Curve Best Yields & Key Metrics | Week 2, 2026

Weekly yield and Curve ecosystem metric updates as of the 8th January, 2026

Market Overview

It has been a very positive week for Curve. There was plenty of notable news this week:

- TVL has increased to $2.570B, up 4.3%.

- crvUSD borrowed supply has increased over 19% ($15M) to $91M.

- YieldBasis launched a new WETH market with a $25M cap, which filled up in less than 3 minutes. It uses the efficient new FXSwap pool types.

- Resupply launched a new sreUSD market, helping protect the crvUSD peg by creating a liquidity sink.

- The year in review is out, read it here: Curve: 2025 Year in Review

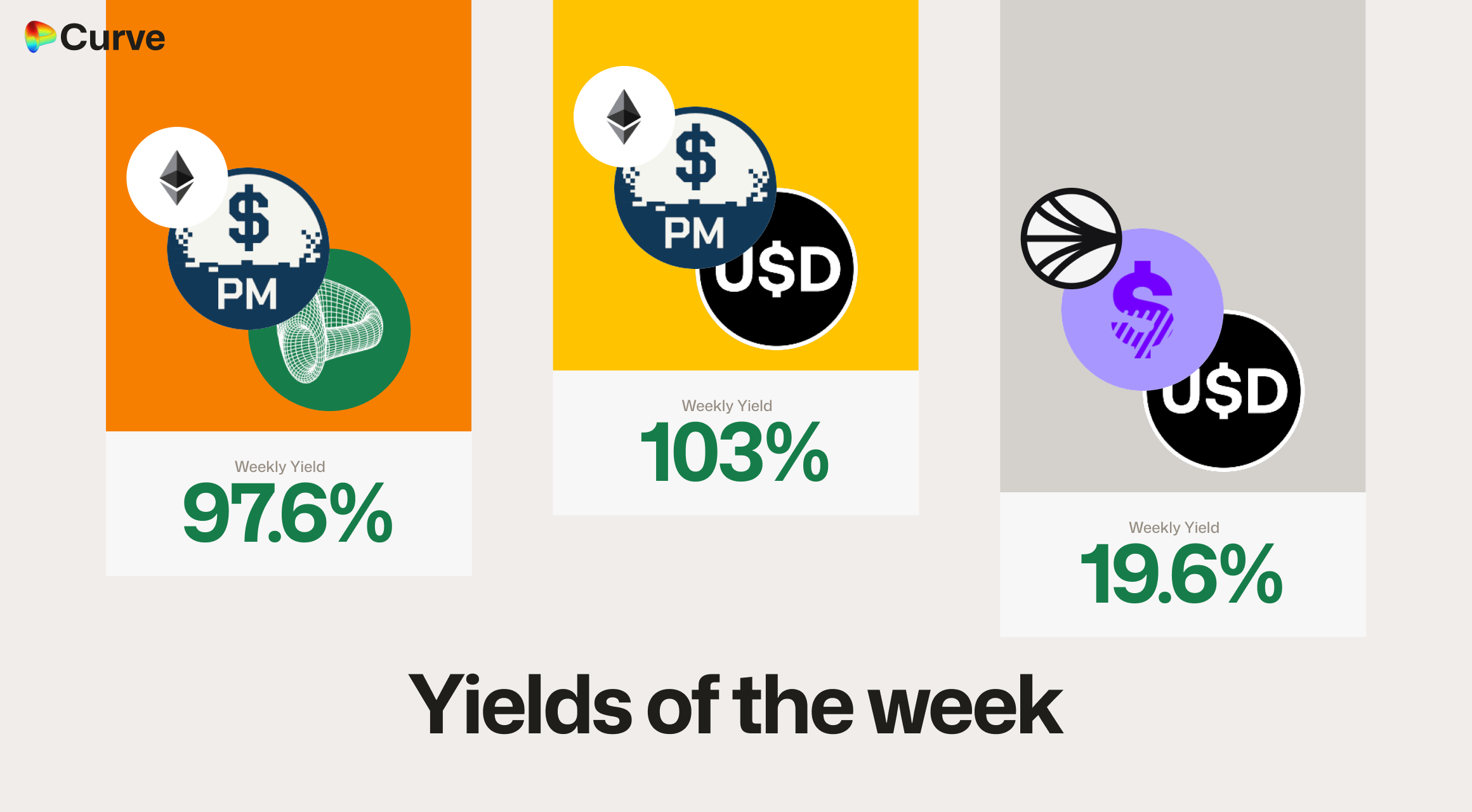

There are some great yields available this week, especially with the new pmUSD stablecoin from RAAC. See all the highlighted yields and metrics below.

