Curve Best Yields & Key Metrics | Week 31, 2025

Weekly yield and Curve ecosystem metric updates as of the 31th July, 2025

Market Overview

Well, it's been another interesting week. Volatility has remained high, generating over $2B in volume, which made it another strong week for LPs and the Curve DAO through earned fees. This week, including last week’s unprocessed fees, veCRV holders received a total of $569k. Nice!

Curve’s TVL held steady at $2.57B, down just 1.2%. Top yields are slightly lower this week, as rewards are spread across more pools and markets. That said, there are still great yields available on low-risk assets across the board. Check them out, along with the latest metrics, below.

We’re also trialing a new “Winners and Losers” section for lending markets. Let us know what you think. Feedback is always welcome.

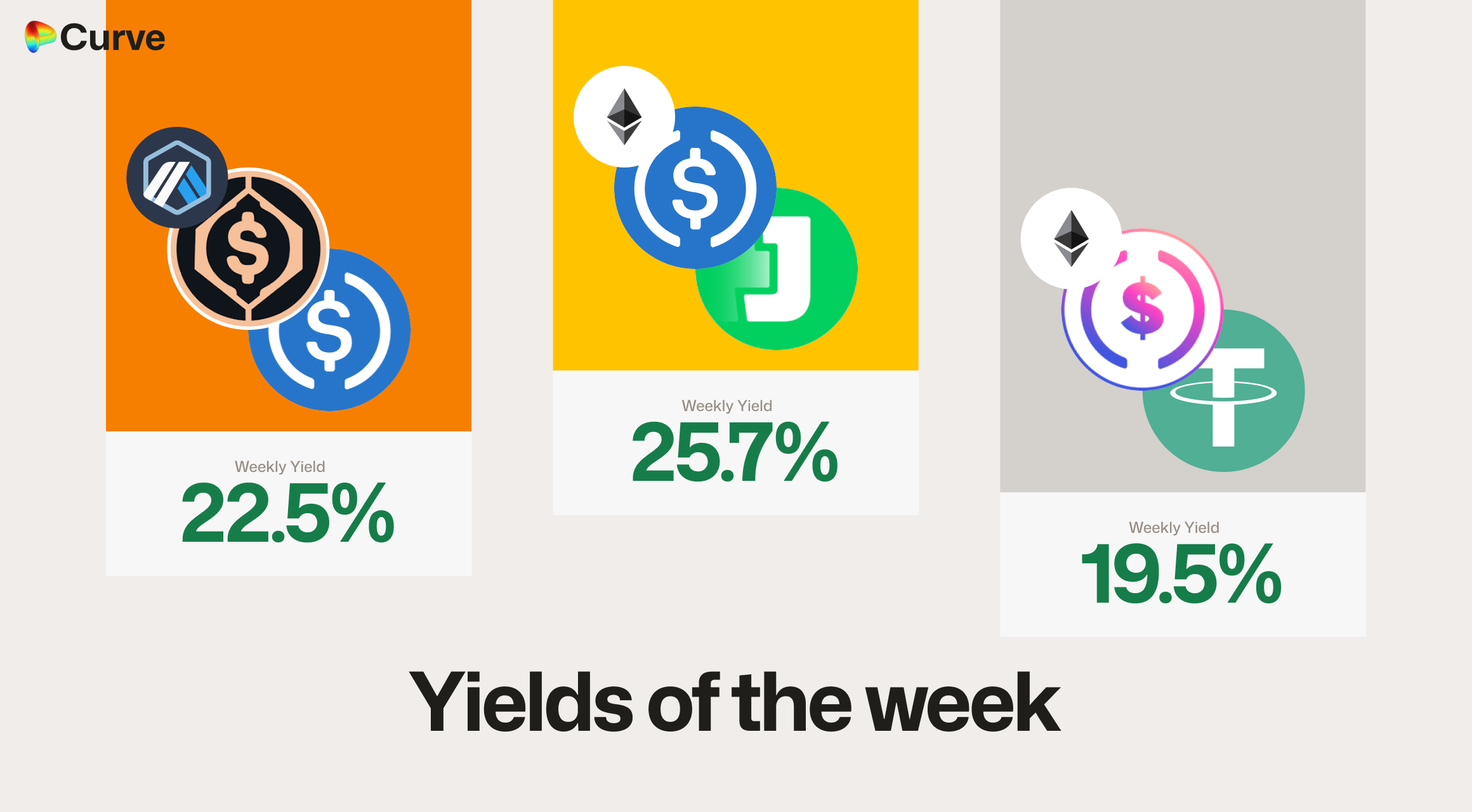

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDC USDC jUSD jUSD |

Pool | 25.7% |

|

alUSD alUSD USDC USDC |

Pool | 22.5% |

|

deUSD deUSD USDT USDT |

Pool | 19.5% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 18.5% |

|

sdeUSD sdeUSD deUSD deUSD |

Pool | 18.3% |

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 17.7% |

|

DOLA DOLA scrvUSD scrvUSD |

Pool | 17.0% |

|

frxUSD frxUSD crvUSD crvUSD |

Pool | 16.0% |

|

deUSD deUSD USDC USDC |

Pool | 15.4% |

|

sfrxUSD sfrxUSD scrvUSD scrvUSD |

Pool | 14.5% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

scETH scETH frxETH frxETH |

ETH | 11.4% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 9.9% |

|

ETH+ ETH+ WETH WETH |

ETH | 7.6% |

|

WETH WETH superOETHb superOETHb |

ETH | 6.9% |

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 6.7% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 5.9% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 2.8% |

|

EBTC EBTC tBTC tBTC |

BTC | 2.0% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CRV CRV frxUSD frxUSD |

