Curve Best Yields & Key Metrics | Week 21, 2025

Weekly yield and Curve ecosystem metric updates as of the 22nd May, 2025

Market Overview

Curve's TVL increased by 2% to $2.4B this week, supported by rising liquidity across swap pools, sustained growth from Llamalend, and continued borrowing of crvUSD.

This weekly update highlights some of the most compelling opportunities and metrics across the Curve ecosystem.

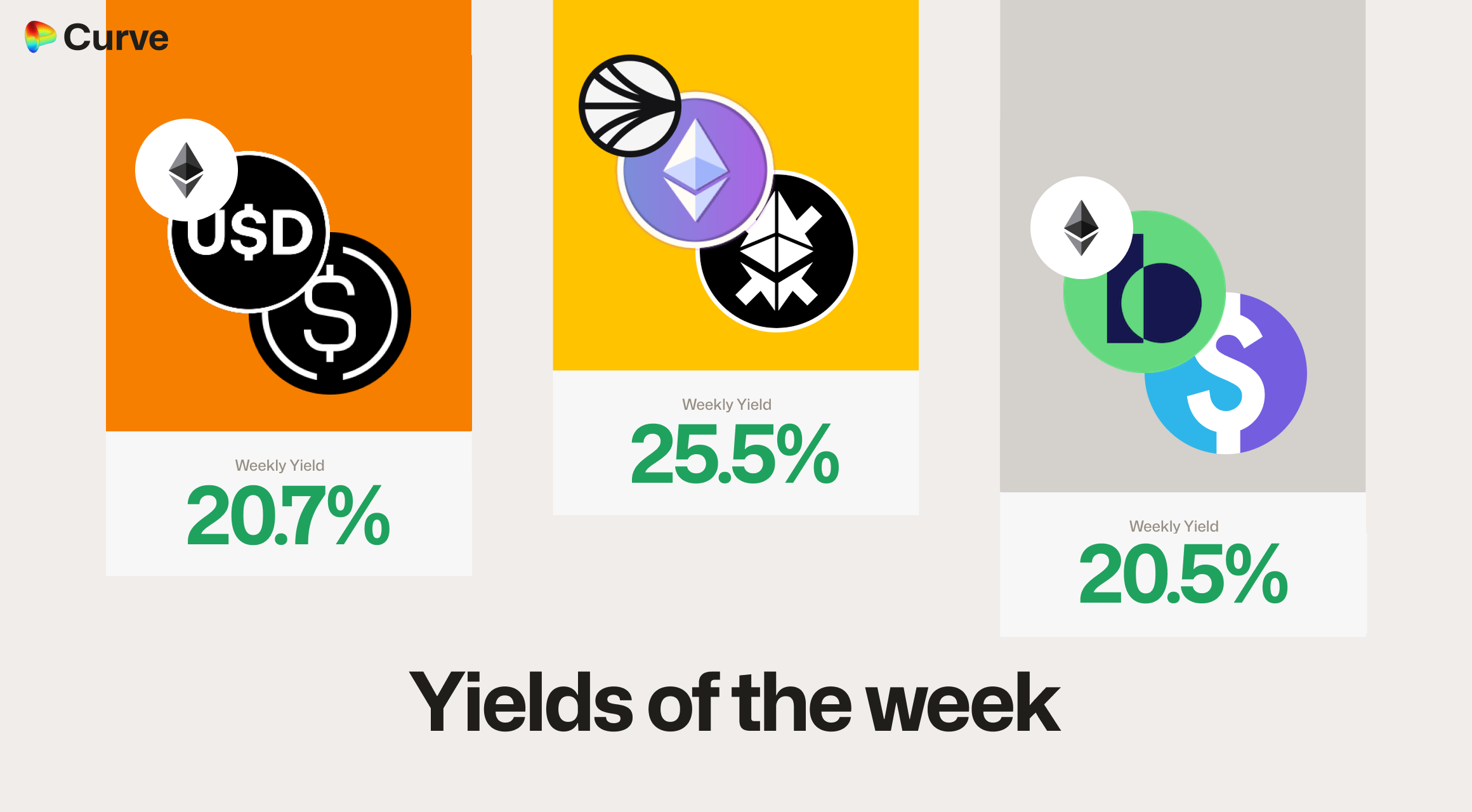

Top Yields

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

frxUSD frxUSD USDe USDe |

Pool | 20.7% |

|

BOLD BOLD LUSD LUSD |

Pool | 20.5% |

|

scUSD scUSD frxUSD frxUSD |

Pool | 15.8% |

|

frxUSD frxUSD dUSD dUSD |

Pool | 15.4% |

|

msUSD msUSD FRAX FRAX USDC USDC |

Pool | 15.3% |

|

BOLD BOLD USDC USDC |

Pool | 14.2% |

|

OUSD OUSD USDC USDC |

Pool | 13.2% |

|

dUSD dUSD sfrxUSD sfrxUSD |

Pool | 12.9% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 12.7% |

|

USDC USDC scrvUSD scrvUSD |

Pool | 12.7% |

Top Asset Yields

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

scETH scETH frxETH frxETH |

ETH | 25.5% |

|

CrossCurve CRV CrossCurve CRV |

CRV | 25.2% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 19.3% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 15.7% |

|

msETH msETH WETH WETH |

ETH | 13.7% |

|

msETH msETH OETH OETH |

ETH | 10.2% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 6.3% |

|

EBTC EBTC tBTC tBTC |

BTC | 5.0% |

|

WBTC WBTC tBTC tBTC |

BTC | 3.7% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

As leverage demand rises, borrowers mint crvUSD and swap it for assets like ETH and BTC. This exerts downward pressure on the peg, triggering PegKeepers to withdraw crvUSD and protect its peg with their Peg Stability Reserves. As a result, borrow rates, fees, and scrvUSD APY all increased this week due to the peg-driven rate adjustments and PegKeeper activity.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$153M | -9.5% |

crvUSD Borrowed crvUSD Borrowed |

