Curve Best Yields & Key Metrics | Week 29, 2025

Weekly yield and Curve ecosystem metric updates as of the 17th July, 2025

Market Overview

It has been an absolutely huge week for Curve. Curve's TVL has increased 11.7% to $2.498B, adding over $200M in a single week!

With Curve's great performance there are some many fantastic yields to check out below. Check out the yields, or the metrics below, in this weekly report.

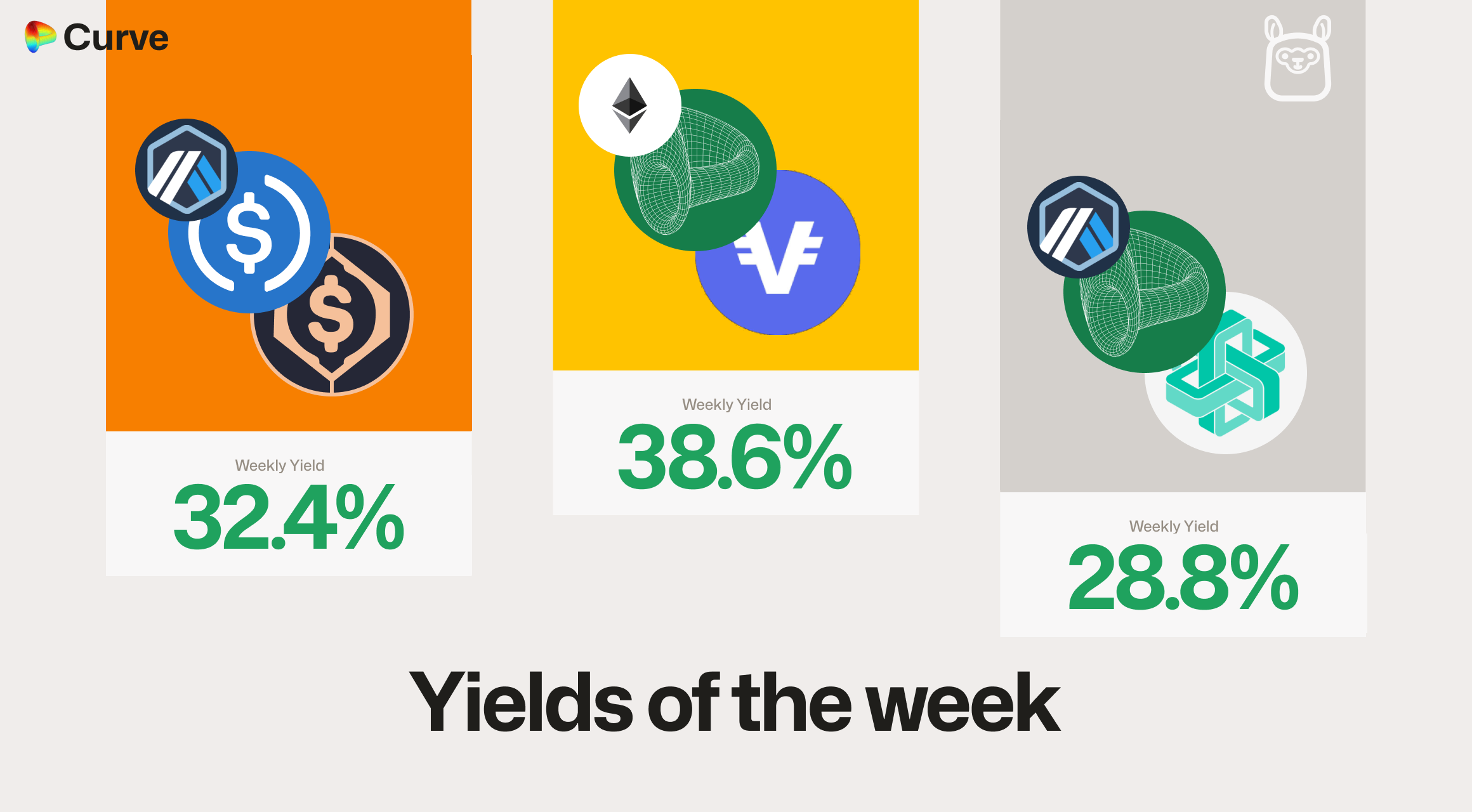

Top Yields

USD Stablecoins

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD VUSD VUSD |

Pool | 38.6% |

|

alUSD alUSD USDC USDC |

Pool | 32.4% |

|

crvUSD crvUSD EYWA EYWA |

Llamalend | 28.8% |

|

frxUSD frxUSD USDf USDf |

Pool | 24.5% |

|

reUSD reUSD sDOLA sDOLA |

Pool | 17.9% |

|

USDC USDC USDf USDf |

Pool | 17.7% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 17.5% |

|

crvUSD crvUSD CRV CRV |

Llamalend | 16.9% |

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 16.8% |

|

msUSD msUSD FRAX FRAX USDC USDC |

Pool | 16.6% |

Top BTC & ETH Yields

This week there are multiple ETH pools yielding over 10%, but there's also a high yielding BTC pool at 12%!

