Curve Best Yields & Key Metrics | Week 1, 2026

Weekly yield and Curve ecosystem metric updates as of the 1st January, 2026

Market Overview

Welcome to 2026, a whole new year! 🥳

Curve doesn't stop and neither will the yields (for the next 100 years at least). As the market chop continues, TVL has declined modestly, down 2.3% to $2.465B over the past week.

Check out all the highlighted opportunities and weekly metrics below.

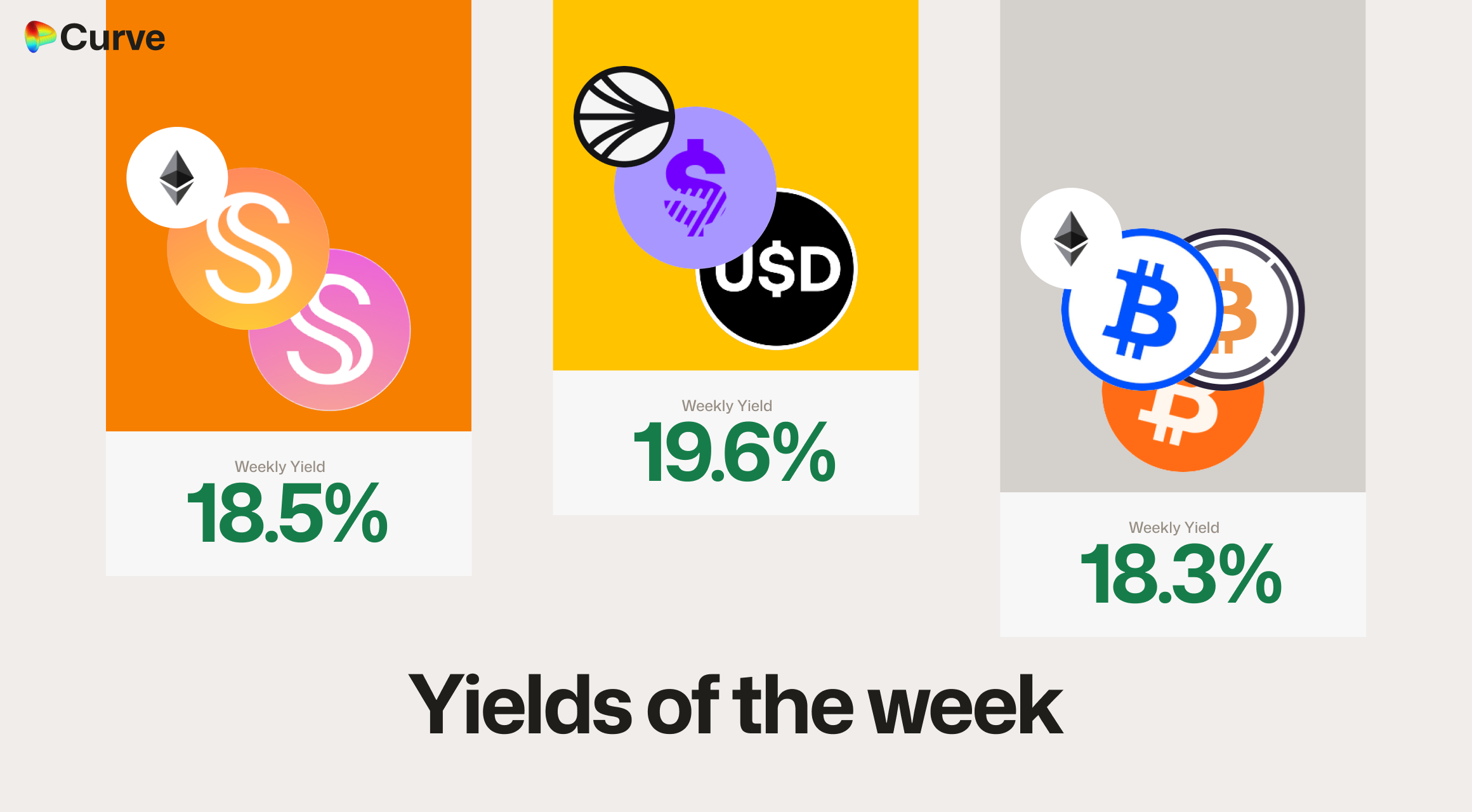

Top Yields

All yields shown below are the unboosted rates offered directly through Curve. However, projects such as Convex, StakeDAO and Yearn all offer boosting for these yields.

