Curve Best Yields & Key Metrics | Week 28, 2025

Weekly yield and Curve ecosystem metric updates as of the 10th July, 2025

Market Overview

Curve’s TVL rose 2.7% to $2.23B this week, as Ethereum and battle-tested DeFi start to gain some positive momentum, and BTC celebrates a new All Time High!

There are some great yields to take advantage of this week, including many for USD, BTC and ETH stablecoin pools. This update highlights those opportunities along with key weekly metrics from across the Curve ecosystem.

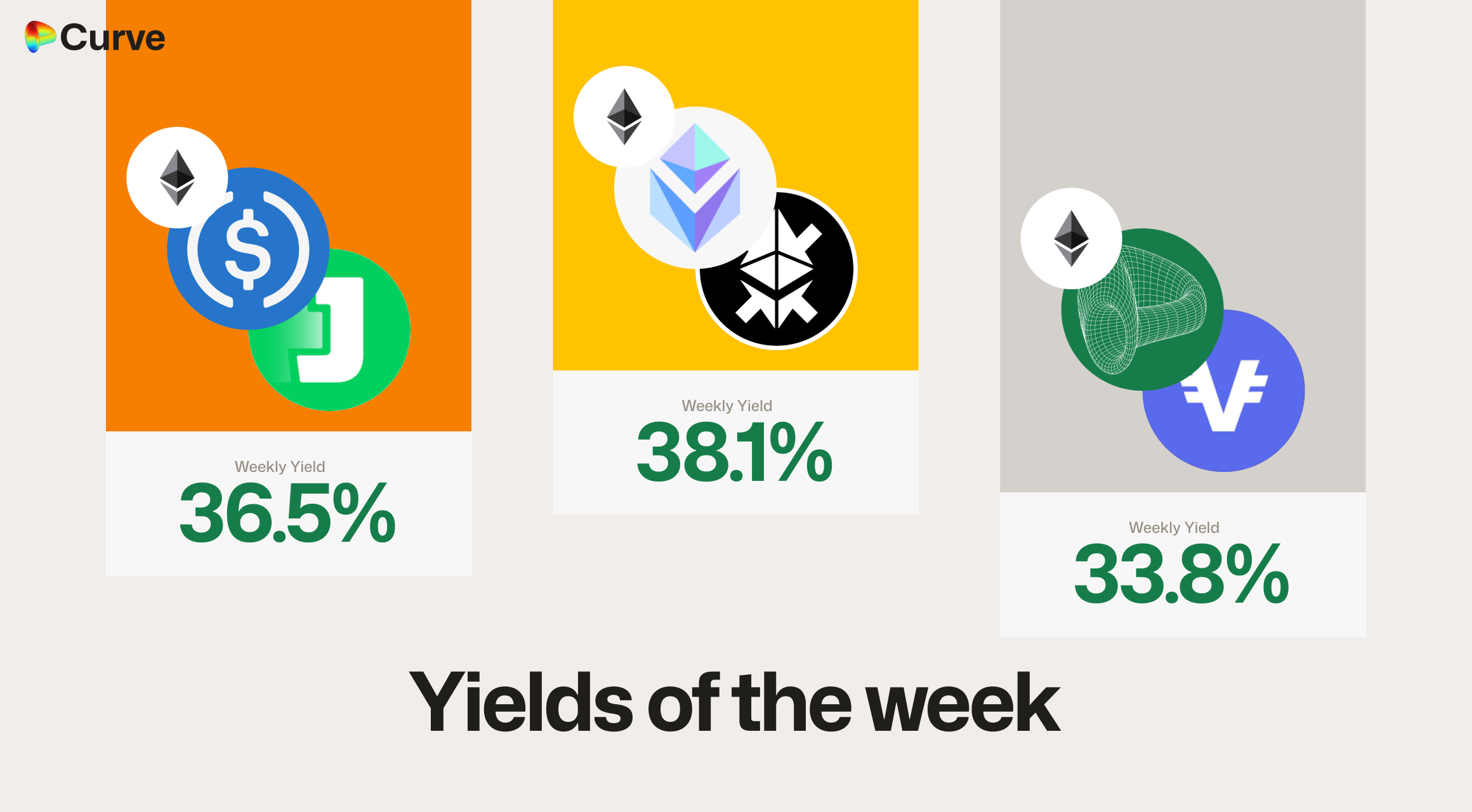

Top Yields

USD Stablecoins

Note: The jUSD/USDC pool below shows a yield above 36.5%, but this has been adjusted based on the assumption that $100K is staked in its gauge. At the time of writing, only $45K of the $1M in the pool is actually staked.

