weekly metrics and some of the best opportunities for yield available below.

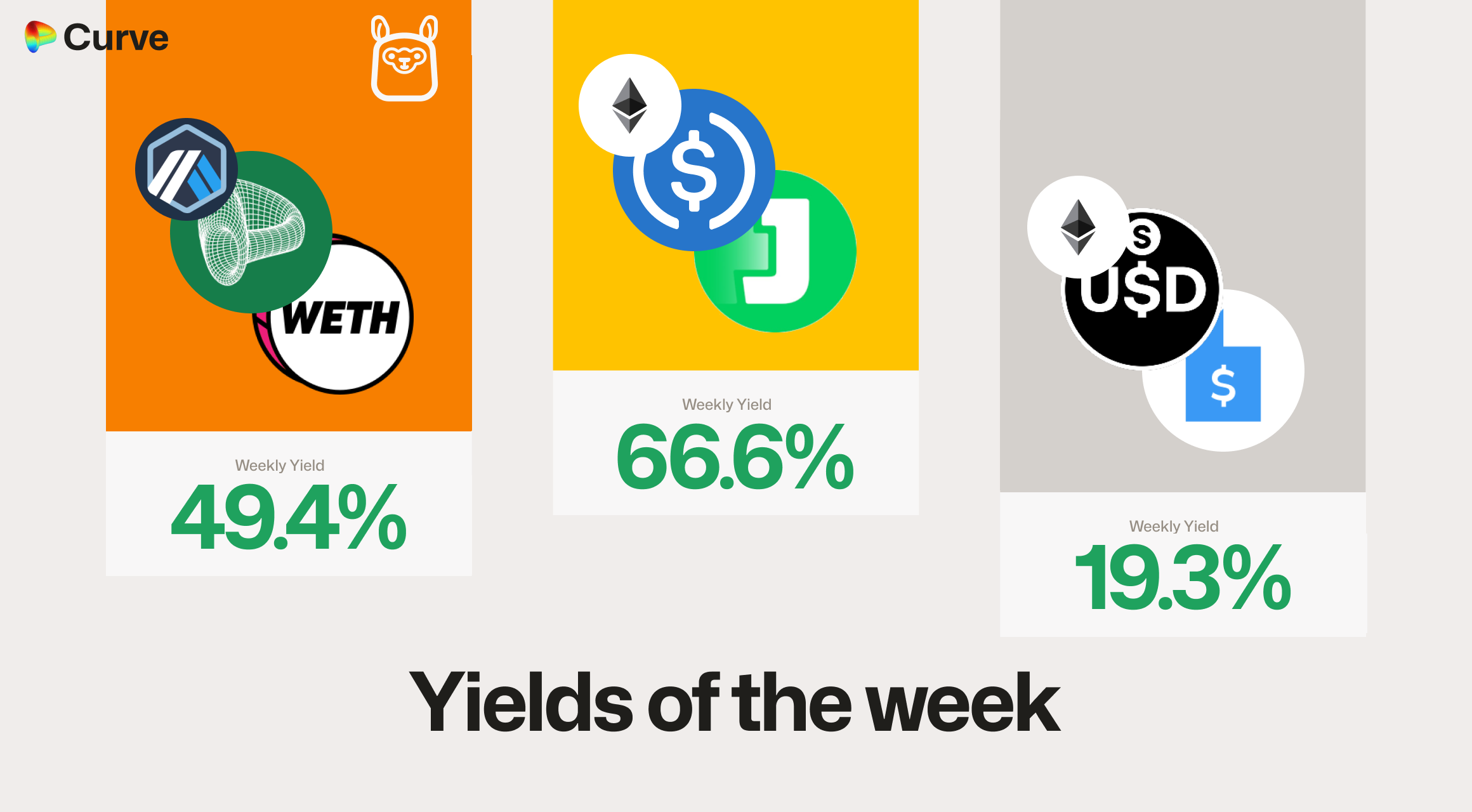

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDC USDC jUSD jUSD |

Pool | 66.6% |

|

crvUSD crvUSD WETH WETH |

Llamalend | 49.4% |

|

litUSD litUSD sfrxUSD sfrxUSD |

Pool | 19.3% |

|

crvUSD crvUSD ycvxCRV ycvxCRV |

Llamalend | 19.2% |

|

crvUSD crvUSD fxSAVE fxSAVE |

Llamalend | 18.6% |

|

USDT USDT USDN USDN |

Pool | 15.7% |

|

dUSD dUSD frxUSD frxUSD |

Pool | 14.9% |

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 14.2% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.8% |

|

fxUSD fxUSD USDN USDN |

Pool | 12.4% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC uniBTC uniBTC |

BTC | 7.2% |

|

uniETH uniETH frxETH frxETH |

ETH | 6.1% |

|

scETH scETH frxETH frxETH |

ETH | 5.9% |

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 5.5% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.0% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 1.2% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 26.2% |

|

CrossCurve CRV CrossCurve CRV |

CRV | 19.0% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 10.6% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 10.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.9% |

|

EURA EURA EURC EURC |

EUR | 2.2% |

Weekly Metrics

crvUSD & scrvUSD

Lately it's been a great time to be in the scrvUSD vault, with many weeks of high yield now. The peg remains strong, and the amount of minted crvUSD is not subsiding substantially even with this pullback in markets, a positive signal.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$117M | -3.3% |

