Curve Best Yields & Key Metrics | Week 24, 2025

Weekly yield and Curve ecosystem metric updates as of the 12th June, 2025

Market Overview

It's been another great week for Curve, with TVL increasing 2.8% to $2.41B, despite market volatility.

Curve also celebrated a full deployment on Hyperliquid, and a Curve-lite deployment on XDC Network just this week!

As always there are some fantastic yields available, and this weekly update highlights some of most compelling opportunities and metrics from across the Curve ecosystem.

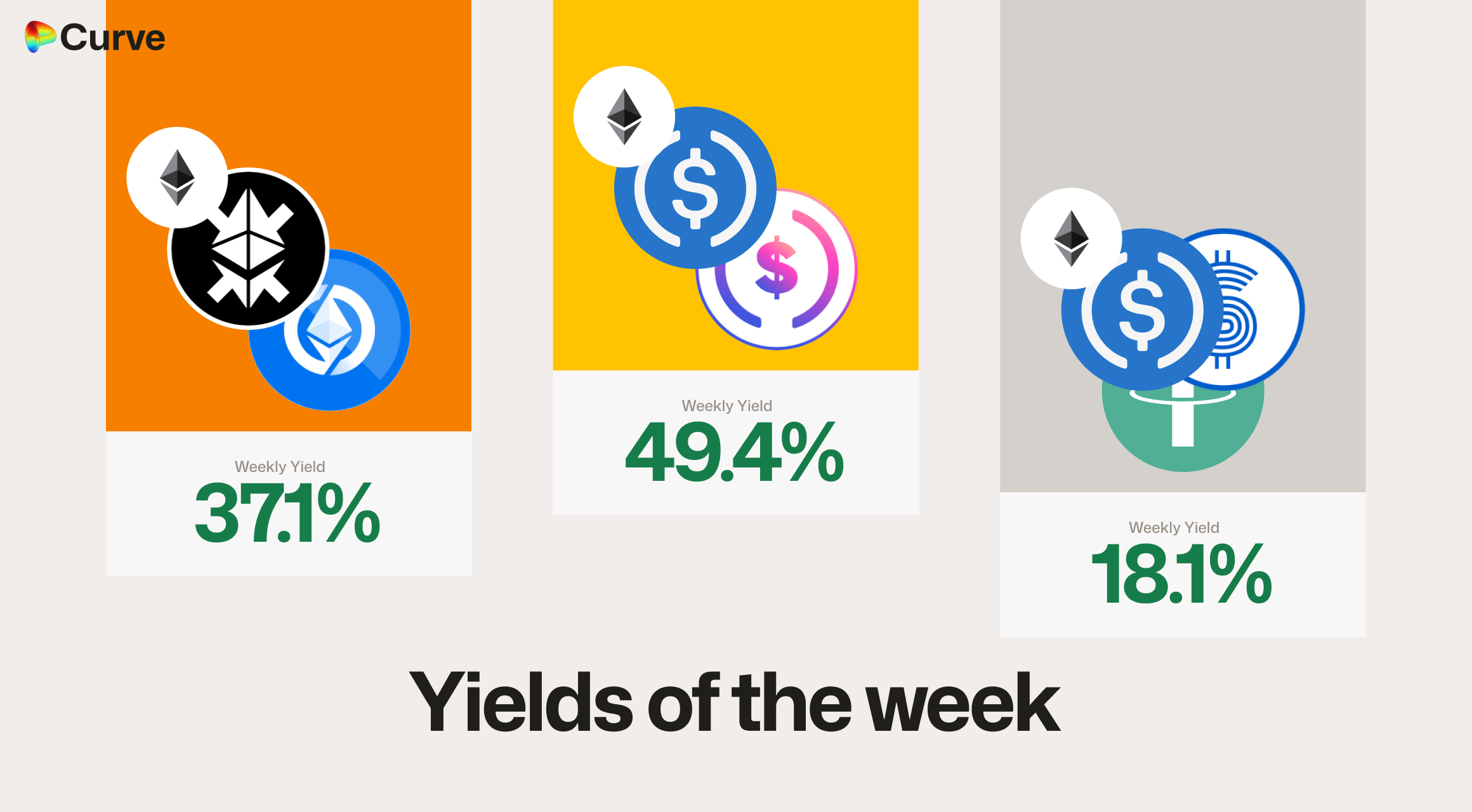

Top Yields

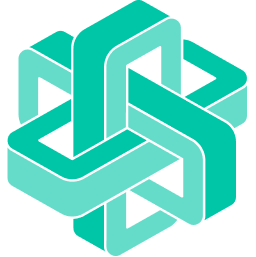

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

deUSD deUSD USDC USDC |

Pool | 49.4% |

|

USDaf USDaf USDC USDC USDT USDT |

Pool | 18.1% |

|

crvUSD crvUSD EYWA EYWA |

Llamalend | 14.4% |

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 14.3% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 12.9% |