CRV | 27.9% |

|

CRV CRV crvUSD crvUSD |

CRV | 24.7% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 12.0% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 10.6% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 6.9% |

|

EURA EURA EURC EURC |

EUR | 3.8% |

Weekly Metrics

crvUSD & scrvUSD

After last week's increase across the board, everything is moderating again for now. As always, the peg remains strong, and there is some high, low-risk yield available in the scrvUSD vault.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$116M | -0.5% |

Peg Stability Reserves Peg Stability Reserves |

$12M | -$553k |

scrvUSD Interest Rate scrvUSD Interest Rate |

7.1% | -0.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

45.2% | +0.3% |

crvUSD Price crvUSD Price |

$0.9997 | -$0.0006 |

Avg. Borrow Rate Avg. Borrow Rate |

7.2% | +0.2% |

DEX

After last week's crazy metrics, everything has calmed slightly, but these are still great volumes and fees.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.31B | -1.1% |

| 🔄 Volume | $2.01B | -9.2% |

| 🔄 Swaps | 495k | -0.6% |

| 🔄 Total Fees | $474k | -17.0% |

Llamalend

A few more borrowers have come to Llamalend, with all other metrics remaining steady.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $257M | -1.7% |

| 🦙 Supplied | $103M | -0.2% |

| 🦙 Borrowed | $192M | +1.6% |

| 🦙 Collateral | $346M | -0.3% |

| 🦙 Loans | 1623 | +11 |

DAO

veCRV holders received almost a double distribution of fees this week, after an issue with the automatic conversion to crvUSD prevented all but $80k from being distributed last week. This is why the metric has increased significantly. The recent rise in CRV's price has also boosted the value of emissions distributed to pools and lending markets each week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.38B | +0.2% |

CRV Locked CRV Locked |

873M | +0.1% |

Total veCRV Total veCRV |

796M | -0.4% |

veCRV Distribution veCRV Distribution |

$569k | +614.3% |

CRV Emissions CRV Emissions |

$2.69M (2.64M CRV) | +5.0% |

Inflation Rate Inflation Rate |

6.0% | -0.1% |

Top Pools by Fees

The CVX/WETH pool is once again in the top spot for fees generated. Most of the highest-fee pools this week are Cryptoswap pools (volatile assets), as Stableswap pools (pegged assets) typically offer lower fees and are more competitive.

Fees here are the total fees paid by traders for access to liquidity.

| 📌 | 🔃 | Chain | Pool | Swaps | Volume | Fees |

|---|---|---|---|---|---|---|

| 1 | - |  |

WETH WETH CVX CVX |

3.3k | $17.8M | $67.8k |

| 2 | - |  |

ETH ETH stETH stETH |

1.7k | $349.2M | $34.9k |

| 3 | +2 |  |

USDT USDT WBTC WBTC WETH WETH |

2.5k | $22.3M | $31.2k |

| 4 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

12.4k | $38.8M | $28.2k |

| 5 | +1 |  |

DAI DAI USDC USDC USDT USDT |

1.5k | $142.5M | $21.4k |

| 6 | +4 |  |

frxETH frxETH CVX CVX |

1.4k | $4.7M | $17.3k |

| 7 | - |  |

USDC USDC WBTC WBTC WETH WETH |

7.4k | $32.4M | $16.1k |

| 8 | +1 |  |

USDC USDC RLUSD RLUSD |

114 | $66.5M | $13.3k |

| 9 | +11 |  |

GEAR GEAR ETH ETH |

1.2k | $2.8M | $11.4k |

| 10 | -2 |  |

USDT USDT WBTC WBTC WETH WETH |

5.1k | $18.7M | $11.0k |

Lending Market Winners & Losers

This is a new section highlighting changes and the weekly winners and losers in the Llamalend peer-to-peer lending markets (not to be confused with crvUSD minting markets).

Winners and losers are based on the amount of debt (borrows) or lending (supplies) added or withdrawn over the week.

Borrowing Winners

| Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|

|

crvUSD crvUSD sfrxUSD sfrxUSD |

$19.9M | $15.4M | +$1.63M |

|

crvUSD crvUSD sUSDe sUSDe |

$31.2M | $23.9M | +$1.31M |

|

crvUSD crvUSD CRV CRV |

$4.61M | $3.33M | +$337k |

Borrowing Losers

| Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|

|

crvUSD crvUSD sUSDS sUSDS |

$301k | $181k | -$288k |

|

crvUSD crvUSD asdCRV asdCRV |

$247k | $32.9k | -$178k |

|

crvUSD crvUSD WETH WETH |

$1.42M | $457k | -$93k |

Supplying Winners

| Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|

|

crvUSD crvUSD sfrxUSD sfrxUSD |

$19.9M | $15.4M | +$1.47M |

|

crvUSD crvUSD sUSDe sUSDe |

$31.2M | $23.9M | +$958k |

|

crvUSD crvUSD WETH WETH |

$1.42M | $457k | +$204k |

Supplying Losers

| Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|

|

crvUSD crvUSD WBTC WBTC |

$6.64M | $5.51M | -$1.03M |

|

crvUSD crvUSD sUSDS sUSDS |

$301k | $181k | -$533k |

|

crvUSD crvUSD WETH WETH |

$3.8M | $2.6M | -$513k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.