| Chain | Pool | Market | Yield |

|---|---|---|---|

|

USDC USDC jUSD jUSD |

Pool | 36.5% |

|

crvUSD crvUSD VUSD VUSD |

Pool | 33.8% |

|

USD3 USD3 sUSDS sUSDS |

Pool | 29.9% |

|

frxUSD frxUSD USDf USDf |

Pool | 26.0% |

|

alUSD alUSD USDC USDC |

Pool | 23.3% |

|

sfrxUSD sfrxUSD scrvUSD scrvUSD |

Pool | 22.4% |

|

USDC USDC USDf USDf |

Pool | 17.8% |

|

crvUSD crvUSD USDT USDT |

Pool | 13.4% |

|

crvUSD crvUSD USDC USDC |

Pool | 13.1% |

|

frxUSD frxUSD dUSD dUSD |

Pool | 12.2% |

Top BTC & ETH Yields

| Chain | Pool | Asset | Market | Yield |

|---|---|---|---|---|

|

uniETH uniETH frxETH frxETH |

ETH | Pool | 38.1% |

|

uniETH uniETH WETH WETH |

ETH | Pool | 18.6% |

|

WBTC WBTC uniBTC uniBTC |

BTC | Pool | 12.8% |

|

ETH+ ETH+ WETH WETH |

ETH | Pool | 10.3% |

|

frxETH frxETH OETH OETH |

ETH | Pool | 6.9% |

|

EBTC EBTC tBTC tBTC |

BTC | Pool | 4.5% |

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

BTC | Pool | 3.4% |

|

WBTC WBTC tBTC tBTC |

BTC | Pool | 2.0% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD supply declined slightly this week, which is expected given the recent high borrow rates. However, the peg remains strong, and there’s optimism ahead with Yield Basis coming soon and Resupply stabilizing, and moving forward positively.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$120M | -3.3% |

crvUSD Borrowed crvUSD Borrowed |

$108M | -8.2% |

Peg Stability Reserves Peg Stability Reserves |

$11.7M | +$5.7M |

scrvUSD Yield scrvUSD Yield |

7.2% APY | +1.0% |

crvUSD in crvUSD in scrvUSD scrvUSD |

45.8% | +3.4% |

crvUSD Peg crvUSD Peg |

$1.0000 | +$0.0002 |

Avg. Borrow Rate Avg. Borrow Rate |

7.0% | -1.3% |

Loans Loans |

743 | -11 |

Fees Fees |

$180k | +21.3% |

DEX

Last week was relatively quiet, so it’s expected to see swap-related metrics down across the board. However, TVL is up on the week, which is a positive signal for the ecosystem.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.02B | +3.0% |

| 🔄 Volume | $1.02B | -30.1% |

| 🔄 Swaps | 313k | -21.3% |

| 🔄 Total Fees | $202k | -24.6% |

Llamalend

Lending TVL and supplied assets awaiting borrowers increased this week, while borrowed amounts and collateral saw slight declines. Overall, the market appears to be stabilizing, and an almost 7% increase in the number of loans signals new users are testing the system.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $110M | +0.9% |

| 🦙 Supplied | $90.5M | +0.1% |

| 🦙 Borrowed | $63.4M | -6.5% |

| 🦙 Collateral | $82.5M | -4.1% |

| 🦙 Loans | 859 | +55 |

Top Assets by Fees

This week, instead of focusing on the highest-volume assets, we’re highlighting the assets that generated the most fees. These figures represent the total raw fees paid by all swappers, both into and out of each asset, so each swap is effectively double-counted.

USDf ranks high this week, reflecting strong fee generation, and CVX also appears to be in high demand, along with WETH dethroning USDC for the top spot.

| Position | Change | Asset | Swaps | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +1 |  WETH WETH |

32.2k | $124.4M | $69.3k |

| 2 | -1 |  USDC USDC |

88.8k | $446.4M | $59.4k |

| 3 | - |  USDT USDT |

38.3k | $342.4M | $39.1k |

| 4 | - |  crvUSD crvUSD |

70.5k | $80.3M | $14.8k |

| 5 | +3 |  WBTC WBTC |

6.7k | $24.9M | $13.9k |

| 6 | +12 |  CVX CVX |

1.1k | $3.2M | $11.7k |

| 7 | +35 |  USDf USDf |

559.0 | $33.7M | $10.0k |

| 8 | -2 |  RLUSD RLUSD |

107.0 | $40.4M | $8.1k |

| 9 | +2 |  USD0 USD0 |

783.0 | $24.4M | $8.1k |

| 10 | +2 |  CRV CRV |

33.5k | $8.7M | $7.6k |

Top Chains by Fees

This week’s top chains are ranked by fees generated from swap pools. Hyperliquid is performing strongly, but the data clearly shows just how dominant Ethereum and Curve on Ethereum really is, nothing else even comes close.

| Position | Change | Chain | Swaps | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  Ethereum Ethereum |

46.1k | $949.3M | $188.2k |

| 2 | - |  Hyperliquid Hyperliquid |

36.7k | $17.8M | $4.6k |

| 3 | +1 |  Arbitrum Arbitrum |

26.0k | $24.0M | $2.8k |

| 4 | +2 |  Base Base |

20.3k | $8.6M | $2.6k |

| 5 | - |  Fraxtal Fraxtal |

74.9k | $3.1M | $1.7k |

| 6 | +1 |  Optimism Optimism |

60.3k | $4.2M | $902 |

| 7 | -4 |  Polygon Polygon |

10.8k | $320.7k | $587 |

| 8 | +1 |  Sonic Sonic |

19.4k | $8.4M | $382 |

| 9 | +1 |  Fantom Fantom |

1.2k | $109.4k | $303 |

| 10 | -2 |  Gnosis Gnosis |

17.2k | $4.8M | $274 |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.