Curve Best Yields & Key Metrics | Week 26, 2025

Weekly yield and Curve ecosystem metric updates as of the 26th June, 2025

Market Overview

It's been a tough day for the Curve ecosystem, with Resupply falling victim to a hack, because of this the TVL for Llamalend is down sharply and total TVL for Curve is down about 5.9% to $2.15B. Curve products remain safe, no Curve product is affected by the hack.

Despite the incident, there are still excellent yield opportunities this week. As users redeem from Resupply-linked markets, there are some high crvUSD yields available. Take advantage while they last, or explore other options across the ecosystem alongside this week’s key metrics.

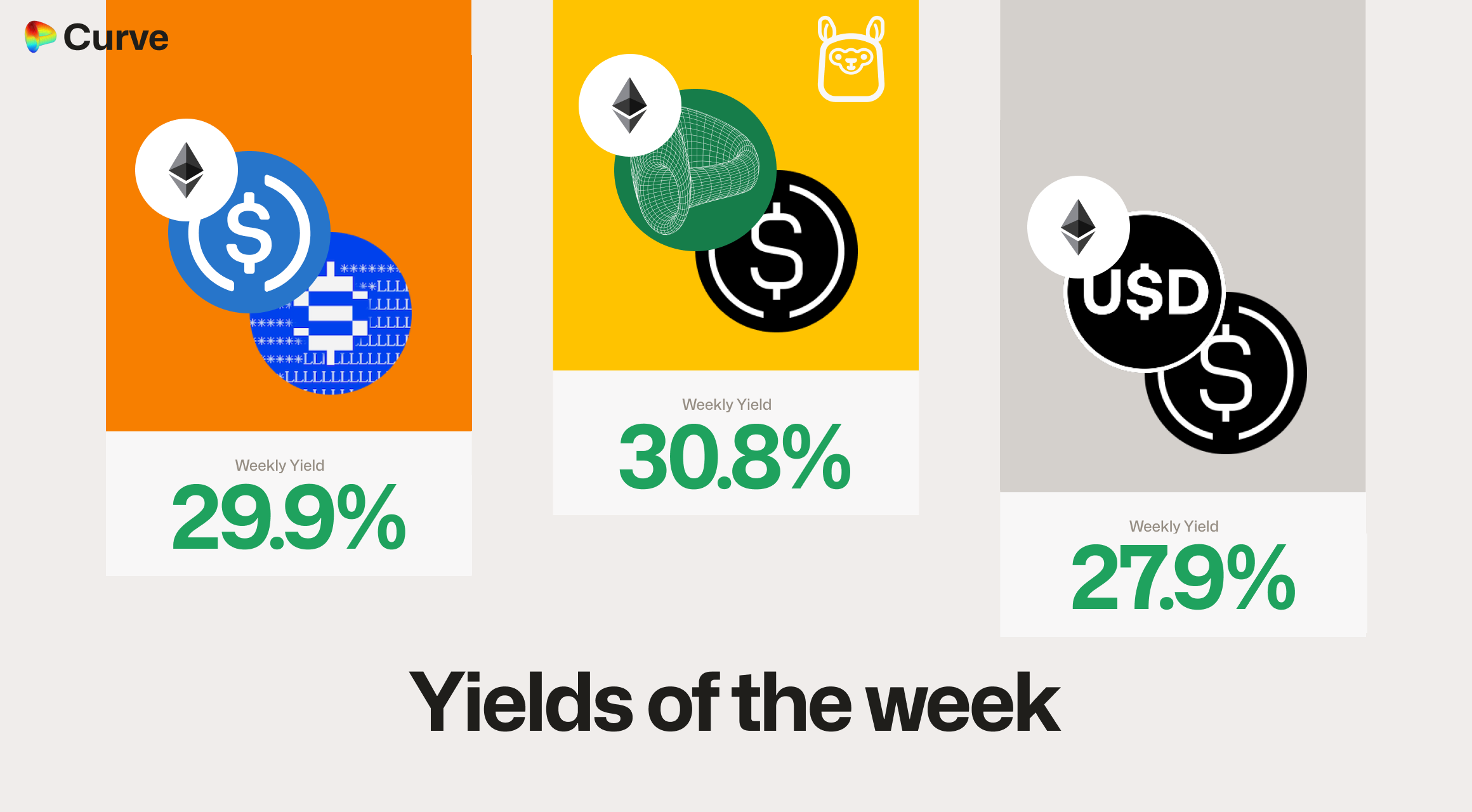

Top Yields

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD USDe USDe |

Llamalend | 30.8% |

|

USDC USDC lvlUSD lvlUSD |

Pool | 29.9% |

|

frxUSD frxUSD USDe USDe |

Pool | 27.6% |

|

crvUSD crvUSD sUSDe sUSDe |

Llamalend | 26.9% |

|

crvUSD crvUSD sUSDS sUSDS |

Llamalend | 23.5% |

|

crvUSD crvUSD wstETH wstETH |

Llamalend | 22.9% |

|

crvUSD crvUSD WETH WETH |

Llamalend | 20.9% |

|

USDaf USDaf USDC USDC USDT USDT |

Pool | 19.3% |

|

crvUSD crvUSD tBTC tBTC |

Llamalend | 18.6% |

|

ebUSD ebUSD USDC USDC |

Pool | 17.1% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 13.7% |

Top Major Asset Yields

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

ETH+ ETH+ WETH WETH |

ETH | 35.0% |

|

scETH scETH frxETH frxETH |

ETH | 11.6% |

|

msETH msETH WETH WETH |

ETH | 6.7% |

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

BTC | 5.2% |

|

EBTC EBTC tBTC tBTC |

BTC | 4.1% |

|

WBTC WBTC tBTC tBTC |

BTC | 1.7% |

Other Asset Top Yields

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 19.9% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 18.6% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 10.9% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.0% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