$136M | +3.6% |

Peg Stability Reserves Peg Stability Reserves |

$17.5M | -$20.7M |

scrvUSD Yield scrvUSD Yield |

3.7% APY | +2.0% |

crvUSD in crvUSD in scrvUSD scrvUSD |

28.1% | -0.8% |

crvUSD Peg crvUSD Peg |

$0.9999 | - |

Avg. Borrow Rate Avg. Borrow Rate |

6.4% | +3.5% |

Loans Loans |

791 | +3 |

Fees Fees |

$106k | +127% |

Pool Statistics

Despite reduced volatility and lower trading volumes this week, fees have remained relatively strong — a positive indicator — and TVL has increased.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.96B | +1.2% |

| 🔄 Volume | $1.39B | -47.7% |

| 🔄 Swaps | 385k | -6.4% |

| 🔄 Total Fees | $320k | -32.8% |

Llamalend Performance

It’s notable to see an L2 pool among the top volume generators, reflecting Curve’s growing presence across EVM chains.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $179M | +2.6% |

| 🦙 Supplied | $151M | +0.4% |

| 🦙 Borrowed | $92.3M | +8.5% |

| 🦙 Loans | 870 | +23 |

Notable Pool Activity

Highest Volume Pools

It's great to see a L2 pool here in the top pools for volume, as Curve's presence continues to increase over all EVM chains.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$204M | $181M |

|

USDC USDC USDT USDT |

$96.9M | $6.4M |

|

ETH ETH stETH stETH |

$64.8M | $136M |

|

USDC.e USDC.e USD₮0 USD₮0 |

$49.1M | $4.0M |

Recently Launched and High Growth Pools

All the pools listed below either launched or experienced 10x growth over the past week, contributing over $11M in additional TVL on Curve.

| Chain | Pool | TVL |

|---|---|---|

|

tacBTC tacBTC cbBTC cbBTC FBTC FBTC |

$7.95M |

|

msETH msETH OETH OETH |

$1.54M |

|

USDT USDT tacUSD tacUSD |

$1.43M |

|

WETH WETH tacETH tacETH |

$981k |

|

reUSD reUSD fxUSD fxUSD |

$668k |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

USDT USDT WBTC WBTC WETH WETH |

$32.2k | $13.5M |

|

DAI DAI USDC USDC USDT USDT |

$16.3k | $204M |

|

USDT USDT WBTC WBTC WETH WETH |

$15.5k | $23.9M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.