Curve Best Yields & Key Metrics | Week 33, 2025

Weekly yield and Curve ecosystem metric updates as of the 14th August, 2025

Market Overview

What a week! The Curve DAO just turned 5, and we're celebrating with some great numbers to match.

- Total Value Locked (TVL) is up 11.7%, hitting $2.888B, a new high for 2025!

- To celebrate its birthday, the Curve DAO saw its programmed yearly decrease in CRV emissions, which reduced yearly inflation from 6% to 5%.

- Read about the Rise of Curve here: Curve Finance: The Rise of the Home of Stablecoins

Below, you'll find a breakdown of the week's metrics and a look at some of the best yield opportunities on Curve right now.

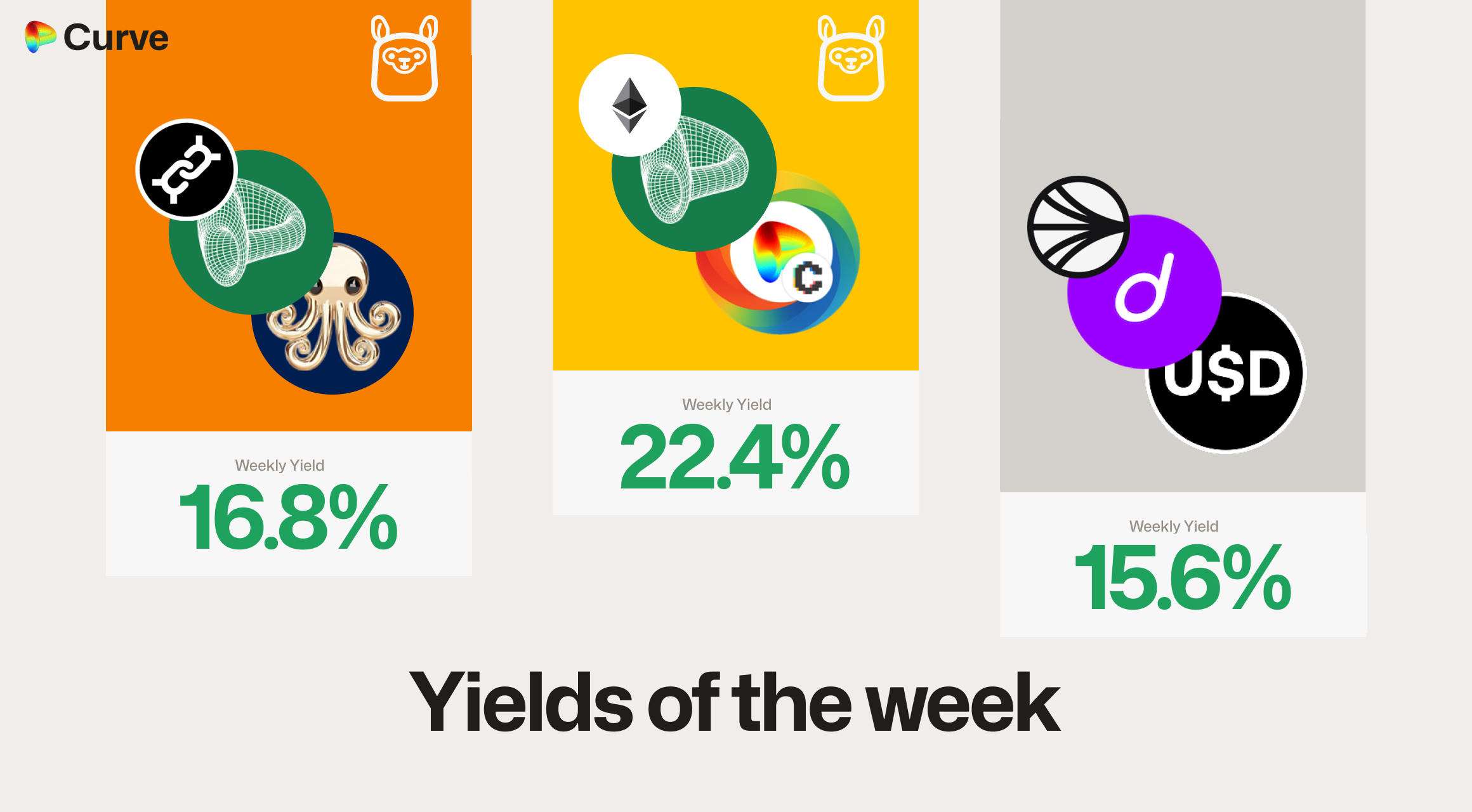

Top Yields

USD Stablecoins

This week, we're seeing yields spread across a variety of pools, with many offering attractive opportunities over 12%. Leading the pack are the Llamalend markets, which are topping the charts with the best available crvUSD yields. As sUSD has now recovered its peg, we've included it in our list of top opportunities as well.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD ycvxCRV ycvxCRV |