crvUSD & scrvUSD Metrics

With the Resupply hack the crvUSD total supply has dropped sharply. However, part of the drop does come from a reduction in peg stability reserves. Once again the peg has held strong, and all the systems are working perfectly through this unfortunate event.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$116M | -18.3% |

crvUSD Borrowed crvUSD Borrowed |

$110M | -16.1% |

Peg Stability Reserves Peg Stability Reserves |

$6.3M | -$4.8M |

scrvUSD Yield scrvUSD Yield |

5.1% APY | -3.3% |

crvUSD in crvUSD in scrvUSD scrvUSD |

43.0% | +7.0% |

crvUSD Peg crvUSD Peg |

$1.0001 | - |

Avg. Borrow Rate Avg. Borrow Rate |

11.7% | +4.0% |

Loans Loans |

746 | -7 |

Fees Fees |

$167k | +0.3% |

Pool Metrics

Pools TVL and swap numbers and fees are holding strong, even as volume has declined slightly.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.83B | -4.3% |

| 🔄 Volume | $1.26B | -18.8% |

| 🔄 Swaps | 548k | -1.0% |

| 🔄 Total Fees | $315k | -5.8% |

Llamalend Metrics

While the decline is unfortunate, it’s reassuring to see that all systems functioned exactly as intended and held up well throughout the downturn.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $117M | -31.7% |

| 🦙 Supplied | $98.4M | -33.5% |

| 🦙 Borrowed | $75.9M | -26.4% |

| 🦙 Loans | 804 | -132 |

Notable Pool Activity

Highest Volume Pools

Great to see 2 new pools in this list, notably the cUSD0 pool, and Polygon's pool.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$236M | $178M |

|

USDC USDC USDT USDT |

$104M | $4.8M |

|

cUSDO cUSDO USDC USDC |

$74.8M | $49.9M |

|

sUSDS sUSDS USDT USDT |

$45.2M | $50.6M |

|

amDAI amDAI amUSDC amUSDC amUSDT amUSDT |

$41.9M | $3.9M |

Highest Volume Assets

It’s always interesting to watch how demand for assets shifts week to week. This time, cUSD0 entered the top 10, jumping 12 spots from last week. FRAX also climbed 11 positions, and crvUSD moved up two spots to reach the top six.

| Position | Change | Asset | Trades | Volume |

|---|---|---|---|---|

| 1. | - |  USDC USDC |

$111k | $579M |

| 2. | - |  USDT USDT |

67.6k | $473M |

| 3. | - |  ETH ETH |

40.7k | $177M |

| 4. | - |  DAI DAI |

23.8k | $157M |

| 5. | - |  USDe USDe |

35.9k | $93.2M |

| 6. | +2 |  crvUSD crvUSD |

92.9k | $83.9M |

| 7. | +12 |  cUSDO cUSDO |

1.1k | $75.9M |

| 8. | -1 |  sUSDS sUSDS |

1.1k | $63.8M |

| 9. | +11 |  FRAX FRAX |

2.6k | $40.2M |

| 10. | -4 |  RLUSD RLUSD |

141 | $39.5M |

Highest Volume Chains

Just a few shifts among the lower-volume chains this week, all the top chains remained the same.

| Position | Change | Chain | Name | Swaps | Volume |

|---|---|---|---|---|---|

| 1. | - |  |

Ethereum | 56.0k | $1.12B |

| 2. | - |  |

Polygon | 67.1k | $58.5M |

| 3. | - |  |

Hyperliquid | 149k | $27.0M |

| 4. | - |  |

Arbitrum | 38.9k | $20.9M |

| 5. | +1 |  |

Sonic | 29.9k | $9.9M |

| 6. | -1 |  |

Optimism | 77.5 | $6.7M |

| 7. | +1 |  |

Fraxtal | 99.7k | $4.9M |

| 8. | +1 |  |

Gnosis | 9.5k | 3.2M |

| 9. | -2 |  |

Base | 18.3k | 3.3M |

High Growth Pools

All the following pools had more than a 10x TVL increase just in the past 7 days!

| Chain | Pool | TVL |

|---|---|---|

|

OETH OETH WETH WETH |

$30.7M |

|

xfrxUSD xfrxUSD sfrxUSD_fr sfrxUSD_fr |

$763k |

|

ETH+ ETH+ WETH WETH |

$477k |

|

reUSD reUSD USDC USDC |

$420k |

|

alUSD alUSD USDC USDC |

$278k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.