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Large crvUSD Markets

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

crvUSD crvUSD sDOLA sDOLA |

$32.2M | 5.0% |

|

crvUSD crvUSD sreUSD sreUSD |

$21.3M | 5.0% |

|

reUSD reUSD scrvUSD scrvUSD |

$14.6M | 3.6% |

|

USDT USDT crvUSD crvUSD |

$72.7M | 3.5% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

pmUSD pmUSD frxUSD frxUSD |

Pool | 103.6% |

|

pmUSD pmUSD crvUSD crvUSD |

Pool | 97.6% |

|

USDp USDp frxUSD frxUSD |

Pool | 19.6% |

|

USDT0 USDT0 USDe USDe |

Pool | 17.9% |

|

miMATIC miMATIC USDC.e USDC.e |

Pool | 12.8% |

|

alUSD alUSD USDC USDC |

Pool | 12.6% |

|

USDT0 USDT0 sUSDe sUSDe |

Pool | 12.4% |

|

crvUSD crvUSD WFRAX WFRAX |

Llamalend | 11.4% |

|

AUSD AUSD USDC USDC USDT0 USDT0 |

Pool | 9.7% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 13.6% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 10.7% |

|

WETH WETH pufETH pufETH |

ETH | 7.9% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 6.0% |

|

msETH msETH OETH OETH |

ETH | 5.8% |

|

msETH msETH WETH WETH |

ETH | 5.3% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV/USD CrossCurve CRV/USD |

CRV | 25.7% |

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 14.2% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 9.5% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 7.7% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 7.3% |

|

EURA EURA EURC EURC |

EUR | 6.0% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 5.9% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 5.5% |

Weekly Metrics

crvUSD & scrvUSD

crvUSD minted this week was up over 19% (with over $15M borrowed during the week), marking an incredible week for crvUSD.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$91.4M | +19.2% |

scrvUSD Yield scrvUSD Yield |

1.9% | +1.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

22.1% | -4.2% |

crvUSD Price crvUSD Price |

$0.9993 | - |

Avg. Borrow Rate Avg. Borrow Rate |

2.8% | +1.8% |

Peg Stability Reserves Peg Stability Reserves |

$39.2M | -$17.8M |

PegKeeper Profit PegKeeper Profit |

$3.4k | +$3.4k |

Llamalend

Llamalend had a great week with positive metrics across the board. Perhaps people are starting to recognize Curve's cheap loans and liquidation protection features?

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $251M | +10.3% |

| 🦙 Supplied | $83.8M | +0.2% |

| 🦙 Borrowed | $162M | +11.5% |

| 🦙 Collateral | $239M | +11.9% |

| 🦙 Loans | 1261 | +59 |

DEX

DEX Pools also had a great week, with fees and volumes once again seeing a significant increase, along with TVL and the number of swaps.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.53B | +4.6% |

| 🔄 Volume | $1.55B | +45.0% |

| 🔄 Swaps | 348k | +11.3% |

| 🔄 Total Fees | $222k | +57.0% |

DAO

The DAO recorded a positive week as well, with veCRV holder distributions higher than last week. CRV emissions to LPs increased by 6.3%, driven by a higher average CRV price over the week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.46B | +0.2% |

CRV Locked CRV Locked |

859M | - |

Total veCRV Total veCRV |

791M | -0.4% |

veCRV Distribution veCRV Distribution |

$99.3k | +73.1% |

CRV Emissions CRV Emissions |

$912k (2.22M CRV) | +6.3% |

Inflation Rate Inflation Rate |

4.941% | -0.005% |

Top Stableswap Pools

The top pools by volume were once again the USDS pools. The standout surprises were the NUSD and USDe/USDT pools, both of which saw very large jumps up the leaderboard.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

PYUSD PYUSD USDS USDS |

$404.3M | $4.4k |

| 2 | +2 |  |

sUSDS sUSDS USDT USDT |

$202.9M | $3.0k |

| 3 | - |  |

DAI DAI USDC USDC USDT USDT |

$128.0M | $19.2k |

| 4 | +3 |  |

USDC USDC USDT USDT |

$83.2M | $1.1k |

| 5 | -3 |  |

USDT USDT crvUSD crvUSD |

$70.5M | $7.0k |

| 6 | +5 |  |

USDC USDC RLUSD RLUSD |

$60.9M | $13.0k |

| 7 | +23 |  |

NUSD NUSD USDC USDC |

$56.2M | $5.8k |

| 8 | -3 |  |

USDC USDC crvUSD crvUSD |

$39.3M | $3.9k |

| 9 | -3 |  |

WETH WETH weETH weETH |

$36.0M | $2.1k |

| 10 | +46 |  |

USDT USDT USDe USDe |

$25.0M | $874.3 |

Top Cryptoswap Pools

Due to CVX’s sharp price increase and heightened volatility this week, CVX pools saw strong demand. This resulted in substantial fee generation for LPs.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | +2 |  |

