Curve Best Yields & Key Metrics | Week 3, 2026

Weekly yield and Curve ecosystem metric updates as of the 15th January, 2026

Market Overview

Welcome to another week of yields and metrics!

It’s been a stabilizing but productive week for Curve, with TVL up 2.0% to $2.628B. The crvUSD minted supply also increased, alongside several other key metrics.

See all the highlighted yield opportunities and metrics available below.

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

All highlighted markets below have more than $10M of TVL.

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

crvUSD crvUSD sDOLA sDOLA |

$32.6M | 4.7% |

|

reUSD reUSD scrvUSD scrvUSD |

$13.4M | 4.4% |

|

crvUSD crvUSD sreUSD sreUSD |

$23.1M | 4.1% |

|

frxUSD frxUSD crvUSD crvUSD |

$37.9M | 3.7% |

|

USDC USDC crvUSD crvUSD |

$39.1M | 3.7% |

Other Top USD Yields

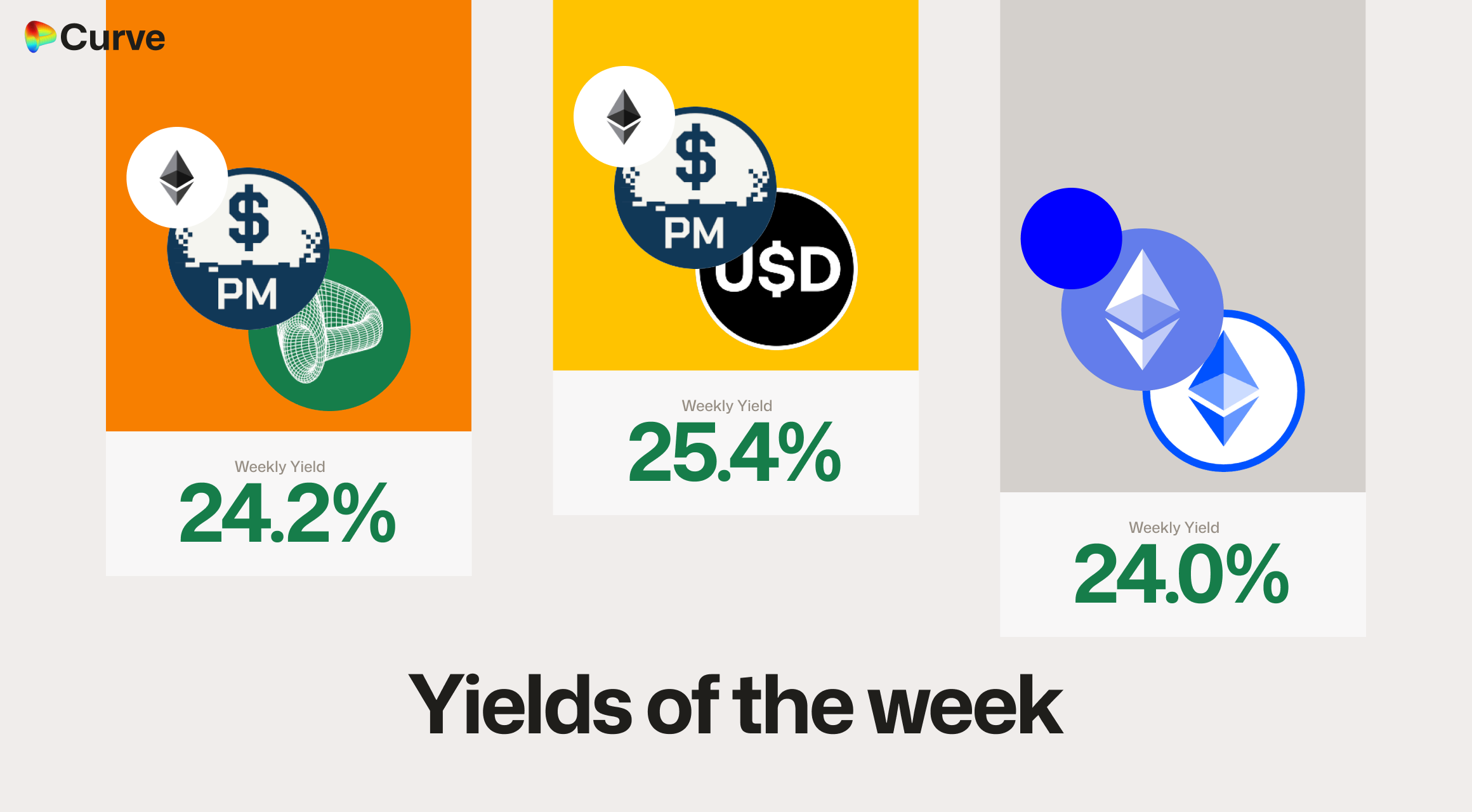

RAAC's pmUSD has dominated the USD yields for the second week in a row.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