Peg Stability Reserves Peg Stability Reserves |

$11M | - |

scrvUSD Yield scrvUSD Yield |

7.7% | +0.4% |

crvUSD in crvUSD in scrvUSD scrvUSD |

46.3% | +4.1% |

crvUSD Price crvUSD Price |

$0.9997 | -$0.0005 |

Avg. Borrow Rate Avg. Borrow Rate |

7.5% | -0.1% |

Llamalend

TVL is down, but this is mostly due to collateral values decreasing. Users are largely keeping their loans open, and with Curve's in liquidation protection, this makes sense.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $263M | -9.4% |

| 🦙 Supplied | $109M | -1.8% |

| 🦙 Borrowed | $200M | -1.7% |

| 🦙 Collateral | $354M | -7.6% |

| 🦙 Loans | 1593 | -6 |

DEX

Number of swaps are up, however volumes and TVL has subsided. Yet total fees paid by swappers have not decreased as much as volume. So this must mean users this week are swapping in higher fee pools.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.46B | -5.2% |

| 🔄 Volume | $1.93B | -23.5% |

| 🔄 Swaps | 493k | +3.7% |

| 🔄 Total Fees | $406k | -12.2% |

DAO

Most metrics across the DAO stayed the same this week. However, the value of CRV emissions has reduced, because the CRV price has reduced.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.39B | +0.2% |

CRV Locked CRV Locked |

871M | -0.1% |

Total veCRV Total veCRV |

794M | -0.2% |

veCRV Distribution veCRV Distribution |

$242k | -1.8% |

CRV Emissions CRV Emissions |

$1.96M (2.22M CRV) | -8.3% |

Inflation Rate Inflation Rate |

5.0% | -0.1% |

DEX Winners & Losers

Fees Winners & Losers

Stableswap pools were the winners this week for fees, even in a time of volatility, with Metronome's msETH/WETH pool the biggest winner for the week. Also, because stETH volatility and has now decreased, their pools were the largest losers for the week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

msETH msETH WETH WETH |

$52.3M | $20.9k | +$10.4k |

| 2 |  |

PYUSD PYUSD USDC USDC |

$131M | $13.1k | +$10k |

| 3 |  |

msUSD msUSD FRAX FRAX USDC USDC |

$54.7M | $21.9k | +$9.65k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$77.4M | $6.2k | -$7.96k |

| -2 |  |

WETH WETH CVX CVX |

$4.25M | $15.6k | -$9.47k |

| -1 |  |

ETH ETH stETH stETH |

$225M | $22.5k | -$27.2k |

Volume Winners & Losers

Some of the fee winners and losers can be seen within these volume numbers. However PayPal's PYUSD pool has topped the charts for the winners, with a huge extra $100M volume this week, nearly 4 times it's usual value.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDC USDC |

$131M | $13.1k | +$100M |

| 2 |  |

USDT USDT USDe USDe |

$37.2M | $1.12k | +$30.7M |

| 3 |  |

msETH msETH WETH WETH |

$52.3M | $20.9k | +$26M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC USDT USDT |

$136M | $1.36k | -$99M |

| -2 |  |

ETH ETH stETH stETH |

$77.4M | $6.2k | -$99.5M |

| -1 |  |

ETH ETH stETH stETH |

$225M | $22.5k | -$272M |

TVL Winners & Losers

BTC pools on TAC (Telegram's EVM network) were some of the biggest winners for the week for TVL. Also, USDL's TVL seems to have moderated after it's huge rise and fall in popularity over the last few weeks.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

FRAX FRAX USDe USDe |

$75.2M | +$7.5M |

| 2 |  |

uniBTC uniBTC satUniBTC satUniBTC |

$2.74M | +$2.71M |

| 3 |  |

uniBTC uniBTC M-BTC M-BTC |

$2.66M | +$2.62M |

| ... | ... | ... | ... | ... |

| -3 |  |

USDL USDL USDC USDC |

$9.89M | -$11M |

| -2 |  |

FRAX FRAX sDAI sDAI |

$204k | -$11.4M |

| -1 |  |

ETH ETH stETH stETH |

$201M | -$17.7M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

Small changes across the board for crvUSD markets, with only the LBTC market unfortunately seeing substantial changes as a large borrower closed their loan.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD weETH weETH |

$5.3M | $1.34M | +$352k |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$18.2M | $6.99M | +$187k |

| 3 |  |

crvUSD crvUSD tBTC tBTC |

$23.5M | $10.1M | +$2.97k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD cbBTC cbBTC |

$6.31M | $3.95M | -$1.29M |

| -2 |  |

crvUSD crvUSD WETH WETH |

$86.6M | $40.3M | -$1.4M |

| -1 |  |

crvUSD crvUSD LBTC LBTC |

$857k | $496k | -$1.45M |

Lend Markets - Borrowing Winners & Losers

The biggest borrowing winners and losers seemed to come out roughly even. With the WETH market being the biggest winner, and f(x)'s fxSAVE rising quickly in popularity and demand, with borrows doubling during the week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$3.58M | $2.65M | +$778k |

| 2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$557k | $509k | +$268k |

| 3 |  |

crvUSD crvUSD sDOLA sDOLA |

$20.6M | $16.5M | +$252k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD CRV CRV |

$4.9M | $3.48M | -$197k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$3.59M | $3.06M | -$320k |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$6.3M | $5.23M | -$401k |

Lend Markets - Supplying Winners & Losers

People liked to lend to yield bearing stablecoin markets this week, while withdrawing supply to volatile assets.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sUSDe sUSDe |

$33.5M | $25.4M | +$786k |

| 2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$18.7M | $15.3M | +$366k |

| 3 |  |

crvUSD crvUSD sDOLA sDOLA |

$20.6M | $16.5M | +$306k |

| ... | ... | ... | ... | ... | ... |

| 76 |  |

crvUSD crvUSD sDOLA sDOLA |

$3.59M | $3.06M | -$341k |

| 77 |  |

crvUSD crvUSD WETH WETH |

$3.58M | $2.65M | -$529k |

| 78 |  |

crvUSD crvUSD WBTC WBTC |

$6.3M | $5.23M | -$2.4M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.