Premier crvUSD Pools

| Chain | Market | TVL | Yield |

|---|---|---|---|

|

frxUSD frxUSD crvUSD crvUSD |

$36M | 4.5% |

|

crvUSD crvUSD sDOLA sDOLA |

$32.1M | 4.5% |

|

crvUSD crvUSD sreUSD sreUSD |

$20.9M | 4.3% |

|

reUSD reUSD scrvUSD scrvUSD |

$15.5M | 4.0% |

|

USDC USDC crvUSD crvUSD |

$40M | 3.7% |

Other Top USD Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

USDp USDp frxUSD frxUSD |

Pool | 19.6% |

|

USDS USDS stUSDS stUSDS |

Pool | 18.5% |

|

USDT0 USDT0 sUSDe sUSDe |

Pool | 16.3% |

|

crvUSD crvUSD CRV CRV |

Llamalend | 14.1% |

|

alUSD alUSD USDC USDC |

Pool | 11.1% |

|

ynUSDx ynUSDx USDC USDC |

Pool | 11.1% |

|

frxUSD frxUSD msUSD msUSD |

Pool | 10.6% |

|

crvUSD crvUSD VUSD VUSD |

Pool | 10.2% |

|

crvUSD crvUSD asdCRV asdCRV |

Llamalend | 8.7% |

Top BTC & ETH Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

BTC | 18.3% |

|

WBTC WBTC LBTC LBTC BTC.b BTC.b |

BTC | 11.6% |

|

msETH msETH OETH OETH |

ETH | 6.7% |

|

msETH msETH WETH WETH |

ETH | 5.5% |

|

ynETH ynETH ynETHx ynETHx |

ETH | 5.2% |

|

uniBTC uniBTC brBTC brBTC |

BTC | 5.0% |

Other Top Yields

| Chain | Market | Asset | Yield |

|---|---|---|---|

|

CrossCurve CRV 2 CrossCurve CRV 2 |

CRV | 14.6% |

|

CRV CRV sdCRV sdCRV |

CRV | 11.6% |

|

EURe EURe WXDAI WXDAI USDC USDC USDT USDT |

FOREX | 9.0% |

|

crvUSD crvUSD CJPY CJPY |

FOREX | 8.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 6.9% |

|

crvUSD crvUSD ZCHF ZCHF |

FOREX | 6.5% |

|

GHO GHO cbBTC cbBTC WETH WETH |

TRICRYPTO | 6.2% |

|

EURA EURA EURC EURC |

EUR | 4.4% |

Weekly Metrics

crvUSD & scrvUSD

The crvUSD minted supply continues to climb, posting a notable 4.2% increase this week. This growth is particularly significant as it persists despite a slight struggle across broader crypto markets and the typical holiday lull.

| Metric | Value | Change |

|---|---|---|

crvUSD Minted crvUSD Minted |

$76.7M | +4.2% |

scrvUSD Yield scrvUSD Yield |

0.8% | +0.1% |

crvUSD in crvUSD in scrvUSD scrvUSD |

26.3% | -8.6% |

crvUSD Price crvUSD Price |

$0.9994 | -$0.0001 |

Avg. Borrow Rate Avg. Borrow Rate |

1.0% | +0.1% |

Peg Stability Reserves Peg Stability Reserves |

$57M | - |

PegKeeper Profit PegKeeper Profit |

$0 | -$6.92k |

Llamalend

Llamalend metrics have once again mostly increased this week. The only exception is the amount of crvUSD supplied to markets, which decreased slightly as lenders rotate capital toward better yield opportunities currently available within Curve pools.

| Metric | Value | Change |

|---|---|---|

| 🦙 Llamalend TVL | $228M | +2.3% |

| 🦙 Supplied | $83.6M | -0.6% |

| 🦙 Borrowed | $146M | +3.2% |

| 🦙 Collateral | $213M | +3.4% |

| 🦙 Loans | 1202 | +14 |

DEX

DEX pool's saw a decline, mostly from an outflow of Sky's stUSDS in pools as they modified their incentive structure.