|

crvUSD crvUSD scrvUSD scrvUSD |

Pool | 12.7% |

|

USDT USDT tacUSD tacUSD |

Pool | 12.4% |

Top Major Asset Yields

The 37% yield on ETH stablecoins is impressive, but BTC holders also have strong opportunities this week. The LBTC/WBTC pool is offering an 8.8% organic trading yield, plus additional points.

| Chain | Pool | Asset | Yield |

|---|---|---|---|

|

frxETH frxETH OETH OETH |

ETH | 37.1% |

|

InstETH InstETH stETH stETH |

ETH | 17.4% |

|

LBTC LBTC WBTC WBTC |

BTC | 8.8% |

|

WETH WETH tacETH tacETH |

ETH | 7.3% |

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

BTC | 5.4% |

|

EBTC EBTC tBTC tBTC |

BTC | 3.3% |

Other Asset Top Yields

| Chain | Pool | Asset | Yield |

|---|---|---|---|

|

CRV CRV frxUSD frxUSD |

CRV | 75.0% |

|

CrossCurve CRV CrossCurve CRV |

CRV | 25.9% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 14.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 4.2% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Metrics

CrvUSD supply declined slightly this week, mainly due to PegKeepers reducing their deployed reserves to support the peg, which is still reassuringly close to $1. Borrowed amounts and open loans remain steady, despite a rise in average borrow rates across Curve and the broader DeFi sector.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$132M | -14.5% |

crvUSD Borrowed crvUSD Borrowed |

$126M | -1.9% |

Peg Stability Reserves Peg Stability Reserves |

$6.3M | -$19.9M |

scrvUSD Yield scrvUSD Yield |

4.7% APY | -2.2% |

crvUSD in crvUSD in scrvUSD scrvUSD |

34.2% | -3.7% |

crvUSD Peg crvUSD Peg |

$0.9999 | -$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

9.5% | +2.6% |

Loans Loans |

766 | -1 |

Fees Fees |

$167k | +0.3% |

Pool Metrics

The number of swaps rose significantly this week, though the average swap size declined. TVL increased, and fees remain strong despite lower volume, supported by dynamic fee adjustments.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.97B | +0.7% |

| 🔄 Volume | $1.43B | -26.9% |

| 🔄 Swaps | 471k | +32.3% |

| 🔄 Total Fees | $297k | -13.2% |

Llamalend Metrics

Larger borrowers are continuing to take loans out in Llamalend, because it's now one of the cheapest places to borrow across the DeFi landscape. TVL remains sticky, thanks to Resupply.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $177M | -1.0% |

| 🦙 Supplied | $151M | -1.7% |

| 🦙 Borrowed | $107M | +5.0% |

| 🦙 Loans | 935 | -7 |

Notable Pool Activity

Highest Volume Pools

Both the USDC/RLUSD and WETH/weETH pools are welcome additions to the top volume pools this week.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$290M | $182M |

|

USDC USDC RLUSD RLUSD |

$118M | $51.6M |

|

USDC USDC USDT USDT |

$107M | $4.5M |

|

WETH WETH weETH weETH |

$64.4M | $19.7M |

Recently Launched Pools

Two newly launched pools reached significant TVL this week. Details are shown below.

| Chain | Pool | TVL |

|---|---|---|

|

CRV CRV frxUSD frxUSD |

$120.00k |

|

fxSAVE fxSAVE scrvUSD scrvUSD |

$31.20k |

Highest Fee Generating Pools

It’s impressive to see the Hyperliquid PURR/WHYPE pool rank in the top 3 for fees this week. After beginning to attract TVL just last week, it has already reached $2.6M in TVL and generated strong returns for LPs on only $3.6M in volume.

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$23.2k | $290M |

|

USDT USDT WBTC WBTC WETH WETH |

$19.2k | $4.33M |

|

PURR PURR WHYPE WHYPE |

$13.9k | $3.58M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.