Llamalend | 22.4% |

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 16.8% |

|

dUSD dUSD frxUSD frxUSD |

Pool | 15.6% |

|

sUSD sUSD sUSDe sUSDe |

Pool | 14.9% |

|

alUSD alUSD USDC USDC |

Pool | 14.7% |

|

crvUSD crvUSD fxSAVE fxSAVE |

Llamalend | 14.2% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 13.4% |

|

sUSD sUSD DAI DAI USDC.e USDC.e USDT USDT |

Pool | 13.1% |

|

msUSD msUSD FRAX FRAX USDC USDC |

Pool | 12.8% |

|

crvUSD crvUSD CRV CRV |

Llamalend | 12.7% |

Top BTC & ETH Yields

Yields across major crypto assets have seen a slight downturn this week. Bedrock's uniBTC once again holds the top spot, while the real standout is the stETH concentrated pool, which delivered an impressive organic yield of over 8%.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC uniBTC uniBTC |

BTC | 8.9% |

|

WETH WETH stETH stETH |

ETH | 8.7% |

|

msETH msETH WETH WETH |

ETH | 6.1% |

|

weETH weETH rswETH rswETH |

ETH | 5.7% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 4.1% |

|

tBTC tBTC WBTC WBTC |

BTC | 1.4% |

Other Top Yields

Leading the CRV yield charts is CrossCurve's CRV pool. Meanwhile, for those holding Euros, Curve continues to offer a compelling alternative, with its Euro yields comfortably outperforming traditional bonds.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

xCRV xCRV sCRV_t sCRV_t CRV CRV |

CRV | 39.0% |

|

CRV CRV crvUSD crvUSD |

CRV | 20.2% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 11.3% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 8.4% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 5.5% |

|

EURA EURA EURC EURC |

EUR | 2.5% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD supply continues its steady increase, finding homes in Llamalend markets and DEX pools. Interestingly, this comes as the ratio of crvUSD staking for the 7.3% yielding scrvUSD pool decreases, a rate that is 50% more than Sky's savings rate.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$121M | +2.2% |

Peg Stability Reserves Peg Stability Reserves |

$11M | -$3.94M |

scrvUSD Yield scrvUSD Yield |

7.3% | +0.5% |

crvUSD in crvUSD in scrvUSD scrvUSD |

43.0% | -4.9% |

crvUSD Price crvUSD Price |

$1.0 | +$0.0002 |

Avg. Borrow Rate Avg. Borrow Rate |

7.6% | +1.8% |

Llamalend

Llamalend metrics are on the rise across the board, with the exception of the total number of loans. This suggests that current borrowers are highly confident in the system and its robust, built-in liquidation protection.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $291M | +9.4% |

| 🦙 Supplied | $112M | +2.3% |

| 🦙 Borrowed | $203M | +3.0% |

| 🦙 Collateral | $383M | +8.0% |

| 🦙 Loans | 1598 | -28 |

DEX

As is often the case, volatility proved to be beneficial for liquidity providers this week. Average swap sizes increased by approximately 20%, contributing to a 25% increase in total fees paid by swappers.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.59B | +11.4% |

| 🔄 Volume | $2.52B | +19.4% |

| 🔄 Swaps | 475k | -0.2% |

| 🔄 Total Fees | $462k | +25.2% |

DAO

This week, the programmed annual 16% CRV emissions reduction went into effect. This yearly reduction, which mirrors Bitcoin's halving model (reducing emissions by 50% every four years), successfully lowered the annual inflation rate from 6% to 5%. This dropped weekly CRV emissions from 2.64M to 2.22M, which is the direct cause of the decrease in the weekly CRV emission amount.

Interestingly, total veCRV is up, suggesting that some CRV lockers renewed their commitments this week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.39B | +0.2% |

CRV Locked CRV Locked |

872M | - |

Total veCRV Total veCRV |

795M | +0.3% |

veCRV Distribution veCRV Distribution |

$246k | +3.7% |

CRV Emissions CRV Emissions |

$2.14M (2.22M CRV) | -11.7% |

Inflation Rate Inflation Rate |

5.0% | -16.0% |

DEX Winners & Losers

Looking at the DEX, it was a great week for stETH pools. Thanks to the bump in ETH's price, they came out on top in TVL, volumes, and fees for liquidity providers.