| Metric | Value | Change |

|---|---|---|

| 🔄 TVL | $2.42B | -2.9% |

| 🔄 Volume | $1.07B | -19.3% |

| 🔄 Swaps | 313k | -19.0% |

| 🔄 Total Fees | $141k | -28.4% |

DAO

As volatility slows and crvUSD borrow rates remain low to incentivize supply expansion, veCRV holders saw a lower-than-usual distribution this week.

| Metric | Value | Change |

|---|---|---|

CRV Circ. Supply CRV Circ. Supply |

1.46B | +1.5% |

CRV Locked CRV Locked |

859M | -0.2% |

Total veCRV Total veCRV |

794M | +0.4% |

veCRV Distribution veCRV Distribution |

$57.3k | -47.3% |

CRV Emissions CRV Emissions |

$858k (2.22M CRV) | +8.1% |

Inflation Rate Inflation Rate |

4.946% | -0.005% |

Top Stableswap Pools

Demand for crvUSD continues to climb, with two of its pools now ranking in the top 10. Additionally, USDS and PYUSD pools are seeing high demand this week, reflecting a strong appetite for these assets within the ecosystem.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

PYUSD PYUSD USDS USDS |

$368.5M | $4.1k |

| 2 | +2 |  |

USDT USDT crvUSD crvUSD |

$64.9M | $6.5k |

| 3 | -1 |  |

DAI DAI USDC USDC USDT USDT |

$59.7M | $9.0k |

| 4 | -1 |  |

sUSDS sUSDS USDT USDT |

$49.9M | $1.3k |

| 5 | +4 |  |

USDC USDC crvUSD crvUSD |

$29.8M | $3.0k |

| 6 | +4 |  |

WETH WETH weETH weETH |

$26.5M | $1.5k |

| 7 | +1 |  |

USDC USDC USDT USDT |

$24.8M | $474.5 |

| 8 | +4 |  |

USDai USDai USDC USDC |

$23.5M | $2.4k |

| 9 | +7 |  |

PYUSD PYUSD USDC USDC |

$22.0M | $2.6k |

| 10 | +3 |  |

WBTC WBTC tBTC tBTC |

$21.2M | $2.1k |

Top Cryptoswap Pools

As usual, the Tricrypto pools led the week in volume. The standout surprise was the YB/crvUSD pool, which jumped up seven spots in the rankings to secure a top position.

| 📍 | 🔄 | Chain | Pool | Volume | Fees |

|---|---|---|---|---|---|

| 1 | - |  |

USDC USDC WBTC WBTC WETH WETH |

$20.9M | $9.3k |

| 2 | - |  |

USDT USDT WBTC WBTC WETH WETH |

$16.6M | $7.2k |

| 3 | +1 |  |

USDT USDT WBTC WBTC WETH WETH |

$13.6M | $13.1k |

| 4 | -1 |  |

crvUSD crvUSD WETH WETH CRV CRV |

$10.2M | $4.9k |

| 5 | +7 |  |

crvUSD crvUSD YB YB |

$1.7M | $6.3k |

| 6 | -1 |  |

WETH WETH CVX CVX |

$1.7M | $6.3k |

DEX Winners & Losers

Fees Winners & Losers

With the surge in YB demand, it led the week in terms of fee growth from swappers. PYUSD pools also saw strong growth for the week.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD YB YB |

$1.74M | $6.29k | +$4.22k |

| 2 |  |

PYUSD PYUSD USDS USDS |

$369M | $4.15k | +$2.42k |

| 3 |  |

PYUSD PYUSD USDC USDC |

$22M | $2.56k | +$1.63k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

ETH ETH stETH stETH |

$5.86M | $586 | -$7.18k |

| -2 |  |

DAI DAI USDC USDC USDT USDT |

$59.7M | $8.96k | -$7.57k |

| -1 |  |

USDC USDC RLUSD RLUSD |

$13M | $2.66k | -$9.59k |

Volume Winners & Losers

PYUSD pools led the week in volume growth, while stETH pools saw a decline in activity. This shift may be attributed to the ETH staking withdrawal queue reducing to less than four days, potentially lowering the immediate need for secondary market liquidity.

