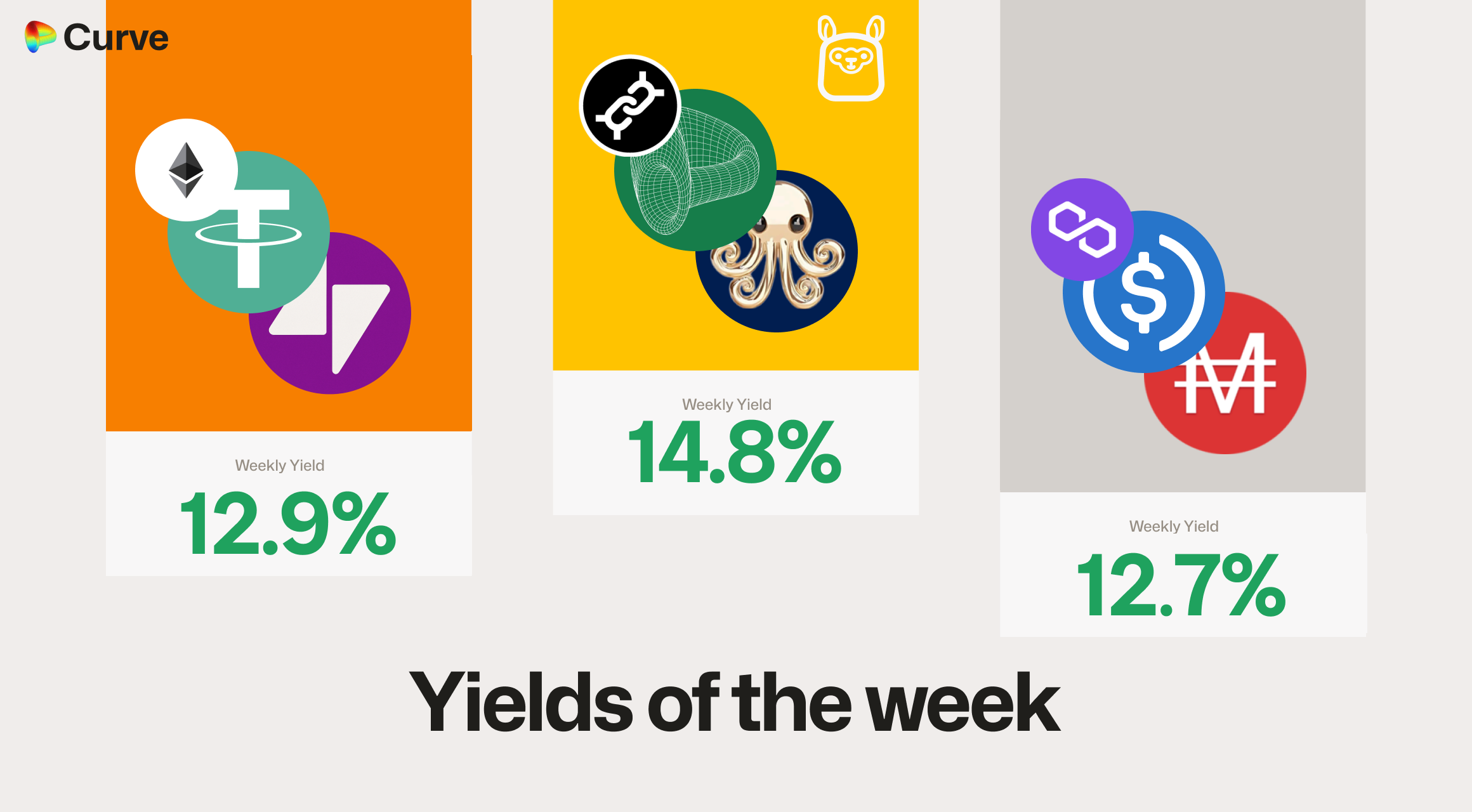

Curve Best Yields & Key Metrics | Week 23, 2025

Weekly yield and Curve ecosystem metric updates as of the 5th June, 2025

Market Overview

Risk appetite has declined across markets, leading to compressed yields and a slight 1.6% drop in Curve’s TVL, now at $2.34B. This decrease is primarily due to reduced crvUSD borrowing demand and a slight pullback in Llamalend TVL after ten consecutive weeks of growth.