USDT USDT WBTC WBTC WETH WETH |

$21.6M | $20.8k |

| 2 | -1 |  |

USDC USDC WBTC WBTC WETH WETH |

$21.1M | $9.9k |

| 3 | -1 |  |

USDT USDT WBTC WBTC WETH WETH |

$17.5M | $8.1k |

| 4 | - |  |

crvUSD crvUSD WETH WETH CRV CRV |

$12.7M | $6.7k |

| 5 | +1 |  |

WETH WETH CVX CVX |

$7.9M | $31.5k |

| 6 | +7 |  |

frxETH frxETH CVX CVX |

$2.3M | $9.0k |

| 7 | - |  |

ETH+ ETH+ eUSD eUSD RSR RSR |

$1.9M | $1.7k |

| 8 | -3 |  |

crvUSD crvUSD YB YB |

$1.4M | $4.9k |

| 9 | +8 |  |

EIGEN EIGEN WETH WETH |

$657.9k | $2.2k |

| 10 | - |  |

crvUSD crvUSD WETH WETH |

$478.1k | $2.1k |

DEX Winners & Losers

Fees Winners & Losers

The extreme rally in CVX drove significant fee generation, with the WETH/CVX pool winning the week by a wide margin. Notably, very few pools saw declines in swap fees this week. The YB/crvUSD pool recorded the largest decrease, though this was limited to a $1.36k week-on-week drop.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

WETH WETH CVX CVX |

$7.86M | $31.5k | +$25.2k |

| 2 |  |

USDC USDC RLUSD RLUSD |

$60.9M | $13k | +$10.3k |

| 3 |  |

DAI DAI USDC USDC USDT USDT |

$128M | $19.2k | +$10.2k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

YB YB sdYB sdYB |

$59.1k | $174 | -$672 |

| -2 |  |

cUSDO cUSDO USDC USDC |

$149k | $30.1 | -$938 |

| -1 |  |

crvUSD crvUSD YB YB |

$1.42M | $4.93k | -$1.36k |

Volume Winners & Losers

Volumes rebounded strongly this week across major pools, following lower-than-usual volatility and activity last week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

sUSDS sUSDS USDT USDT |

$203M | $3.04k | +$153M |

| 2 |  |

DAI DAI USDC USDC USDT USDT |

$128M | $19.2k | +$68.3M |

| 3 |  |

USDC USDC USDT USDT |

$83.2M | $1.13k | +$58.3M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

cUSDO cUSDO USDC USDC |

$149k | $30.1 | -$4.51M |

| -2 |  |

USDai USDai USDC USDC |

$18.9M | $2.03k | -$4.57M |

| -1 |  |

WBTC WBTC tBTC tBTC |

$16.4M | $1.64k | -$4.77M |

TVL Winners & Losers

Capital rotated through the stUSDS pools this week, with liquidity exiting the older pool and even more flowing into the newer USDS/stUSDS pool. The USDT/crvUSD pool experienced a $16M outflow as PegKeepers withdrew liquidity to help maintain the crvUSD peg.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

USDS USDS stUSDS stUSDS |

$31.3M | +$17.5M |

| 2 |  |

DOLA DOLA sUSDe sUSDe |

$95.5M | +$10.5M |

| 3 |  |

scBTC scBTC sWBTC_ar sWBTC_ar |

$9.95M | +$9.95M |

| ... | ... | ... | ... | ... |

| -3 |  |

DOLA DOLA wstUSR wstUSR |

$39.5M | -$2.77M |

| -2 |  |

sUSDS sUSDS stUSDS stUSDS |

$598k | -$4.63M |

| -1 |  |

USDT USDT crvUSD crvUSD |

$72.7M | -$16.5M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

The WBTC market saw a substantial $11.7M increase in borrowing this week, representing a very large week-on-week change. Notably, only one market experienced any outflow at all, and that outflow was less than $1k.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD WBTC WBTC |

$81.8M | $47M | +$11.7M |

| 2 |  |

crvUSD crvUSD WETH WETH |

$34.7M | $20.2M | +$1.33M |

| 3 |  |

crvUSD crvUSD wstETH wstETH |

$16.4M | $8.65M | +$755k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD weETH weETH |

$2.14M | $1.15M | +$8.92k |

| -2 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$497k | $150k | +$9.84 |

| -1 |  |

crvUSD crvUSD LBTC LBTC |

$395k | $251k | -$606 |

Lend Markets - Borrowing Winners & Losers

sDOLA continued its dominance, once again increasing week on week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$32.2M | $27.5M | +$1.61M |

| 2 |  |

crvUSD crvUSD sreUSD sreUSD |

$21.3M | $18M | +$130k |

| 3 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$7.03M | $6.53M | +$108k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WETH WETH |

$498k | $355k | -$13.1k |

| -2 |  |

crvUSD crvUSD WBTC WBTC |

$911k | $722k | -$25.9k |

| -1 |  |

crvUSD crvUSD ynETHx ynETHx |

$11.2k | $8.66k | -$51.8k |

Lend Markets - Supplying Winners & Losers

sreUSD led the week in increased supplied crvUSD, taking the top spot among lending markets.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sreUSD sreUSD |

$21.3M | $18M | +$390k |

| 2 |  |

crvUSD crvUSD CRV CRV |

$4.29M | $3.36M | +$231k |

| 3 |  |

crvUSD crvUSD wstETH wstETH |

$803k | $606k | +$157k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD WBTC WBTC |

$911k | $722k | -$78.7k |

| -2 |  |

crvUSD crvUSD ynETHx ynETHx |

$11.2k | $8.66k | -$87.4k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$7.03M | $6.53M | -$417k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.