Curve Best Yields & Key Metrics | Week 19, 2025

Weekly yield and Curve ecosystem metric updates as of the 8th May, 2025

Market Overview

Curve's TVL has again increased, up to $2.123B (+4.43%) this week.

CrvUSD has also hit a new all-time high in total supply—a strong signal that the system is functioning effectively and users are recognizing the benefits of borrowing with crvUSD.

There are always great opportunities for yield on Curve, and this weekly update highlights some of the most compelling opportunities and metrics.

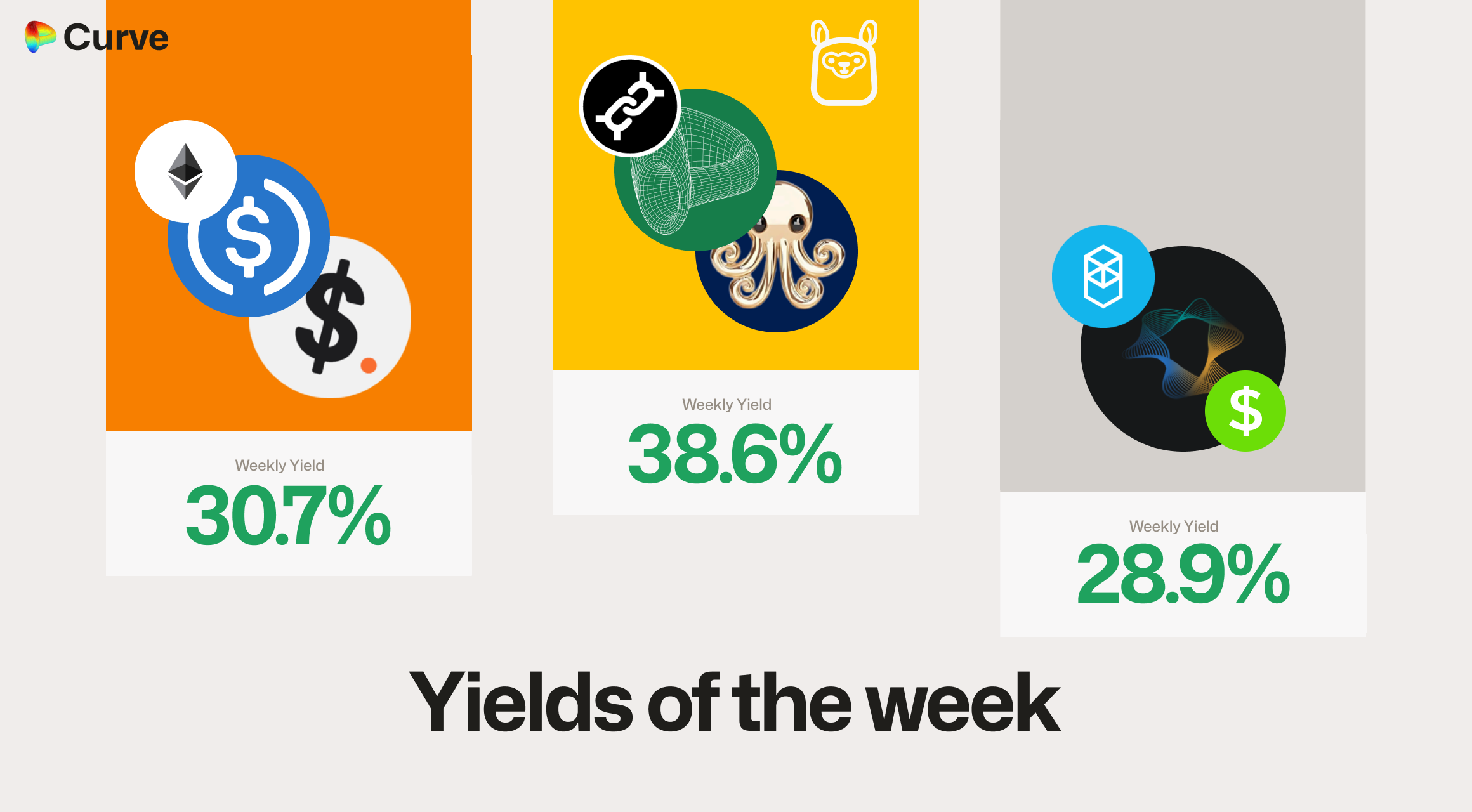

Top Yields

Note: for pools with less than $100k TVL, the yield has been calculated as if the pool has $100k TVL.