Fees Winners & Losers

It's great to see Stargate's STG Cryptoswap pool have significant fee generation for their LPs, while it's interesting to see some of the winning pools from last week turning into the losers for fee generation this week as markets ebb and flow.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

ETH ETH stETH stETH |

$497M | $49.7k | +$30.6k |

| 2 |  |

STG STG USDC USDC |

$3.78M | $13.4k | +$10.6k |

| 3 |  |

ETH ETH stETH stETH |

$177M | $14.2k | +$9.29k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sDAI sDAI sUSDe sUSDe |

$38.2M | $7.65k | -$7.43k |

| -2 |  |

WETH WETH CVX CVX |

$6.97M | $25.1k | -$8.72k |

| -1 |  |

USDL USDL USDC USDC |

$12.6M | $1.26k | -$8.89k |

Volume Winners & Losers

Liquidity demand shifted this week, with ETH being the star of the show while USD stablecoins were a bit less sought after.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

ETH ETH stETH stETH |

$497M | $49.7k | +$306M |

| 2 |  |

WETH WETH weETH weETH |

$138M | $6.88k | +$118M |

| 3 |  |

ETH ETH stETH stETH |

$177M | $14.2k | +$116M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sDAI sDAI sUSDe sUSDe |

$38.2M | $7.65k | -$37.1M |

| -2 |  |

USDL USDL USDC USDC |

$12.6M | $1.26k | -$88.9M |

| -1 |  |

sUSDS sUSDS USDT USDT |

$274M | $2.74k | -$140M |

TVL Winners & Losers

Curve's Base deployment had the biggest TVL winner this week, as Origin's SuperOETH pool almost doubled it's TVL.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

WETH WETH superOETHb superOETHb |

$109M | +$50.2M |

| 2 |  |

ETH ETH stETH stETH |

$216M | +$35M |

| 3 |  |

OETH OETH WETH WETH |

$115M | +$18.7M |

| ... | ... | ... | ... | ... |

| -3 |  |

USDC USDC RLUSD RLUSD |

$55.6M | -$2.66M |

| -2 |  |

TBTC TBTC renBTC renBTC WBTC WBTC sBTC sBTC |

$1.02M | -$5.12M |

| -1 |  |

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

$6.98M | -$8.54M |

Llamalend Winners & Losers

An interesting trend emerged in Llamalend user behavior this week:

- Users with WETH collateral shifted from Lend markets to crvUSD Minting markets.

- Conversely, users with WBTC collateral moved from crvUSD Minting markets to Lend markets.

Despite these internal reallocations, the platform saw a net increase of $6M in total borrows and a $5M increase in crvUSD supplied to Lend markets, highlighting a strong overall growth for the protocol.

crvUSD Minting Markets - Borrowing Winners & Losers

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$94.6M | $41.7M | +$6.26M |

| 2 |  |

crvUSD crvUSD tBTC tBTC |

$25.3M | $10.1M | +$82.4k |

| 3 |  |

crvUSD crvUSD cbBTC cbBTC |

$8.55M | $5.24M | +$31k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD LBTC LBTC |

$3.19M | $1.95M | -$5.53k |

| -2 |  |

crvUSD crvUSD wstETH wstETH |

$20.9M | $6.81M | -$764k |

| -1 |  |

crvUSD crvUSD WBTC WBTC |

$104M | $51.8M | -$2.92M |

Lend Markets - Borrowing Winners & Losers

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$20.3M | $16.2M | +$3.43M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$8.7M | $5.63M | +$725k |

| 3 |  |

crvUSD crvUSD sUSDe sUSDe |

$32.7M | $25.6M | +$269k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$198k | $77.2k | -$133k |

| -2 |  |

crvUSD crvUSD WETH WETH |

$4.11M | $1.87M | -$842k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$19M | $15.2M | -$951k |

Lend Markets - Supplying Winners & Losers

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$20.3M | $16.2M | +$3.76M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$8.7M | $5.63M | +$1.98M |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$1.94M | $1.05M | +$139k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$32.7M | $25.6M | -$272k |

| -2 |  |

crvUSD crvUSD sDOLA sDOLA |

$3.93M | $3.38M | -$279k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$19M | $15.2M | -$2.12M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.