pmUSD pmUSD frxUSD frxUSD |

Pool | 25.4% |

|

pmUSD pmUSD crvUSD crvUSD |

Pool | 24.2% |

|

alUSD alUSD USDC USDC |

Pool | 17.0% |

|

USDp USDp frxUSD frxUSD |

Pool | 16.4% |

|

crvUSD crvUSD WBTC WBTC |

Llamalend | 13.0% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 12.2% |

|

frxUSD frxUSD dUSD dUSD |

Pool | 10.8% |

|

crvUSD crvUSD CRV CRV |

Llamalend | 10.6% |

|

crvUSD crvUSD asdCRV asdCRV |

Llamalend | 9.1% |

Top BTC & ETH Yields

Once again there's some great yield available in BTC Stableswap pools. But the winner this week is the ETH/cbETH pool on Base.

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

ETH ETH cbETH cbETH |

ETH | 24.0% |

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 13.3% |

|

OETH OETH ARM-WETH-stETH ARM-WETH-stETH |

ETH | 7.0% |

|

WETH WETH pufETH pufETH |

ETH | 7.0% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 5.8% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 4.8% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CRV CRV crvUSD crvUSD |

CRV | 11.3% |

|

CRV CRV yCRV yCRV |

CRV | 10.3% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 8.6% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 6.4% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.0% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 5.1% |

|

EURA EURA EURC EURC |

EUR | 3.9% |

Weekly Metrics

crvUSD & scrvUSD

The crvUSD minted supply increased again this week, reaching $92.3M. Borrow rates rose slightly as PegKeepers withdrew a portion of deployed Stability Reserves, which helped support the crvUSD price and keep it firmly at the $1 level.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$92.3M | +1.1% |

scrvUSD Yield scrvUSD Yield |

2.5% | +0.6% |

crvUSD in crvUSD in scrvUSD scrvUSD |

20.3% | -1.7% |

crvUSD Price crvUSD Price |

$1.0 | +$0.0007 |

Avg. Borrow Rate Avg. Borrow Rate |

3.1% | +0.3% |

Peg Stability Reserves Peg Stability Reserves |

$35.7M | -$3.49M |

PegKeeper Profit PegKeeper Profit |

$0 | -$3.4k |

Llamalend

The value of collateral in Llamalend increased as ETH and BTC had a strong week. At the same time, the number of loans and the total value borrowed remained largely steady over the week.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $264M | +4.9% |

| 🦙 Supplied | $83.3M | -0.5% |

| 🦙 Borrowed | $162M | -0.3% |

| 🦙 Collateral | $250M | +4.8% |

| 🦙 Loans | 1275 | +14 |

DEX

DEX activity was mixed this week. While total volume declined, swap counts and fees increased, and DEX TVL continued to rise, indicating steady liquidity and active usage despite smaller average trade sizes.

| Metric | Value | Change |

|---|---|---|

| 🔄 DEX TVL | $2.57B | +1.5% |

| 🔄 Volume | $1.24B | -20.0% |

| 🔄 Swaps | 387k | +11.2% |

| 🔄 Total Fees | $259k | +17.0% |

DAO

DAO metrics were stable this week, with veCRV distribution to holders continuing its upward trend.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.47B | +0.3% |

CRV Locked CRV Locked |

856M | -0.3% |

Total veCRV Total veCRV |

791M | - |

veCRV Distribution veCRV Distribution |

$112k | +13.2% |

CRV Emissions CRV Emissions |

$911k (2.22M CRV) | -0.2% |

Inflation Rate Inflation Rate |

4.936% | -0.005% |

Top Stableswap Pools

USDS pools win the week again, however it was a great week for the DAI/USDC/USDT pool, with it generating $19k fees all flowing to the DAO.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

sUSDS sUSDS USDT USDT |

$177.7M | $2.8k |

| 2 | -1 |  |

PYUSD PYUSD USDS USDS |

$136.9M | $1.4k |

| 3 | - |  |

DAI DAI USDC USDC USDT USDT |

$126.6M | $19.0k |

| 4 | - |  |

USDC USDC USDT USDT |

$69.6M | $1.0k |

| 5 | +1 |  |

USDC USDC RLUSD RLUSD |

$66.6M | $14.1k |

| 6 | -1 |  |

USDT USDT crvUSD crvUSD |

$59.2M | $5.9k |

| 7 | +1 |  |

USDC USDC crvUSD crvUSD |

$34.3M | $3.4k |

| 8 | +1 |  |

WETH WETH weETH weETH |

$30.4M | $1.6k |

| 9 | -2 |  |

NUSD NUSD USDC USDC |

$29.8M | $3.1k |

| 10 | +1 |  |

PYUSD PYUSD USDC USDC |

$23.5M | $2.4k |

Top Cryptoswap Pools

The top Cryptoswap pools were largely unchanged this week. One notable exception was YieldBasis’s new WETH/crvUSD pool, which stood out with strong fee generation relative to volume.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  |