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD SQUID SQUID |

LlamaLend | 38.6% |

|

USDC USDC USDf USDf |

Pool | 30.7% |

|

CrossCurve Stable 2 CrossCurve Stable 2 |

Pool | 28.9% |

|

CrossCurve Stable 3 CrossCurve Stable 3 |

Pool | 22.8% |

|

frxUSD frxUSD PYUSD PYUSD |

Pool | 19.0% |

|

fxUSD fxUSD USDN USDN |

Pool | 17.8% |

|

CrossCurve Stable CrossCurve Stable |

Pool | 16.7% |

|

reUSD reUSD sDOLA sDOLA |

Pool | 14.4% |

|

crvUSD crvUSD WFRAX WFRAX |

LlamaLend | 12.9% |

|

crvUSD crvUSD CRV CRV |

LlamaLend | 11.9% |

Top Alternative Asset Yields

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

CrossCurve ETH 2 CrossCurve ETH 2 |

ETH | 27.4% |

|

CrossCurve CRV CrossCurve CRV |

CRV | 27.3% |

|

OETH OETH WETH WETH |

ETH | 25.7% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 23.5% |

|

InsfrxETH InsfrxETH sfrxETH sfrxETH |

ETH | 15.7% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 15.2% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 7.5% |

|

WBTC WBTC tBTC tBTC |

BTC | 6.1% |

|

EBTC EBTC tBTC tBTC |

BTC | 4.3% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

CrvUSD reached a new all-time high in supply this week, with outstanding debt continuing to rise. This growth comes as no surprise—thanks to a consistently strong peg and PegKeepers enabling large borrowers to leverage with minimal slippage.

| Metric | Value | Change |

|---|---|---|

crvUSD Total Supply crvUSD Total Supply |

$176.2M | +7.58% |

crvUSD Debt crvUSD Debt |

$119M | +4.80% |

scrvUSD Yield scrvUSD Yield |

1.41% APY | +0.29% |

crvUSD in crvUSD in scrvUSD scrvUSD |

29.48% | +1.16% |

crvUSD Peg crvUSD Peg |

$1.0000 | -$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

1.158% | -0.23% |

Loans Loans |

768 | +21 |

Fees Fees |

$32.9k | -8.28% |

Pegkeeper Debt Pegkeeper Debt |

$57.29M | +6.961M |

Pool Statistics

It’s been a strong week for both trading volume and TVL growth across Curve pools.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $1.771B | +3.93% |

| 🔄 Volume | $1.277B | +9.74% |

| 🔄 Swaps | 329,823 | -15.94% |

| 🔄 Total Fees | $211k | -16.82% |

LlamaLend Performance

Llamalend metrics remain consistently positive—unsurprising given that many borrowing rates are currently near zero due to Resupply.

| Metric | Value | Change |

|---|---|---|

| 🦙 Lending TVL | $159M | +8.99% |

| 🦙 Supplied | $139.5M | +11.06% |

| 🦙 Borrowed | $72.53M | +17.64% |

| 🦙 Loans | 831 | +42 |

Notable Pool Activity

Highest Volume Pools

The Spark.fi USDT Reserve pool is a new entrant to both the platform and this week’s top three by volume—recording over $80M in trades and adding more than $20M in TVL over the past seven days.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$219.8M | $175.5M |

|

USDC USDC USDT USDT |

$160.6M | $9.417M |

|

sUSDS sUSDS USDT USDT |

$80.66M | $50.39M |

Recently Launched Pools

Twenty-two new pools have been launched recently, adding over $5.2M in TVL to Curve—many of them from CrossCurve’s new deployments on Sonic.

| Chain | Pool | TVL |

|---|---|---|

|

OETH OETH WETH WETH |

$3.025M |

|

scBTC scBTC sWBTC_ar sWBTC_ar |

$232.1k |

|

scBTC scBTC sWBTC_l sWBTC_l |

$178.2k |

|

scBTC scBTC sBTCB_b sBTCB_b |

$164.7k |

|

scBTC scBTC sWBTC_op sWBTC_op |

$137k |

|

scBTC scBTC sWBTC_p sWBTC_p |

$129.6k |

|

xfrxETH xfrxETH sWETH_ba sWETH_ba |

$99.15k |

|

xfrxETH xfrxETH sWETH_ar sWETH_ar |

$98.73k |

|

scBTC scBTC sWBTC_e sWBTC_e |

$96.94k |

|

xfrxETH xfrxETH sWETH_bl sWETH_bl |

$91.05k |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$17.59k | $219.8M |

|

WETH WETH CVX CVX |

$16.14k | $4.48M |

|

USDT USDT WBTC WBTC WETH WETH |

$11.41k | $9.948M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.