| 📍 | Chain | Pool | Volume | Fees | Change |

|---|---|---|---|---|---|

| 1 |  |

PYUSD PYUSD USDS USDS |

$369M | $4.15k | +$205M |

| 2 |  |

PYUSD PYUSD USDC USDC |

$22M | $2.56k | +$12.9M |

| 3 |  |

WBTC WBTC tBTC tBTC |

$21.2M | $2.12k | +$4.6M |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

sUSDS sUSDS USDT USDT |

$49.9M | $1.31k | -$54.5M |

| -2 |  |

ETH ETH stETH stETH |

$4.19M | $335 | -$62.6M |

| -1 |  |

ETH ETH stETH stETH |

$5.86M | $586 | -$71.8M |

TVL Winners & Losers

DOLA continues to see strong TVL increases across Curve, while the hemiBTC pool also posted robust growth fueled by its generous incentives.

Conversely, the sUSDS/stUSDS pool experienced a large outflow this week as its specific incentive program concluded. However, significant opportunity remains in the other USDS/stUSDS pool, which is still offering over 18% APR.

| 📍 | Chain | Pool | TVL | Change |

|---|---|---|---|---|

| 1 |  |

DOLA DOLA sUSDe sUSDe |

$85M | +$4.05M |

| 2 |  |

WBTC WBTC cbBTC cbBTC hemiBTC hemiBTC |

$5.5M | +$3.75M |

| 3 |  |

ETH+ ETH+ WETH WETH |

$17.9M | +$3.05M |

| ... | ... | ... | ... | ... |

| -3 |  |

PYUSD PYUSD USDC USDC |

$25.1M | -$5.53M |

| -2 |  |

USDS USDS stUSDS stUSDS |

$13.8M | -$21.7M |

| -1 |  |

sUSDS sUSDS stUSDS stUSDS |

$5.23M | -$57.8M |

Llamalend Winners & Losers

crvUSD Minting Markets - Borrowing Winners & Losers

With a negative real interest rate for borrowing against ETH staking derivatives, it’s no surprise they saw the highest growth this week.

| 📍 | Chain | Market | Collateral | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD wstETH wstETH |

$14.3M | $7.89M | +$1.57M |

| 2 |  |

crvUSD crvUSD weETH weETH |

$2.04M | $1.14M | +$1.01M |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$64.3M | $35.3M | +$846k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$478k | $150k | -$14 |

| -2 |  |

crvUSD crvUSD tBTC tBTC |

$11M | $7.16M | -$130k |

| -1 |  |

crvUSD crvUSD WETH WETH |

$33.6M | $18.9M | -$223k |

Lend Markets - Borrowing Winners & Losers

The sDOLA and sreUSD markets both maintained their growth momentum this week. In contrast, several other staked stablecoin markets saw modest outflows as yields across the broader DeFi landscape continue to compress.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$32.1M | $25.9M | +$1.95M |

| 2 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.9M | $17.9M | +$671k |

| 3 |  |

crvUSD crvUSD WBTC WBTC |

$990k | $748k | +$71.7k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sUSDe sUSDe |

$3.09M | $2.68M | -$233k |

| -2 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$9.32M | $8.71M | -$495k |

| -1 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$7.45M | $6.42M | -$578k |

Lend Markets - Supplying Winners & Losers

sDOLA saw a notable increase in crvUSD supplied to its market this week. In contrast, sreUSD deviated from its usual trend, experiencing an outflow of supplied crvUSD which slightly pushed up borrow rates for remaining users. This marks the first time a single market has simultaneously landed in both the "winners" and "losers" categories within a single week.

| 📍 | Chain | Market | Supplied | Borrowed | Change |

|---|---|---|---|---|---|

| 1 |  |

crvUSD crvUSD sDOLA sDOLA |

$32.1M | $25.9M | +$1.81M |

| 2 |  |

crvUSD crvUSD WBTC WBTC |

$728k | $367k | +$41.1k |

| 3 |  |

crvUSD crvUSD sfrxETH sfrxETH |

$907k | $540k | +$33.8k |

| ... | ... | ... | ... | ... | ... |

| -3 |  |

crvUSD crvUSD sreUSD sreUSD |

$20.9M | $17.9M | -$469k |

| -2 |  |

crvUSD crvUSD sfrxUSD sfrxUSD |

$7.45M | $6.42M | -$559k |

| -1 |  |

crvUSD crvUSD fxSAVE fxSAVE |

$9.32M | $8.71M | -$640k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.