Despite lower yields, Curve continues to offer some of the most attractive opportunities in DeFi. This weekly update highlights key metrics and standout yield opportunities across the ecosystem.

Top Yields

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD SQUID SQUID |

Llamalend | 14.8% |

|

USDT USDT tacUSD tacUSD |

Pool | 12.9% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 12.7% |

|

scrvUSD scrvUSD sfrxUSD sfrxUSD |

Pool | 12.3% |

|

crvUSD crvUSD sfrxETH sfrxETH |

Llamalend | 12.3% |

|

axlUSDT axlUSDT USDt USDt |

Pool | 12.0% |

|

crvUSD crvUSD sfrxUSD sfrxUSD |

Llamalend | 11.4% |

|

crvUSD crvUSD scrvUSD scrvUSD |

Pool | 10.8% |

|

USDC USDC RLUSD RLUSD |

Pool | 10.6% |

Top Major Asset Yields

| Chain | Pool | Asset | Yield |

|---|---|---|---|

|

msETH msETH OETH OETH |

ETH | 7.3% |

|

frxETH frxETH sfrxETH sfrxETH |

ETH | 6.6% |

|

uniETH uniETH WETH WETH |

ETH | 6.4% |

|

EBTC EBTC tBTC tBTC |

BTC | 3.4% |

|

WBTC WBTC tBTC tBTC |

BTC | 2.5% |

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

BTC | 2.0% |

Other Asset Yields

| Chain | Pool | Asset | Yield |

|---|---|---|---|

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 20.9% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 18.5% |  |

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 13.3% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 3.9% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

crvUSD supply increased this week, driven primarily by PegKeepers deploying part of their allocated reserves to push down the peg. Demand for crvUSD was strong, with the scrvUSD rate becoming especially attractive at 6.9%.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$154M | +7.4% |

crvUSD Borrowed crvUSD Borrowed |

$128M | -0.7% |

Peg Stability Reserves Peg Stability Reserves |

$26.2M | +$11.5M |

scrvUSD Yield scrvUSD Yield |

6.9% APY | +0.6% |

crvUSD in crvUSD in scrvUSD scrvUSD |

37.9% | +9.2% |

crvUSD Peg crvUSD Peg |

$1.0000 | - |

Avg. Borrow Rate Avg. Borrow Rate |

4.1% | -2.8% |

Loans Loans |

767 | -14 |

Fees Fees |

$167k | +0.3% |

Pool Statistics

Nearly all pool metrics are positive this week, showing how Curve shines in volatility.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.95B | +0.2% |

| 🔄 Volume | $1.96B | +20.5% |

| 🔄 Swaps | $356k | -1.1% |

| 🔄 Total Fees | $342k | +8.2% |

Llamalend Performance

TVL finally decreased slightly after being up only for the past 10 weeks, but borrowers continue to be attracted to the low rates and safety Llamalend has to offer.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $179M | -2.8% |

| 🦙 Supplied | $154M | -1.6% |

| 🦙 Borrowed | $102M | +1.6% |

| 🦙 Loans | 942 | +32 |

Notable Pool Activity

Highest Volume Pools

The usual suspects continued to be the highest volume pools.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$365M | $182M |

|

USDC USDC USDT USDT |

$178M | $4.8M |

|

USDC USDC RLUSD RLUSD |

$131M | $54.2M |

|

sUSDS sUSDS USDT USDT |

$99.5M | $50.6M |

Recently Launched Pools

There have been 14 new pools this week bringing in a total of over $12M TVL, the biggest 6 are highlighted below.

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$29.2k | $365M |

|

USDT USDT WBTC WBTC WETH WETH |

$21.3k | $13.4M |

|

WETH WETH CVX CVX |

$13.3k | $3.4M |

|

USDC USDC RLUSD RLUSD |

$13.0k | $131M |

|

USD0 USD0 USD0++ USD0++ |

$11.5k | $28.8M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.