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

uniETH uniETH frxETH frxETH |

ETH | 15.1% |

|

scETH scETH frxETH frxETH |

ETH | 12.9% |

|

uniETH uniETH WETH WETH |

ETH | 12.2% |

|

WBTC WBTC uniBTC uniBTC |

BTC | 12.2% |

|

ETH+ ETH+ WETH WETH |

ETH | 9.2% |

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

BTC | 4.7% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 3.5% |

|

EBTC EBTC tBTC tBTC |

BTC | 3.3% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CRV CRV crvUSD crvUSD |

CRV | 37.4% |

|

xCRV xCRV sCRV_t sCRV_t CRV CRV |

CRV | 35.8% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 13.3% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 12.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 5.0% |

|

EURA EURA EURC EURC |

EUR | 5.0% |

Weekly Metrics

crvUSD & scrvUSD

Users are coming in to borrow crvUSD as the borrowing rate decreases, with the amount minted (borrowed from minting markets) increasing nearly 5%. scrvUSD also acheived the highest risk-free rate of any DeFi stablecoin this week. It's a great time to deposit or borrow crvUSD.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$113M | +4.8% |

Peg Stability Reserves Peg Stability Reserves |

$11.7M | +$41.4k |

scrvUSD Yield scrvUSD Yield |

8.6% | +1.4% |

crvUSD in crvUSD in scrvUSD scrvUSD |

42.6% | -3.2% |

crvUSD Price crvUSD Price |

$1.0001 | +$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

7.1% | +0.1% |

DEX

Everything's up, let's let the numbers speak for themeselves.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.25B | +11.2% |

| 🔄 Volume | $1.56B | +52.8% |

| 🔄 Swaps | 399k | +27.4% |

| 🔄 Total Fees | $421k | +107.9% |

Llamalend

This week we've combined the crvUSD markets and Lending markets under the Llamalend banner, as they've been combined on the official UI. Considering this, all Llamalend metrics are also higher, it's a great time to within the Curve ecosystem.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $254M | +17.3% |

| 🦙 Supplied | $99.9M | +10.3% |

| 🦙 Borrowed | $180M | +5.1% |

| 🦙 Collateral | $334M | +12.4% |

| 🦙 Loans | 1606 | +4 |

DAO

This section is new, it's been created and will evolve to highlight important metrics within the Curve DAO. There's over $800M of locked CRV currently securing the Curve DAO, all locked for an average of 3.65 years.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.37B | +0.2% |

CRV Locked CRV Locked |

873M | - |

Total veCRV Total veCRV |

797M | -0.2% |

veCRV Weekly Fees veCRV Weekly Fees |

$210k | +16.1% |

CRV Emissions (2.64M CRV) CRV Emissions (2.64M CRV) |

$1.77M | +30.4% |

Inflation Rate Inflation Rate |

6.0% | -0.1% |

Top Assets by Fees

The top three assets for fee generation haven't changed, but it's been a huge shakeup for the other assets in this leaderboard.

| Position | Change | Asset | Swaps | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  WETH WETH |

47.0k | $169.0M | $182.6k |

| 2 | - |  USDC USDC |

119.6k | $638.3M | $103.4k |

| 3 | - |  USDT USDT |

61.3k | $483.6M | $67.1k |

| 4 | +2 |  CVX CVX |

2.6k | $14.2M | $57.2k |

| 5 | +5 |  CRV CRV |

49.3k | $28.4M | $32.1k |

| 6 | -1 |  WBTC WBTC |

9.9k | $43.6M | $29.5k |

| 7 | -3 |  crvUSD crvUSD |

100.8k | $94.8M | $28.5k |

| 8 | +5 |  ETH ETH |

4.0k | $184.7M | $18.1k |

| 9 | +7 |  stETH stETH |

1.5k | $186.9M | $18.0k |

| 10 | +4 |  sUSDe sUSDe |

1.5k | $53.6M | $12.7k |

Top Chains by Fees

Arbitrum took the second place in terms of fee generation, but notably Optimism achieved over 100k swaps!

| Position | Change | Chain | Swaps | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  Ethereum Ethereum |

52.8k | $1.5B | $378.4k |

| 2 | +1 |  Arbitrum Arbitrum |

49.9k | $38.4M | $23.9k |

| 3 | -1 |  Hyperliquid Hyperliquid |

45.8k | $24.1M | $8.0k |

| 4 | +2 |  Optimism Optimism |

103.9k | $9.3M | $2.8k |

| 5 | -1 |  Base Base |

24.1k | $5.6M | $2.5k |

| 6 | +1 |  Polygon Polygon |

13.4k | $994.3k | $2.2k |

| 7 | -2 |  Fraxtal Fraxtal |

73.2k | $7.0M | $2.0k |

| 8 | - |  Sonic Sonic |

21.2k | $9.2M | $540 |

| 9 | +1 |  Xdai Xdai |

14.3k | $5.8M | $482 |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.