USDC USDC WBTC WBTC WETH WETH |

$18.4M | $9.4k |

| 2 | -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$15.5M | $19.9k |

| 3 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$14.0M | $7.2k |

| 4 | +6 |  |

crvUSD crvUSD WETH WETH |

$11.8M | $63.7k |

| 5 | -1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$11.6M | $5.9k |

| 6 | +1 |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$1.9M | $1.4k |

DEX Winners & Losers

Fees Winners & Losers

The new YieldBasis WETH/crvUSD pool appears again in the fees table this week. While its fees accrue to YieldBasis rather than Curve directly, the pool highlights the capital efficiency of the new FXSwap design under real trading conditions. The pool will be removed from this section next week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$11.8M | $63.7k | +$61.6k |

| 2 |  |

USDS USDS stUSDS stUSDS |

$2.57M | $2.65k | +$2.43k |

| 3 |  |

msETH msETH WETH WETH |

$11.4M | $4.56k | +$2.36k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

PYUSD PYUSD USDS USDS |

$137M | $1.43k | -$2.93k |

| -2 |  |

frxETH frxETH CVX CVX |

$439k | $1.45k | -$7.52k |

| -1 |  |

WETH WETH CVX CVX |

$1.68M | $5.4k | -$26.1k |

Volume Winners & Losers

Ethena’s USDtb stablecoin led the week in volume growth, more than doubling its weekly trading activity. PYUSD/USDS recorded the largest decline week over week, though volumes remained elevated at $137M, with the drop reflecting a pullback from an unusually strong prior week rather than weak underlying activity.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

USDC USDC USDtb USDtb |

$21.8M | $2.27k | +$13.6M |

| 2 |  |

crvUSD crvUSD WETH WETH |

$11.8M | $63.7k | +$11.3M |

| 3 |  |

USDG USDG USDC USDC |

$11.5M | $1.16k | +$9.96M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sUSDS sUSDS USDT USDT |

$178M | $2.76k | -$25.2M |

| -2 |  |

NUSD NUSD USDC USDC |

$29.8M | $3.05k | -$26.4M |

| -1 |  |

PYUSD PYUSD USDS USDS |

$137M | $1.43k | -$267M |

TVL Winners & Losers

TVL increases among the top gainers were driven primarily by higher BTC and ETH prices. Whereas decreases were mainly driven by reduced incentives.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD cbBTC cbBTC |

$221M | +$11.2M |

| 2 |  |

ETH ETH stETH stETH |

$149M | +$10.3M |

| 3 |  |

crvUSD crvUSD tBTC tBTC |

$109M | +$7.3M |

| ... | ... | ... | ... | ... |

| -3 |  |

WBTC WBTC LBTC LBTC BTC.b BTC.b |

$5.12M | -$4.71M |

| -2 |  |

USDC USDC RLUSD RLUSD |

$73.9M | -$8.82M |

| -1 |  |

scBTC scBTC sWBTC_ar sWBTC_ar |

$647 | -$9.95M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

ETH-backed markets led borrowing activity this week, with total crvUSD minted increasing by over $1M.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WETH WETH |

$38.5M | $21.3M | +$1.05M |

| 2 |  |

crvUSD crvUSD wstETH wstETH |

$18.2M | $8.92M | +$275k |

| 3 |  |

crvUSD crvUSD LBTC LBTC |

$618k | $351k | +$100k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WBTC WBTC |

$87.3M | $46.9M | -$52.7k |

| -2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$6.85M | $4.11M | -$88.6k |

| -1 |  |

crvUSD crvUSD tBTC tBTC |

$11.3M | $7.08M | -$275k |

Lend Markets - Borrowing Winners & Losers

sreUSD recorded a strong week for borrowing, with crvUSD borrowed increasing by over 8%. In contrast, several other stablecoin markets saw outflows as yields compressed and leveraged yield opportunities became less attractive.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$23.1M | $19.5M | +$1.52M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$731k | $408k | +$30.3k |

| 3 |  |

crvUSD crvUSD sUSDe sUSDe |

$3.07M | $2.77M | +$27.6k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sDOLA sDOLA |

$32.6M | $26.8M | -$641k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$8.06M | $7.63M | -$1.11M |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$6.15M | $5.36M | -$1.17M |

Lend Markets - Supplying Winners & Losers

sreUSD also led in supplied crvUSD this week, posting an increase of over 8%. Notably, despite a decline in borrowing, the sDOLA market saw an increase in supplied crvUSD, indicating more suppliers are chasing the smaller available yields across DeFi.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$23.1M | $19.5M | +$1.82M |

| 2 |  |

crvUSD crvUSD sDOLA sDOLA |

$32.6M | $26.8M | +$393k |

| 3 |  |

crvUSD crvUSD sUSDe sUSDe |

$3.07M | $2.77M | +$33.4k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD wstETH wstETH |

$666k | $534k | -$138k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$6.15M | $5.36M | -$884k |

| -1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$8.06M | $7.63M | -$1.3M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.